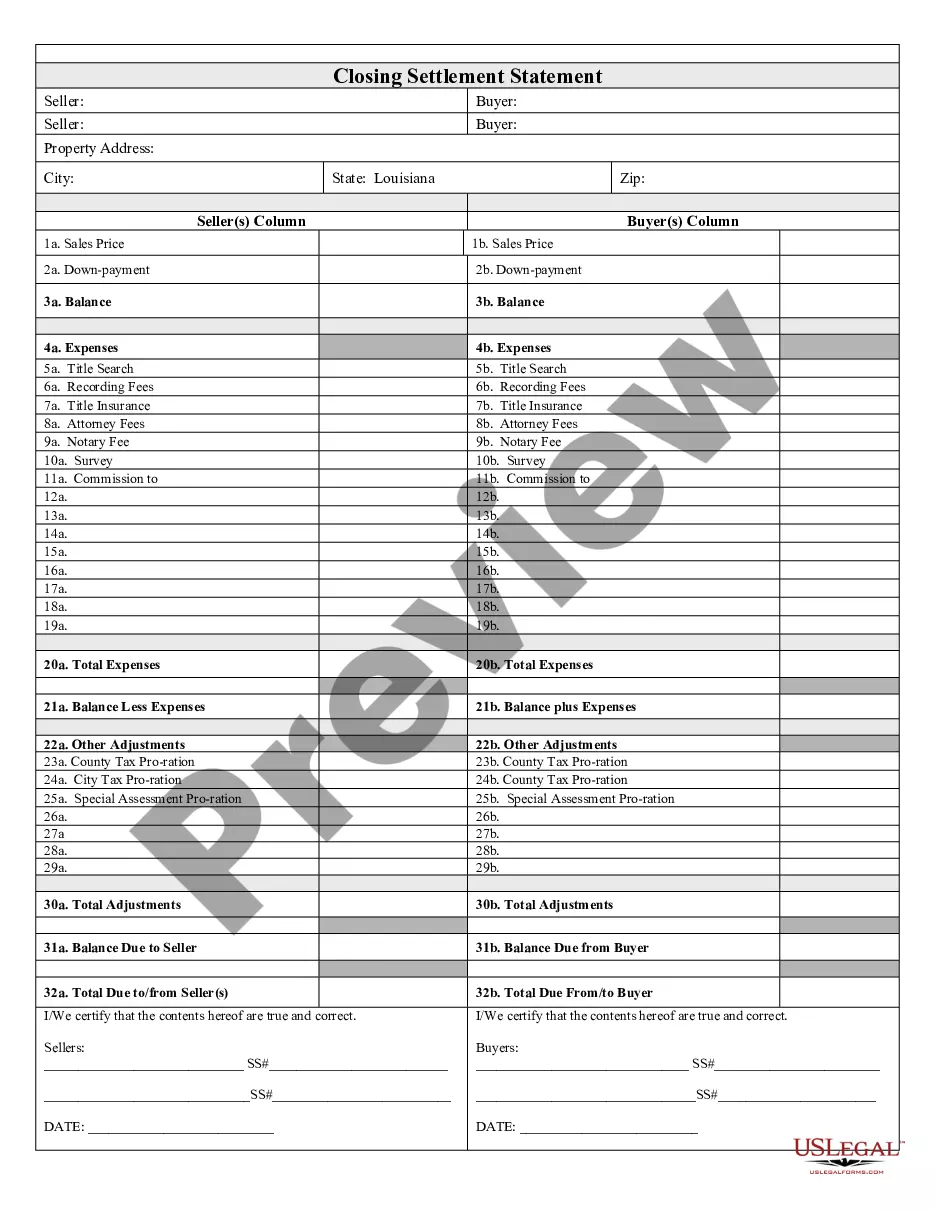

Louisiana Closing Statement

Description Closing Settlement Statement Form

How to fill out Average Closing Costs Louisiana?

Welcome to the biggest legal files library, US Legal Forms. Here you can get any template such as Louisiana Closing Statement templates and save them (as many of them as you wish/need). Prepare official files in just a few hours, instead of days or even weeks, without having to spend an arm and a leg on an attorney. Get your state-specific sample in a few clicks and feel assured with the knowledge that it was drafted by our state-certified legal professionals.

If you’re already a subscribed consumer, just log in to your account and click Download near the Louisiana Closing Statement you want. Because US Legal Forms is online solution, you’ll generally have access to your downloaded files, regardless of the device you’re using. Find them inside the My Forms tab.

If you don't have an account yet, just what are you awaiting? Check our instructions below to begin:

- If this is a state-specific document, check its validity in your state.

