Louisiana PLLC Notices and Resolutions

Description

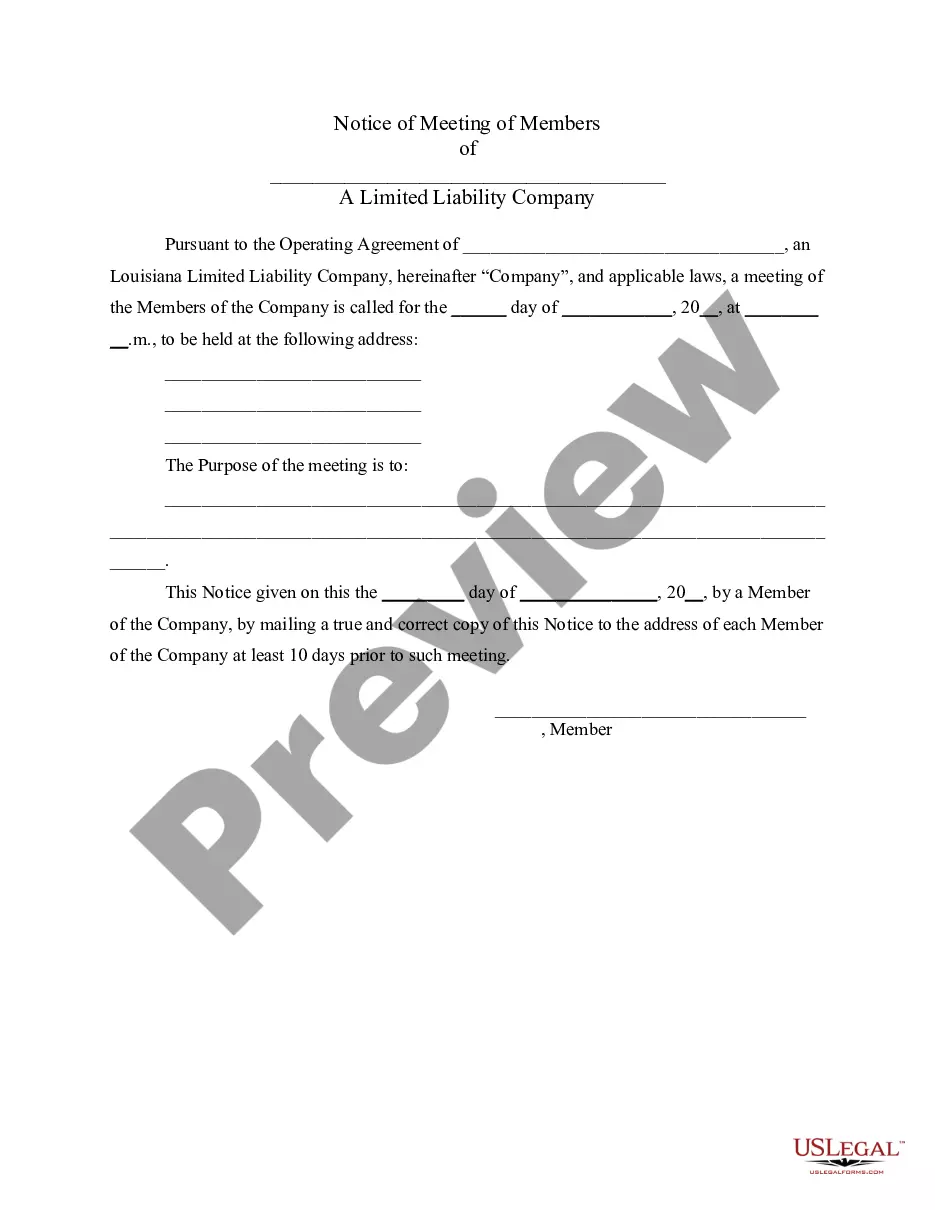

