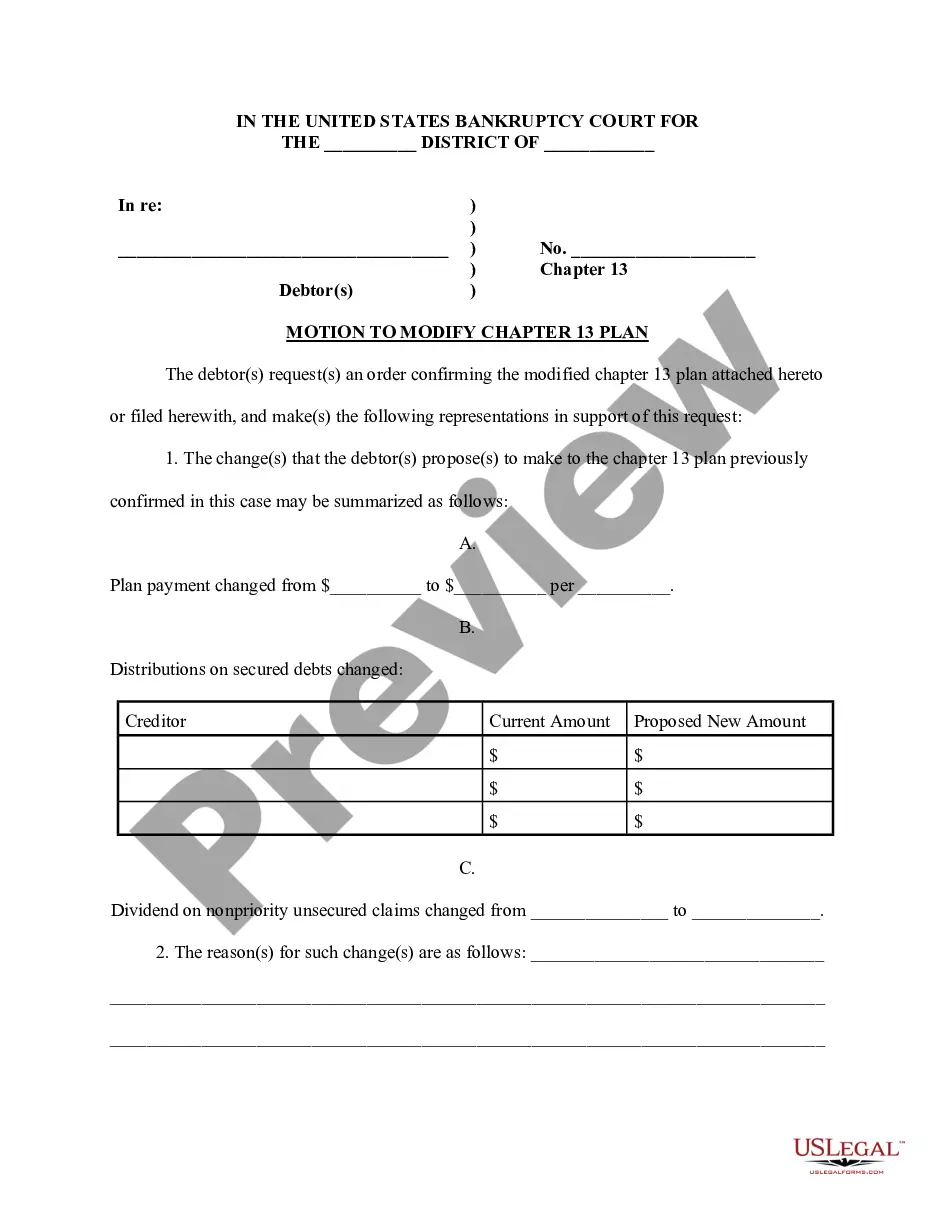

The Louisiana Chapter 13 Plan/Modified Plan (Effective December 1, 2017) is a court-approved debt repayment plan that allows individuals who are financially overwhelmed to pay off their debt over a period of three to five years, rather than all at once. This plan is available to individuals who have a regular source of income, such as a job or other form of regular income, and who are able to pay a portion of their debt each month. This plan is voluntary and does not require that creditors agree to the terms of the plan. The Louisiana Chapter 13 Plan/Modified Plan (Effective December 1, 2017) is divided into two types: the Standard Plan and the Modified Plan. The Standard Plan requires that all unsecured creditors receive at least the same amount that they would receive if the debtor were to file for Chapter 7 bankruptcy, while the Modified Plan allows the debtor to pay only a portion of their unsecured debt over a three to five-year period. Under this plan, the debtor is required to make monthly payments to the court-appointed trustee, who in turn distributes the payment to creditors. The debtor is also required to submit a budget to the trustee each month indicating their income and expenses. The trustee will review the budget and adjust the payment amount accordingly. At the end of the repayment period, any remaining debt will be discharged.

Louisiana Chapter 13 Plan/Modified Plan (Effective December 1, 2017)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Chapter 13 Plan/Modified Plan (Effective December 1, 2017)?

How many resources and hours do you typically allocate for preparing official documents.

There’s a better method to obtain these forms than employing legal professionals or spending hours searching the internet for an appropriate template.

Another benefit of our service is that you can retrieve previously obtained documents securely stored in your profile under the My documents tab. Access them anytime and redo your paperwork as often as needed.

Conserve time and energy filling out formal documents with US Legal Forms, one of the most reliable online services. Register with us today!

- Review the form details to verify it adheres to your state regulations. For this, consult the form description or utilize the Preview feature.

- If your legal template does not meet your requirements, search for an alternative using the search tab located at the top of the page.

- If you are already registered with us, sign in and retrieve the Louisiana Chapter 13 Plan/Modified Plan (Effective December 1, 2017). Otherwise, continue with the following steps.

- Click Buy now after locating the correct blank document. Select the subscription plan that best fits your needs to access the complete library.

- Create an account and process your subscription payment. You can pay with a credit card or via PayPal - our service is entirely secure for these transactions.

- Download your Louisiana Chapter 13 Plan/Modified Plan (Effective December 1, 2017) onto your device and complete it either on a printed copy or digitally.

Form popularity

FAQ

Debts dischargeable in a chapter 13, but not in chapter 7, include debts for willful and malicious injury to property (as opposed to a person), debts incurred to pay nondischargeable tax obligations, and debts arising from property settlements in divorce or separation proceedings.

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.

Why do roughly 2 out of every 3 Chapter 13 cases fail? Well, to get a discharge of your debts, you need to complete a 3-5 year repayment plan. And most plans are 5 years long. Only at the end of the plan will the remainder of some debts be forgiven.

In chapter 12 and chapter 13 cases, the debtor is usually entitled to a discharge upon completion of all payments under the plan. As in chapter 7, however, discharge may not occur in chapter 13 if the debtor fails to complete a required course on personal financial management.

About 45 days after you've received your discharge, you will receive a document called a Final Decree. It's the document that officially closes your case. Once this document is received, you are no longer in bankruptcy.

A Chapter 13 bankruptcy can remain on your credit report for up to 10 years, and you will lose all your credit cards. Bankruptcy also makes it nearly impossible to get a mortgage if you don't already have one.

Dismissal of a Bankruptcy Case ? Dismissal ordinarily means that the court stopped all proceedings in the main bankruptcy case AND in all adversary proceedings, and a discharge order was not entered. Dismissal can occur because a debtor requested the dismissal and qualifies for voluntary dismissal.