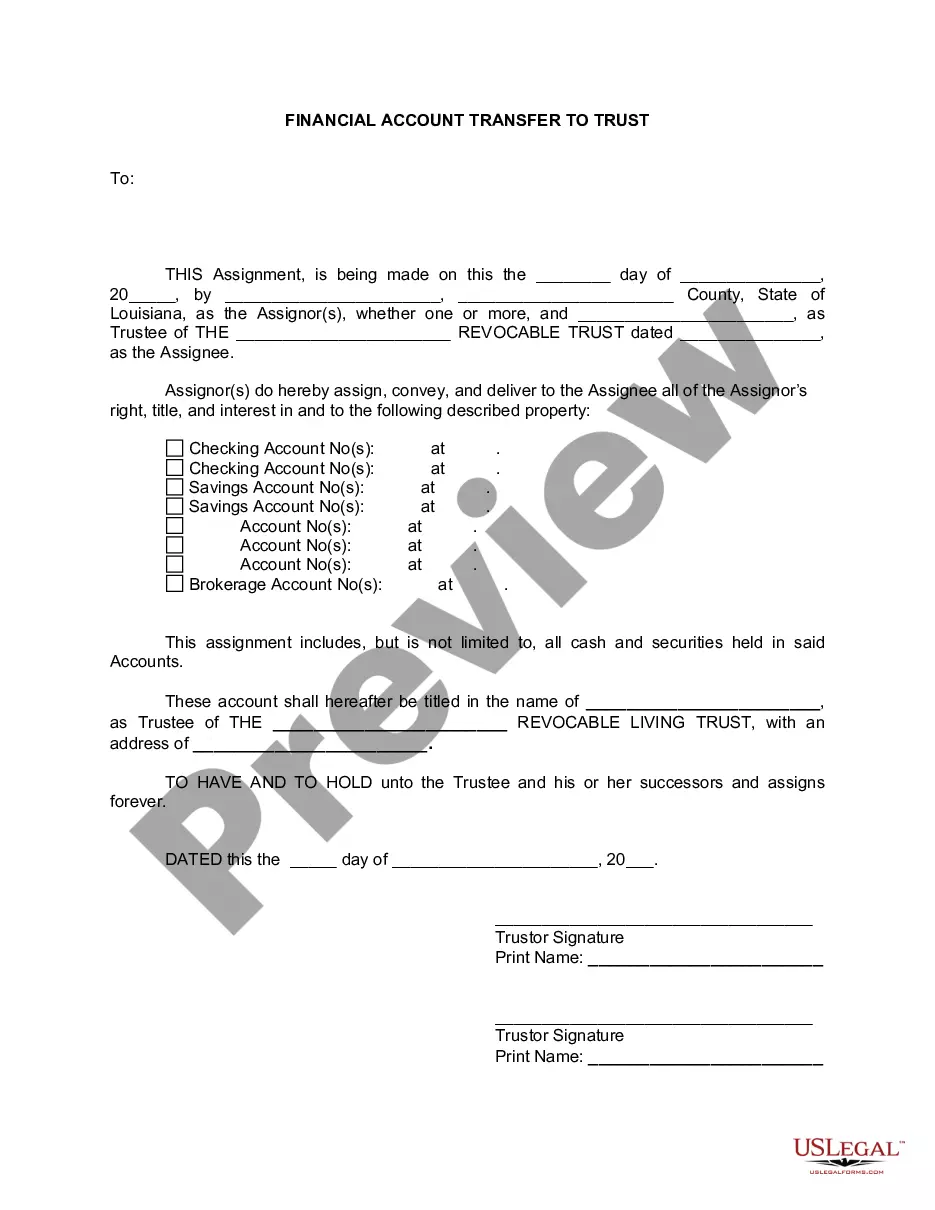

Louisiana Financial Account Transfer to Living Trust

Description

How to fill out Louisiana Financial Account Transfer To Living Trust?

Welcome to the greatest legal documents library, US Legal Forms. Right here you will find any template including Louisiana Financial Account Transfer to Living Trust templates and download them (as many of them as you want/need). Make official files in a couple of hours, rather than days or even weeks, without spending an arm and a leg on an legal professional. Get your state-specific sample in a few clicks and be confident with the knowledge that it was drafted by our qualified lawyers.

If you’re already a subscribed user, just log in to your account and click Download near the Louisiana Financial Account Transfer to Living Trust you require. Because US Legal Forms is web-based, you’ll generally get access to your downloaded forms, no matter the device you’re using. Find them in the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check our guidelines listed below to get started:

- If this is a state-specific document, check its applicability in your state.

