Louisiana Tax Free Exchange Agreement Section 1031 is a provision in the state's tax code that allows taxpayers to defer the capital gains tax on the sale of certain investment or business properties, provided they reinvest the proceeds into a like-kind property. This exchange is also known as a 1031 exchange or a tax-free exchange. In a Louisiana Tax Free Exchange Agreement Section 1031, property owners can sell their investment property and defer the recognition of any capital gains tax that would normally be owed upon the sale, as long as they reinvest the proceeds into a similar type of property within a specific time frame. This provision aims to encourage investment and promote economic growth by allowing taxpayers to reallocate their investments without incurring immediate tax liabilities. There are a few key requirements to qualify for a tax-free exchange in Louisiana: 1. Like-Kind Property: The property being sold and the property being acquired must be "like-kind," meaning they are of the same nature or character, even if they differ in grade or quality. For example, a rental property can be exchanged for another rental property, commercial property for commercial property, or land for land. 2. Timing: The taxpayer must identify the potential replacement property within 45 days of selling the original property. The acquisition must be completed within 180 days, including the 45-day identification period. 3. Use as Investment Property or Business: Both the relinquished and replacement properties must be held for investment or business purposes and not for personal use or primary residency. By utilizing Louisiana Tax Free Exchange Agreement Section 1031, investors can defer capital gains taxes and have more capital available for reinvestment or to acquire higher-value properties. This provision is particularly beneficial for real estate investors, allowing them to build wealth and diversify their portfolio without being burdened by immediate tax obligations. It is important to note that Louisiana’s tax-free exchange agreement under Section 1031 aligns with the federal tax code, ensuring that taxpayers can defer both state and federal capital gains taxes. However, it is recommended to consult with a tax professional or attorney familiar with Louisiana tax laws to ensure compliance and maximize the benefits of a 1031 exchange. Different types or variations of Louisiana Tax Free Exchange Agreement Section 1031 include Reverse Exchanges and Improvement Exchanges. In a Reverse Exchange, the replacement property is acquired first, while in an Improvement Exchange, the taxpayer can use some exchange funds to improve the replacement property before finalizing the exchange. In conclusion, Louisiana Tax Free Exchange Agreement Section 1031 provides a valuable opportunity for taxpayers to defer capital gains taxes on investment or business property sales, ensuring they have more funds available for reinvestment and property acquisition. By complying with the specific requirements and considering different variations of exchanges available, taxpayers can strategically utilize this provision to further their investment goals and financial success.

