A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to add property to the trust. This form is a sample of a trustor amending the trust agreement in order to add property to the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

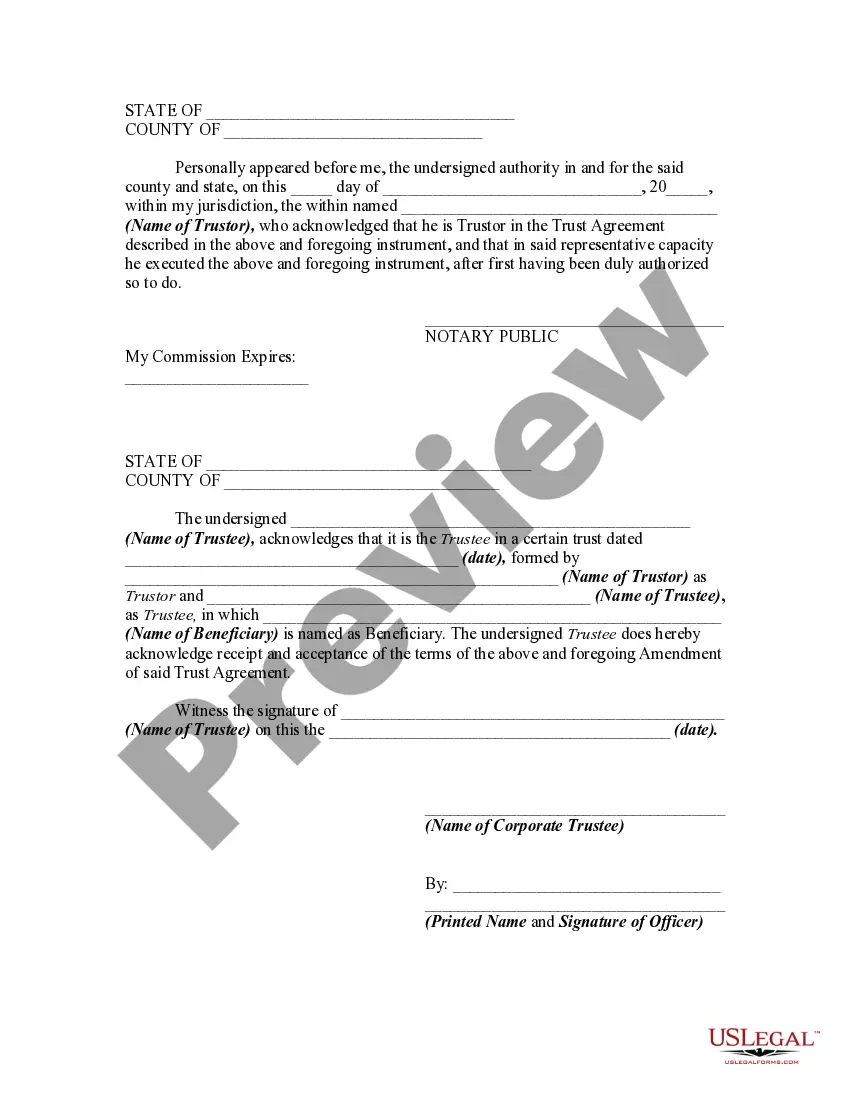

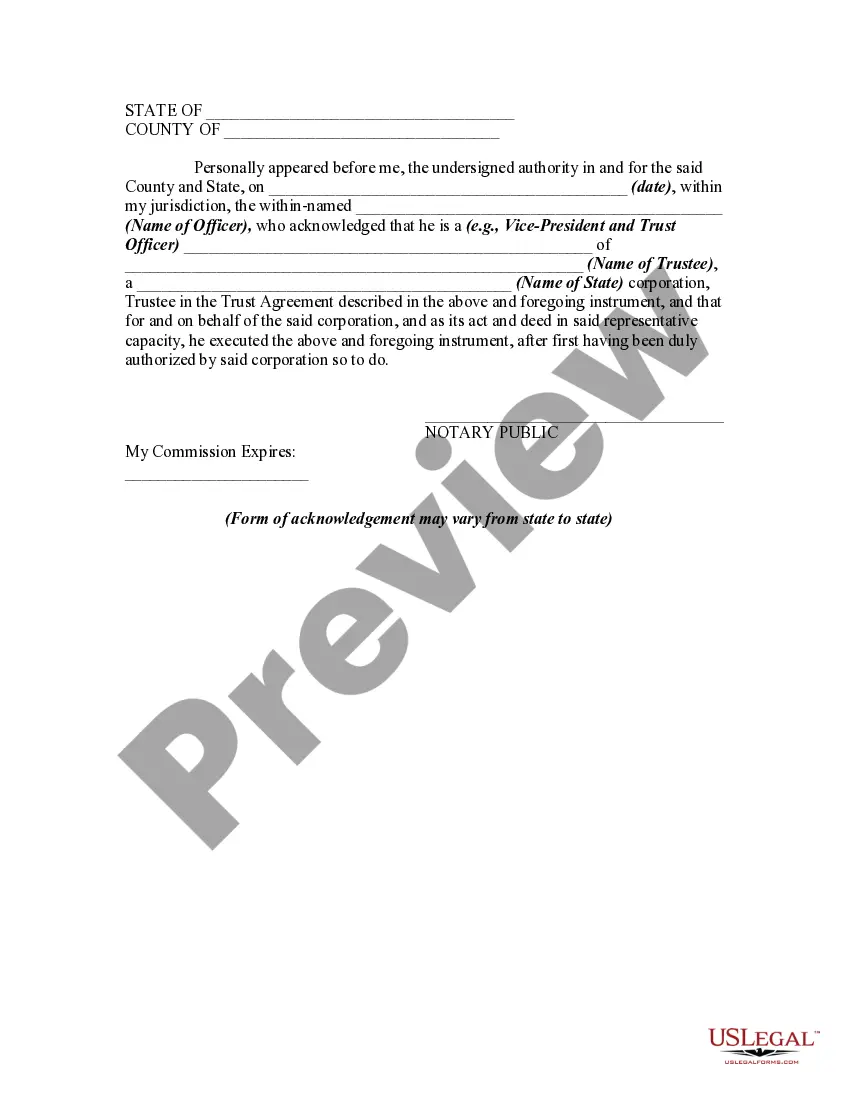

Louisiana Amendment to Trust Agreement in Order to Add Property from Inter Vivos Trust and Consent of Trustee In Louisiana, an amendment to a trust agreement may be necessary when adding property from an inter vivos trust and obtaining the consent of the trustee. This legal process ensures the smooth transference of assets and ensures compliance with the state's trust laws. With the amendment and consent in place, the trust agreement can be updated to reflect the inclusion of new assets. There are several types of Louisiana Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee, including: 1. Amendment to Trust Agreement: This type of amendment modifies the existing trust agreement to include the additional property from the inter vivos trust. It outlines the specifics of the added property and how it will be managed within the trust structure. This amendment serves as a legal document that is binding on all parties involved. 2. Consent of Trustee: The consent of the trustee is an essential component of the amendment process. The trustee, appointed to oversee the trust and safeguard the interests of the beneficiaries, must provide explicit consent to add the property from the inter vivos trust. This consent ensures that the trustee acknowledges and agrees to the changes made to the trust agreement. Both the amendment to the trust agreement and the consent of the trustee are crucial to the successful addition of property from an inter vivos trust. These documents protect the rights and interests of all parties involved — the trusgranteror, beneficiaries, and the trustee. They also provide legal clarity and guidance regarding how the added property should be managed, distributed, and accounted for within the trust structure. When undertaking a Louisiana Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee, it is essential to consult with an experienced attorney who specializes in trust and estate planning. These professionals can guide individuals through the procedural requirements, ensure compliance with state laws, and draft the necessary legal documents to effectuate the desired changes to the trust agreement. In summary, a Louisiana Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee is a legal process that allows for the smooth inclusion of assets and ensures compliance with state trust laws. This process involves the amendment of the trust agreement itself and obtaining the consent of the trustee. By following the proper