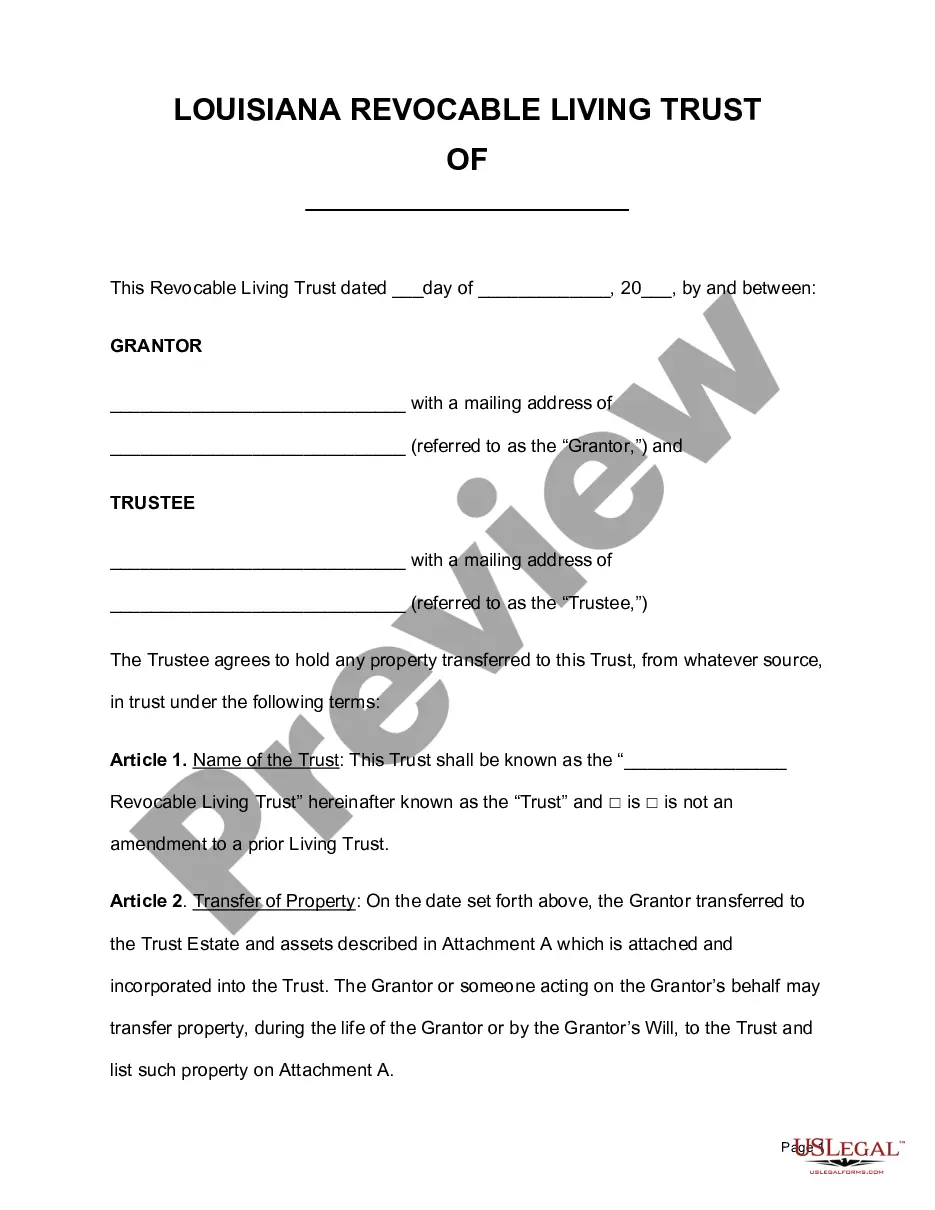

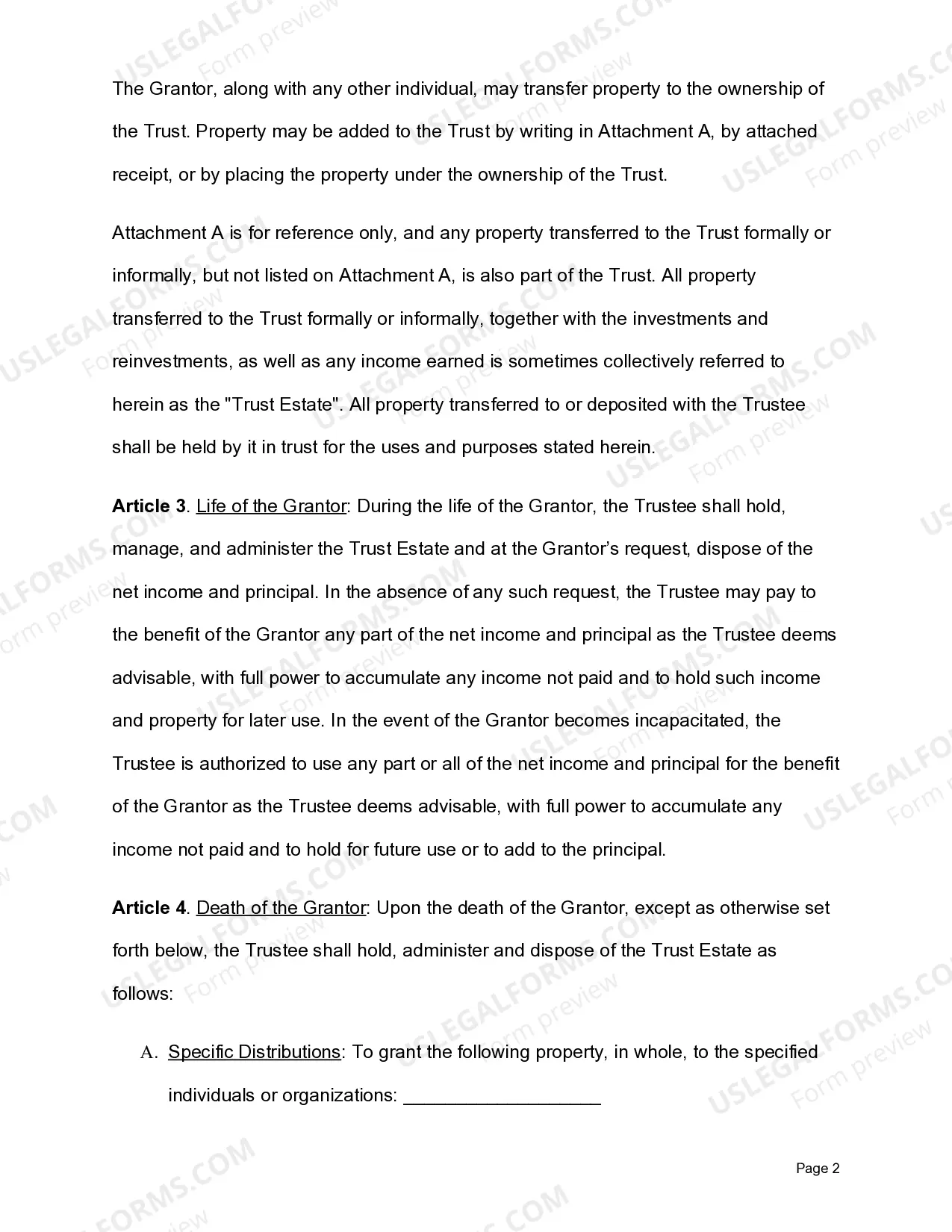

A Louisiana Revocable LivingTrust is an estate planning instrument used to manage a person's assets during their lifetime, and to pass on their assets to their chosen beneficiaries after their death. This type of trust is revocable, meaning that the granter can make changes to the trust at any time. There are two main types of Louisiana Revocable LivingTrusts: single-grantor trusts and multi-grantor trusts. A single-grantor trust is created by one person and enables them to manage their own assets, while a multi-grantor trust is created by two or more people and allows them to manage their collective assets. The trust also allows the granter to designate a trustee, who is responsible for managing and distributing assets according to the terms of the trust. The granter can also specify how assets should be distributed to their chosen beneficiaries, as well as who should receive the assets upon their death. By creating a Louisiana Revocable LivingTrust, the granter can ensure that their assets are managed according to their wishes, and that their beneficiaries will receive their assets in an orderly manner.

Louisiana Revocable LivingTrust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Revocable LivingTrust?

US Legal Forms is the most simple and cost-effective way to find suitable formal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable blanks that comply with federal and local laws - just like your Louisiana Revocable LivingTrust.

Getting your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Louisiana Revocable LivingTrust if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one corresponding to your needs, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Louisiana Revocable LivingTrust and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your reliable assistant in obtaining the required formal documentation. Try it out!

