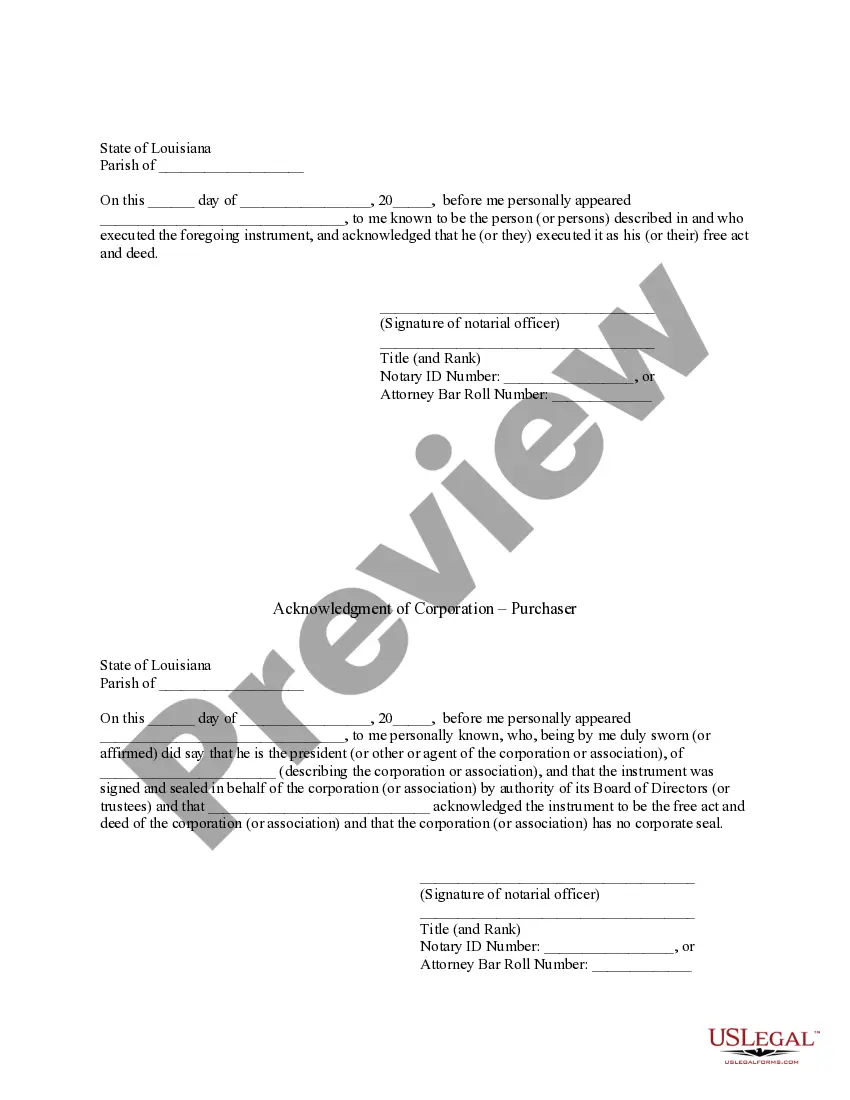

Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors

Description Assumption Agreement Mortgage

How to fill out Louisiana Mortgagors Paper?

Welcome to the greatest legal documents library, US Legal Forms. Right here you can get any example such as Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors forms and save them (as many of them as you wish/need to have). Prepare official papers with a several hours, instead of days or weeks, without spending an arm and a leg on an lawyer or attorney. Get your state-specific sample in clicks and feel assured with the knowledge that it was drafted by our qualified lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download near the Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors you require. Due to the fact US Legal Forms is online solution, you’ll generally have access to your saved templates, no matter what device you’re using. Locate them within the My Forms tab.

If you don't have an account yet, what are you waiting for? Check out our instructions below to get started:

- If this is a state-specific form, check its validity in your state.

- View the description (if offered) to learn if it’s the correct template.