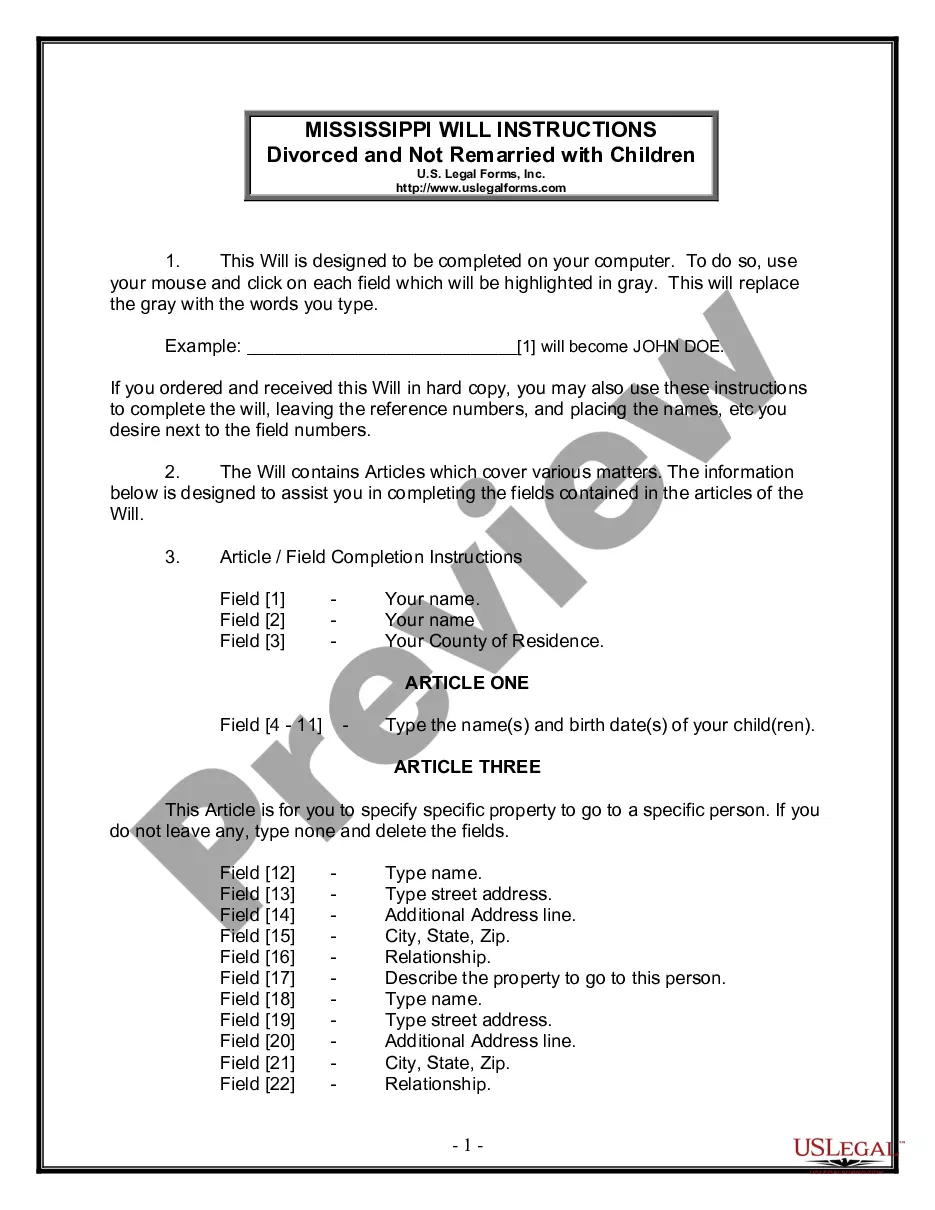