Louisiana Tax Free Exchange Agreement Section 1031

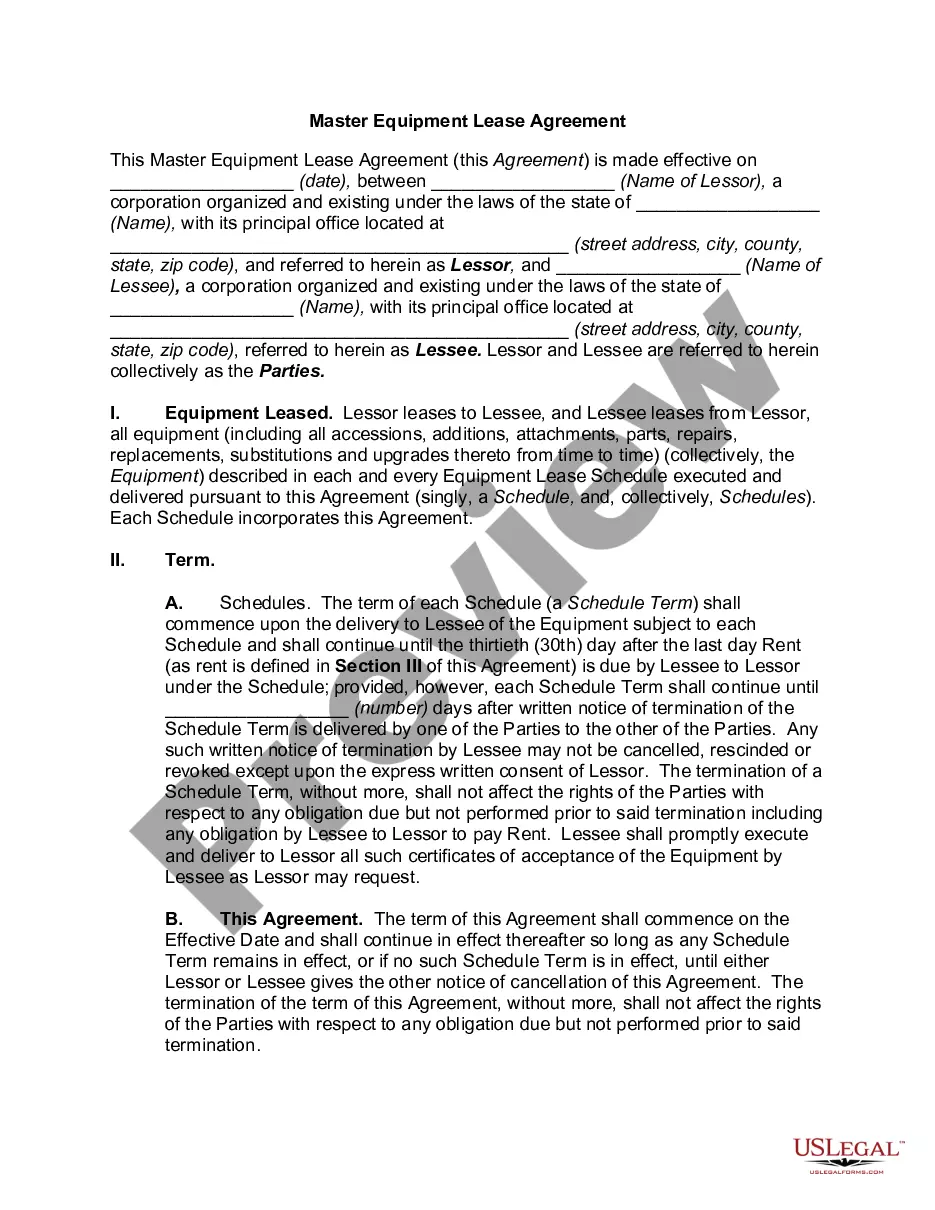

Description

How to fill out Louisiana Tax Free Exchange Agreement Section 1031?

Are you in a place in which you will need documents for either enterprise or person functions just about every working day? There are a lot of legitimate papers templates accessible on the Internet, but discovering versions you can rely on isn`t easy. US Legal Forms offers a large number of kind templates, such as the Louisiana Tax Free Exchange Agreement Section 1031, that are published to meet state and federal demands.

Should you be previously acquainted with US Legal Forms web site and have your account, basically log in. After that, it is possible to obtain the Louisiana Tax Free Exchange Agreement Section 1031 format.

If you do not offer an accounts and would like to begin using US Legal Forms, follow these steps:

- Obtain the kind you need and ensure it is for that proper metropolis/area.

- Take advantage of the Review switch to check the form.

- See the explanation to actually have selected the proper kind.

- In case the kind isn`t what you`re trying to find, utilize the Lookup discipline to obtain the kind that meets your needs and demands.

- If you obtain the proper kind, click Acquire now.

- Choose the pricing prepare you need, fill in the desired information and facts to produce your money, and pay money for an order with your PayPal or Visa or Mastercard.

- Choose a convenient file formatting and obtain your duplicate.

Locate all of the papers templates you have purchased in the My Forms food selection. You can get a additional duplicate of Louisiana Tax Free Exchange Agreement Section 1031 anytime, if needed. Just click the essential kind to obtain or print the papers format.

Use US Legal Forms, the most comprehensive variety of legitimate forms, to save lots of efforts and stay away from faults. The assistance offers appropriately created legitimate papers templates that can be used for a range of functions. Create your account on US Legal Forms and start making your life a little easier.