Louisiana Living Trust for Husband and Wife with One Child

Description

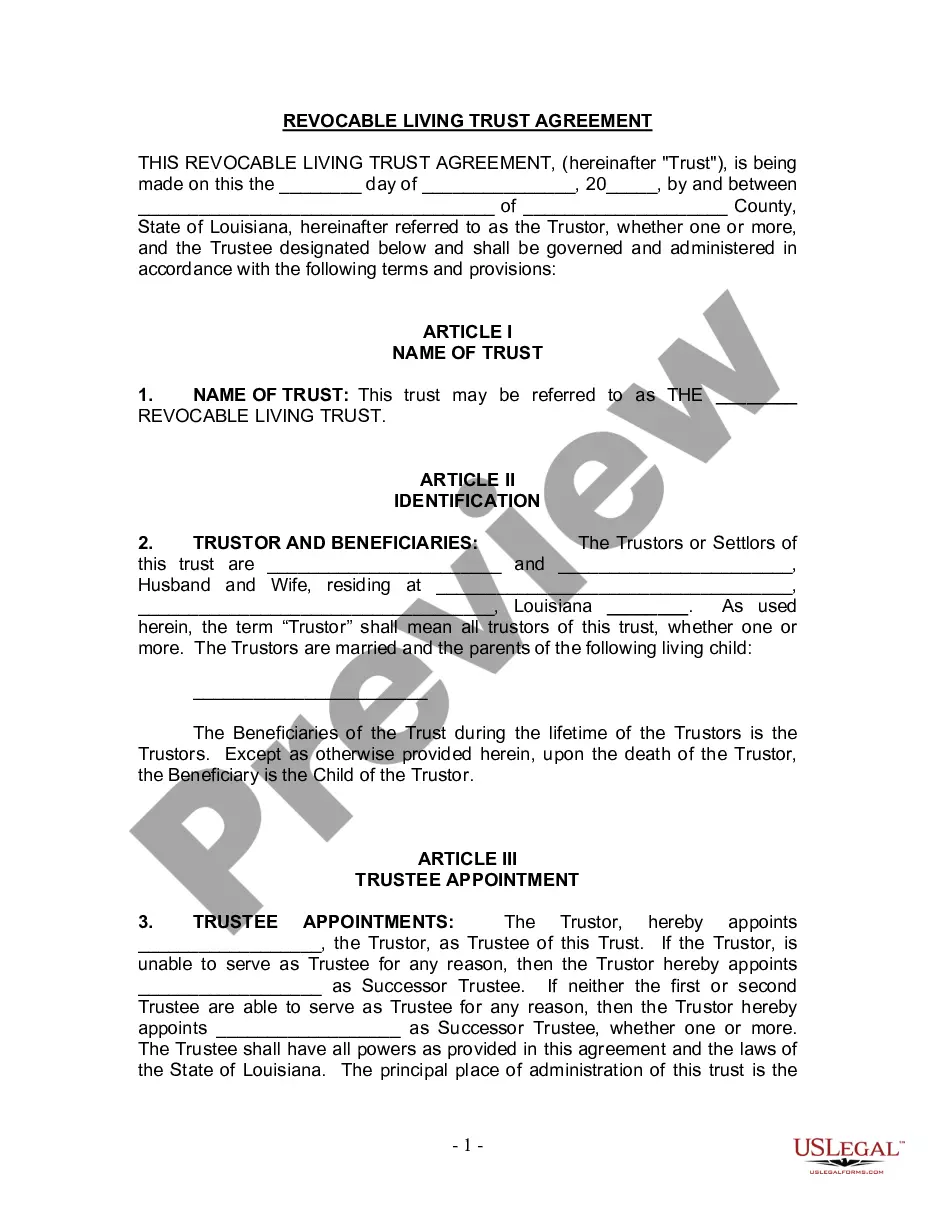

How to fill out Louisiana Living Trust For Husband And Wife With One Child?

Welcome to the biggest legal files library, US Legal Forms. Here you can get any sample such as Louisiana Living Trust for Husband and Wife with One Child templates and download them (as many of them as you want/need). Get ready official files in just a few hours, instead of days or weeks, without spending an arm and a leg on an attorney. Get your state-specific sample in a couple of clicks and be confident with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and click Download near the Louisiana Living Trust for Husband and Wife with One Child you need. Because US Legal Forms is online solution, you’ll always have access to your saved files, no matter what device you’re using. Locate them in the My Forms tab.

If you don't come with an account yet, just what are you waiting for? Check our guidelines below to begin:

- If this is a state-specific document, check its applicability in your state.

- Look at the description (if available) to understand if it’s the proper template.

- See a lot more content with the Preview option.

- If the sample fulfills all of your needs, click Buy Now.

- To make your account, select a pricing plan.

- Use a credit card or PayPal account to sign up.

- Download the document in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s information.

After you’ve completed the Louisiana Living Trust for Husband and Wife with One Child, give it to your legal professional for verification. It’s an additional step but an essential one for making certain you’re completely covered. Become a member of US Legal Forms now and get a large number of reusable examples.

Form popularity

FAQ

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.

Costs of setting up the trust. A trust agreement is a more complicated document than a basic will. Costs of funding the trust. Your living trust is useless if it doesn't hold any property. No income tax advantages. A will may still be required.

A Trust (or Marital Trust) It is a trust that takes advantage of the unlimited marital deduction in order to avoid estate taxes at the time of the first spouse's death in the event that the first spouse's individual estate is more than the individual exemption amount.

In Louisiana, your children are forced heirs if, at the time of your death, they have not attained age 24. Children of any age, who because of mental incapacity or physical infirmity, are permanently incapable of taking care of their person or administering their estate at the time of your death are also forced heirs.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

At the time of your death, the assets in your family trust are protected by the exemption, and the assets in your marital trust are protected by the marital deduction. No estate taxes are due.

A marital trust is a type of irrevocable trust that allows you to transfer assets to a surviving spouse tax free. It can also shield the estate of the surviving spouse before the remaining assets pass on to your children.