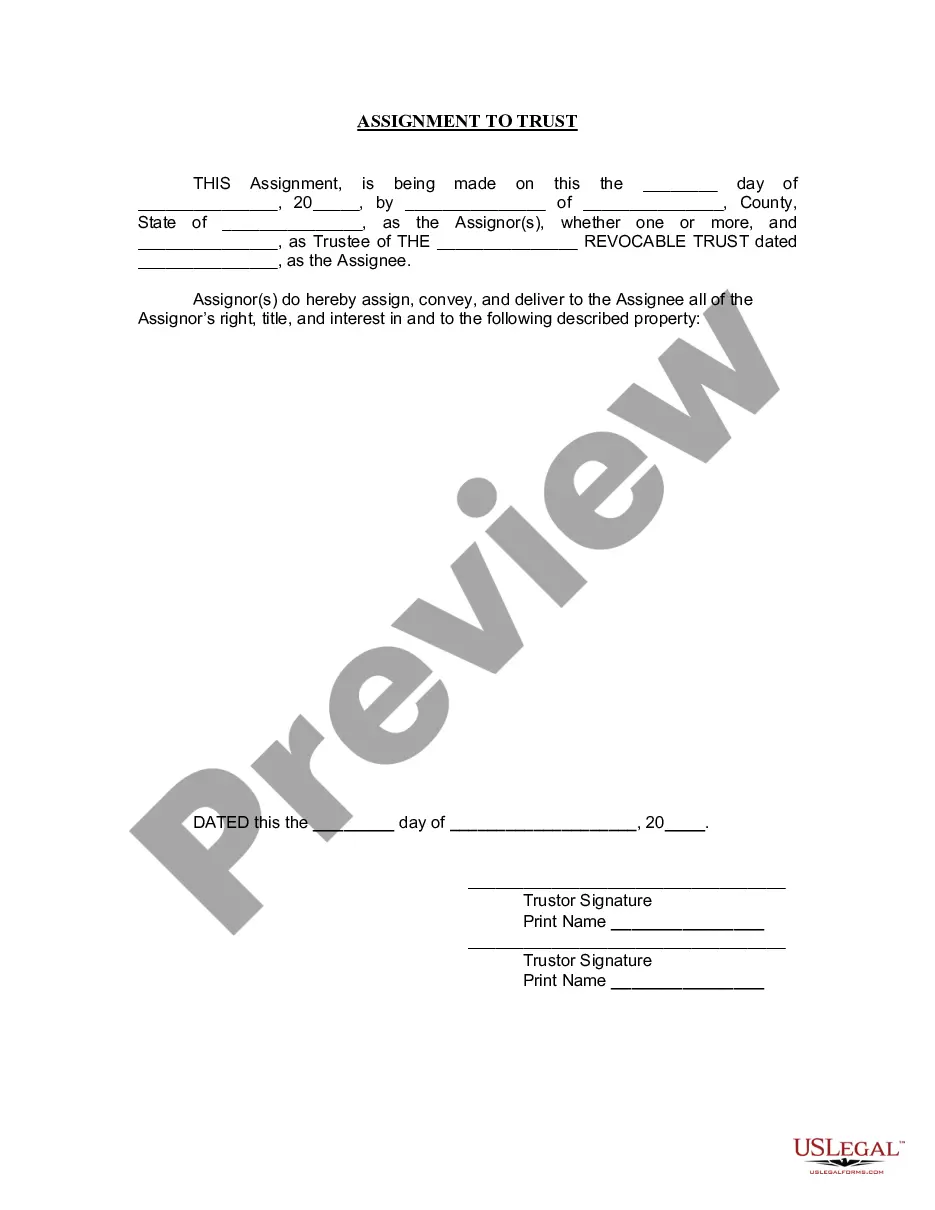

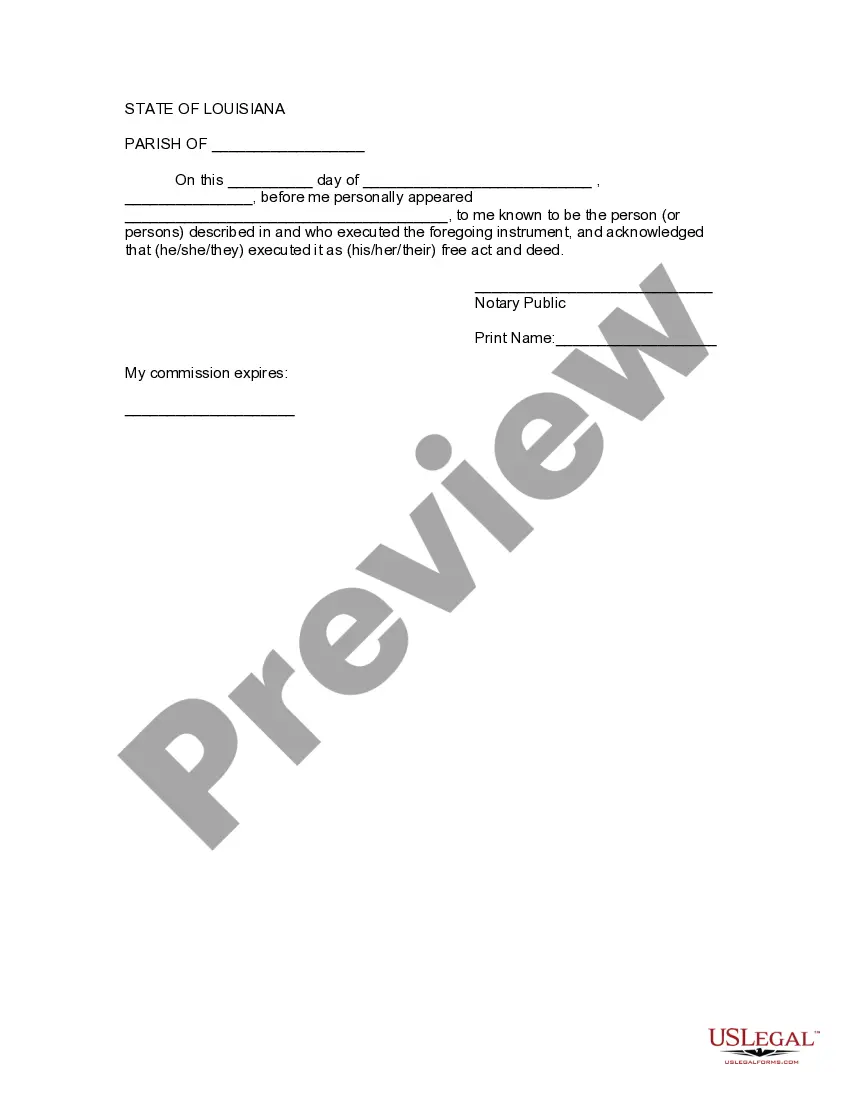

Louisiana Assignment to Living Trust

Description

How to fill out Louisiana Assignment To Living Trust?

You are welcome to the largest legal documents library, US Legal Forms. Here you can find any example such as Louisiana Assignment to Living Trust forms and save them (as many of them as you wish/need). Make official documents in a several hours, instead of days or even weeks, without having to spend an arm and a leg on an attorney. Get the state-specific sample in a couple of clicks and feel confident understanding that it was drafted by our accredited attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download near the Louisiana Assignment to Living Trust you want. Due to the fact US Legal Forms is web-based, you’ll always have access to your saved forms, no matter what device you’re using. Find them inside the My Forms tab.

If you don't have an account yet, what are you awaiting? Check our instructions below to start:

- If this is a state-specific form, check its validity in the state where you live.

- Look at the description (if accessible) to understand if it’s the correct template.

- See far more content with the Preview function.

- If the sample fulfills all of your needs, just click Buy Now.

- To make an account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Download the document in the format you need (Word or PDF).

- Print the file and fill it with your/your business’s details.

