Louisiana Exempt Businesses are businesses that are exempt from certain taxes or fees imposed by the state of Louisiana. These exemptions include sales and use taxes, franchise taxes, occupational license fees, and property taxes. The most common types of Louisiana Exempt Businesses are nonprofits, religious organizations, educational institutions, government agencies, and certain agricultural operations. Nonprofits are exempt from the majority of taxes and fees listed above, while religious organizations are exempt from sales and use taxes. Educational institutions are exempt from sales and use taxes, franchise taxes, and occupational license fees, while government agencies are exempt from sales and use taxes. Certain agricultural operations, such as family farms, are exempt from sales and use taxes, franchise taxes, and property taxes.

Louisiana Exempt Businesses

Description

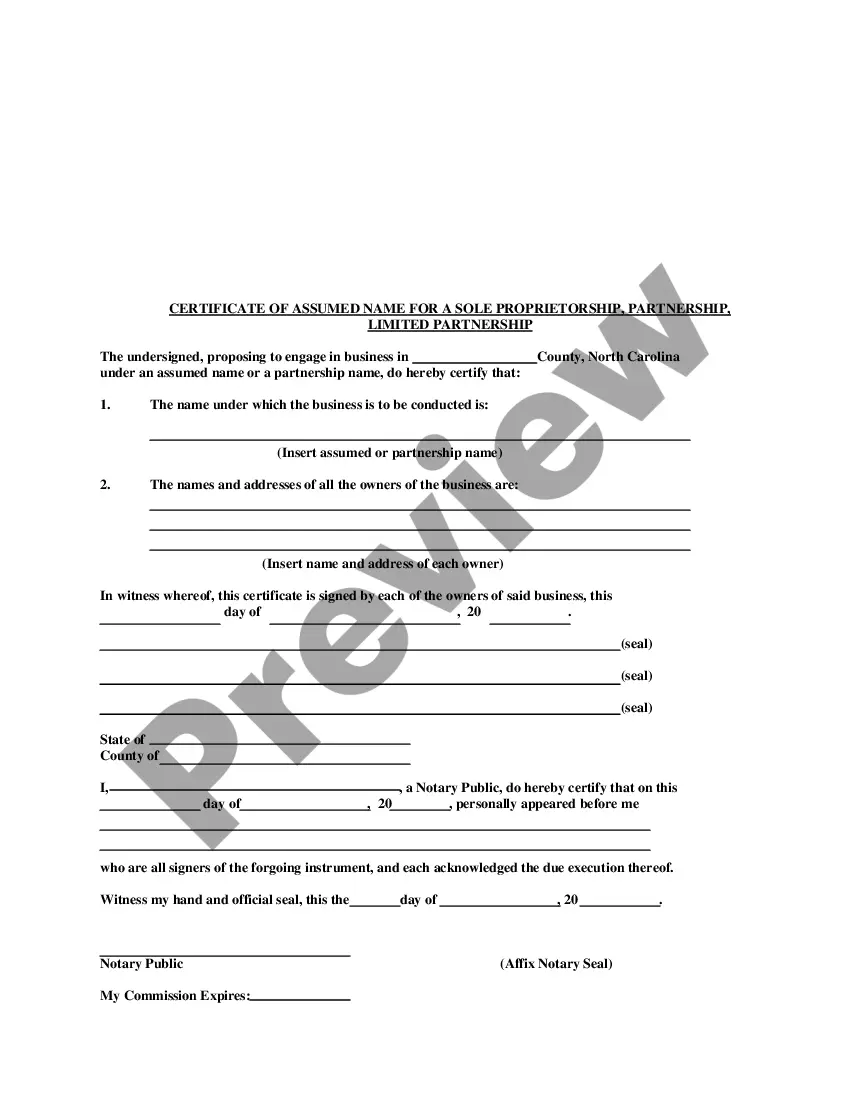

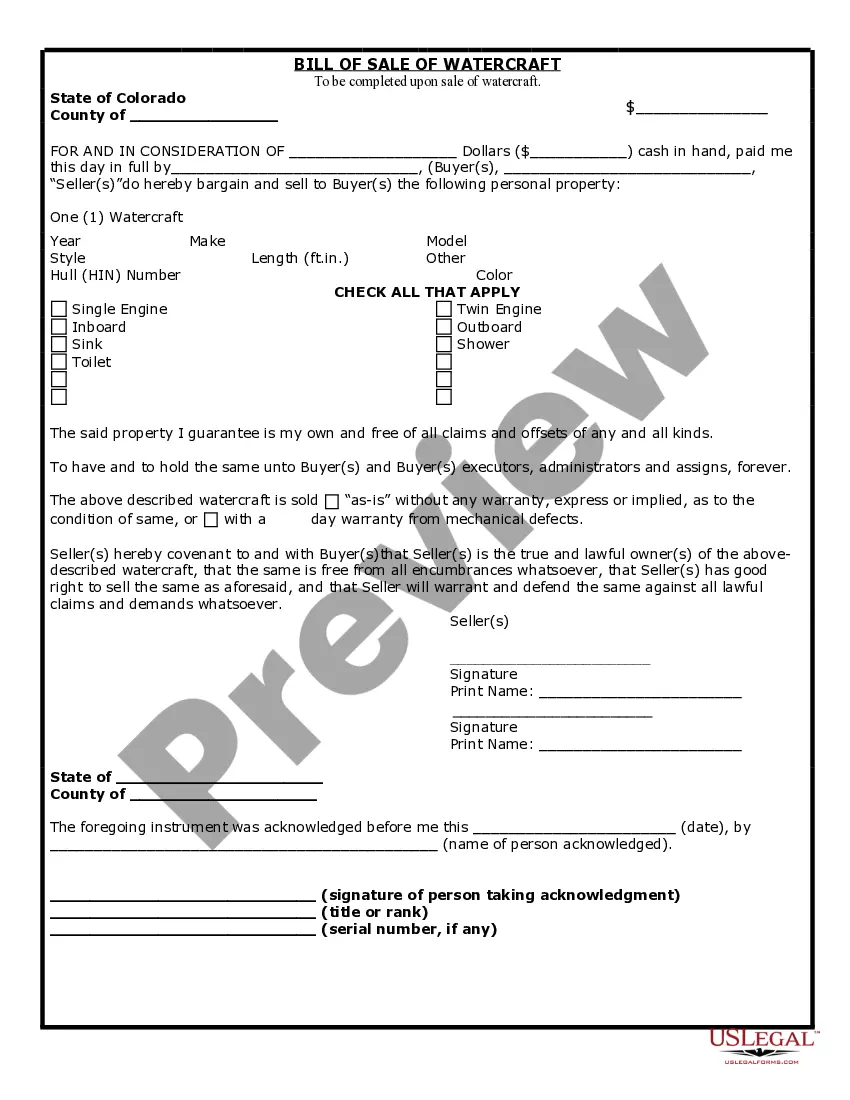

How to fill out Louisiana Exempt Businesses?

US Legal Forms is the most simple and affordable way to find suitable legal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and verified by lawyers. Here, you can find printable and fillable blanks that comply with national and local laws - just like your Louisiana Exempt Businesses.

Obtaining your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Louisiana Exempt Businesses if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one meeting your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you like most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Louisiana Exempt Businesses and save it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding official paperwork. Give it a try!

Form popularity

FAQ

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

Non-profit organizations are not generally exempt from sales tax on purchases in Louisiana. The tax exemption applies to income tax for the corporation. For more information on exemptions for nonprofit organizations, see Form R-20125, Sales Tax Exemptions for Nonprofit Organizations.

You can apply for federal tax exemption with the IRS. They will in turn send you a Letter of Determination stating your tax exempt status if granted after the long review process. Once you have Federal tax exempt 501c3 status you can work with the Department of Revenue to apply for Louisiana tax exemptions.

In Louisiana, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Examples of an exception to the Louisiana sales tax are certain types of prescription medication, farm and agricultural equipment, and some types of grocery items.

Louisiana Tax Rates, Collections, and Burdens Louisiana also has a corporate income tax that ranges from 3.50 percent to 7.50 percent. Louisiana has a 4.45 percent state sales tax rate, a max local sales tax rate of 7.00 percent, and an average combined state and local sales tax rate of 9.55 percent.

All locations located in the state must apply for and receive an exemption, even if the business headquarters are located out of the state. The application is Form R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Department's website.

Franchise/Privilege Tax Franchise tax is charged at a rate of $1.50 per $1,000 or fraction thereof of capital deployed within the state of Louisiana up to a total of $300,000.