procedures and seeking legal guidance, individuals can navigate this process successfully and ensure the proper management and protection of their trust assets.Louisiana Amendment to Trust Agreement in Order to Add Property from Inter Vivos Trust and Consent of Trustee In Louisiana, an amendment to a trust agreement may be necessary when adding property from an inter vivos trust and obtaining the consent of the trustee. This legal process ensures the smooth transference of assets and ensures compliance with the state's trust laws. With the amendment and consent in place, the trust agreement can be updated to reflect the inclusion of new assets. There are several types of Louisiana Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee, including: 1. Amendment to Trust Agreement: This type of amendment modifies the existing trust agreement to include the additional property from the inter vivos trust. It outlines the specifics of the added property and how it will be managed within the trust structure. This amendment serves as a legal document that is binding on all parties involved. 2. Consent of Trustee: The consent of the trustee is an essential component of the amendment process. The trustee, appointed to oversee the trust and safeguard the interests of the beneficiaries, must provide explicit consent to add the property from the inter vivos trust. This consent ensures that the trustee acknowledges and agrees to the changes made to the trust agreement. Both the amendment to the trust agreement and the consent of the trustee are crucial to the successful addition of property from an inter vivos trust. These documents protect the rights and interests of all parties involved — the trusgranteror, beneficiaries, and the trustee. They also provide legal clarity and guidance regarding how the added property should be managed, distributed, and accounted for within the trust structure. When undertaking a Louisiana Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee, it is essential to consult with an experienced attorney who specializes in trust and estate planning. These professionals can guide individuals through the procedural requirements, ensure compliance with state laws, and draft the necessary legal documents to effectuate the desired changes to the trust agreement. In summary, a Louisiana Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee is a legal process that allows for the smooth inclusion of assets and ensures compliance with state trust laws. This process involves the amendment of the trust agreement itself and obtaining the consent of the trustee. By following the proper procedures and seeking legal guidance, individuals can navigate this process successfully and ensure the proper management and protection of their trust assets.