As soon as you’ve filled out the Louisiana Assignment to Living Trust, send it to your lawyer for confirmation. It’s an additional step but an essential one for being sure you’re completely covered. Become a member of US Legal Forms now and get a large number of reusable samples.

Form popularity

FAQ

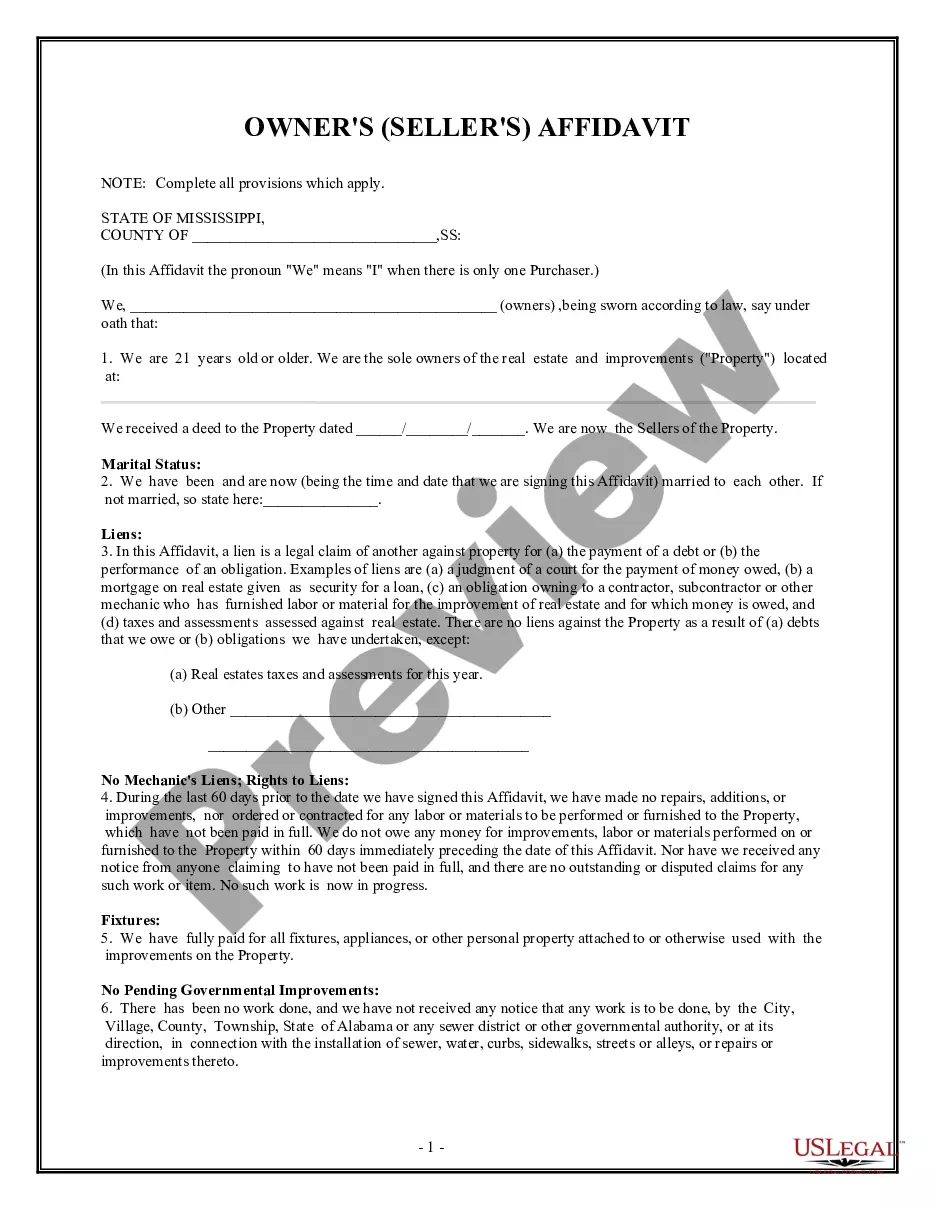

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

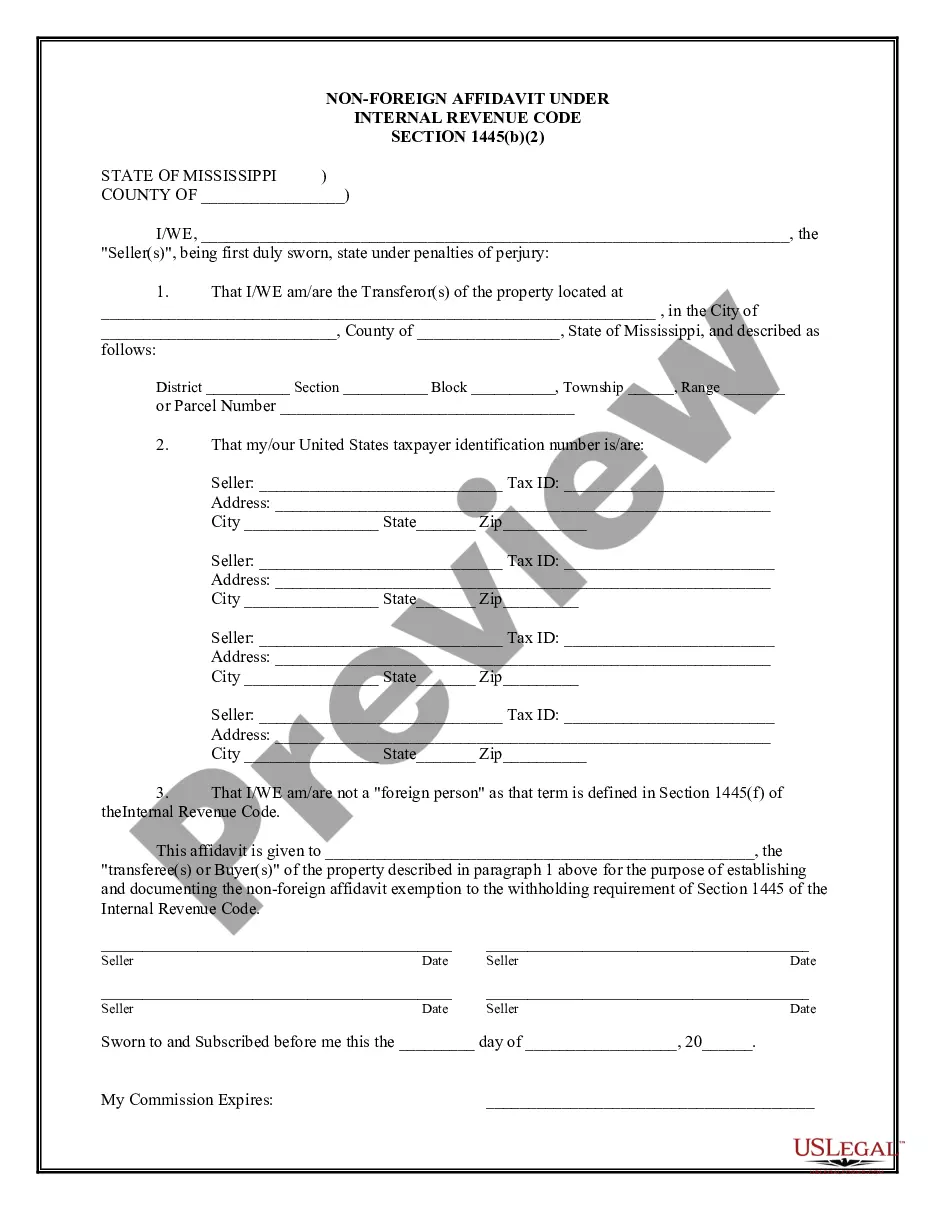

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Decide which type of trust you want. Take stock of your property. Pick a trustee. Create a trust document, either by yourself using a computer program or with the help of a lawyer. Sign the trust in front of a notary public. Put your assets inside the trust.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

When you set up a Living Trust, you fund the trust by transferring your assets from your name to the name of your Trust. Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee.