Louisiana Letter to principal Heirs Legatees of the Secession of Decedent

Description Louisiana Heirs

How to fill out Letter Heirs?

Welcome to the biggest legal documents library, US Legal Forms. Right here you can find any sample such as Louisiana Letter to principal Heirs Legatees of the Secession of Decedent templates and save them (as many of them as you wish/need to have). Get ready official documents with a few hours, instead of days or even weeks, without having to spend an arm and a leg with an lawyer. Get your state-specific example in clicks and be assured knowing that it was drafted by our state-certified attorneys.

If you’re already a subscribed customer, just log in to your account and click Download near the Louisiana Letter to principal Heirs Legatees of the Secession of Decedent you want. Because US Legal Forms is online solution, you’ll generally have access to your saved files, no matter the device you’re utilizing. See them in the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check our instructions listed below to get started:

- If this is a state-specific document, check its applicability in your state.

- See the description (if available) to understand if it’s the proper example.

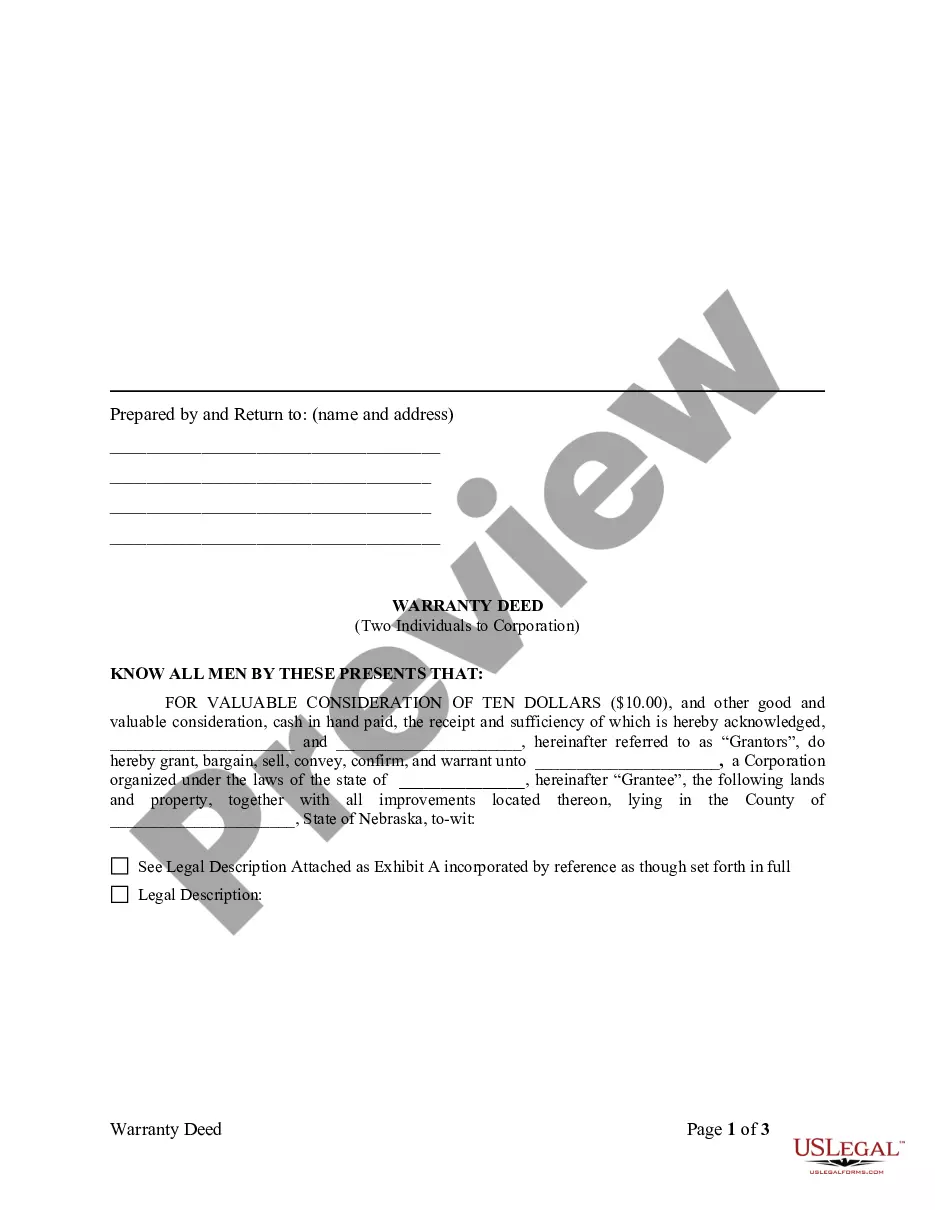

- See far more content with the Preview feature.

- If the document matches all your needs, click Buy Now.

- To make your account, select a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Save the template in the format you need (Word or PDF).

- Print the file and complete it with your/your business’s info.

When you’ve filled out the Louisiana Letter to principal Heirs Legatees of the Secession of Decedent, send it to your lawyer for verification. It’s an additional step but a necessary one for being certain you’re totally covered. Become a member of US Legal Forms now and access a large number of reusable examples.

Louisiana Heirs Agreement Form popularity

Letter Decedent Other Form Names

Louisiana Heirs Contract FAQ

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

Immediately at the death of the decedent, universal successors acquire ownership of the estate and particular successors acquire ownership of the things bequeathed to them.

Under Louisiana's intestate succession laws, separate property is distributed first to a deceased person's children. Each child of the deceased person will share equally in the separate property.At Shemp's death, his two surviving children (Curly and Larry) will each inherit one-third of his separate property.

Maximum $125,000 (CCP 3421 Small Successions Defined) Laws CCP 3432. Step 1 Write in the full name of the person who died. Step 2 Write in the State and County or Parish in which the decedent resided at the time of death. Step 3 Write in the names of the two people signing the petition.

Harris County Civil Courthouse. 201 Caroline, Suite 800. (713) 274-8585.