A Louisiana Financing Statement Additional Party (LISA) is a document used to register a security interest in personal property in the state of Louisiana. It is typically used when someone is taking out a loan against a motor vehicle, boat, or other personal property. The LISA must be filed with the Louisiana Secretary of State in order to protect the lien holder's interest in the collateral. There are two types of Louisiana Financing Statement Additional Parties: the Debtor and the Secured Party. The Debtor is the person taking out the loan and the Secured Party is the person/entity providing the loan. The LISA must list the Debtor and Secured Party, as well as information about the collateral being used.

Louisiana Financing Statement Additional Party

Description

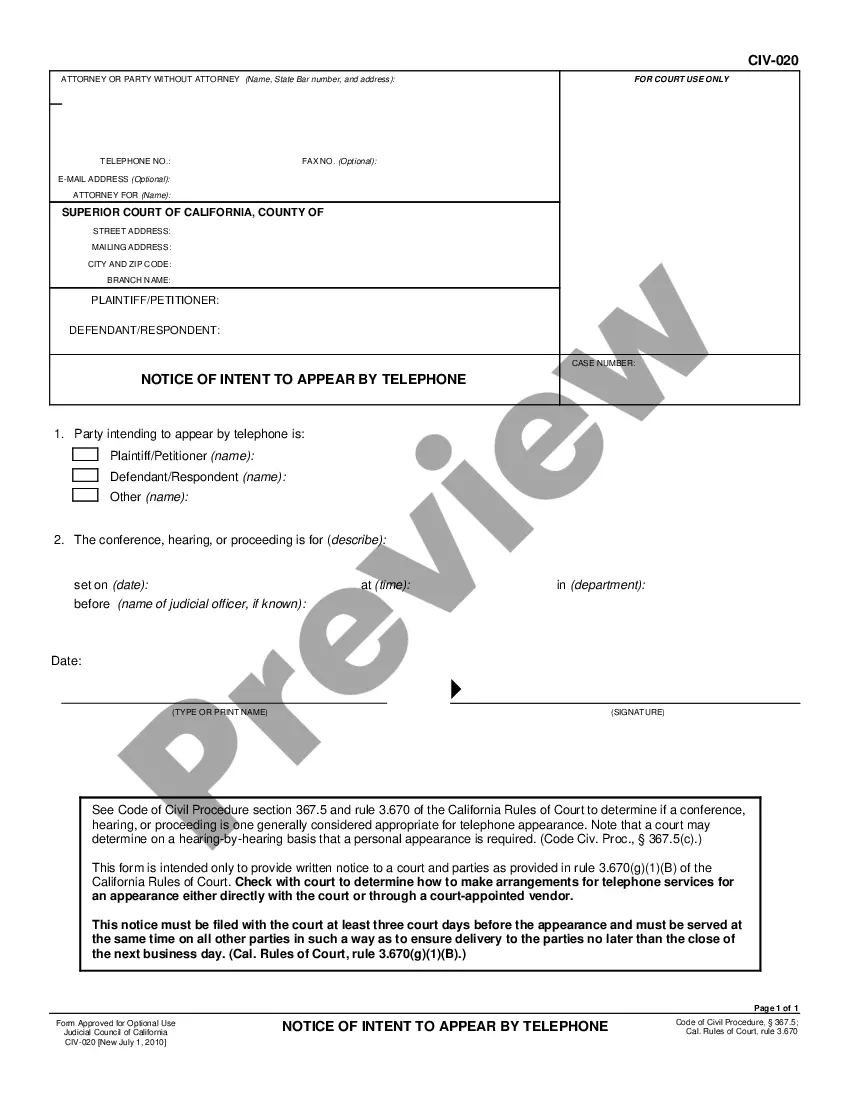

How to fill out Louisiana Financing Statement Additional Party?

Handling official documentation requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Louisiana Financing Statement Additional Party template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is straightforward and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Louisiana Financing Statement Additional Party within minutes:

- Remember to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Louisiana Financing Statement Additional Party in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Louisiana Financing Statement Additional Party you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

How to complete a UCC1 (Step by Step) Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

To put it in simple terms, the secured party is the creditor on the UCC loan. The creditor is the secured party because they have a financial interest in the collateral which the lien is on.

Under Revised Article 9 of the Uniform Commercial Code, secured parties are permitted to file UCC Financing Statements prior to formal execution of the security agreement (pre-file) provided they receive proper authorization from the debtor to do so.

A secured party must be authorized to file a financing statement against the assets of the debtor. If the debtor is bound by a security agreement, authorization to file a financing statement is implied.

The Grantor is any person conveying or encumbering, whom any Lis Pendens, Judgments, Writ of Attachment, or Claims of Separate or Community Property shall be placed on record.

Essentially, a UCC-1 can be described as a financing statement. In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property.

When is a UCC-1 filed? UCC-1 filings typically happen when a loan is first originated. If the borrower has loans from more than one lender, the first lender to file the UCC-1 is first in line for the borrower's assets. This motivates lenders to file a UCC-1 as soon as a loan is made.

A qualified financing statement should include: Debtor and secured party's name, Collateral describing, and. A creditor or other person authorized by the debtor in their security agreement files it.