Louisiana Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

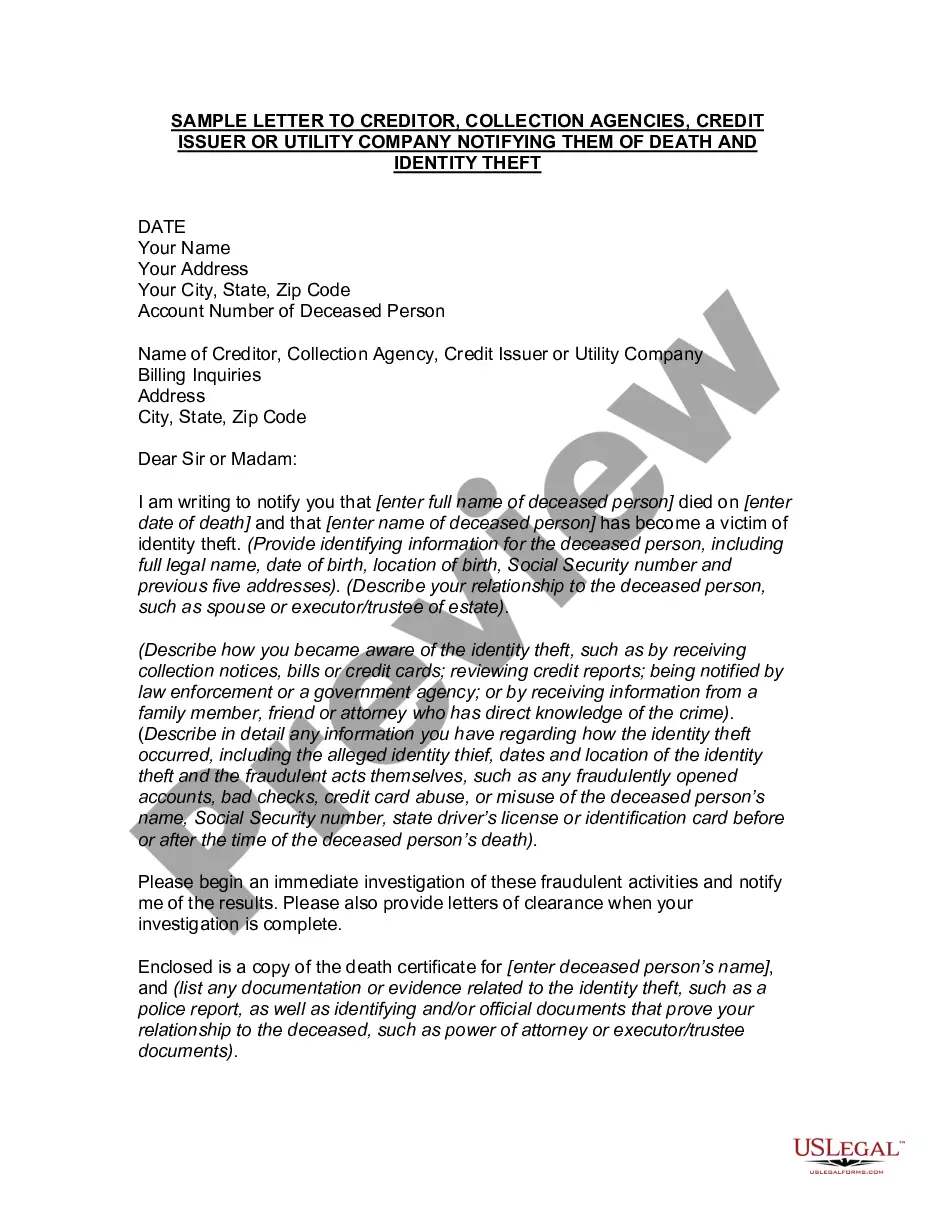

How to fill out Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

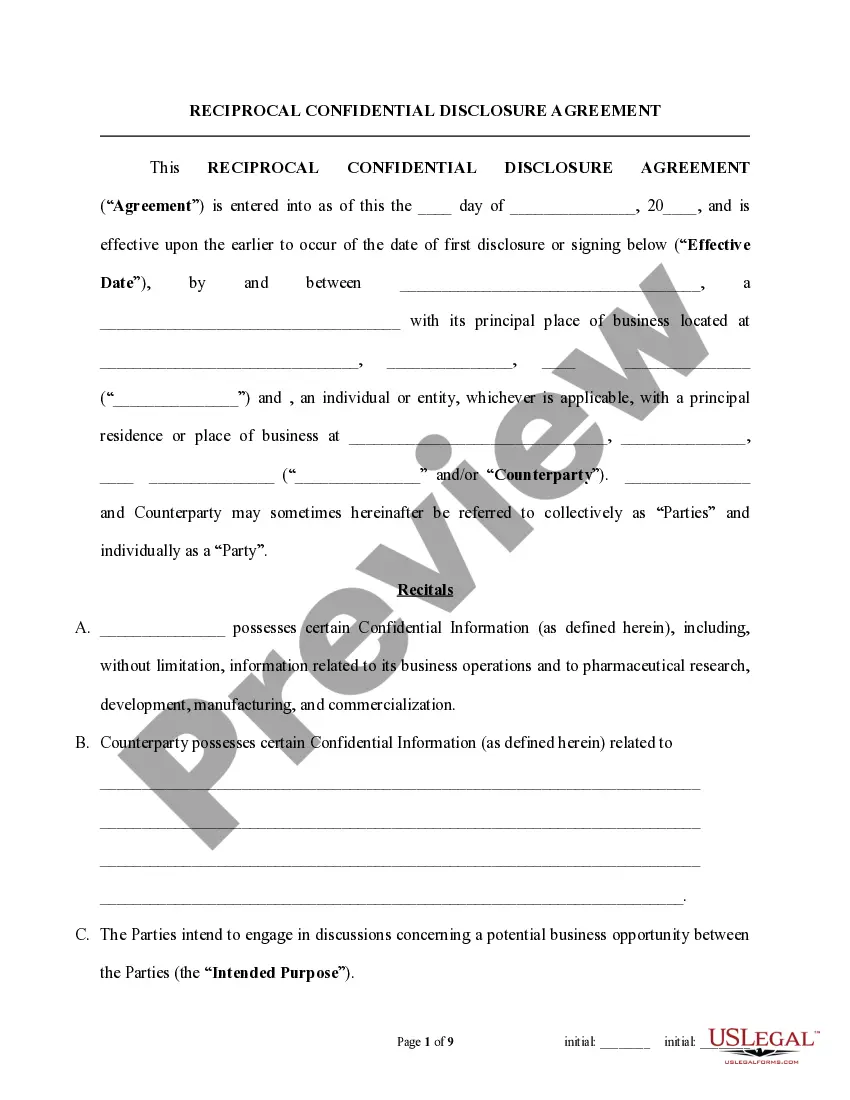

If you need to thorough, obtain, or produce authentic document templates, utilize US Legal Forms, the largest assortment of authentic forms available online.

Take advantage of the site’s straightforward and efficient search to find the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Louisiana Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Louisiana Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions in the legal form template.

Form popularity

FAQ

A death notice flags a person's credit reports as "deceased - do not issue credit." If someone attempts to use the deceased person's information to apply for credit, the notice should be displayed when the deceased person's credit report is accessed, informing the creditor the person is deceased.

If there's no money in their estate, the debts will usually go unpaid. For survivors of deceased loved ones, including spouses, you're not responsible for their debts unless you shared legal responsibility for repaying as a co-signer, a joint account holder, or if you fall within another exception.

If there's no money in their estate, the debts will usually go unpaid. For survivors of deceased loved ones, including spouses, you're not responsible for their debts unless you shared legal responsibility for repaying as a co-signer, a joint account holder, or if you fall within another exception.

