A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

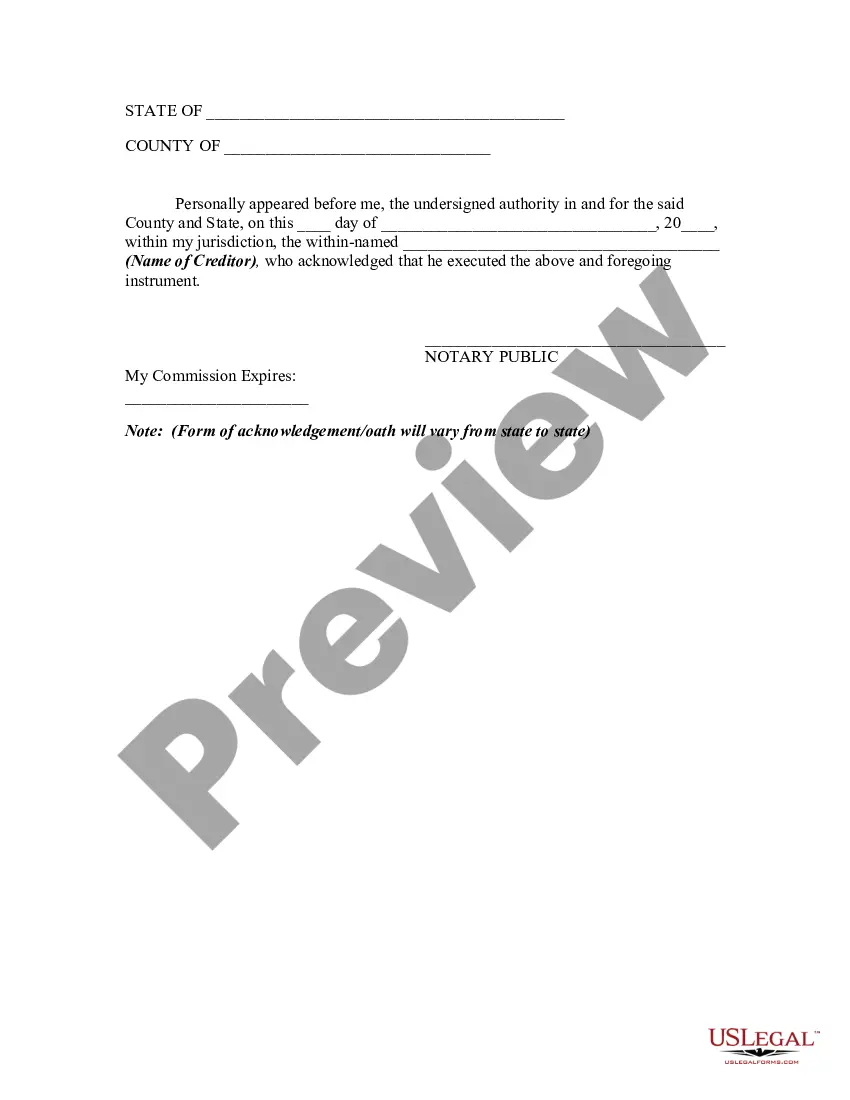

Title: Understanding the Louisiana Release of Claims Against an Estate By Creditor Keywords: Louisiana Release of Claims, Estate By Creditor, Louisiana Probate Law Introduction: In Louisiana, the Release of Claims Against an Estate By Creditor is a legal document that creditors must understand when dealing with an estate during the probate process. This document enables a creditor to release any claims they may have against a deceased person's estate, ensuring a fair and transparent settlement of debts. This article aims to provide a comprehensive description of the Louisiana Release of Claims Against an Estate By Creditor, including its purpose, types, and implications. 1. Purpose of the Louisiana Release of Claims Against an Estate By Creditor: The primary purpose of this document is to establish a mechanism for creditors to renounce any rights or claims they hold against a deceased person's estate. By signing this release, creditors acknowledge that they have received satisfactory settlement or satisfaction for the debtor's liabilities. This allows the estate's executor or administrator to distribute the deceased person's assets in accordance with Louisiana probate laws. 2. Types of Louisiana Release of Claims Against an Estate By Creditor: a. General Release: This type of release encompasses a broad renouncement of any and all claims a creditor may hold against the estate. By signing a general release, the creditor relinquishes their right to pursue any outstanding debts, both known and unknown, against the estate. b. Specific Release: In some cases, a creditor may only want to relinquish claims related to specific debts owed by the deceased individual. This type of release allows creditors to specify which obligations they are releasing, ensuring that other claims not mentioned in the document remain enforceable. 3. Process of Executing a Louisiana Release of Claims Against an Estate By Creditor: a. Drafting the Release: The release should be drafted accurately, including the creditor's name, the estate's details, a clear description of the released claims, and the effective date of the release. b. Review by the Creditor: Prior to signing the release, creditors must carefully review its terms and implications. It is advisable for the creditor to consult with an attorney to ensure the release is fair and doesn't compromise their rights unintentionally. c. Executor/Administrator Approval: Once the creditor signs the release, it must be submitted to the estate's executor or administrator for approval. They will assess the document's validity and ensure it complies with Louisiana probate laws. d. Filing the Release: Once approved, the creditor must file the release with the appropriate probate court and provide copies to all relevant parties involved in the probate process. Conclusion: A thorough understanding of the Louisiana Release of Claims Against an Estate By Creditor is essential for creditors involved in estate settlements. Knowing the purpose, types, and process of executing this release can ensure fair debt settlements, streamline the probate process, and provide a clear roadmap for creditors seeking resolution. Consulting with an attorney when drafting or reviewing the release can help avoid potential pitfalls and protect the rights and interests of all parties involved.