Louisiana Accounts Receivable - Guaranty

Description

How to fill out Accounts Receivable - Guaranty?

US Legal Forms - one of the largest libraries of legal varieties in the USA - gives a wide range of legal papers templates you are able to acquire or produce. Using the web site, you can find a huge number of varieties for organization and personal uses, sorted by categories, states, or keywords and phrases.You will find the latest types of varieties like the Louisiana Accounts Receivable - Guaranty within minutes.

If you already have a monthly subscription, log in and acquire Louisiana Accounts Receivable - Guaranty from your US Legal Forms catalogue. The Obtain option will show up on each form you view. You get access to all previously saved varieties within the My Forms tab of your profile.

In order to use US Legal Forms the first time, here are straightforward guidelines to help you started:

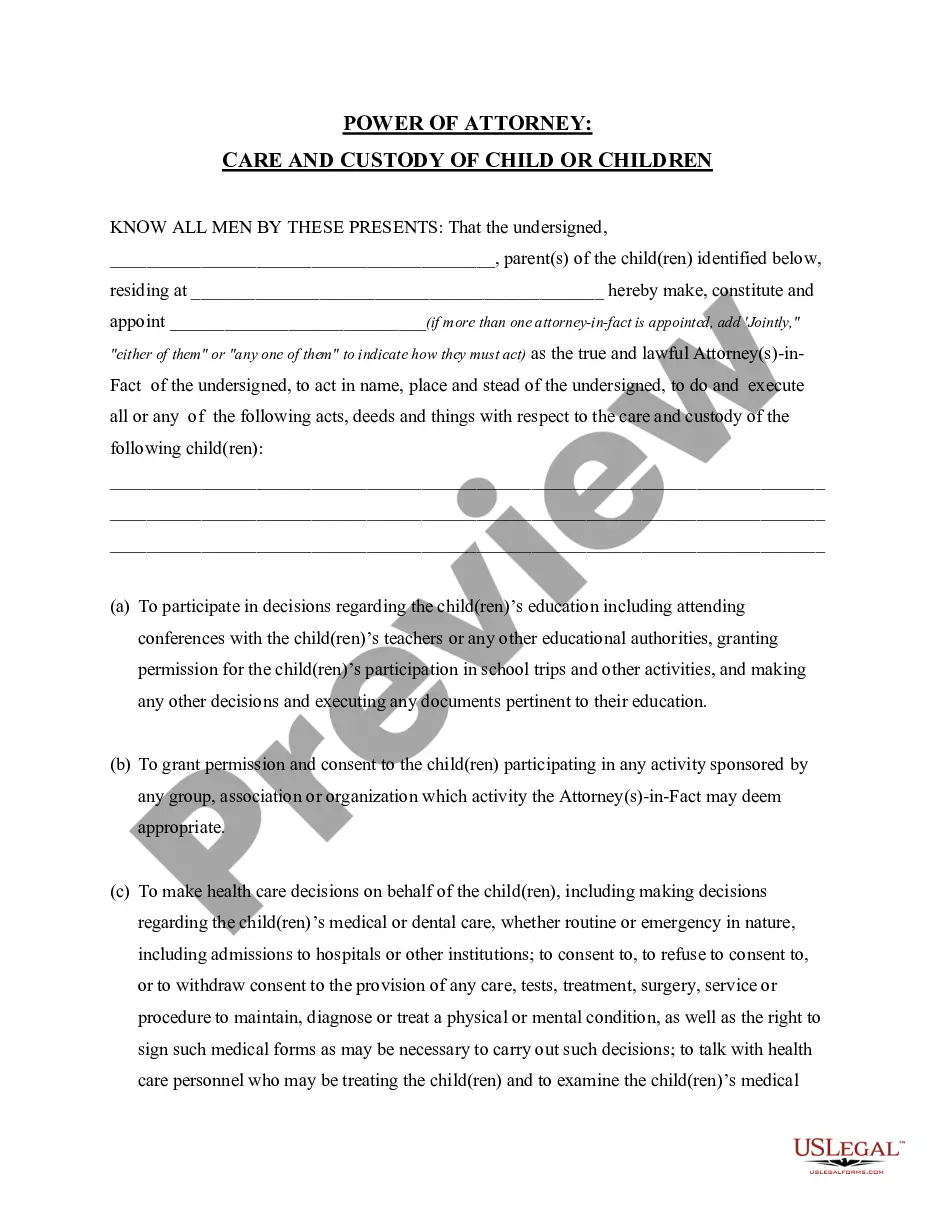

- Make sure you have selected the right form to your metropolis/area. Select the Review option to examine the form`s content. See the form information to actually have chosen the correct form.

- When the form does not satisfy your demands, take advantage of the Lookup area at the top of the display screen to discover the the one that does.

- If you are pleased with the form, affirm your selection by clicking on the Buy now option. Then, select the pricing strategy you prefer and supply your references to register on an profile.

- Process the transaction. Make use of your Visa or Mastercard or PayPal profile to finish the transaction.

- Choose the format and acquire the form on the device.

- Make adjustments. Complete, modify and produce and signal the saved Louisiana Accounts Receivable - Guaranty.

Every format you included in your bank account lacks an expiration particular date and it is your own property for a long time. So, if you wish to acquire or produce an additional backup, just go to the My Forms segment and click on on the form you require.

Get access to the Louisiana Accounts Receivable - Guaranty with US Legal Forms, by far the most extensive catalogue of legal papers templates. Use a huge number of expert and express-distinct templates that fulfill your small business or personal demands and demands.