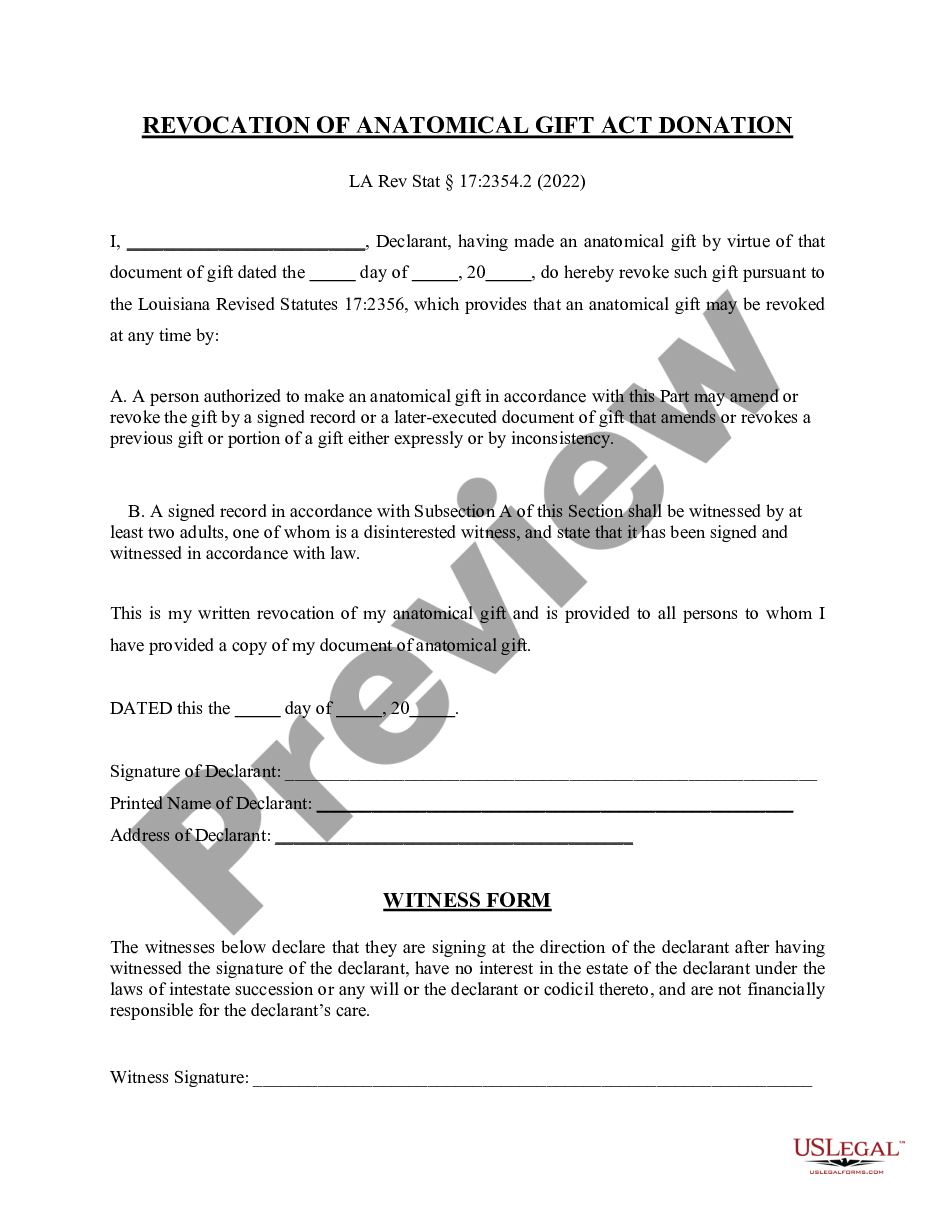

Louisiana Revocation of Anatomical Gift Donation

Description

and communicating the same to the donee, or by keeping a card or writing, signed by the donor on his person or in his effects, revoking the gift. Specific reference is made to the earlier executed Anatomical Gift Donation.

How to fill out Louisiana Revocation Of Anatomical Gift Donation?

You are welcome to the biggest legal documents library, US Legal Forms. Right here you will find any example such as Louisiana Revocation of Anatomical Gift Donation templates and save them (as many of them as you wish/require). Make official documents within a couple of hours, rather than days or even weeks, without spending an arm and a leg on an legal professional. Get the state-specific sample in clicks and feel assured knowing that it was drafted by our qualified attorneys.

If you’re already a subscribed customer, just log in to your account and click Download near the Louisiana Revocation of Anatomical Gift Donation you want. Due to the fact US Legal Forms is online solution, you’ll always have access to your downloaded forms, no matter the device you’re using. Locate them within the My Forms tab.

If you don't come with an account yet, what exactly are you awaiting? Check out our guidelines below to begin:

- If this is a state-specific sample, check out its validity in the state where you live.

- Look at the description (if readily available) to understand if it’s the correct example.

- See much more content with the Preview option.

- If the example fulfills all your requirements, click Buy Now.

- To make your account, choose a pricing plan.

- Use a credit card or PayPal account to register.

- Download the document in the format you want (Word or PDF).

- Print the file and fill it out with your/your business’s details.

When you’ve completed the Louisiana Revocation of Anatomical Gift Donation, send away it to your legal professional for verification. It’s an additional step but a necessary one for being sure you’re totally covered. Become a member of US Legal Forms now and access thousands of reusable examples.

Form popularity

FAQ

The revocation of such a gift, therefore, merely means that the donor has changed his mind and does not want to complete it by the delivery of possession. For the revocation of such gifts, no order of the court is necessary.

With a gift causa mortis, the donor may unilaterally choose to revoke the gift at any time while they are still alive. Additionally, the gift is either revoked or revocable at the donor's discretion, if they survive the conditions that caused them to anticipate death.

Section 126 of Transfer of Property Act, 1882 specifies as to when a gift can be suspended or revoked: If the donor and donee agree that on the happening of a specified event which does not depend on the donor's will, the gift shall be revoked. Any of those cases in which if it were a contract, it might be rescinded.

A gift may be revoked only by a mutual agreement on a condition by the donor and the donee, or by rescinding the contract pertaining to such gift. The Donations mortis causa and Hiba are the only two kinds of gifts which do not follow the provisions of the Transfer of Property Act.

Save as aforesaid, a gift cannot be revoked. Nothing contained in this section shall be deemed to affect the rights of transferees for consideration without notice.

A gift may be revoked only by a mutual agreement on a condition by the donor and the donee, or by rescinding the contract pertaining to such gift. The Donations mortis causa and Hiba are the only two kinds of gifts which do not follow the provisions of the Transfer of Property Act.

A gift is valid and complete on registration.A deed of gift once executed and registered cannot be revoked, unless the mandatory requirement of Section 126 of Transfer of Property Act, 1882 is fulfilled.

The donor and donee may agree that on the happening of any specified event which does not depend on the will of the donor a gift shall be suspended or revoked; but a gift which the parties agree shall be revocable wholly or in part, at the mere will of the donor, is void wholly or in part, as the case may be.

Gift once given cannot be revoked. Gift deed s irrevocable. So once the gift deed s registered it becomes the sole property of the donee I.e., person who received the gift. But in case if the said deed was registered due to threat fraud or by force then it can be revoked and the same has to be proved before the court.