Louisiana Escrow Agreement - Long Form

Description

How to fill out Escrow Agreement - Long Form?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a range of legal template forms that you can download or print.

By utilizing this website, you will have access to a vast array of forms for business and personal use, categorized by types, states, or keywords.

You can swiftly find the latest updates of documents such as the Louisiana Escrow Agreement - Long Form.

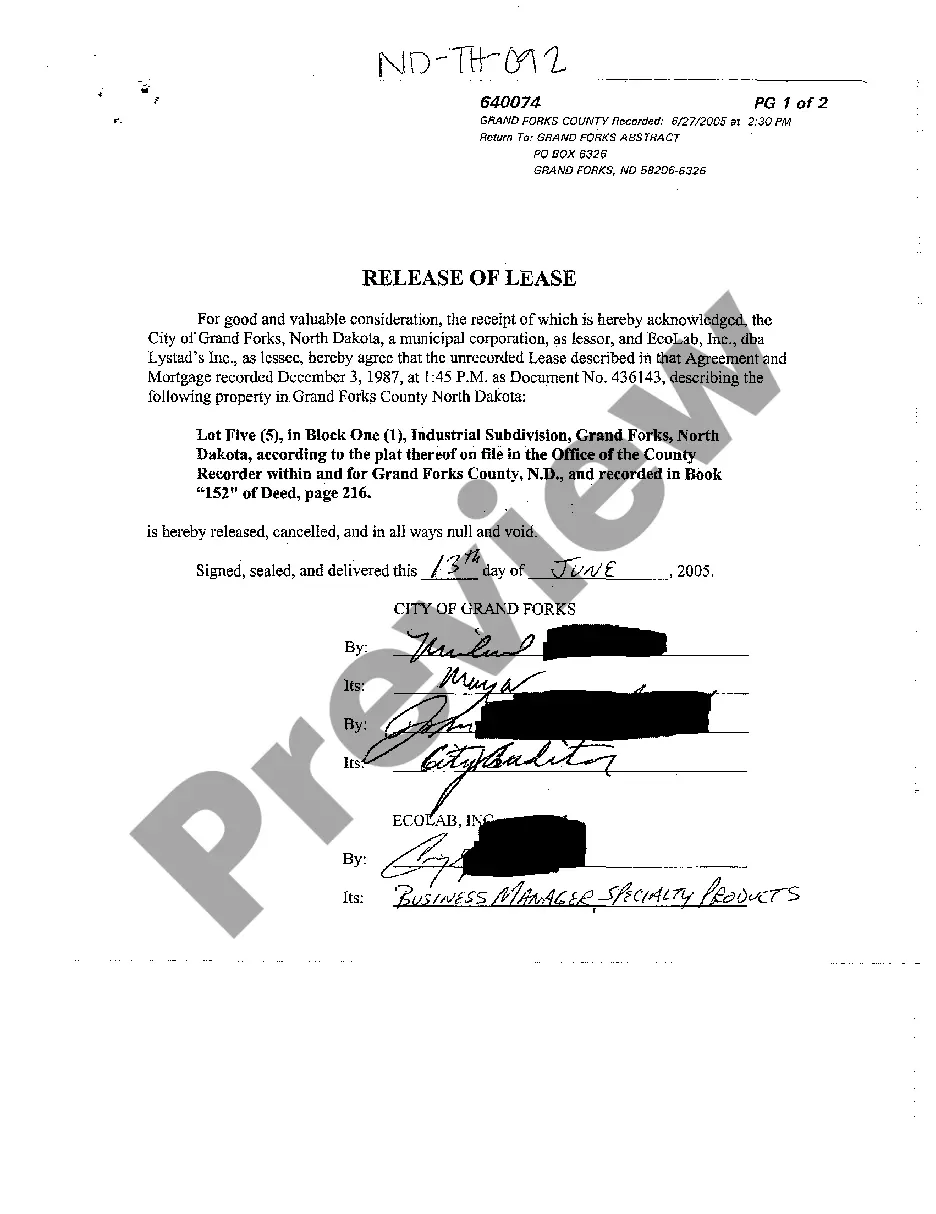

Use the Preview option to examine the content of the form. Review the form description to ensure you have chosen the correct form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you already have a membership, Log In and download the Louisiana Escrow Agreement - Long Form from the US Legal Forms library.

- The Download button will be visible for every form you explore.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your city/region.

Form popularity

FAQ

To establish a valid Louisiana Escrow Agreement - Long Form, the agreement must clearly define the parties involved, the specific assets to be held in escrow, and the terms for release. Additionally, the escrow agent must be a neutral third party, ensuring impartiality. It's vital to include all legal requirements stipulated by Louisiana law to avoid future disputes. Consulting with a legal expert can help ensure compliance and effectiveness.

The most common type of escrow is a real estate escrow, often used during property transactions. In this scenario, the Louisiana Escrow Agreement - Long Form is essential as it outlines the terms and conditions agreed upon by both the buyer and seller. This agreement ensures that funds are securely held until all obligations are met, providing peace of mind to both parties. When you use our platform, you can easily generate a comprehensive Louisiana Escrow Agreement - Long Form tailored to your needs.

The duration of an escrow period can vary, but typically, the longest you can be in escrow is 30 to 90 days, depending on the terms outlined in your Louisiana Escrow Agreement - Long Form. Extended timelines may apply when specific conditions need to be fulfilled, such as property inspections or financing approvals. It is important to have clear communication with all parties involved to prevent misunderstandings. To navigate these details seamlessly, consider using the resources available on the US Legal Forms platform, which can guide you in drafting a comprehensive agreement that protects your interests.

To create an escrow account, you need to establish a Louisiana Escrow Agreement - Long Form and engage a neutral third party to manage the funds. First, the agreement should clearly define the roles of the parties involved and the conditions for releasing the funds. Additionally, choosing a trusted escrow agent is crucial, as this individual or organization will hold the funds and uphold the terms of the agreement.

Yes, you can set up your own escrow account. To do this, you will need to draft a Louisiana Escrow Agreement - Long Form that outlines the terms of the arrangement. It’s essential to include clear instructions on how funds will be handled and released, ensuring both parties understand their responsibilities. Utilizing a platform like US Legal Forms can help streamline this process by providing templates and guidance.

An escrow account can hold a variety of items, including documents, funds, or property titles, depending on the nature of the transaction. Common examples include real estate transactions, online sales, and other contractual agreements. A well-crafted Louisiana Escrow Agreement - Long Form will clearly identify what can be held and under what conditions, reinforcing trust in the transaction.

A standard escrow contract outlines the roles of the parties involved, the items being held, and the conditions for release. It serves as a legally binding document that protects all parties by specifying duties and ensuring compliance. Implementing a Louisiana Escrow Agreement - Long Form creates a comprehensive and formalized understanding of these terms.

When something is held in escrow, it is secured by a neutral party until both parties involved fulfill their contractual obligations. This arrangement guarantees that the item or document will not be released until all terms are met, providing peace of mind to everyone involved. Opting for a Louisiana Escrow Agreement - Long Form ensures clarity and protection throughout the process.

The two main types of escrow are real estate escrow and general escrow. Real estate escrow typically involves property transactions, while general escrow can pertain to various agreements like business deals or financial arrangements. Each type can benefit from a tailored Louisiana Escrow Agreement - Long Form, providing a versatile solution for your needs.

To hold something in escrow, you engage a neutral third party, often referred to as an escrow agent or escrow company. You then draft an escrow agreement that outlines the specific terms and conditions for releasing the item or document. Utilizing a Louisiana Escrow Agreement - Long Form clearly delineates these terms, making the process straightforward and transparent.