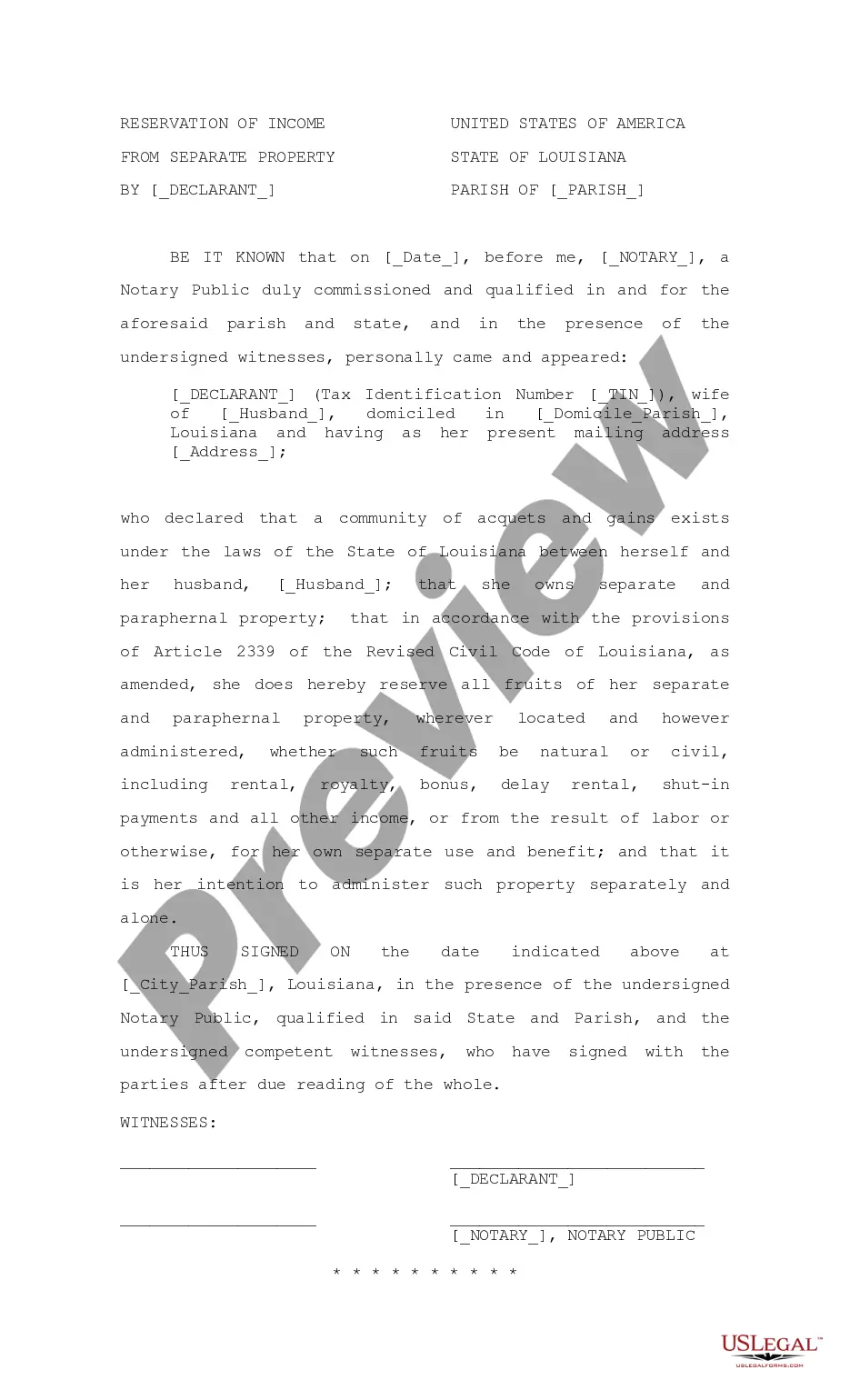

Louisiana Reservation of Income from Separate Property

Description Separate Property Complete

How to fill out Reservation Property Louisiana?

Welcome to the most significant legal files library, US Legal Forms. Here you will find any sample including Louisiana Reservation of Income from Separate Property templates and save them (as many of them as you wish/need to have). Make official documents with a several hours, rather than days or weeks, without spending an arm and a leg with an lawyer or attorney. Get the state-specific sample in clicks and feel confident with the knowledge that it was drafted by our state-certified lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download near the Louisiana Reservation of Income from Separate Property you want. Due to the fact US Legal Forms is web-based, you’ll generally have access to your downloaded files, no matter the device you’re utilizing. See them inside the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check our guidelines below to get started:

- If this is a state-specific sample, check out its applicability in your state.

- View the description (if readily available) to learn if it’s the proper template.

- See a lot more content with the Preview function.

- If the example matches your needs, click Buy Now.

- To create an account, choose a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Download the template in the format you need (Word or PDF).

- Print out the file and complete it with your/your business’s details.

Once you’ve completed the Louisiana Reservation of Income from Separate Property, give it to your attorney for confirmation. It’s an extra step but an essential one for making confident you’re totally covered. Join US Legal Forms now and get a mass amount of reusable examples.

Louisiana Property Online Form popularity

Louisiana Property Other Form Names

Louisiana Separate Statement FAQ

Generally, community income is income from: Community property; Salaries, wages, and other pay received for the services performed by you, your spouse (or your registered domestic partner), or both during your marriage (or registered domestic partnership) while domiciled in a community property state; and.

The California legislature defines community property as all property, real or personal, wherever situated, acquired by a married person during the marriage while domiciled in this state. Your spouse also owns a one-half interest in your regular income, provided it doesn't come from your separate property.

The key to proving separate property is documentation and showing a paper trail to trace your separate property. Tracing is the method used when your original separate property has changed form, been exchanged, or sold during your marriage, resulting in you owning different property at the time of divorce.

In Idaho, Louisiana, Texas, and Wisconsin, income from most separate property is community income. In Arizona, California, Louisiana, Nevada, New Mexico and Washington, income from separate property will also be separate income (and will continue to be separate property after its earned).

Income from separate property is usually community property under Louisiana law. If either the husband or the wife does not want to share the ownership of the income from separate property, however, that spouse can make a declaration before a Notary Public.

What Is Community Property? Community property refers to a U.S. state-level legal distinction that designates a married individual's assets. Any income and any real or personal property acquired by either spouse during a marriage are considered community property and thus belong to both partners of the marriage.

Income that spouses earn after their date of separation is their own separate property. Note that money a spouse earns prior to the date of separation that isn't paid until after the date of separation is still marital property. What's important is when the income was earned, not when the income was paid.