- Look at the description (if accessible) to learn if it’s the right example.

- See much more content with the Preview option.

- If the document meets all your needs, click Buy Now.

- To create an account, choose a pricing plan.

- Use a card or PayPal account to subscribe.

- Download the template in the format you need (Word or PDF).

- Print the document and complete it with your/your business’s info.

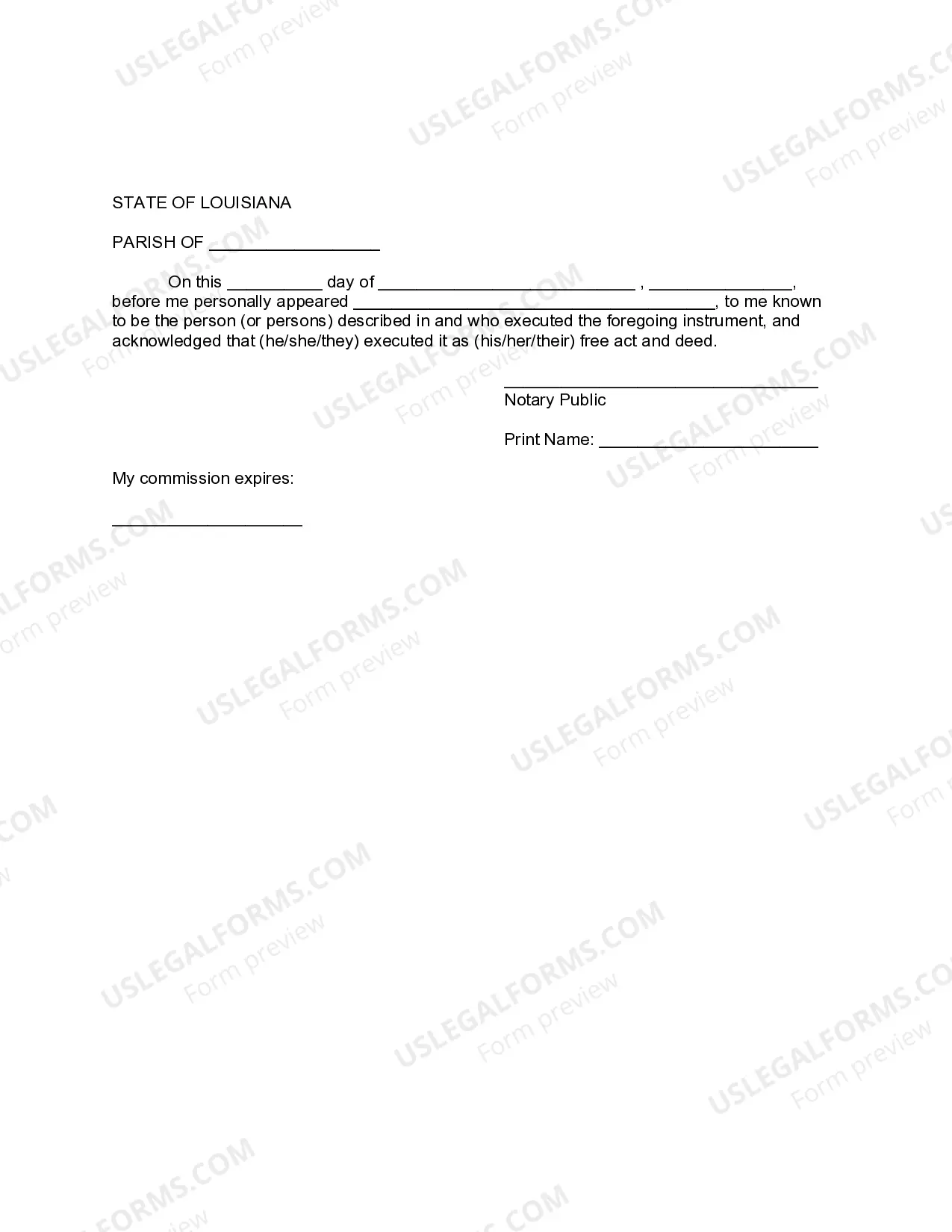

When you’ve completed the Louisiana Financial Account Transfer to Living Trust, give it to your legal professional for verification. It’s an extra step but a necessary one for being confident you’re fully covered. Sign up for US Legal Forms now and access a mass amount of reusable examples.

Form popularity

FAQ

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

Decide which type of trust you want. Take stock of your property. Pick a trustee. Create a trust document, either by yourself using a computer program or with the help of a lawyer. Sign the trust in front of a notary public. Put your assets inside the trust.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.