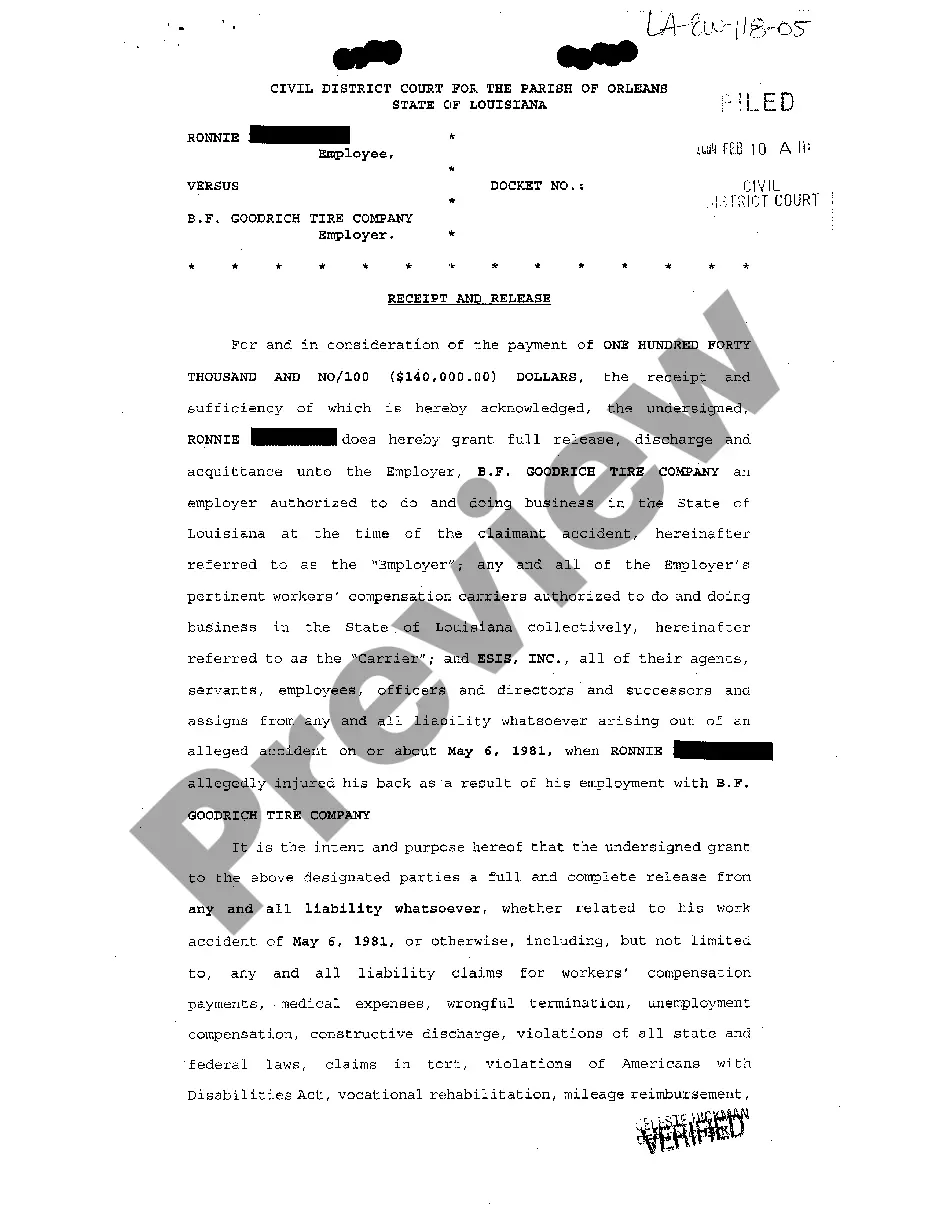

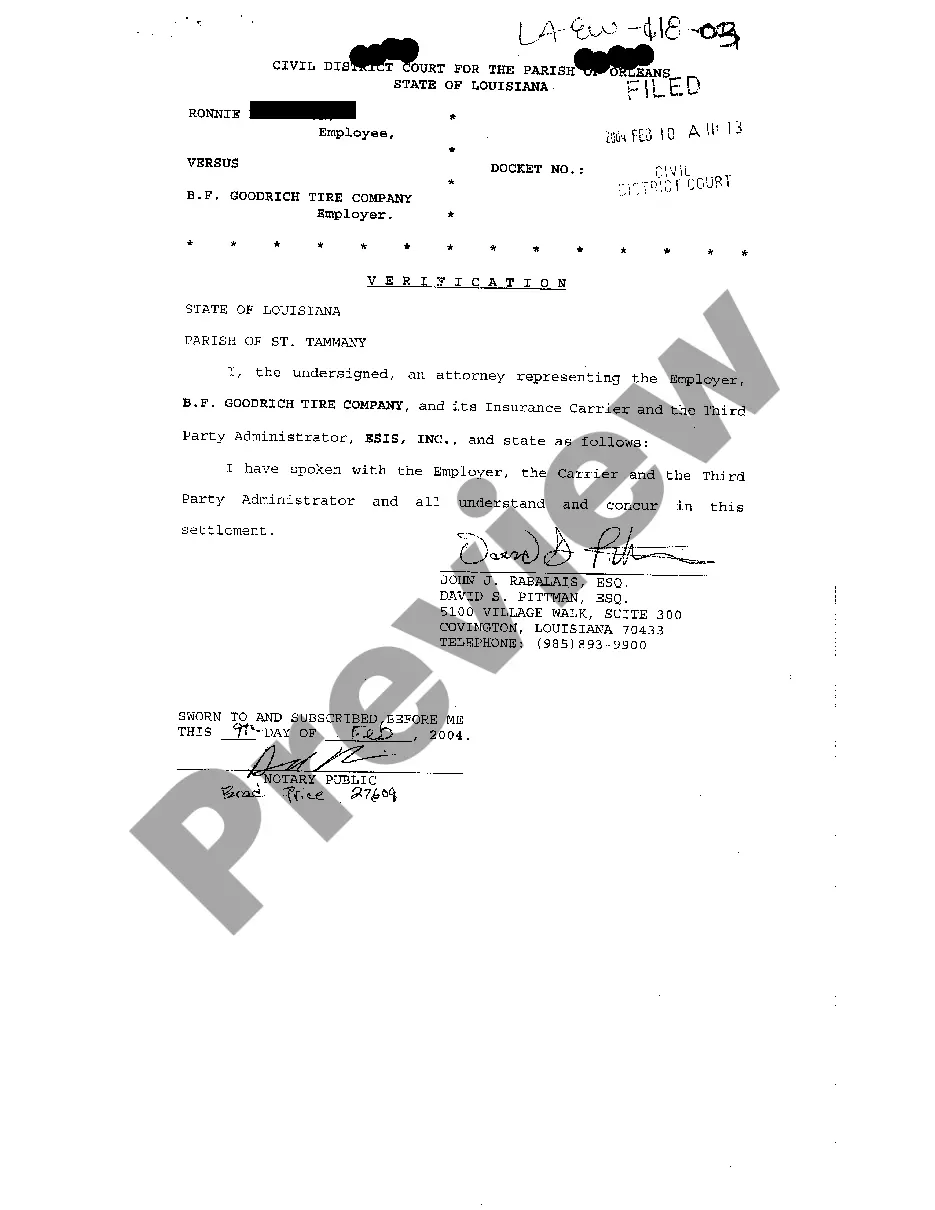

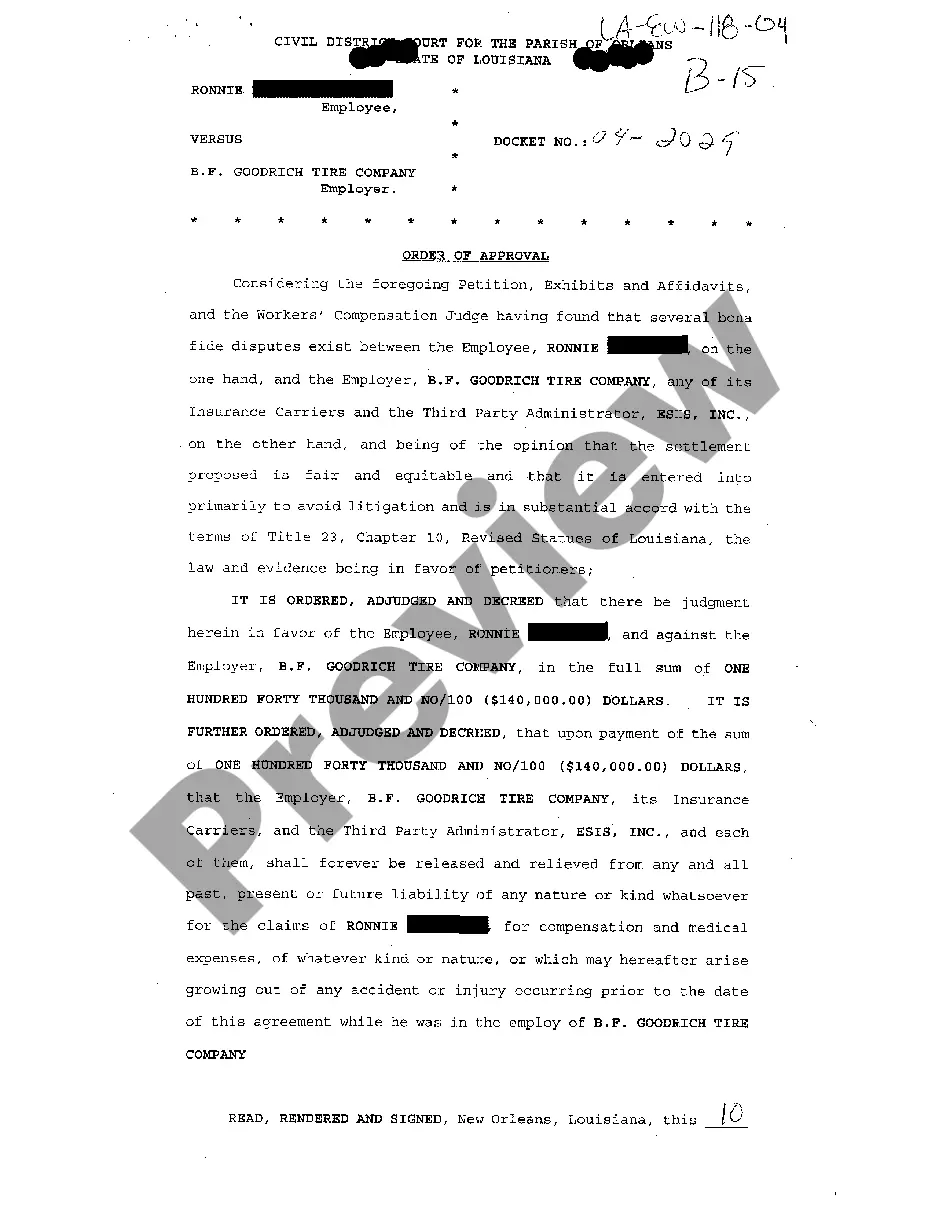

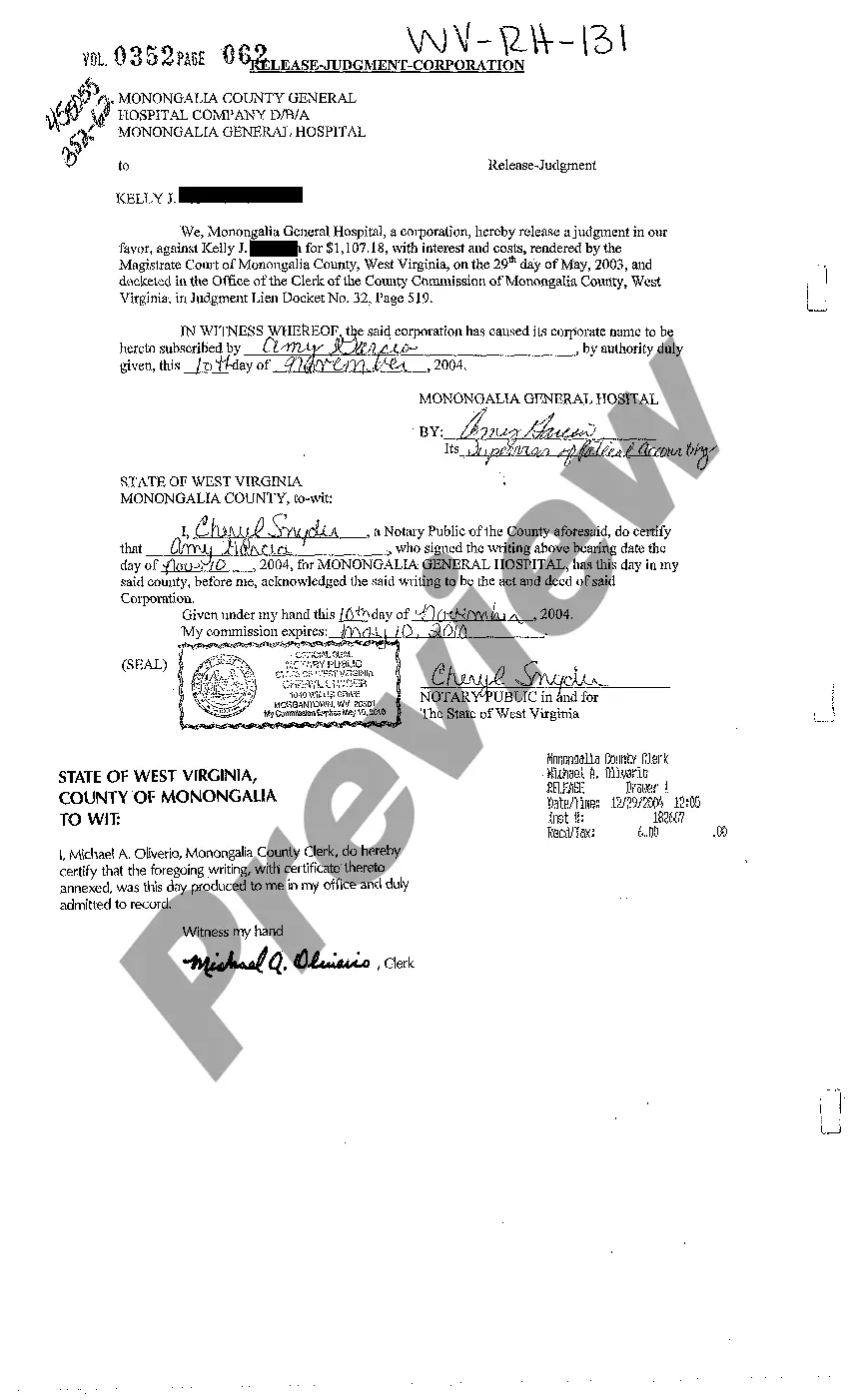

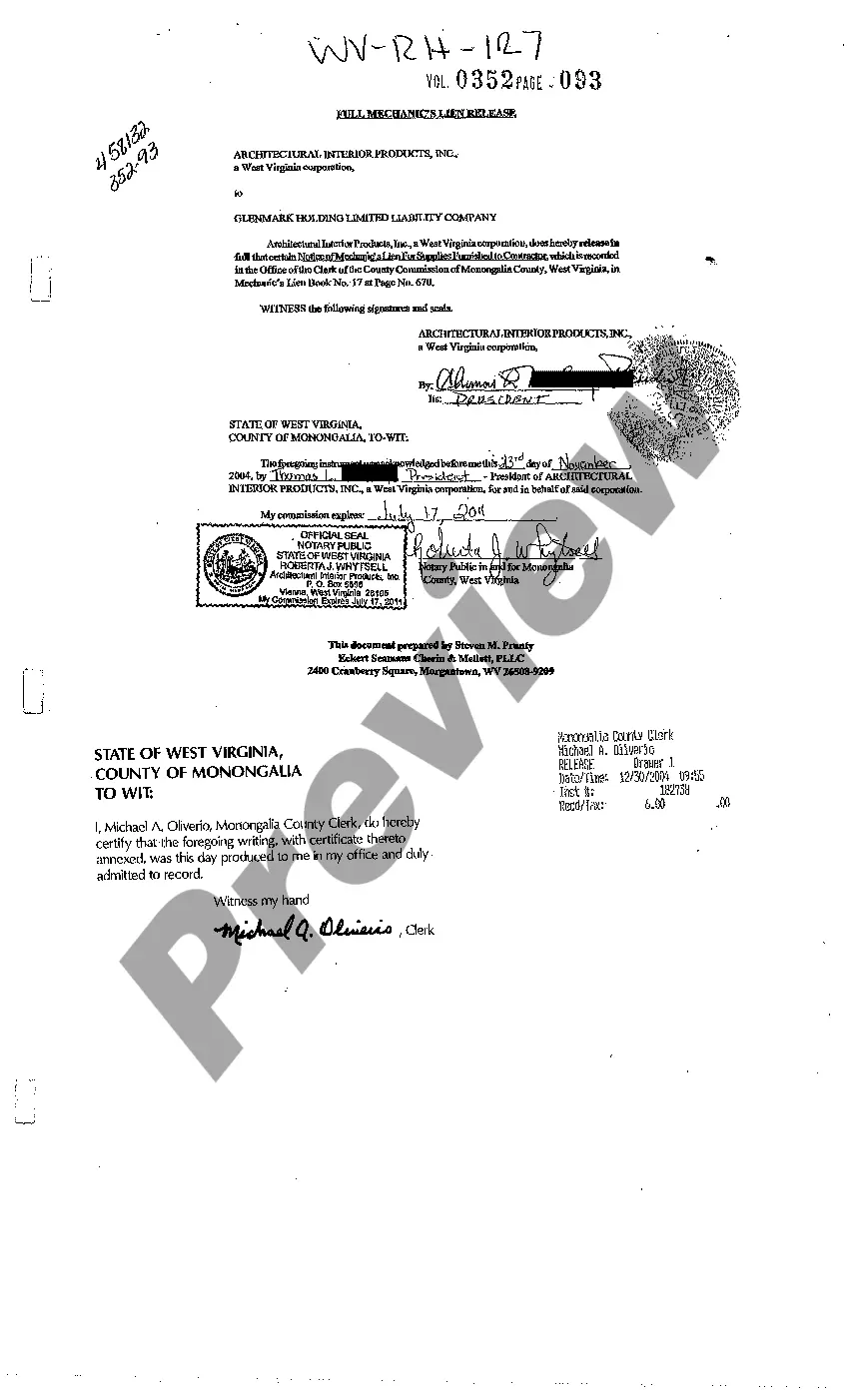

Louisiana Receipt And Release

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Receipt And Release?

Greetings to the most extensive legal documents collection, US Legal Forms. Here, you will discover numerous examples including Louisiana Receipt And Release forms and can download them (as many as you desire). Create formal documents in just a few hours, instead of days or even weeks, without spending a fortune on an attorney. Obtain your state-specific example in just a few clicks and rest assured that it was crafted by our qualified legal experts.

If you’re already a registered user, simply sign in to your profile and then click Download next to the Louisiana Receipt And Release you require. As US Legal Forms is an online resource, you’ll always have access to your saved documents, regardless of which device you are using. View them in the My documents section.