- See a lot more content with the Preview function.

- If the sample fulfills your needs, just click Buy Now.

- To create an account, select a pricing plan.

- Use a card or PayPal account to sign up.

- Save the template in the format you require (Word or PDF).

- Print the document and complete it with your/your business’s information.

After you’ve completed the Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors, send it to your lawyer for verification. It’s an additional step but a necessary one for making confident you’re totally covered. Become a member of US Legal Forms now and access a mass amount of reusable examples.

Louisiana Mortgage Release Form popularity

Agreement Mortgagors Draft Other Form Names

La Assumption Mortgagors FAQ

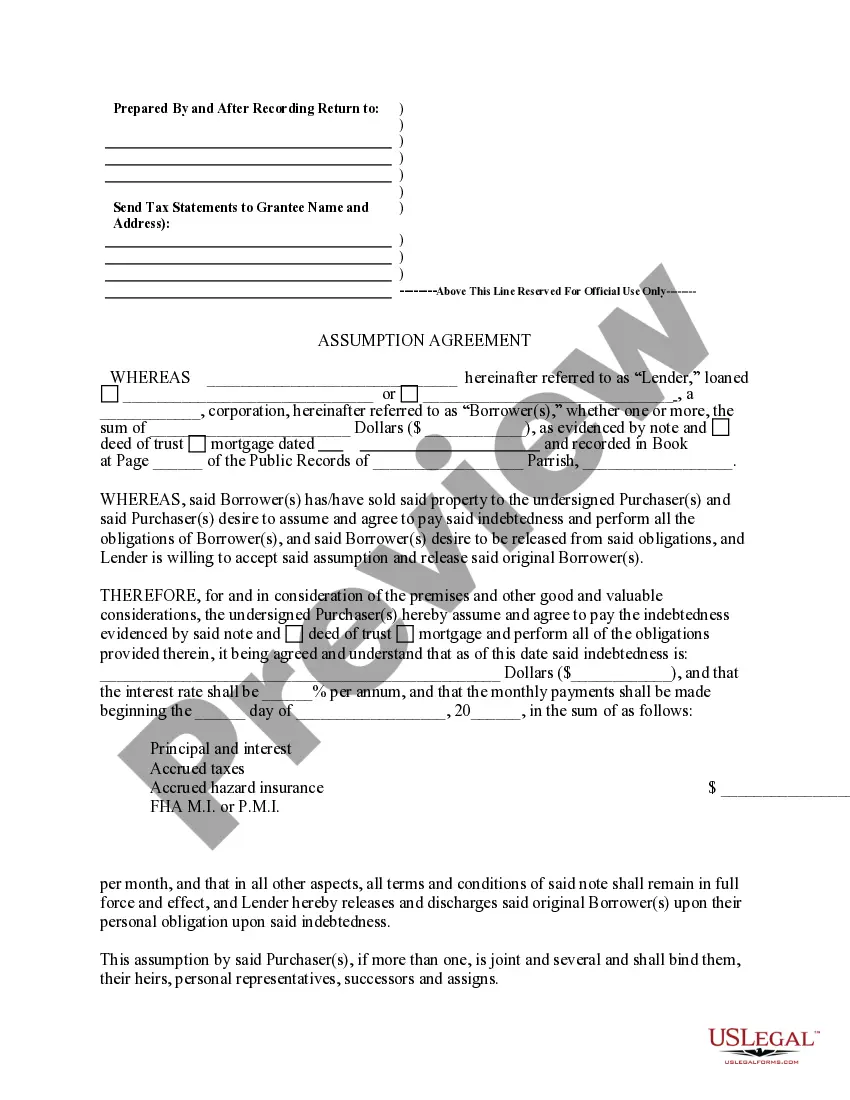

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.

The contractual agreement for repaying the property loan includes the interest that the borrower has to pay per month in addition to the principal repayments to the lender.Therefore, an assumable mortgage during this period is likely to have a lower interest rate reflecting the current state of the economy.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.