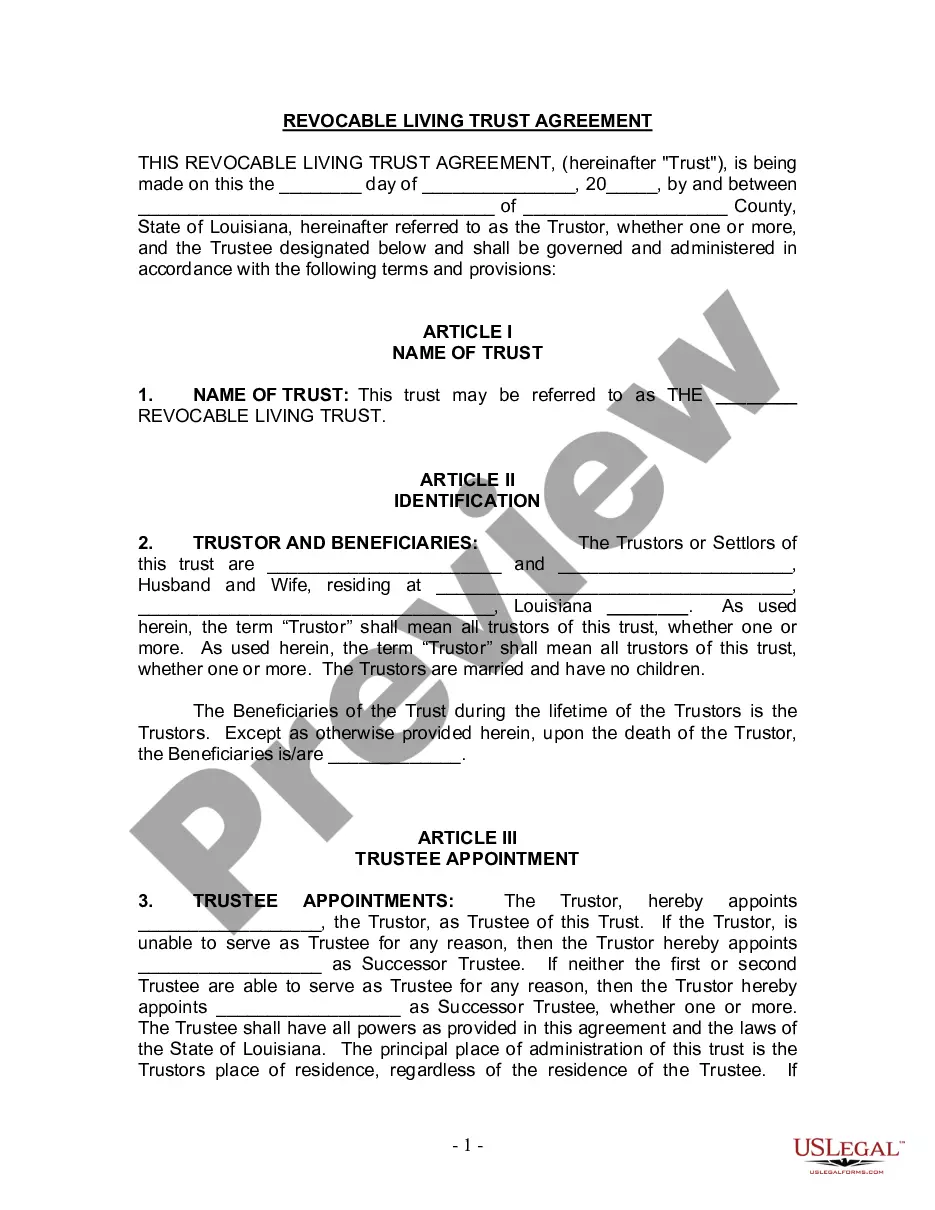

Louisiana Living Trust for Husband and Wife with No Children

Description

How to fill out Louisiana Living Trust For Husband And Wife With No Children?

