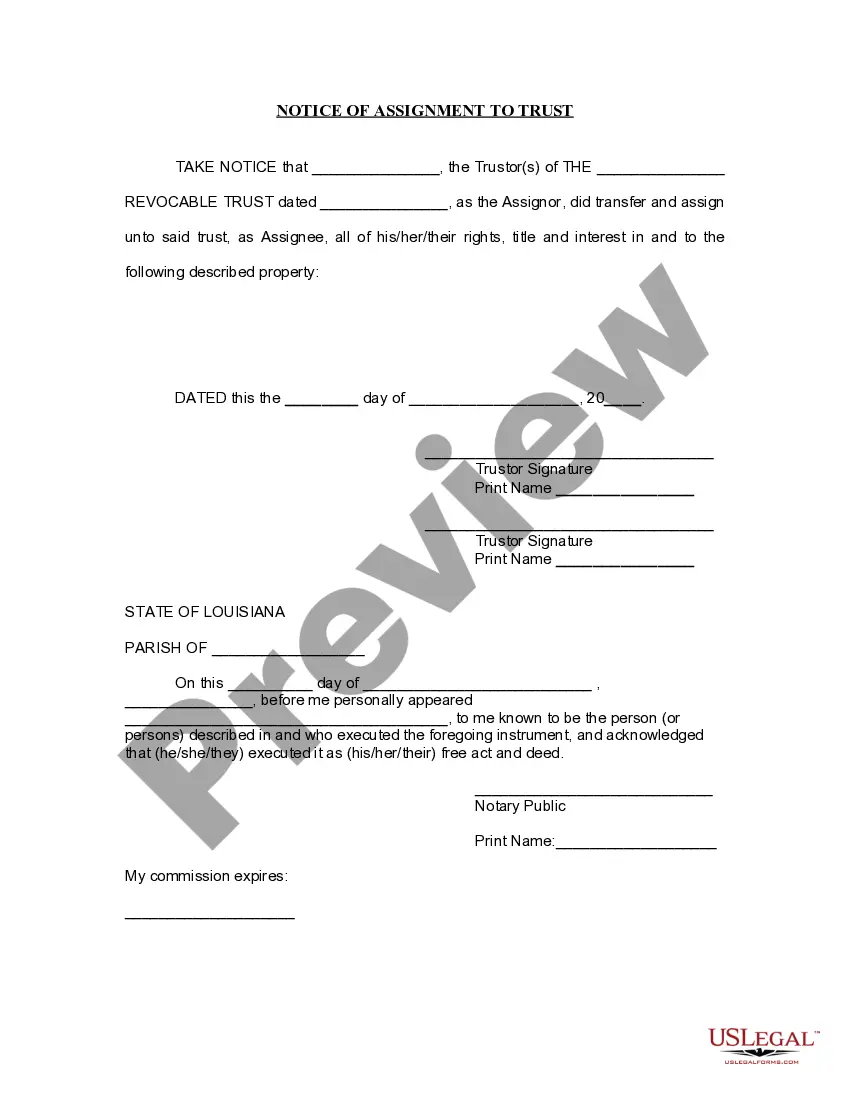

Louisiana Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Louisiana Notice Of Assignment To Living Trust?

You are welcome to the greatest legal documents library, US Legal Forms. Right here you can find any template including Louisiana Notice of Assignment to Living Trust forms and download them (as many of them as you wish/need to have). Prepare official documents in a few hours, rather than days or weeks, without having to spend an arm and a leg on an attorney. Get the state-specific example in a few clicks and feel assured with the knowledge that it was drafted by our qualified lawyers.

If you’re already a subscribed consumer, just log in to your account and click Download near the Louisiana Notice of Assignment to Living Trust you need. Due to the fact US Legal Forms is web-based, you’ll always get access to your saved files, no matter the device you’re using. See them in the My Forms tab.

If you don't have an account yet, what exactly are you waiting for? Check our instructions listed below to begin:

- If this is a state-specific document, check out its applicability in the state where you live.

- View the description (if readily available) to learn if it’s the right template.

- See a lot more content with the Preview function.

- If the sample fulfills all of your requirements, just click Buy Now.

- To make an account, pick a pricing plan.

- Use a card or PayPal account to register.

- Save the template in the format you need (Word or PDF).

- Print out the document and fill it with your/your business’s information.

When you’ve filled out the Louisiana Notice of Assignment to Living Trust, send away it to your lawyer for confirmation. It’s an extra step but an essential one for making certain you’re totally covered. Join US Legal Forms now and get access to a mass amount of reusable samples.

Form popularity

FAQ

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

Decide which type of trust you want. Take stock of your property. Pick a trustee. Create a trust document, either by yourself using a computer program or with the help of a lawyer. Sign the trust in front of a notary public. Put your assets inside the trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).