Louisiana Sample Operating Agreement for Professional Limited Liability Company PLLC

Description Sample Operating Agreement

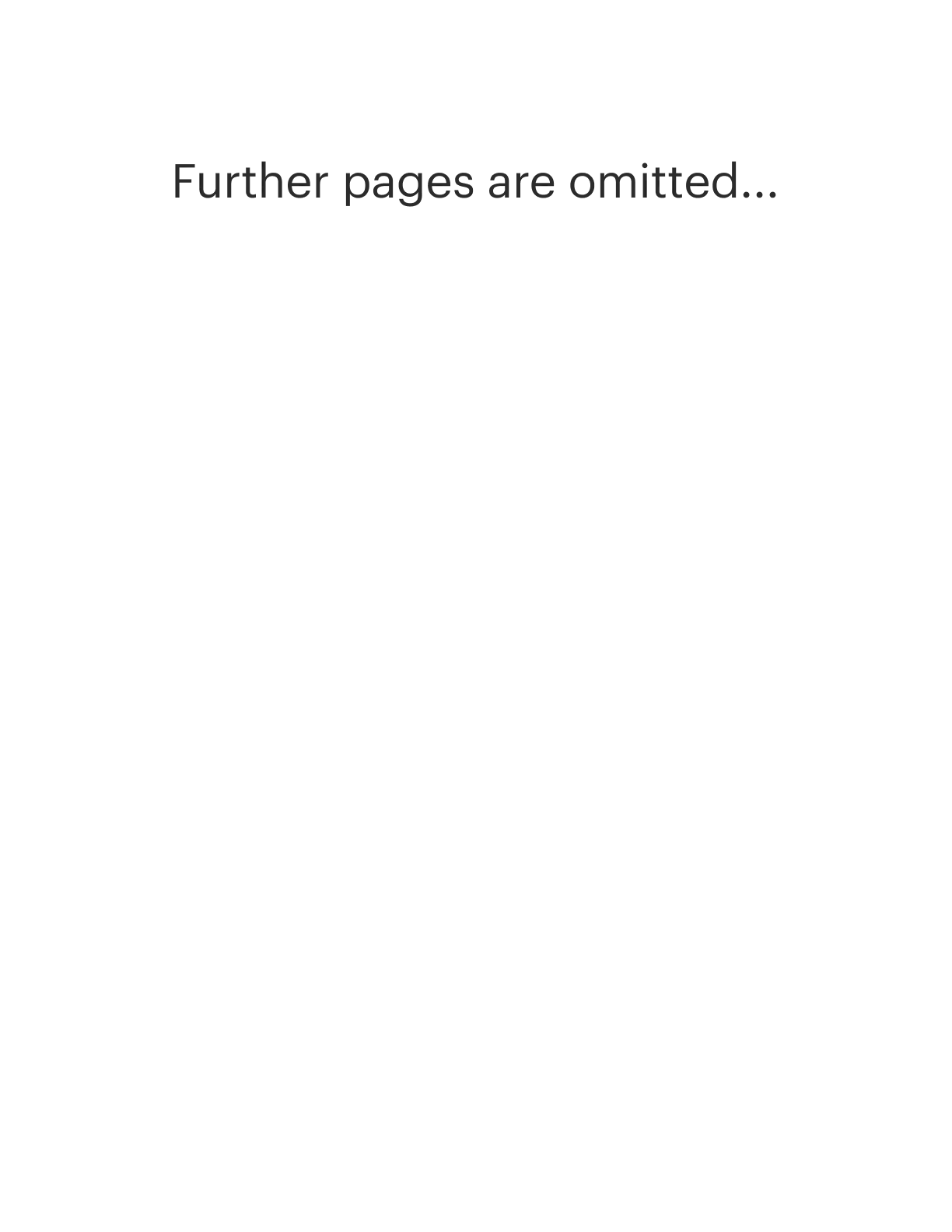

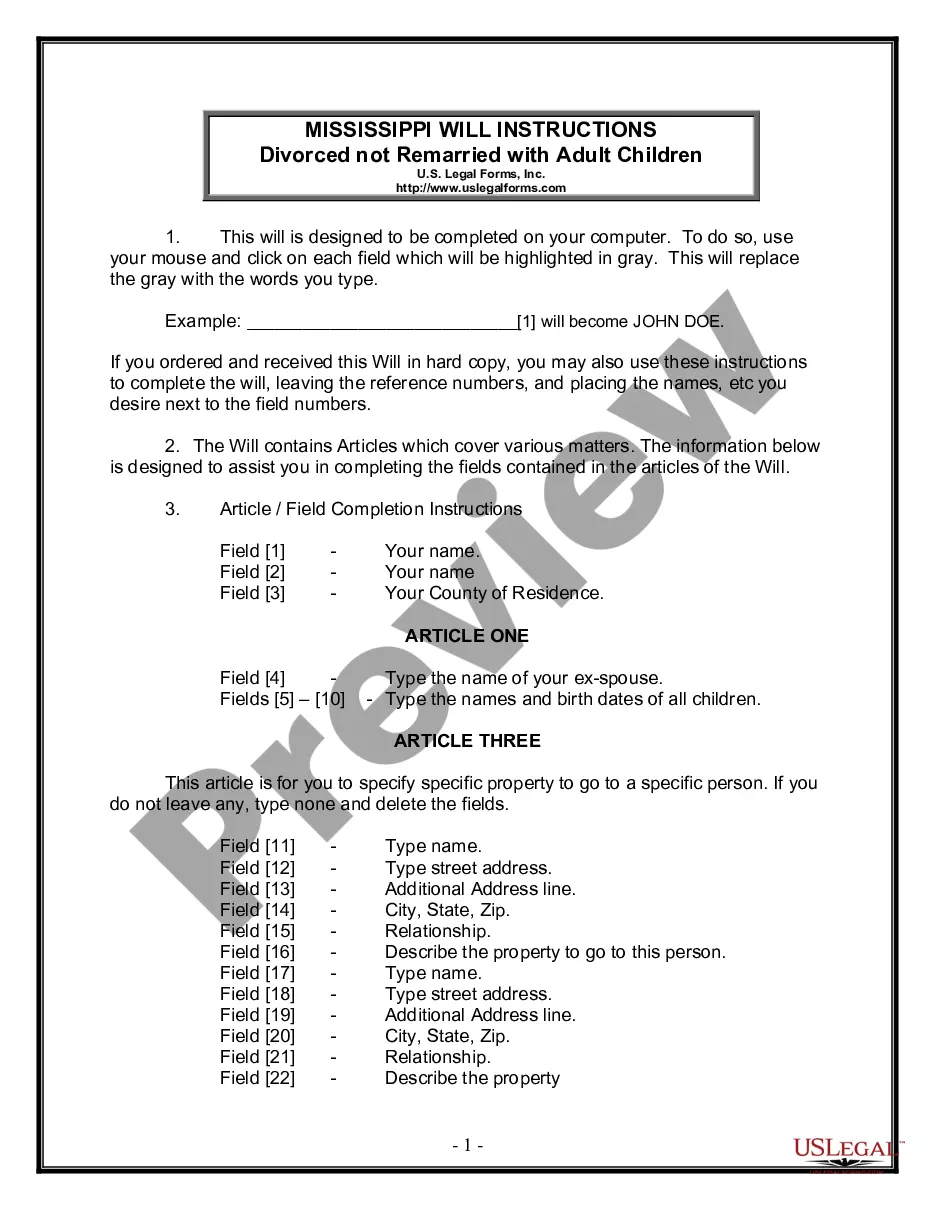

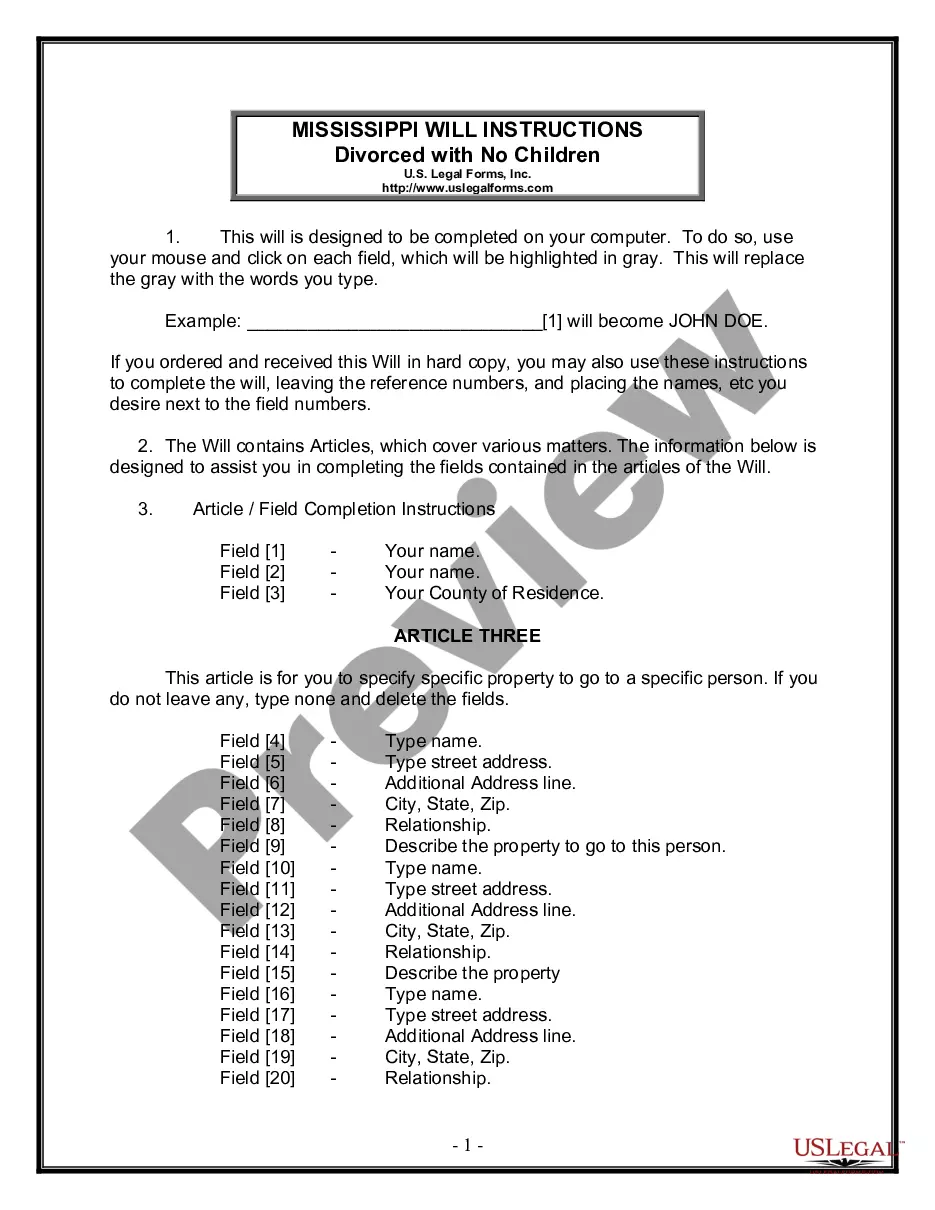

How to fill out Louisiana Sample Operating Agreement For Professional Limited Liability Company PLLC?

Welcome to the biggest legal files library, US Legal Forms. Right here you can get any example including Louisiana Sample Operating Agreement for Professional Limited Liability Company PLLC forms and save them (as many of them as you wish/need). Prepare official documents within a several hours, rather than days or even weeks, without having to spend an arm and a leg with an attorney. Get the state-specific form in a couple of clicks and be assured understanding that it was drafted by our accredited lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Louisiana Sample Operating Agreement for Professional Limited Liability Company PLLC you require. Because US Legal Forms is online solution, you’ll generally have access to your saved forms, no matter what device you’re using. Find them inside the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check our guidelines below to get started:

- If this is a state-specific document, check out its validity in the state where you live.

- See the description (if readily available) to learn if it’s the correct template.

- See much more content with the Preview feature.

- If the sample matches all of your needs, click Buy Now.

- To make your account, choose a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the template in the format you require (Word or PDF).

- Print out the document and fill it out with your/your business’s information.

As soon as you’ve completed the Louisiana Sample Operating Agreement for Professional Limited Liability Company PLLC, send it to your lawyer for confirmation. It’s an extra step but an essential one for being sure you’re completely covered. Join US Legal Forms now and access a large number of reusable samples.

Professional Limited Liability Company Form popularity

Louisiana Limited Liability Company Other Form Names

FAQ

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

Every member of the LLC and the manager or managers (if there are any) need to sign the operating agreement. Each signatory should sign a separate signature page.Learn how to properly sign business documents on your state's LLC formation page.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

There is no requirement that the operating agreement is notarized. Even without being notarized, the document is still considered legally enforceable among the parties.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on