Welcome to the largest legal documents library, US Legal Forms. Here you can find any example including Louisiana Living Trust for Husband and Wife with No Children forms and download them (as many of them as you wish/need). Make official documents within a few hours, rather than days or weeks, without having to spend an arm and a leg on an attorney. Get the state-specific form in clicks and be assured with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed user, just log in to your account and then click Download next to the Louisiana Living Trust for Husband and Wife with No Children you need. Due to the fact US Legal Forms is web-based, you’ll generally get access to your downloaded files, no matter the device you’re using. See them within the My Forms tab.

If you don't have an account yet, what exactly are you waiting for? Check our instructions below to get started:

- If this is a state-specific sample, check out its applicability in your state.

- Look at the description (if available) to learn if it’s the correct example.

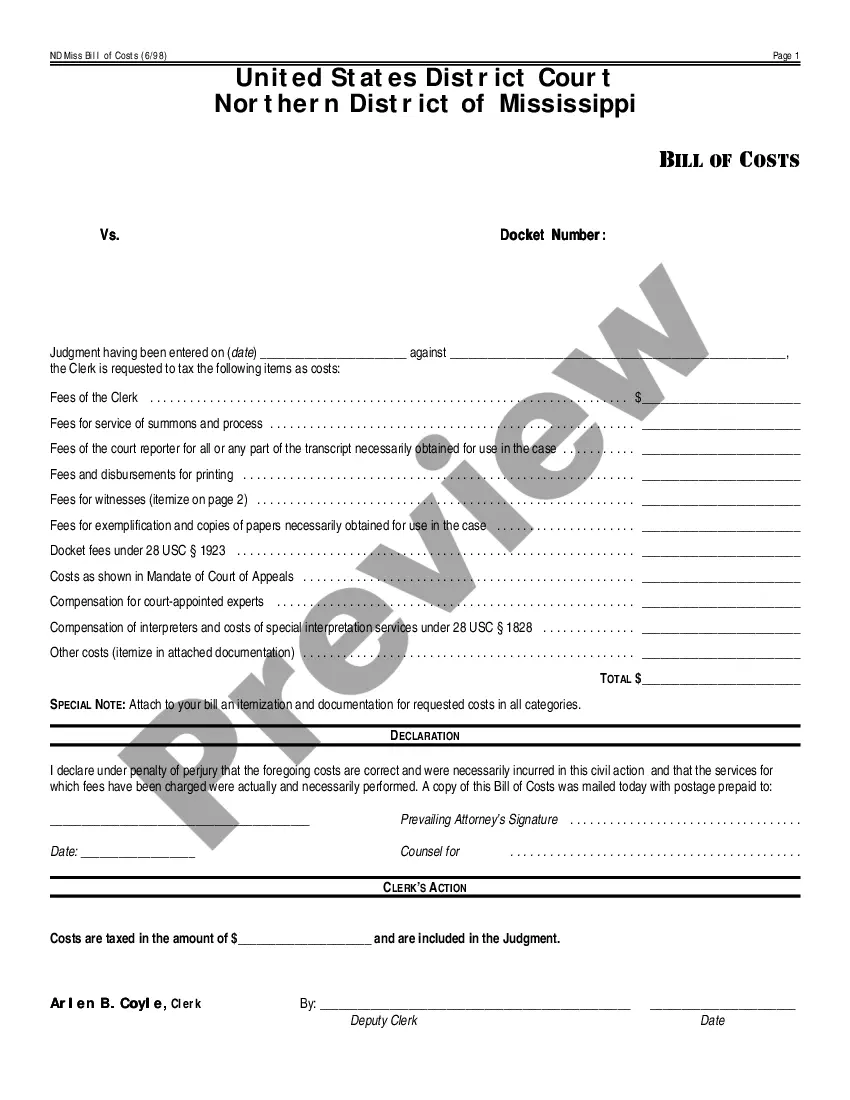

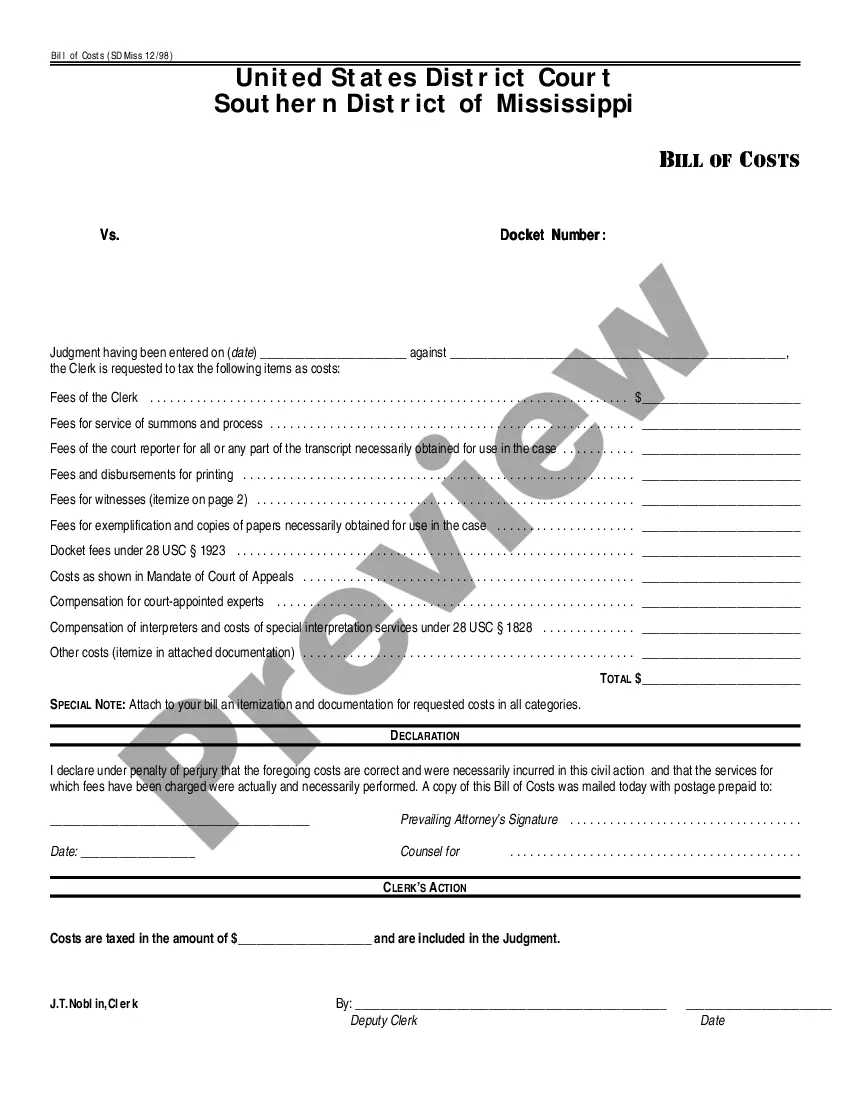

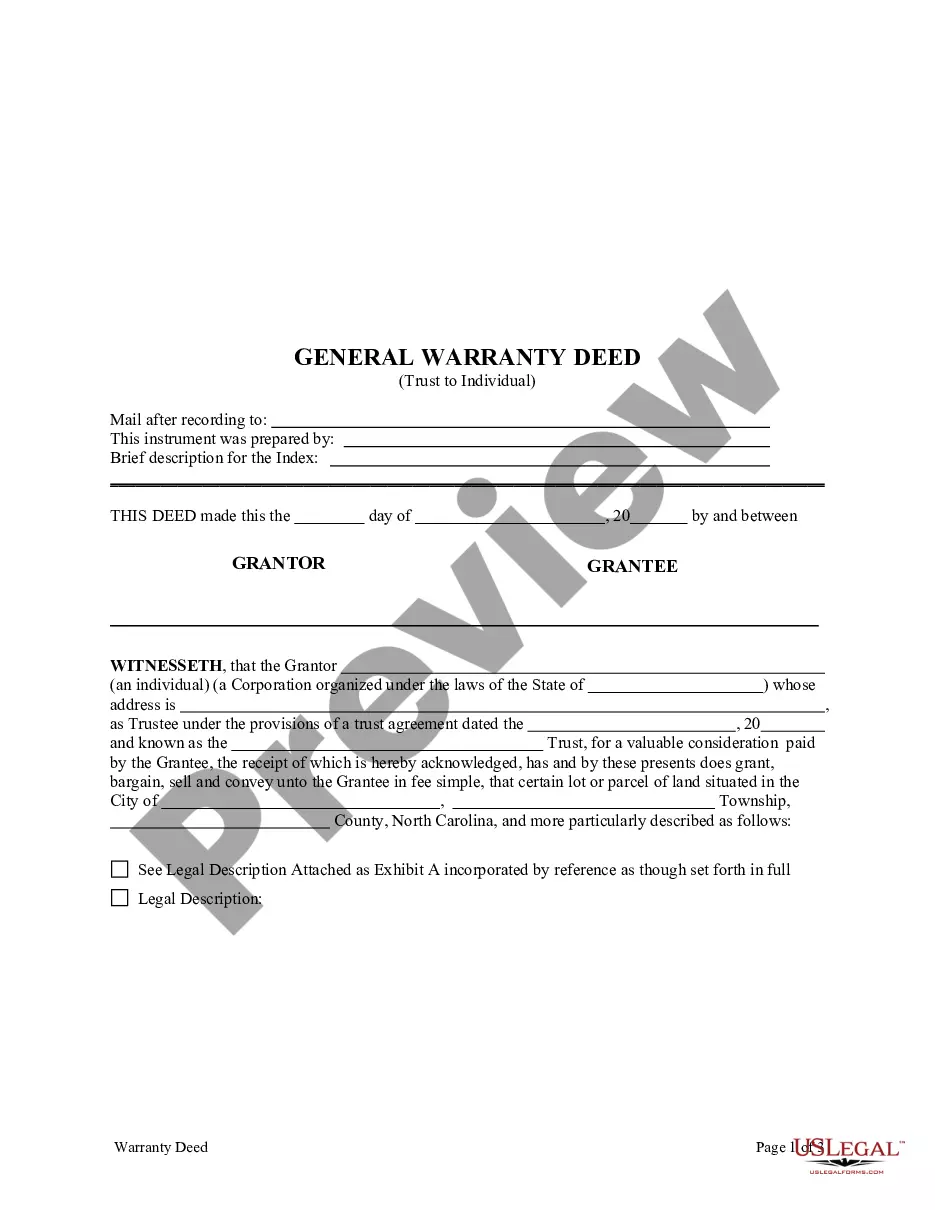

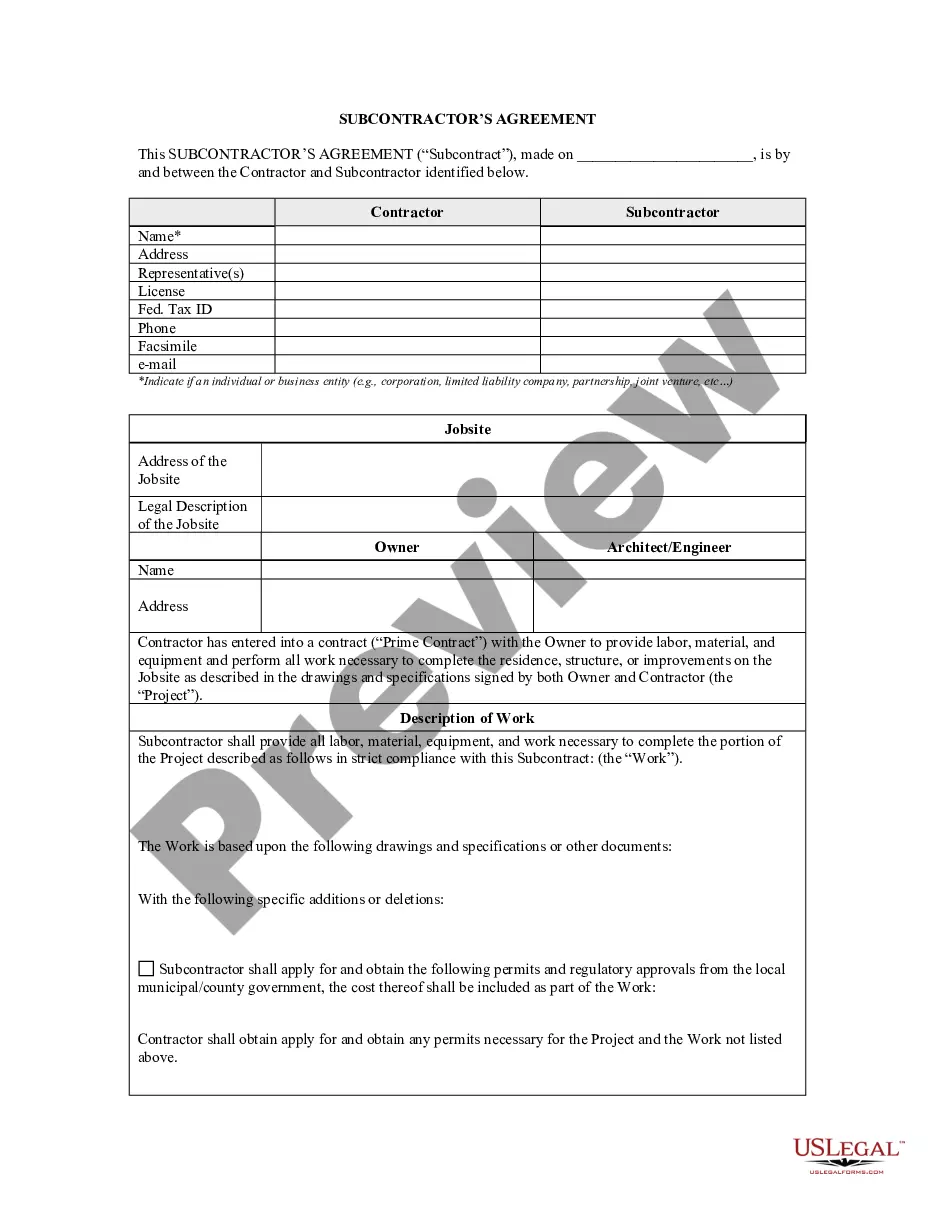

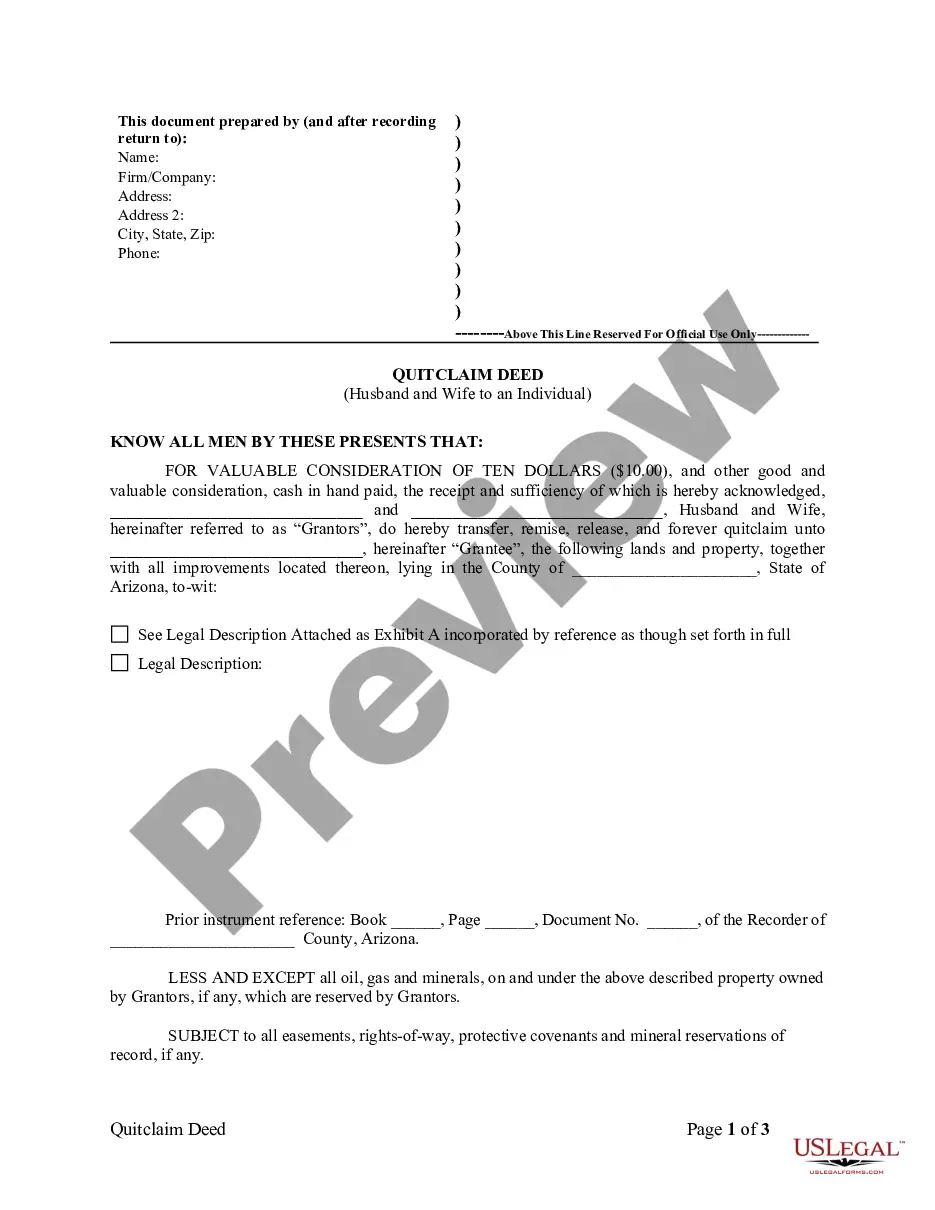

- See more content with the Preview function.

- If the document fulfills all your requirements, just click Buy Now.

- To create an account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Download the document in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s info.

