Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner A Louisiana Limited Partnership Agreement (ALPA) is a legal document that establishes the rights and responsibilities of a limited liability company (LLC) and a limited partner in a limited partnership (LP) based in Louisiana. This agreement outlines the terms and conditions that govern the partnership, including the distribution of profits and losses, decision-making authority, and management responsibilities. In Louisiana, there are different types of Limited Partnership Agreements that can be formed, each catering to the specific needs and objectives of the partners involved. Some common types include: 1. General Partner: The general partner assumes unlimited personal liability for the partnership's obligations and is responsible for managing the day-to-day operations. This partner has the authority to bind the partnership to contracts and make decisions on behalf of the entity. 2. Limited Partner: The limited partner does not have personal liability for the partnership's debts beyond their initial investment. They usually have a passive role, providing capital contributions and sharing in the profits and losses of the business. 3. Silent Partner: The silent partner, also known as a sleeping partner, is a limited partner who is not actively involved in the management or decision-making of the partnership. They provide financial support but have little to no influence on the partnership's operations. 4. General and Limited Partner: In some cases, a partnership may have both general and limited partners. The general partner(s) assume greater liabilities and responsibilities for managing the partnership, while the limited partner(s) enjoy limited liability and a more passive role. The Louisiana Limited Partnership Agreement establishes the specific provisions and obligations for each partner involved, including capital contributions, profit-sharing arrangements, and voting rights. It clarifies the roles and responsibilities of each partner and outlines the procedures for admitting new partners or withdrawing from the partnership. Moreover, the agreement may include provisions regarding dispute resolution, dissolution, and the transfer of partnership interests. It is crucial for partners to draft a comprehensive and well-defined Limited Partnership Agreement to avoid any misunderstandings or conflicts in the future. Hiring a qualified attorney who specializes in business law and has expertise in Louisiana partnership agreements is highly recommended ensuring all legal requirements are met and the partners' interests are properly protected.

Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

How to fill out Louisiana Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Selecting the correct official document format can be a challenge.

It's clear that there are many templates accessible online, but how do you find the official type you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner, which can be utilized for both business and personal needs. All the forms are verified by experts and comply with state and federal regulations.