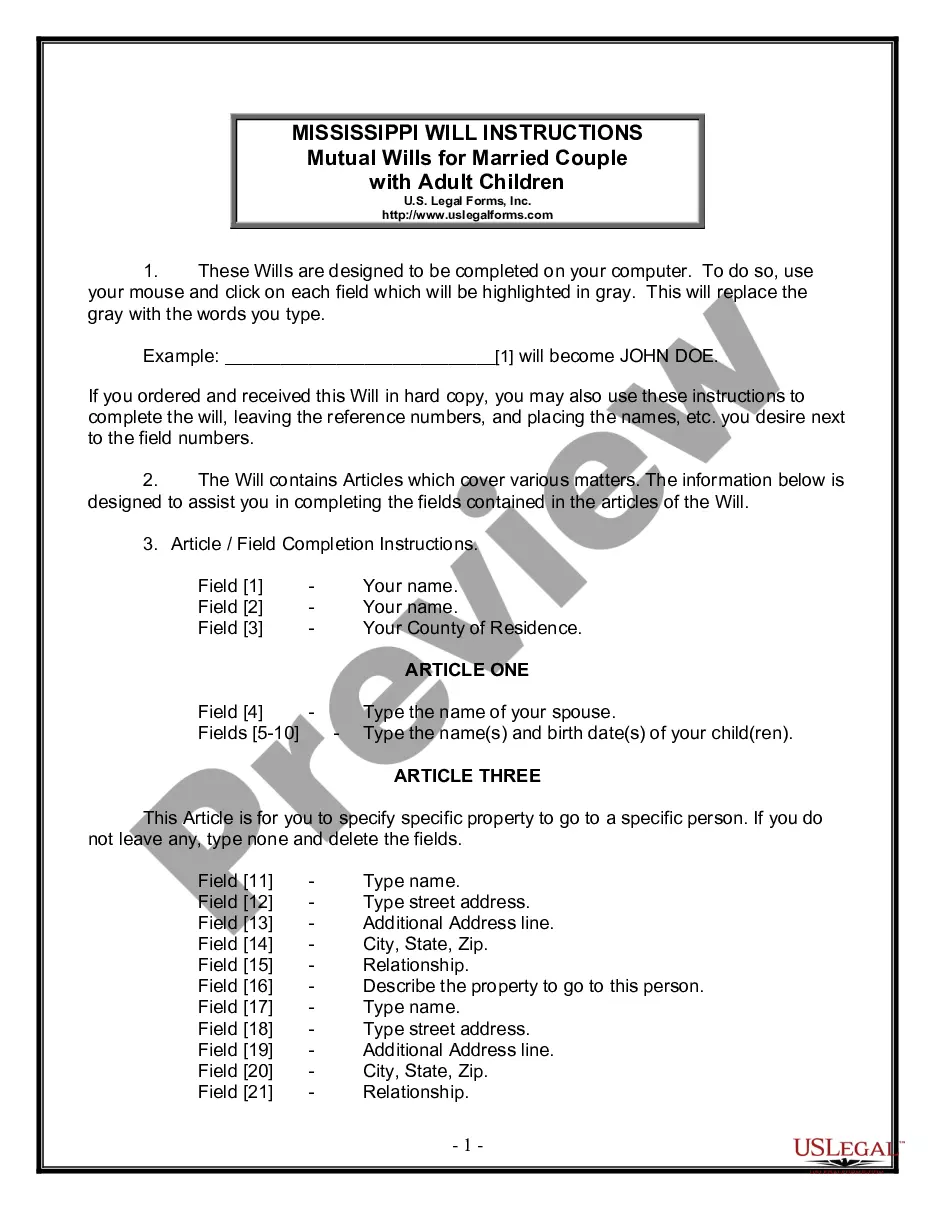

How to fill out Louisiana PLLC Notices And Resolutions?