If you haven’t created an account yet, what are you waiting for? Follow our instructions below to begin: If this is a state-specific document, verify its validity in your state. Check the description (if available) to determine if it’s the correct example. Explore additional content with the Preview option. If the document meets all of your requirements, simply click Buy Now. To create your account, choose a subscription plan. Use a credit card or PayPal account to register. Download the document in the format you need (Word or PDF). Print the document and fill it out with your/your business’s information. Once you’ve completed the Louisiana Receipt And Release, provide it to your lawyer for confirmation. It’s an extra step but a crucial one for ensuring you’re fully protected. Register for US Legal Forms today and gain access to a large selection of reusable examples.

After completing the Louisiana Receipt And Release, consult your attorney for validation. It’s an important step to ensure you are entirely protected. Sign up for US Legal Forms now and obtain a vast array of reusable templates.

- Verify the document's validity in your state if it's state-specific.

- Check the description to ensure it’s the relevant example.

- Use the Preview feature to see additional content.

- If the document satisfies all your requirements, click Buy Now.

- Select a subscription plan to create your account.

- Register using a credit card or PayPal account.

- Download the document in your preferred format (Word or PDF).

- Print the document and complete it with your/your business’s details.

Form popularity

FAQ

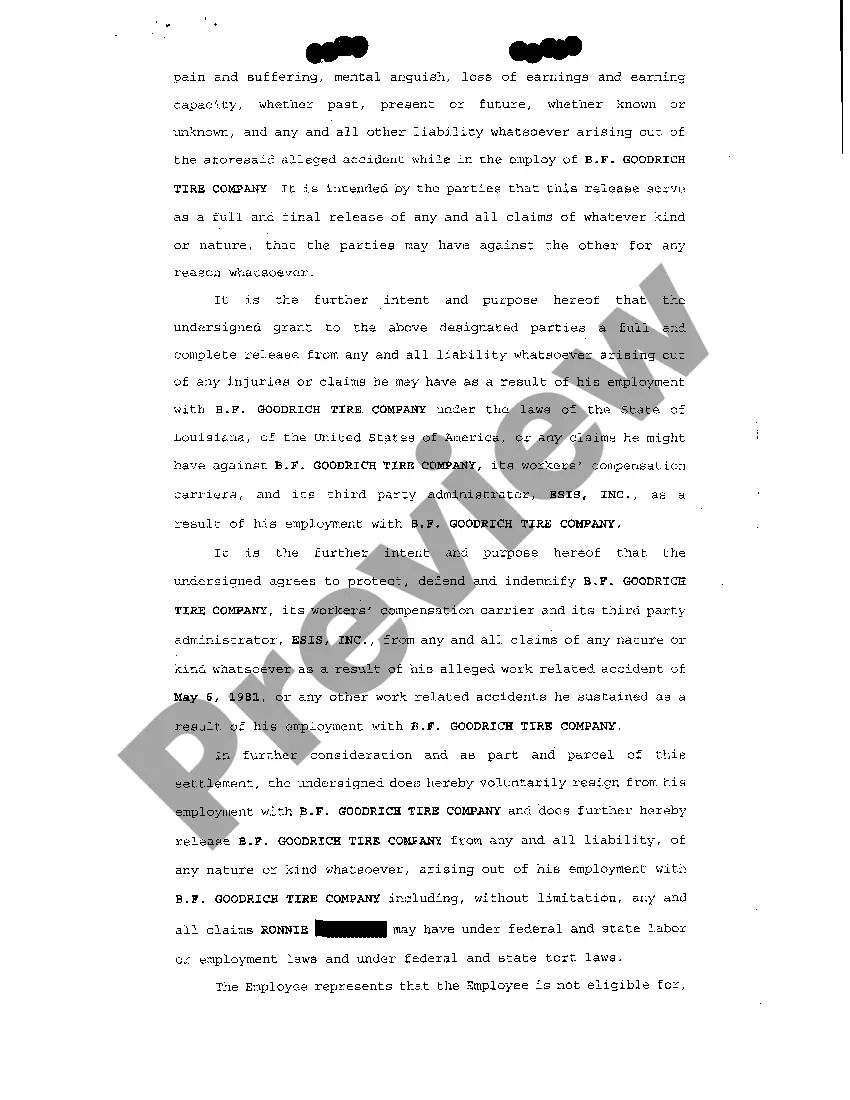

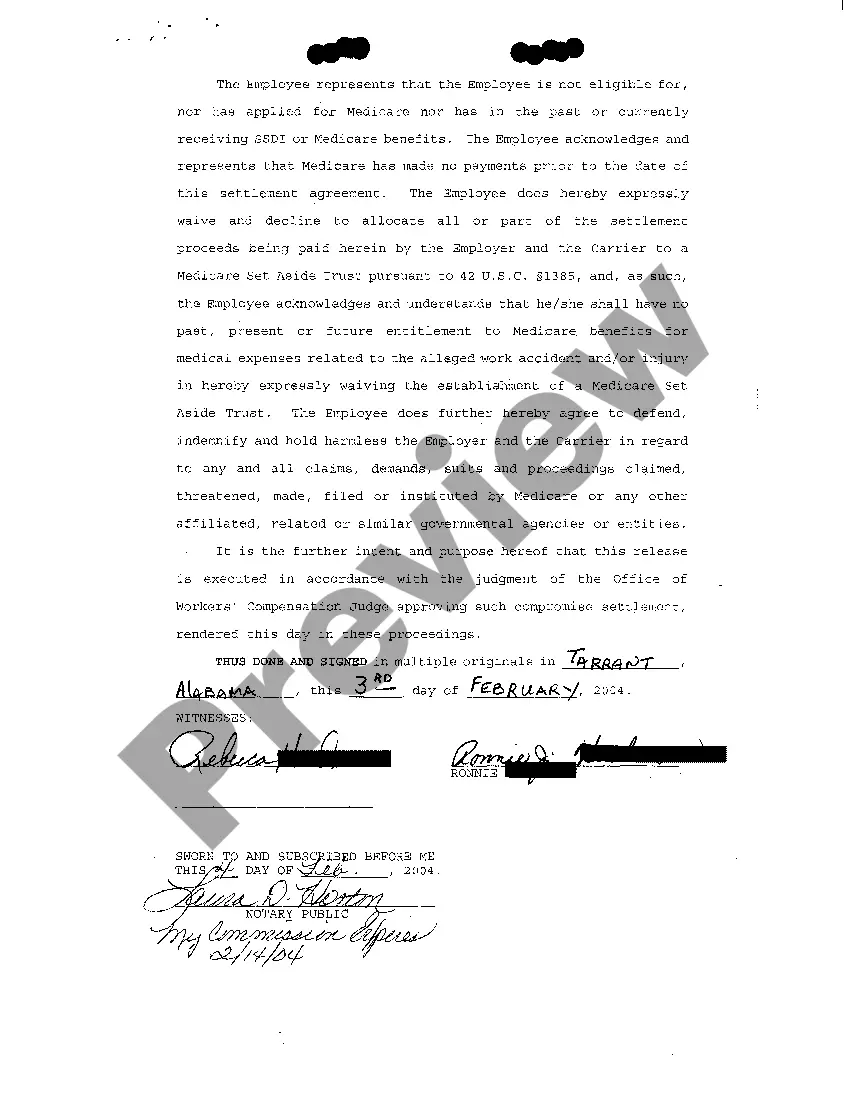

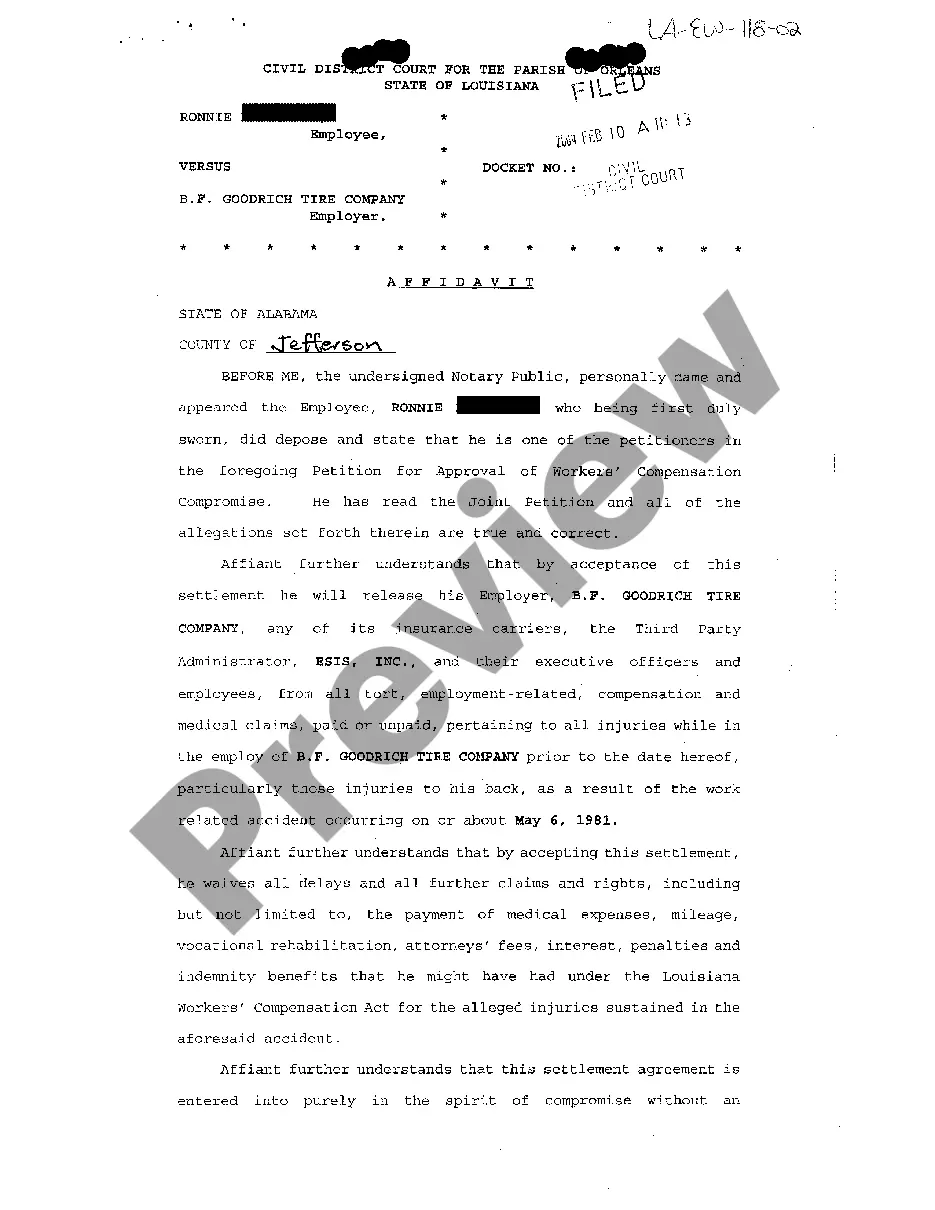

If there is a refusal to sign the final release, then the executor should seek a court order to approve the final accounting without release.

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.

If you are a beneficiary and have been asked to sign a release or waiver under suspicious or unfair circumstances, do not sign anything until you have a lawyer review the release with you.

States vary, but the deadline is commonly within 30 or 60 days of the settlor's death. How long does a trustee have to notify beneficiaries? This is partially because creditors against the estate need time to become aware of the process and make any claims against the estate.

A release provides protection to the trustee in a scenario where the beneficiary later decides to sue the trustee. The trustee can use the release to show that the beneficiary released the trustee of any legal claims the beneficiary might later bring.