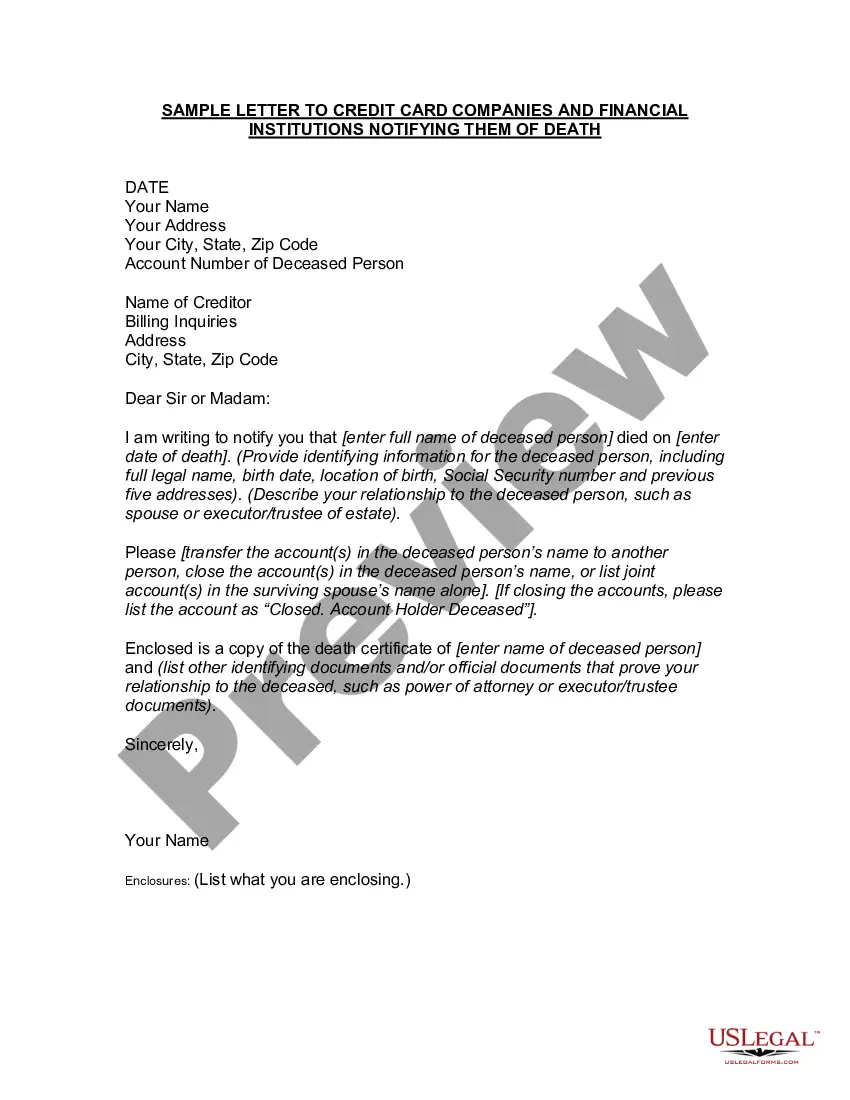

Your loved ones or the executor of your will should notify creditors of your death as soon as possible. To do so, they'll need to send each creditor a copy of your death certificate. Creditors generally pause efforts to collect on unpaid debts while your estate is being settled.

For relatives who are acting as the estate's executor or administrator. If you are the executor or administrator of the deceased person's estate, debt collectors can contact you to discuss the deceased person's debts.

When a debt collector reaches out for payment on a debt belonging to your loved one, they may not know about the death. You can let them know. You can also talk with a lawyer. A lawyer can help you protect your money and property from debt collectors under federal and state exemption laws.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

How to Notify Credit Bureaus of Death Obtain the death certificate. Call the credit agencies and request a credit freeze. Send the death certificate. Request a copy of the credit report. Work with the estate executor to close out credit accounts or pay off any remaining balance.