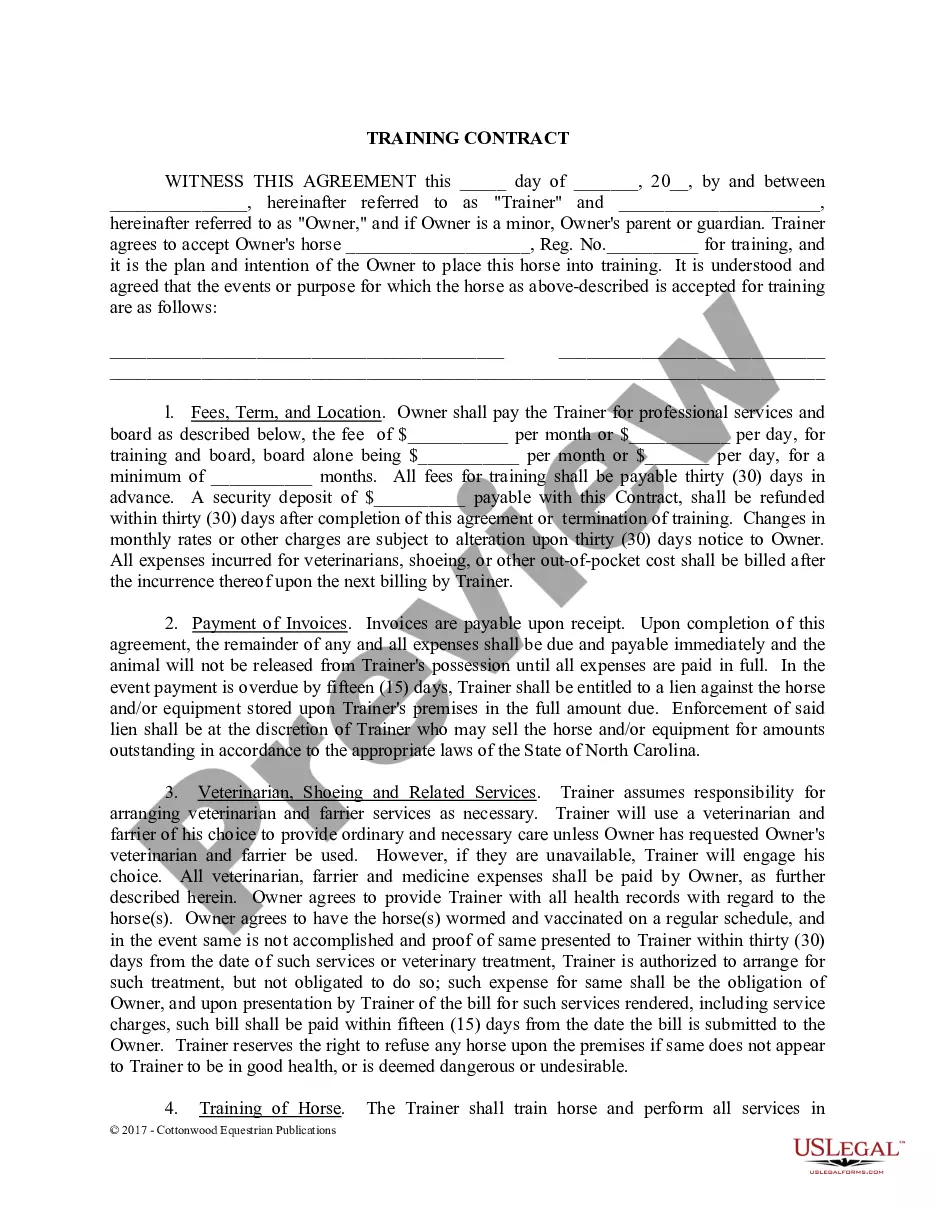

Louisiana Indemnity And Guaranty Agreement is an agreement between two or more parties in which one party agrees to indemnify the other party for potential losses from a specified activity or event. This agreement is commonly used for business transactions in Louisiana, such as the sale of land, real estate, or other assets. It helps protect the interests of all parties involved and provides a mechanism for resolving disputes. The agreement typically includes language that specifies the indemnity will not be liable for any damages or losses suffered by the indemnity. There are two main types of Louisiana Indemnity And Guaranty Agreement: direct indemnity agreements and contingent indemnity agreements. With a direct indemnity agreement, both parties agree to indemnify each other for any losses arising out of the specified activity or event. With a contingent indemnity agreement, one party agrees to indemnify the other party only if certain conditions are met. These conditions could include a deadline for payment, a limit on the amount of damages, or a certain type of risk associated with the activity or event.

Louisiana Indemnity And Guaranty Agreement

Description

How to fill out Louisiana Indemnity And Guaranty Agreement?

US Legal Forms is the most straightforward and profitable way to locate suitable formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your Louisiana Indemnity And Guaranty Agreement.

Getting your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Louisiana Indemnity And Guaranty Agreement if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make sure you’ve found the one corresponding to your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Louisiana Indemnity And Guaranty Agreement and save it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your reliable assistant in obtaining the required formal documentation. Give it a try!