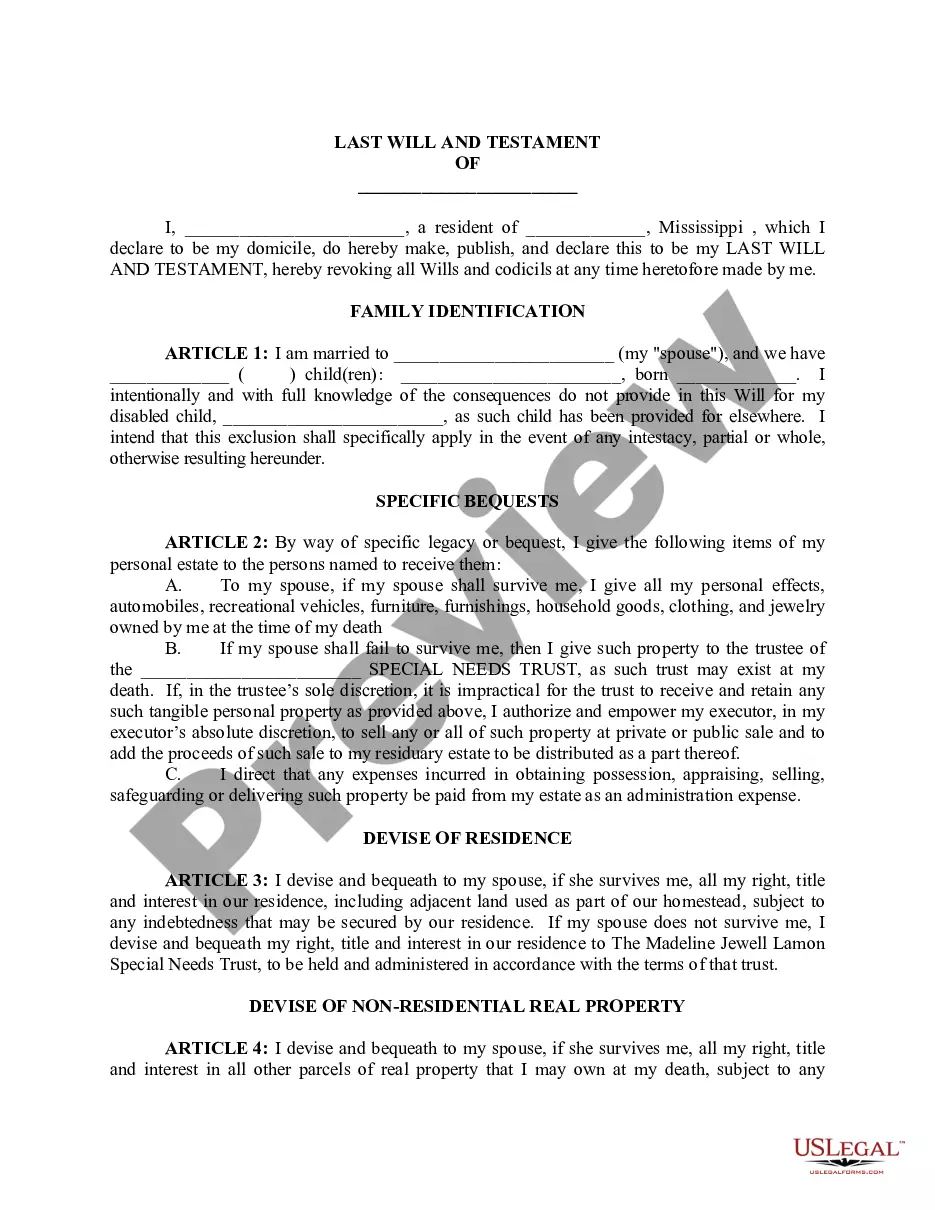

You are welcome to the greatest legal documents library, US Legal Forms. Right here you will find any sample including Louisiana PLLC Notices and Resolutions templates and save them (as many of them as you wish/need to have). Get ready official files in just a several hours, instead of days or weeks, without having to spend an arm and a leg with an attorney. Get the state-specific sample in clicks and be confident understanding that it was drafted by our state-certified attorneys.

If you’re already a subscribed consumer, just log in to your account and click Download near the Louisiana PLLC Notices and Resolutions you require. Because US Legal Forms is web-based, you’ll generally get access to your downloaded forms, regardless of the device you’re utilizing. Find them within the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check our instructions listed below to get started:

- If this is a state-specific document, check its applicability in your state.

- View the description (if accessible) to understand if it’s the proper template.

- See much more content with the Preview function.

- If the sample matches your requirements, click Buy Now.

- To create your account, pick a pricing plan.

- Use a card or PayPal account to join.

- Save the template in the format you want (Word or PDF).

- Print the document and fill it out with your/your business’s info.

As soon as you’ve completed the Louisiana PLLC Notices and Resolutions, send out it to your attorney for verification. It’s an additional step but a necessary one for making certain you’re fully covered. Join US Legal Forms now and get access to a mass amount of reusable examples.

Form popularity

FAQ

Professional LLCs PLLCs offer the same benefits as LLCs. The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs.

A PLLC is a special kind of business entity available to licensed professionals. By Christine Mathias, Attorney. A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Forming your personal service business as a PLLC will protect you personally from creditors seeking unpaid debts owed by the PLLC, provides legal liability protection from any legal claims brought against the business, and also provides asset protection.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

To form a PLLC, a licensed professional must sign all filing documents as well as include their professional license number and a certified copy of their license. Importantly, they must submit these documents for approval with their state licensing board before filing them with their state's secretary of state.

A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.