- See the description (if accessible) to understand if it’s the correct template.

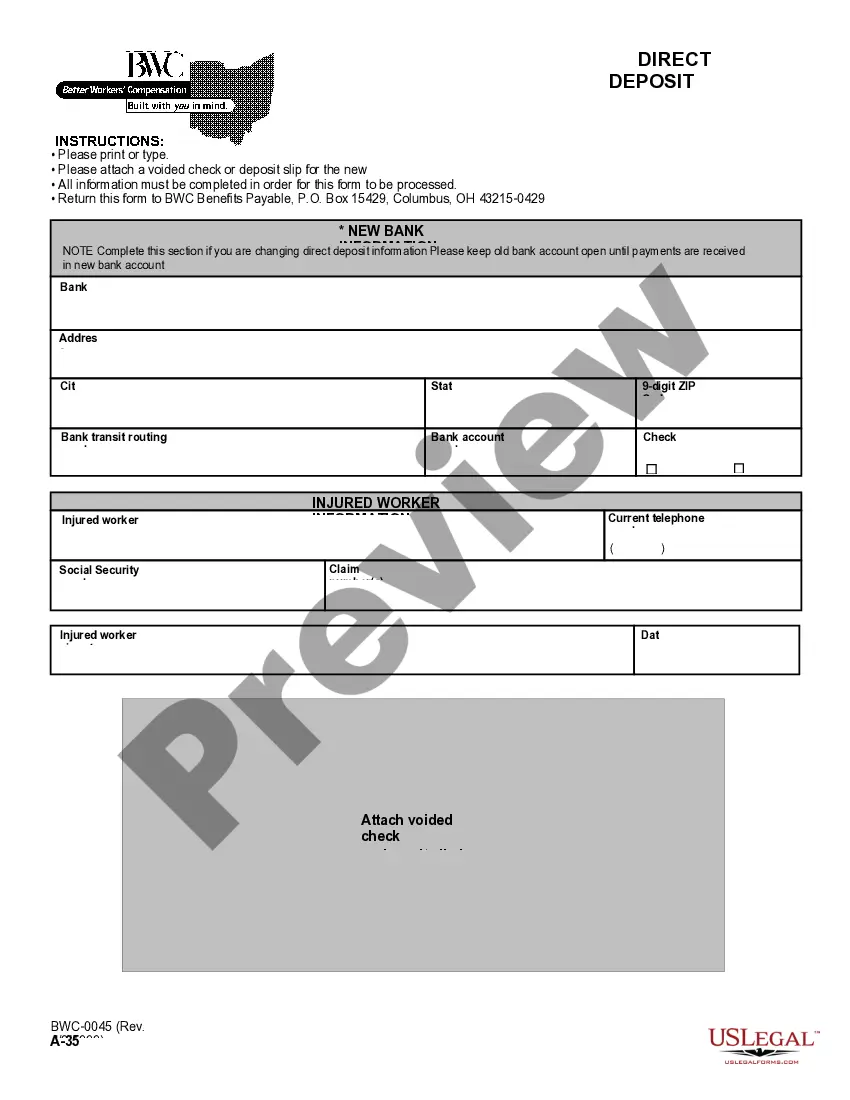

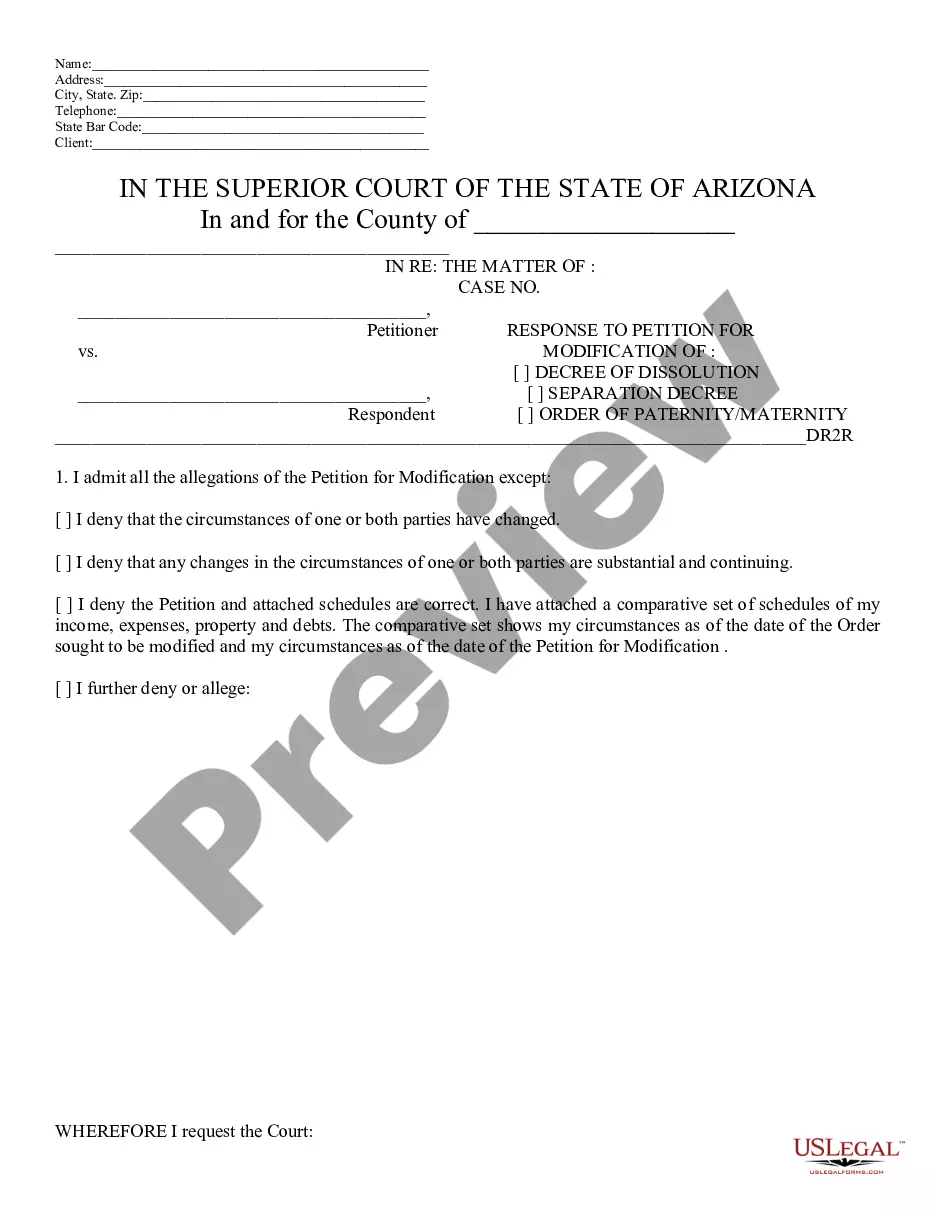

- See much more content with the Preview feature.

- If the sample meets your needs, click Buy Now.

- To create an account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Save the template in the format you want (Word or PDF).

- Print out the document and fill it with your/your business’s details.

After you’ve filled out the Louisiana Closing Statement, send it to your legal professional for verification. It’s an additional step but a necessary one for making sure you’re fully covered. Sign up for US Legal Forms now and get access to a mass amount of reusable examples.

What Is A Closing Statement In Real Estate Form popularity

Closing Settlement Form Other Form Names

Louisiana Closing Form FAQ

According to data from ClosingCorp, the average closing cost in Louisiana is $3,365 after taxes, or approximately 1.68% to 3.37% of the final home sale price.

According to data from ClosingCorp, the average closing cost in Louisiana is $3,365 after taxes, or approximately 1.68% to 3.37% of the final home sale price.

Closing costs are fees and expenses you pay when you close on your house, beyond the down payment. These costs can run 3 to 5 percent of the loan amount and may include title insurance, attorney fees, appraisals, taxes and more.

A mortgage closing disclosure is a type of standard settlement statement that is formulated and regulated for the mortgage lending market. The HUD-1 settlement statement is a type of closing statement used in reverse mortgages.

Louisiana is a community-property state. Attorneys conduct closings. Conveyance is by warranty or quitclaim deed. Mortgages are the security instruments.

A closing statement, also called a HUD1 or settlement sheet, is a legal form your closing or settlement agent uses to itemize all of the costs you and the seller will have to pay at closing to complete a real estate transaction.

Total closing costs to purchase a $300,000 home could cost anywhere from approximately $6,000 to $12,000 or even more. The funds can't typically be borrowed because that would raise the buyer's loan ratios to a point where they might no longer qualify.

According to lines 235 to 237 of the Louisiana Residential Agreement to Buy or Sell, SELLER's title shall be merchantable and free of all liens and encumbrances except those that can be satisfied at Act of Sale. All costs and fees required to make title merchantable shall be paid by SELLER.

The deed and mortgage documents are filed with the county recorder and these become public record. 3feff You can always obtain copies of these from the recorder's office or from a title company. Most documents are digitized in some form, especially those related to the transaction.