Form popularity

FAQ

The main disadvantage of a revocable living trust is that it does not protect you from creditors or lawsuits. Because you have control of everything in your trust and have access to the assets, you can still be sued for liability.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

Among the rigid set of qualifications that must be met for a see-through trust to take effect, the account must be valid and legal under state law, the trust must be irrevocable upon the plan owner's death, and all beneficiaries must be easily identifiable, eligible, and named.

The price of making a living trust depends on the method you use to form it. One way is to use an online program and create the trust document yourself. This will cost you a few hundred dollars or so. You can also use the services of a lawyer, for which you'll probably pay more than $1,000.

One of the most notable disadvantages of bloodline trusts includes the fact that the assets held within the trust can only be used for the beneficiaries' health, education, maintenance and/or support.

A Louisiana living trust passes the assets in the trust to your beneficiaries without going through probate, the process in which a will is verified and enacted by a court. Probate can take many months and incurs the expense of an executor and attorney as well as court fees.

Revocable living trusts have a few key benefits, like avoiding probate, privacy protection and protection in the case of incapacitation. However, revocable living trusts can be expensive, don't have direct tax benefits, and don't protect against creditors.

An irrevocable trust offers your assets the most protection from creditors and lawsuits. Assets in an irrevocable trust aren't considered personal property. This means they're not included when the IRS values your estate to determine if taxes are owed.