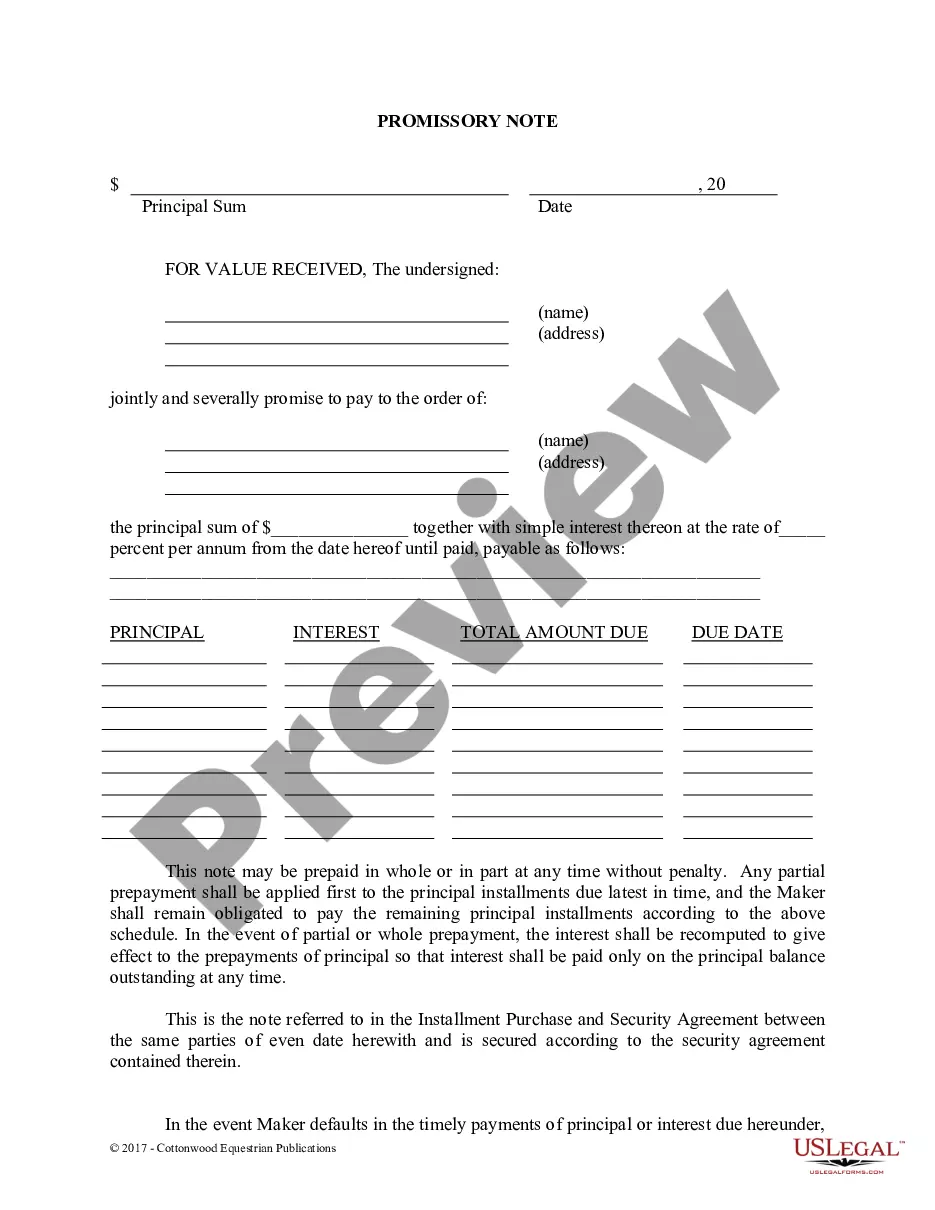

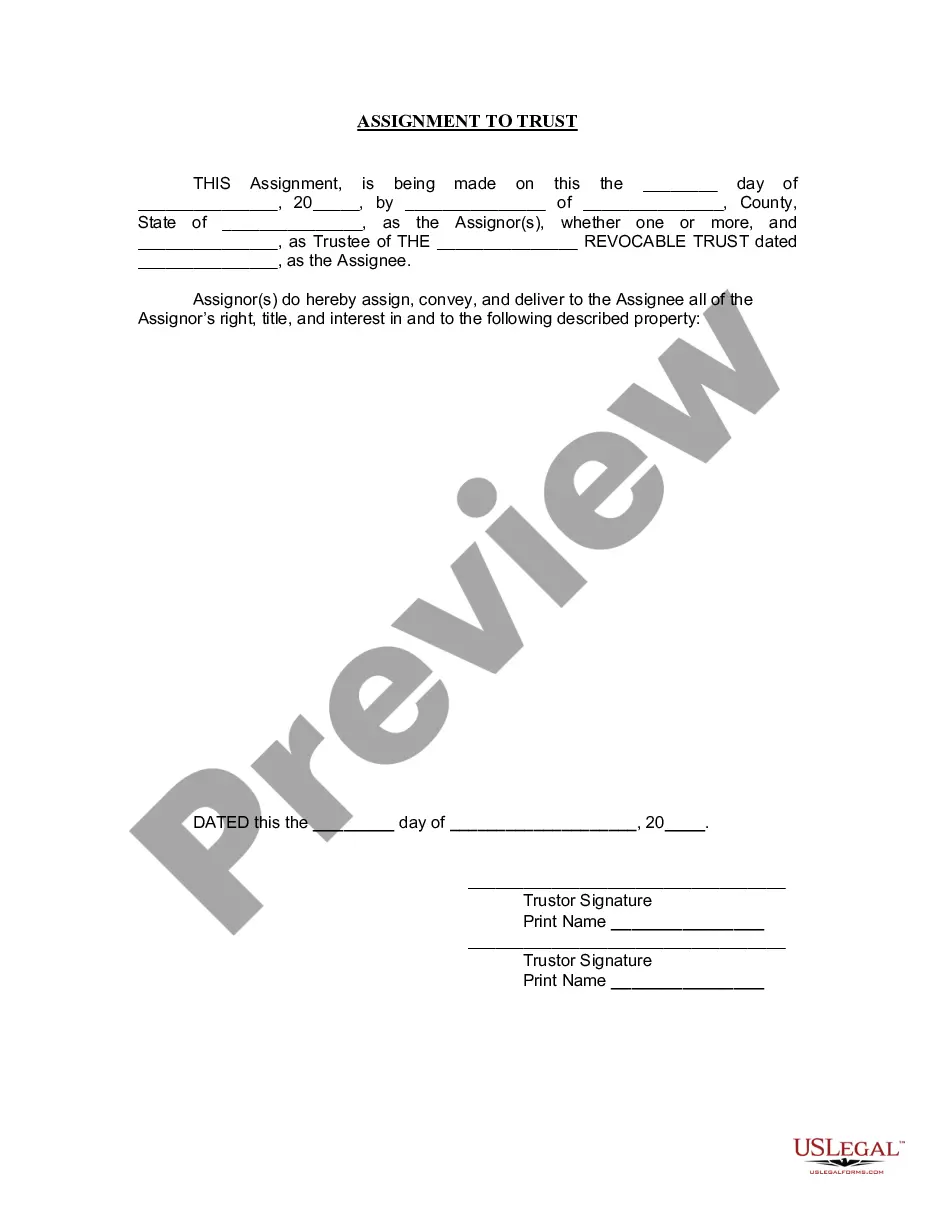

Louisiana Motion for Authority to Borrow Funds is a motion filed by a borrower in the state of Louisiana in order to obtain authorization from the court to borrow funds from a third party. The motion is typically filed in court when the borrower is unable to obtain the funds through traditional means such as a loan from a financial institution or other borrowing source. The motion must provide the court with detailed information regarding the borrower's financial situation and the terms of the loan. There are two types of Louisiana Motion for Authority to Borrow Funds: a Forbearance Motion and a Supervised Loan Motion. A Forbearance Motion allows the borrower to temporarily suspend loan payments for a period of time, while a Supervised Loan Motion requires that the loan be repaid in full of court supervision.

Louisiana Motion for Authority to Borrow Funds is a motion filed by a borrower in the state of Louisiana in order to obtain authorization from the court to borrow funds from a third party. The motion is typically filed in court when the borrower is unable to obtain the funds through traditional means such as a loan from a financial institution or other borrowing source. The motion must provide the court with detailed information regarding the borrower's financial situation and the terms of the loan. There are two types of Louisiana Motion for Authority to Borrow Funds: a Forbearance Motion and a Supervised Loan Motion. A Forbearance Motion allows the borrower to temporarily suspend loan payments for a period of time, while a Supervised Loan Motion requires that the loan be repaid in full of court supervision.