The Louisiana Guaranty of Promissory Note by Corporation — Corporate Borrower is a legal document that serves as a guarantee from a corporation (the guarantor) to repay a promissory note on behalf of another corporation (the borrower). This specific type of guaranty is drafted in accordance with the laws and regulations of the state of Louisiana. The purpose of this guaranty is to protect the lender in case the borrower corporation defaults on its payment obligations under the promissory note. By signing this document, the guarantor corporation agrees to be fully responsible for the payment of the outstanding debt on the promissory note if the borrower is unable to fulfill its financial obligations. This Louisiana guaranty typically contains several key clauses and provisions, including: 1. Identification of Parties: It clearly identifies the parties involved in the agreement, such as the guarantor corporation, borrower corporation, and lender. 2. Recitals: This section provides background information about the promissory note, including the date of execution and the principal amount of the loan. 3. Guarantee: The guarantor corporation explicitly guarantees the performance and payment obligations of the borrower corporation with respect to the promissory note. It ensures that the lender has a secondary source of repayment in case the borrower defaults. 4. Waiver of Rights: The guarantor corporation waives any rights it may have against the borrower, such as the right to seek reimbursement or subrogation until the obligation under the promissory note is fully satisfied. 5. Consent: Often, this guaranty requires the consent of the lender before any changes to the promissory note or the borrower corporation's obligations can be made. 6. Governing Law: As this document is specific to Louisiana, it will state that it is governed by the laws of the state. There may be variations of this guaranty depending on specific circumstances or the preferences of the parties involved. Some variations could include a Limited Guaranty, where the guarantor's liability is limited to a specific amount or timeframe, or a Continuing Guaranty, where the guarantor's liability extends to all present and future obligations of the borrower. In conclusion, the Louisiana Guaranty of Promissory Note by Corporation — Corporate Borrower is a legal document used to secure the repayment of a promissory note by a corporation. It establishes the guarantor corporation's responsibility for the payment of the debt if the borrower defaults, ensuring the lender has a secondary source of repayment. Variations of this guaranty may exist, such as Limited Guaranty or Continuing Guaranty, depending on the specific circumstances of the agreement.

Louisiana Guaranty of Promissory Note by Corporation - Corporate Borrower

Description

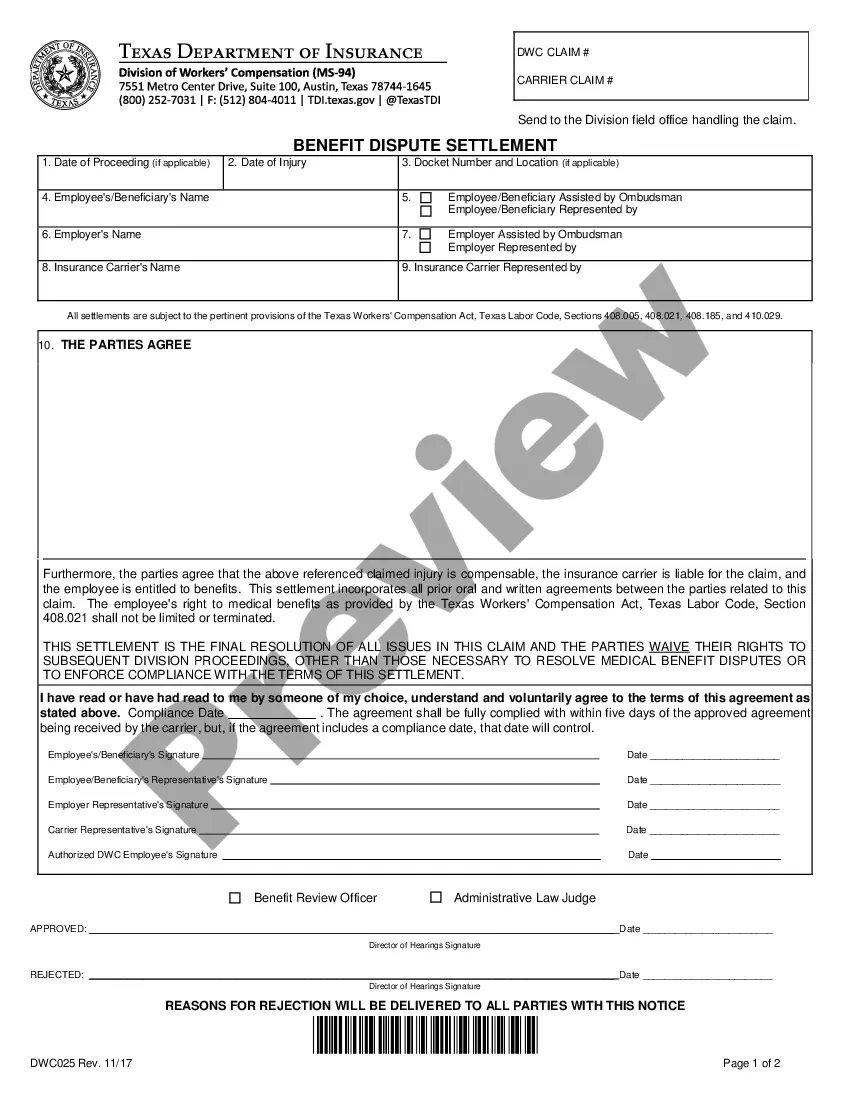

How to fill out Louisiana Guaranty Of Promissory Note By Corporation - Corporate Borrower?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous formats available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of formats, including the Louisiana Guaranty of Promissory Note by Corporation - Corporate Borrower, which you can utilize for both professional and personal purposes.

You can review the form using the Review button and examine the form details to make sure it is suitable for your needs.

- All templates are reviewed by professionals and meet state and federal criteria.

- If you are already registered, Log In to your account and click the Download button to access the Louisiana Guaranty of Promissory Note by Corporation - Corporate Borrower.

- Use your account to browse the legal documents you have previously purchased.

- Go to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

- First, ensure you have selected the correct form for your jurisdiction/state.

Form popularity

FAQ

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

You can create a Promissory Note as a lender or borrower by following these steps:Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.

Guarantors have several rights that extend beyond that of the debtor. These rights include: Right of Subrogation This right allows the guarantor to recover from the debtor if the guarantor has paid the debtor's debts. For example, the guarantor has creditor rights if the debtor claims bankruptcy.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

In case of non-payment, a guarantor is liable to legal action. If the lender files a recovery case, it will file the case against both the borrower and the guarantor. A court can force a guarantor to liquidate assets to pay off the loan," added Mishra.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

According to the Restatement, a party may enforce a guaranty under one of three theories: A promise to be surety for the performance of a contractual obligation, made to the obligee, is binding if: The promise is in writing and signed by the promisor and recites a purported consideration; or.

As per the Contract Act, the guarantor enjoys the right of subrogation wherein the guarantor gets to claim indemnity from the principal debtor in case the guarantor when the principal debtor defaults.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Interesting Questions

More info

Select a form.