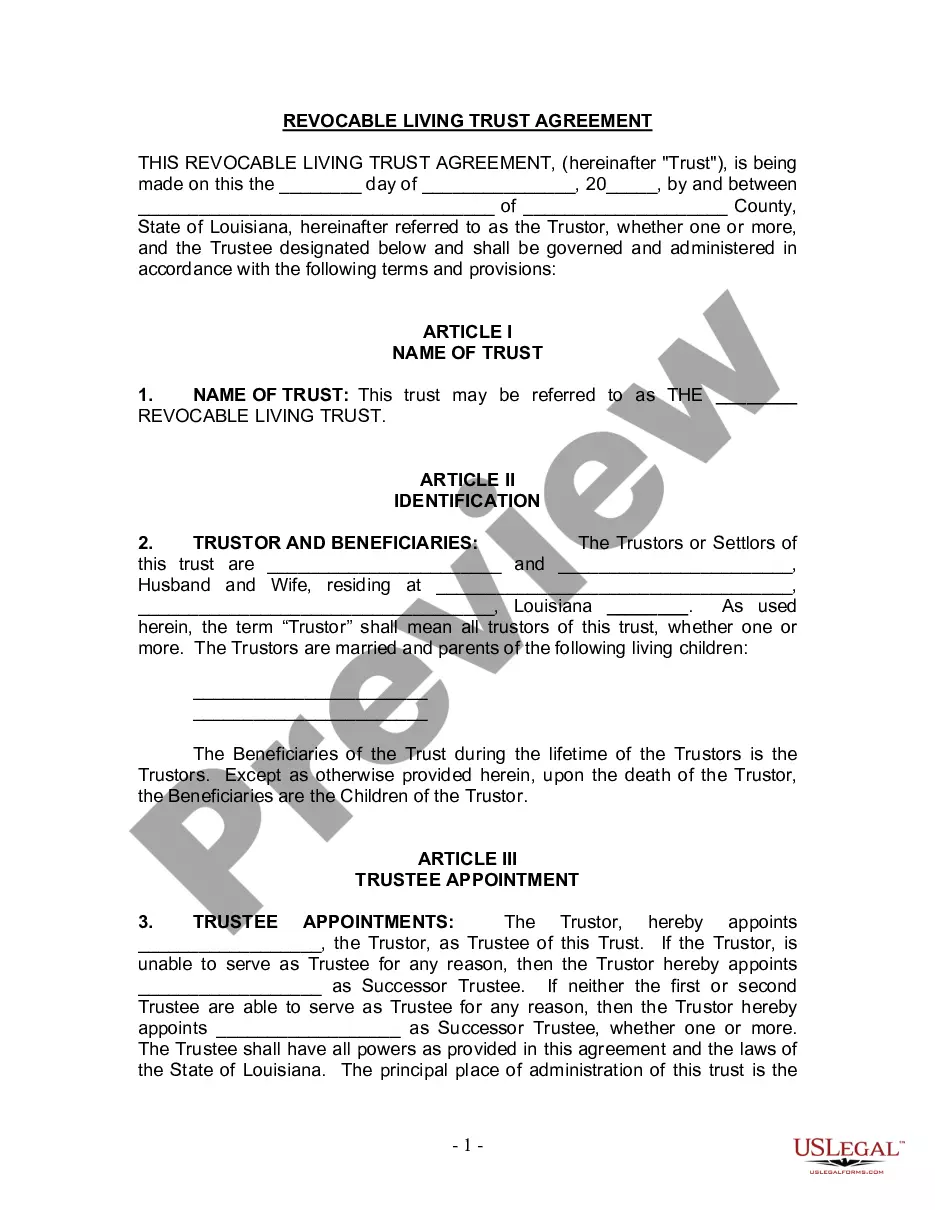

Louisiana Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Louisiana Living Trust For Husband And Wife With Minor And Or Adult Children?

Welcome to the largest legal files library, US Legal Forms. Right here you can get any template such as Louisiana Living Trust for Husband and Wife with Minor and or Adult Children forms and download them (as many of them as you want/need to have). Make official papers with a few hours, rather than days or even weeks, without spending an arm and a leg with an lawyer. Get your state-specific example in a couple of clicks and be confident with the knowledge that it was drafted by our state-certified lawyers.

If you’re already a subscribed user, just log in to your account and then click Download next to the Louisiana Living Trust for Husband and Wife with Minor and or Adult Children you require. Because US Legal Forms is web-based, you’ll always get access to your downloaded forms, no matter the device you’re using. See them within the My Forms tab.

If you don't come with an account yet, just what are you waiting for? Check out our instructions below to begin:

- If this is a state-specific sample, check its applicability in the state where you live.

- View the description (if readily available) to understand if it’s the correct template.

- See much more content with the Preview feature.

- If the example fulfills your needs, click Buy Now.

- To create an account, select a pricing plan.

- Use a card or PayPal account to subscribe.

- Save the file in the format you need (Word or PDF).

- Print the document and fill it with your/your business’s info.

When you’ve completed the Louisiana Living Trust for Husband and Wife with Minor and or Adult Children, send out it to your lawyer for confirmation. It’s an extra step but an essential one for being sure you’re totally covered. Become a member of US Legal Forms now and get a large number of reusable samples.

Form popularity

FAQ

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.

Updating a beneficiary designation: It supersedes your Will or Trust. The beneficiary designation is a legally binding document that supersedes your Will or Trust; neither will override the person you have named as your beneficiary in a life insurance policy, annuity or retirement account.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

If you want more than one person to benefit, write their names and their share of the Trust. If no such shares are specified, and there is more than one beneficiary, the Trust will be held in equal shares. Once the Trust is established, the Beneficiaries can't be changed nor can their percentage share of entitlement.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Trusts can have more than one beneficiary and they commonly do. In cases of multiple beneficiaries, the beneficiaries may hold concurrent interests or successive interests.

In Louisiana, your children are forced heirs if, at the time of your death, they have not attained age 24. Children of any age, who because of mental incapacity or physical infirmity, are permanently incapable of taking care of their person or administering their estate at the time of your death are also forced heirs.

A trust amendment or restatement is typically appropriate if you just want to change or add beneficiaries, if you marry or have a child, or if you divorce, always assuming your ex isn't a co-trustee.

You don't need to include all your accounts in a revocable trust for your heirs to bypass the probate process, notably retirement accounts with designated beneficiaries and investment accounts that have transfer-on-death provisions.