Louisiana General Form of Receipt

Description

How to fill out General Form Of Receipt?

Are you in a position where you need documents for potentially business or personal purposes daily.

There are numerous legitimate document formats accessible online, but locating ones you can rely on is challenging.

US Legal Forms offers a wide range of template formats, including the Louisiana General Form of Receipt, which can be tailored to satisfy federal and state requirements.

Once you find the correct template, click Purchase now.

Select the payment plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Louisiana General Form of Receipt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you require and ensure it is for the correct city/region.

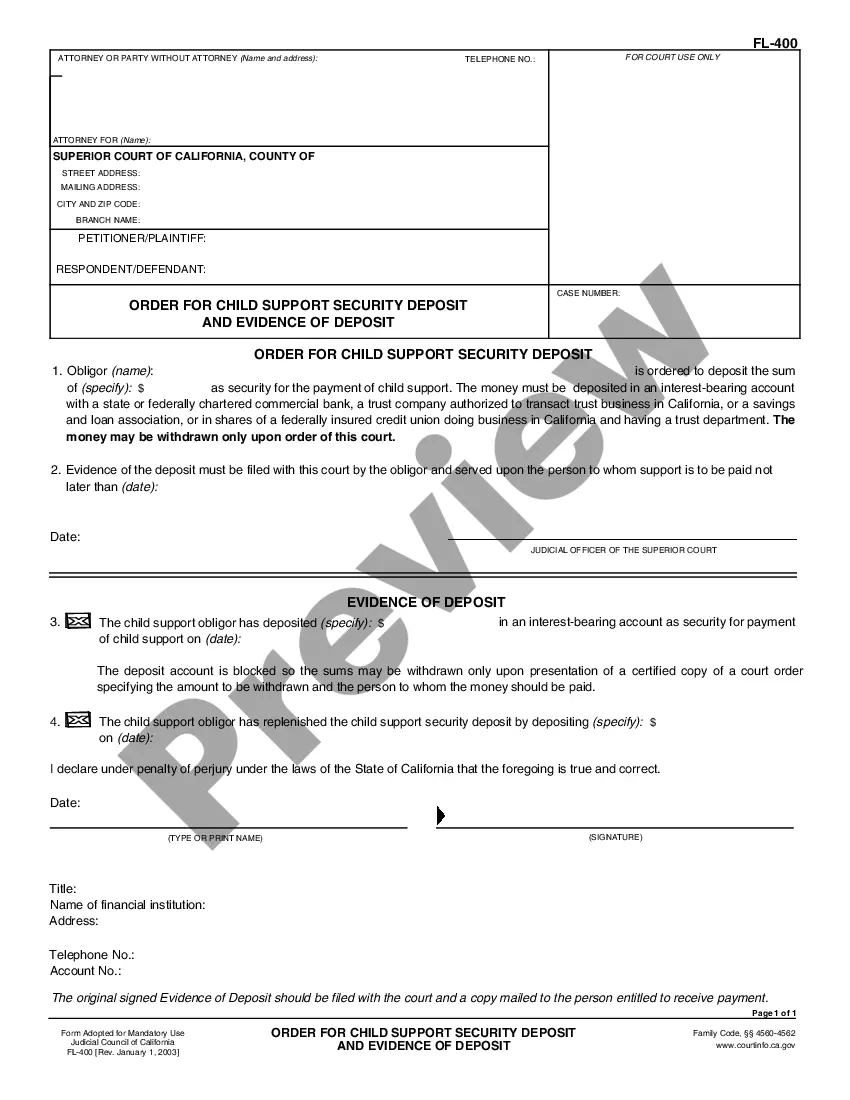

- Use the Review button to evaluate the document.

- Check the details to confirm that you have selected the appropriate template.

- If the template does not meet your needs, use the Research field to search for the template that fits you and your requirements.

Form popularity

FAQ

For downloading your e-filing receipt, start by accessing your account on US Legal Forms. Once inside, navigate to the e-filing or completed forms area, where you will locate your submissions. Click on the corresponding Louisiana General Form of Receipt to download and save it for your records.

You can download your e-filing receipt easily through the US Legal Forms platform. After logging into your account, visit the history or archives section where your past filings are recorded. Here, you will find the option to download your Louisiana General Form of Receipt directly for your reference.

To acquire an e-file acknowledgment receipt, simply check the email linked to your account after you submit your e-file. The US Legal Forms platform sends an acknowledgment promptly, which includes your Louisiana General Form of Receipt. This receipt verifies that your e-file has been received by the tax authority.

You can obtain a receipt for your tax return through the US Legal Forms website. After completing your filing, you should receive an email confirmation that includes your Louisiana General Form of Receipt. This document confirms your submission and serves as proof of your filing for your records.

To retrieve a copy of your e-file, log into your account on the US Legal Forms platform. Navigate to the section labeled 'E-Filing' and look for the option to view or download your filed documents. Ensuring you have access to the Louisiana General Form of Receipt will streamline your process and provide clarity on your tax submissions.

Filing your Louisiana state taxes is a simple process. You can file online through the Louisiana Department of Revenue or submit a paper return based on your preference. Ensure you have your Louisiana General Form of Receipt handy, as it contains important information that can streamline the filing process.

To find out your total amount owed in Louisiana state taxes, visit the Louisiana Department of Revenue website for payment options. After logging in, you can check your outstanding balance, making it easier to plan your payments. The Louisiana General Form of Receipt also provides historical payment details that can inform your current calculations.

The amount of Louisiana state tax you owe can vary based on your income and deductions. To calculate this, consult the Louisiana Department of Revenue's tax calculators or review your tax return. Utilizing the Louisiana General Form of Receipt can help you track your previous payments and understand your tax liability.

To find out how much you owe the state of Louisiana, start by visiting the Louisiana Department of Revenue's online services. Here, you can create an account or log in to access your tax obligations. Make sure to reference your Louisiana General Form of Receipt for clarity on past payments or credits that may affect your balance.

Printing your Louisiana tax return is straightforward. First, download the tax form from the Louisiana Department of Revenue’s website, fill it out completely, and save it as a PDF. You can then print your Louisiana General Form of Receipt and any additional documentation needed after confirming that all entries are accurate.