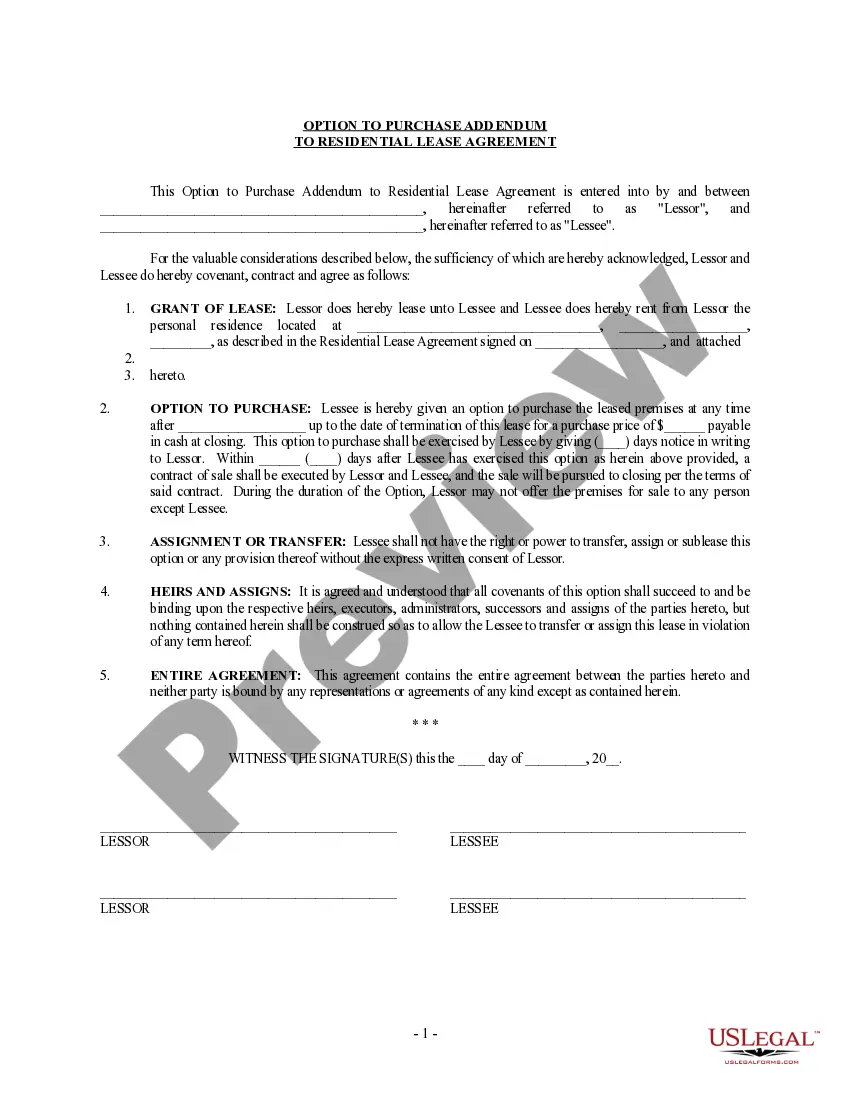

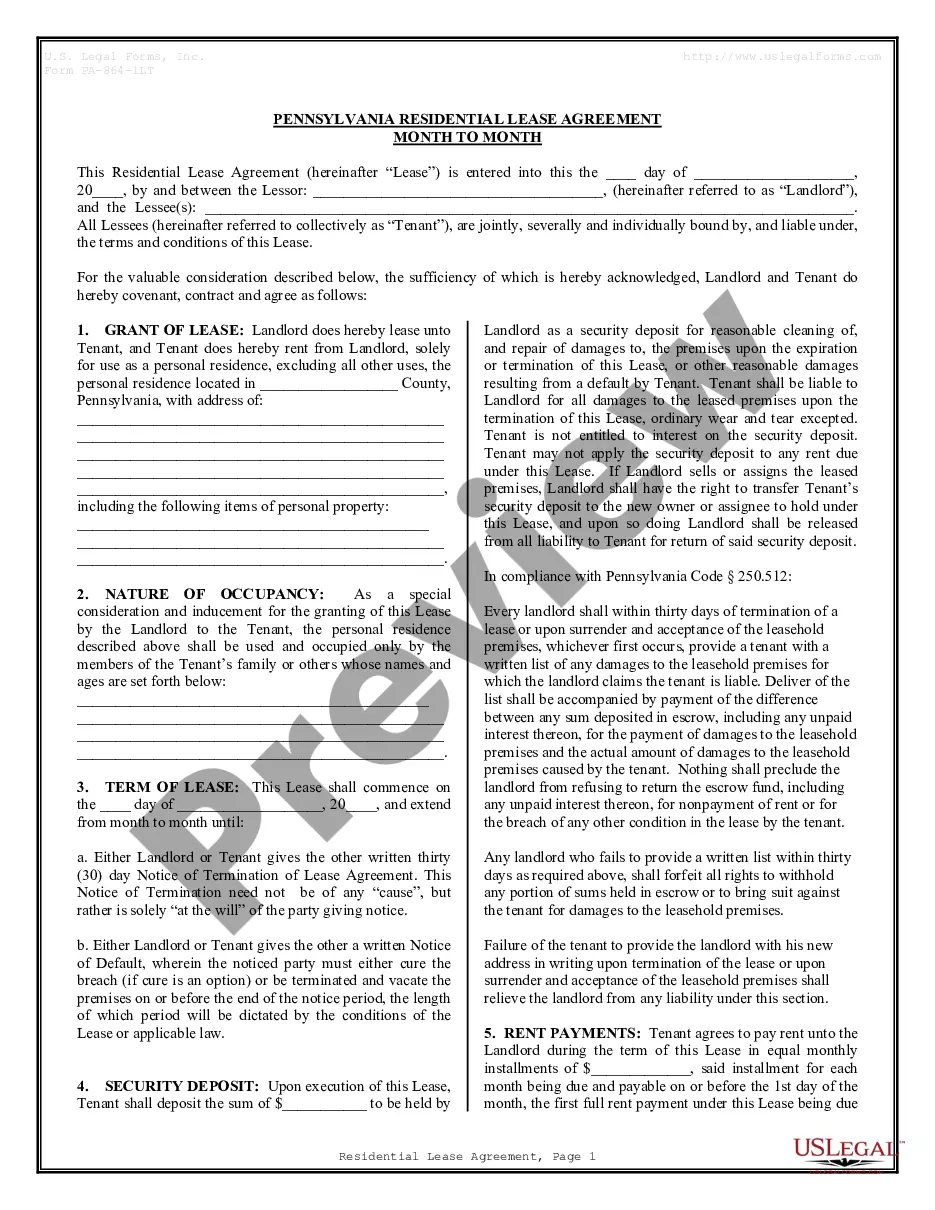

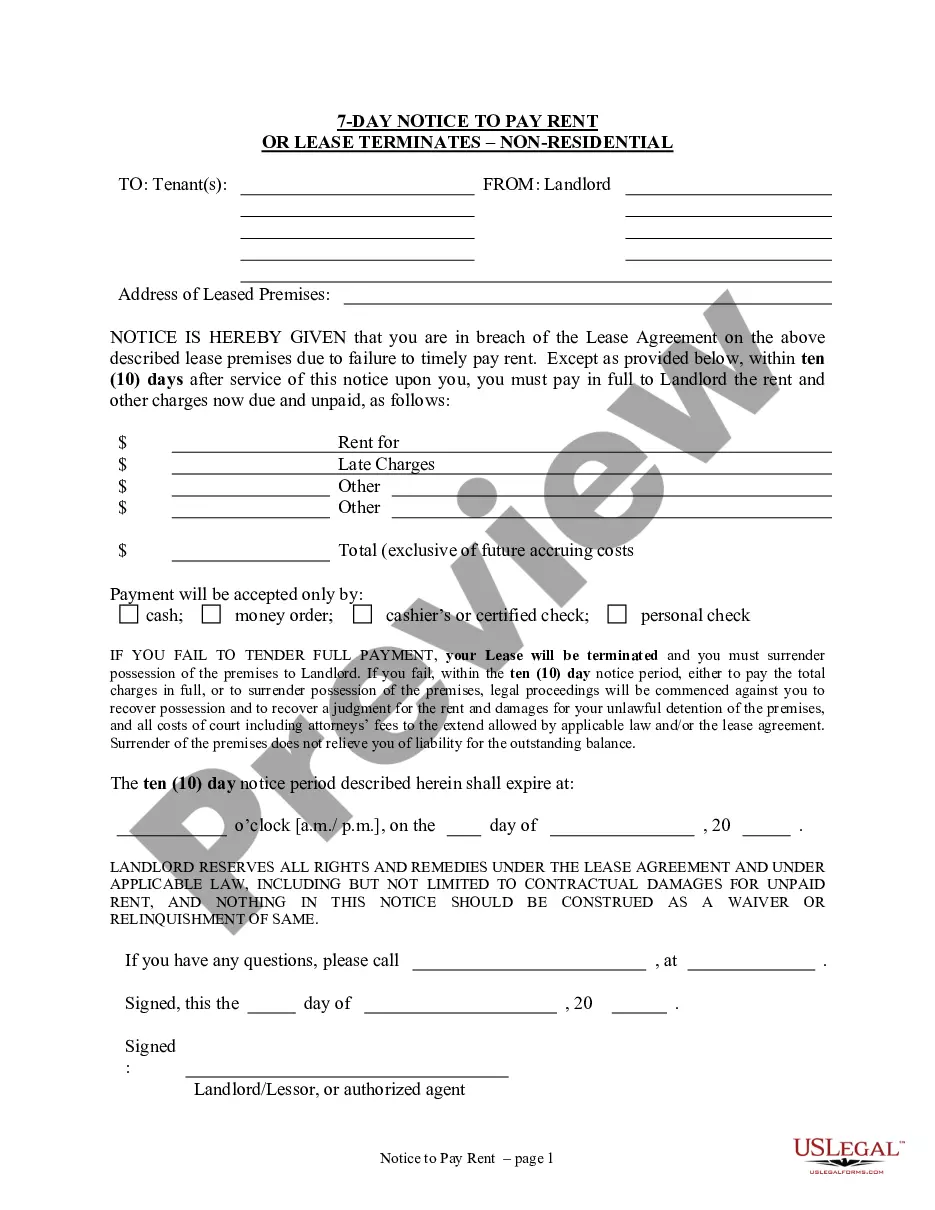

If the form does not meet your needs, use the Search field to find the correct form. Once you are sure the form is suitable, click the Buy Now button to purchase the form. Select the pricing plan you want and fill in the necessary information. Create your account and pay for your order using your PayPal account or credit card. Choose the document format and download the official document template to your device. Complete, modify, print, and sign the acquired Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner. US Legal Forms is the largest collection of official forms where you can explore various document templates. Utilize this service to download professionally crafted paperwork that meets state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Use your account to review the official forms you have previously acquired.

