Louisiana Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust

Description

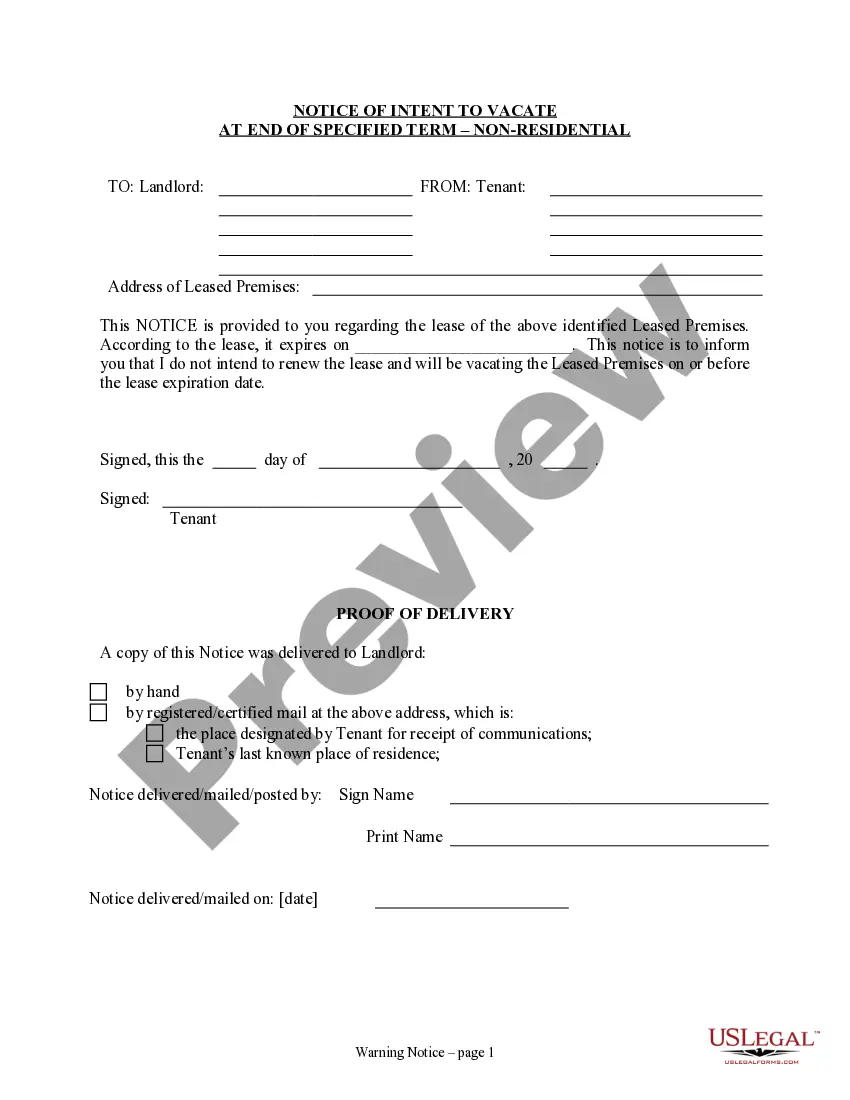

How to fill out Contract Of Sale And Leaseback Of Apartment Building With Purchaser Assuming Outstanding Note Secured By A Mortgage Or Deed Of Trust?

If you have to comprehensive, acquire, or produce legal record themes, use US Legal Forms, the most important selection of legal kinds, which can be found online. Make use of the site`s simple and easy practical search to find the documents you will need. Numerous themes for organization and specific purposes are sorted by categories and states, or search phrases. Use US Legal Forms to find the Louisiana Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust with a number of mouse clicks.

When you are presently a US Legal Forms client, log in to your profile and click the Obtain option to find the Louisiana Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust. You may also gain access to kinds you in the past saved in the My Forms tab of the profile.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for the proper city/land.

- Step 2. Use the Preview option to check out the form`s articles. Don`t neglect to read through the description.

- Step 3. When you are not happy with the develop, use the Look for area at the top of the display to find other types from the legal develop web template.

- Step 4. Upon having found the shape you will need, select the Get now option. Select the pricing strategy you prefer and put your accreditations to sign up to have an profile.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Pick the formatting from the legal develop and acquire it on the gadget.

- Step 7. Comprehensive, revise and produce or signal the Louisiana Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust.

Every legal record web template you purchase is yours eternally. You may have acces to every single develop you saved inside your acccount. Click the My Forms segment and pick a develop to produce or acquire again.

Compete and acquire, and produce the Louisiana Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust with US Legal Forms. There are millions of professional and condition-particular kinds you can use for your personal organization or specific demands.

Form popularity

FAQ

Can You Withhold Rent in Louisiana? The only case in which a tenant may withhold rent in Louisiana is under the repair and deduct statute.

§ 2941. " A bond for deed is a contract to sell real property, in which the purchase price is to be paid by the buyer to the seller in installments and in which the seller after payment of a stipulated sum agrees to deliver title to the buyer.

About Rent to Own (Lease Purchase) Agreements In Louisiana, options to buy have a 10 year limit. If the lessee (tenant) elects to exercise the option (chooses to buy the property), their past rental payments are applied to the purchase price of the property.

A lease of immovable property does not affect third parties unless the lease is recorded. A lease may be made orally or in writing. A lease of an immovable is not effective against third persons until filed for recordation in the manner prescribed by legislation. La.

When it comes to a lease, the landlord cannot evict their tenant from the property in retaliation. This could make the tenant seek an attorney for help; in severe cases, these claims can go to a court in Louisiana.

A Louisiana rent-to-own lease agreement is for a landlord seeking to rent their property while offering an option to purchase. After signing the lease, the tenant will be allowed to buy the property for a pre-negotiated price.

§ 2941. " A bond for deed is a contract to sell real property, in which the purchase price is to be paid by the buyer to the seller in installments and in which the seller after payment of a stipulated sum agrees to deliver title to the buyer.

Yes. A seller can back out of a real estate contract in Louisiana if the contract includes a contingency clause allowing them to do so or if the buyer breaches the contract.