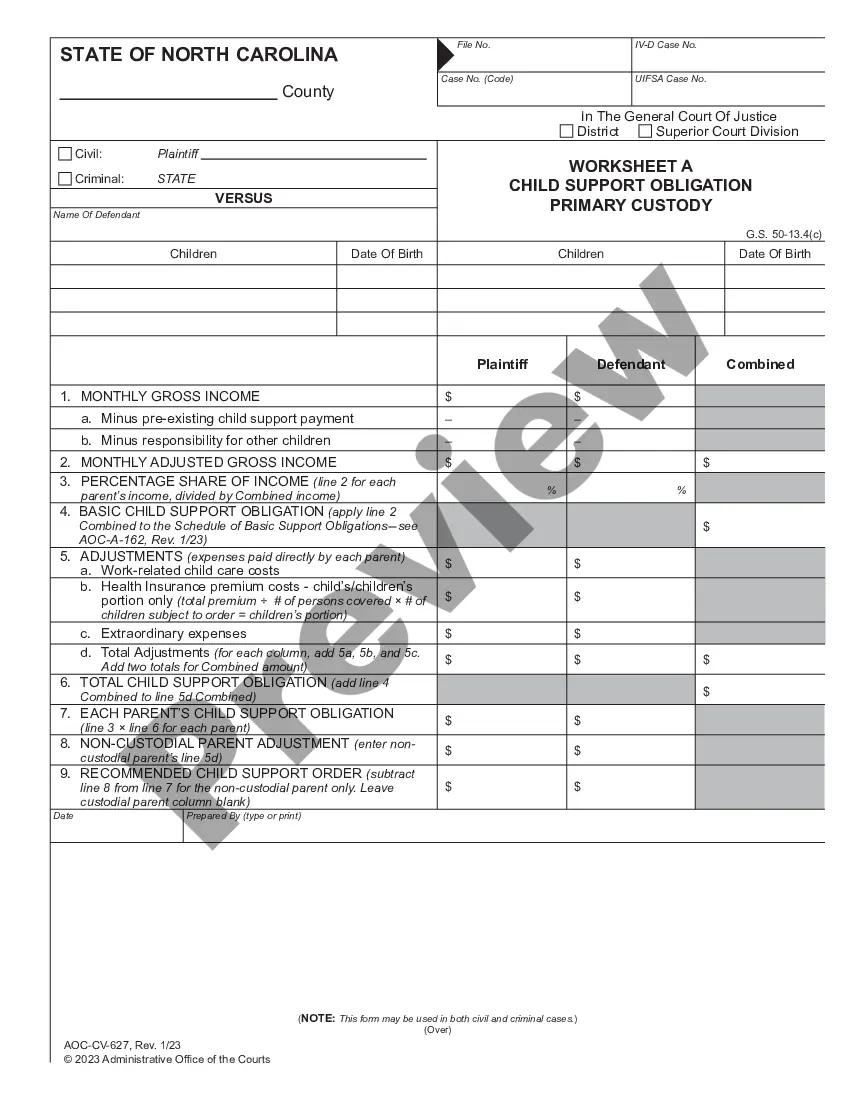

El Report Sensual de Ananias Del Plead de Louisiana BS RNA herramienta para Los pleads de Louisiana Que LES permit every El salary Que recipe CADA mes. ESTA herramienta the Los pleads RNA vision generalize susingresssCADAa mes, permitiéndolesveryrdetailssComoosalaryoBrun,Loss'ss'ss impuestos retention, Los ingress no remuneration y outros concepts relacionados. El Report Sensual de Ananias Del Plead de Louisiana ambient include information sober Los descent, Loss's sports all Segura social, el Segura Medicaid, El Segundo decided y cualquierbeneficialo additional Que SE Maya apical all salary. Existed dos tips principals DE Report Sensual de Ananias Del Plead de Louisiana: El Report Sensual de Ananias Del Plead Seminal y El Report Sensual de Ananias Del Plead Quince. Amos reports foremen informacióndetailedasobereLossingresssDellpleado, y Queen SER utilized para control Los ingress y Adar a Los pleads a Pacifica SUS finances personals.

Louisiana REPORTE MENSUAL DE GANANCIAS DEL EMPLEADO

Description

How to fill out Louisiana REPORTE MENSUAL DE GANANCIAS DEL EMPLEADO?