After you’ve filled out the Louisiana Living Trust for Husband and Wife with No Children, give it to your legal professional for verification. It’s an additional step but an essential one for being certain you’re entirely covered. Join US Legal Forms now and get a mass amount of reusable examples.

Form popularity

FAQ

If a person dies without a valid Last Will and Testament in Louisiana, he or she is said to have died intestate. His or her estate will be handled by intestate succession. This means that the deceased person's assets will be distributed under Louisiana intestate law.

Louisiana law won't let you disinherit children who are 23 years of age or younger, or children of any age who, because of mental incapacity or physical infirmity, are permanently incapable of taking care of themselves or managing their finances. An adult child can only be disinherited for "just cause."

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

If a married person dies without a will, the surviving spouse inherits a usufruct over the deceased spouse's one-half of the community property until the surviving spouse's death or remarriage.

In Louisiana, your children are forced heirs if, at the time of your death, they have not attained age 24. Children of any age, who because of mental incapacity or physical infirmity, are permanently incapable of taking care of their person or administering their estate at the time of your death are also forced heirs.

In Louisiana, your children are forced heirs if, at the time of your death, they have not attained age 24. Children of any age, who because of mental incapacity or physical infirmity, are permanently incapable of taking care of their person or administering their estate at the time of your death are also forced heirs.

If a person dies without a valid Last Will and Testament in Louisiana, he or she is said to have died intestate. His or her estate will be handled by intestate succession. This means that the deceased person's assets will be distributed under Louisiana intestate law.

The term usually means your nearest blood relative. In the case of a married couple or a civil partnership it usually means their husband or wife. Next of kin is a title that can be given, by you, to anyone from your partner to blood relatives and even friends.