- Go to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct form for your city/state.

- You may preview the form with the Review button and read the form summary to confirm it is suitable for you.

Form popularity

FAQ

Partnership law in Louisiana governs the formation and operation of partnerships within the state. This includes regulations on general partnerships, limited partnerships, and the relevant rights and responsibilities of partners. Understanding these laws is essential for creating a valid Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner, which ensures compliance and mitigates potential legal issues in the future.

Starting a partnership business in Louisiana begins with selecting a suitable partnership structure, such as a general partnership or a limited partnership. Following this, you need to draft a partnership agreement outlining responsibilities, contributions, and profit distribution. A Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner will provide a solid foundation for your business, helping you to comply with state regulations while protecting your interests.

To form a partnership, you need at least two individuals or entities who agree to share profits and losses in a business venture. Additionally, a well-drafted partnership agreement is crucial to outline the terms of the partnership. A Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner is beneficial in specifying the rights, duties, and liabilities of each partner, ensuring clarity and reducing disputes down the road.

Writing a limited partnership agreement involves detailing the partnership’s structure, roles, and financial arrangement. Key elements to include are the names and addresses of the partners, the purpose of the partnership, capital contributions, profit sharing, and procedures for adding or removing partners. Using a Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner template can simplify this process and ensure you cover all critical aspects.

Limited partners in a limited partnership typically have liability that is restricted to their investment amount. This means that they are not personally liable for the partnership's debts beyond their contribution. This structure is one of the key advantages of forming a Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner, as it protects the personal assets of limited partners. However, it is essential for limited partners to refrain from taking part in management decisions to retain this limited liability.

To form a partnership in Louisiana, you need to choose a business structure, which could be a general partnership or a limited partnership. You should then draft and sign a partnership agreement, which outlines the partnership's operations and the roles of each partner. For a limited partnership, a Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner will help clarify the obligations and liabilities of each partner, ensuring a smooth start to your business.

The four types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and limited liability companies. Each type has distinct characteristics and levels of liability for partners. Specifically, a limited partnership involves at least one general partner who manages the business and one limited partner who contributes capital but has limited involvement. A Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner outlines the roles and responsibilities of each partner.

One significant disadvantage of being a limited partner is the lack of control over daily operations, as they cannot participate in management without losing liability protection. Additionally, limited partners typically do not have a say in important decisions, which can restrict their influence in the partnership. Nonetheless, the benefits of limited liability and investment potential often outweigh these concerns, as laid out in the Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

Yes, a partnership can have multiple limited partners. Each limited partner can contribute capital and share in profits without being involved in management. The Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner will specify the rights and obligations of each partner, which is crucial in establishing a clear operational framework.

General partnerships involve all partners sharing equal management roles and liability. In contrast, limited partnerships include both general partners, who manage daily activities, and limited partners, who contribute financially without management duties. Limited liability partnerships offer liability protection to all partners, shielding them from personal liability for the partnership’s debts. Choosing the right structure often involves reviewing elements from the Louisiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

Interesting Questions

More info

An LLP also limits the amount of liabilities an individual owner may carry when an individual business is filed for bankruptcy. While it is more expensive to incorporate than a general partnership, Laps are often preferred within small business for the combination of increased cost savings and increased risk protection. Limited liability partnerships are commonly used in small business and often have lower compliance costs than general partnerships. However, if required, they are required to invest in insurance to protect the other partners from any personal liability. While not as common in the public market, with the rise of the internet and social media, a limited liability partnership is becoming one more way for small business owners to protect themselves from the possibility of damage or loss. This is particularly true when it comes to investments and contracts. Form of Partnership LLP.