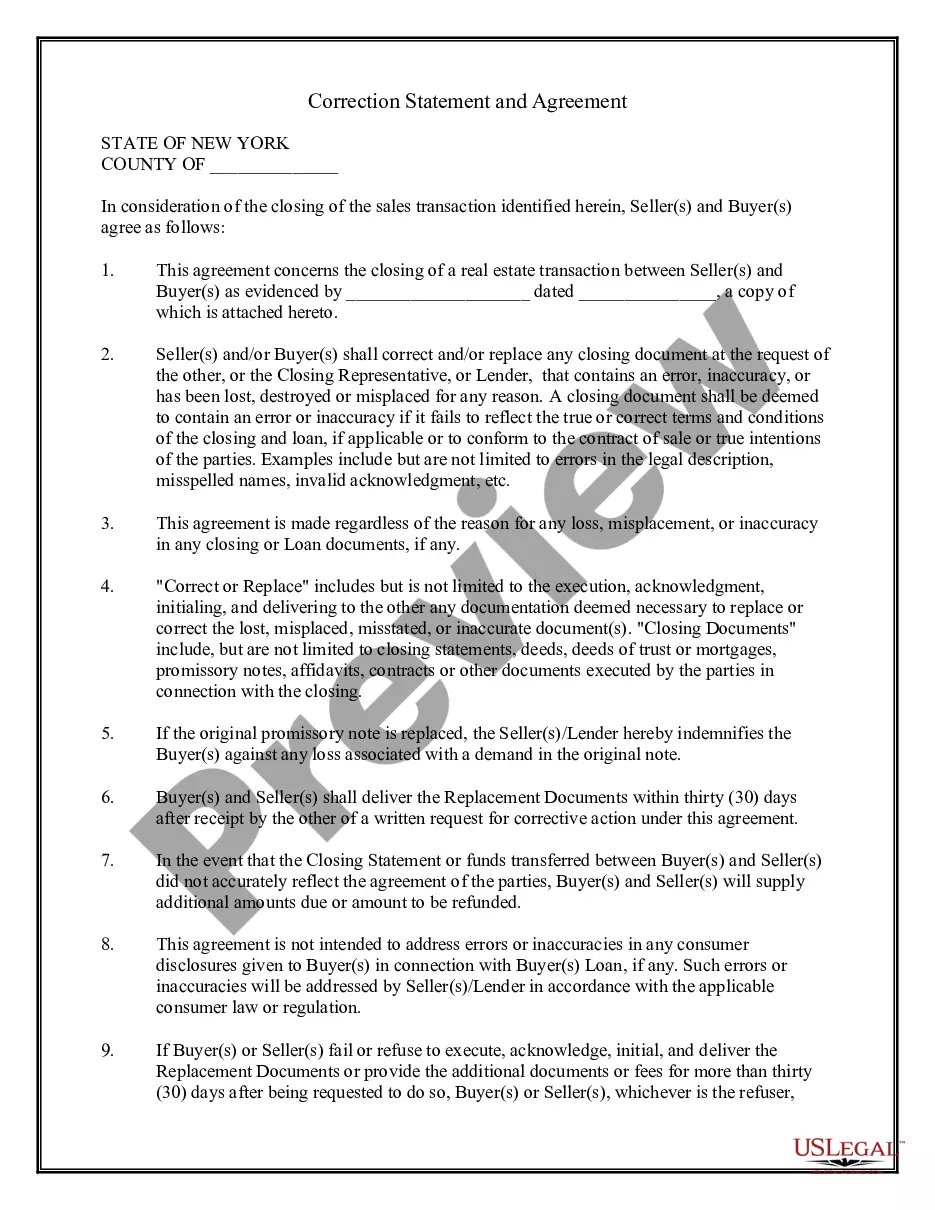

If you’re looking for a way to properly prepare the Louisiana REPORTE MENSUAL DE GANANCIAS DEL EMPLEADO without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business situation. Every piece of documentation you find on our web service is designed in accordance with federal and state laws, so you can be sure that your documents are in order.

Follow these straightforward guidelines on how to get the ready-to-use Louisiana REPORTE MENSUAL DE GANANCIAS DEL EMPLEADO:

- Ensure the document you see on the page corresponds with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your Louisiana REPORTE MENSUAL DE GANANCIAS DEL EMPLEADO and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.