The Louisiana Receipt Template for Cash Payment is a valuable tool used by businesses and individuals to document financial transactions conducted in cash within the state of Louisiana. This customizable template allows users to create a detailed receipt that includes essential information such as the date of payment, the name of the payer, the amount paid in cash, and a description of the goods or services provided. One of the popular types of Louisiana Receipt Templates for Cash Payment is the Simple Cash Receipt Template. This straightforward template is ideal for smaller transactions and includes all the necessary details in a concise format. Another commonly used Louisiana Receipt Template is the Detailed Cash Receipt Template. This template provides a more comprehensive overview of the cash transaction, with additional fields to specify the payment method, itemized breakdown of the goods or services, and any applicable taxes or discounts. Furthermore, businesses can utilize the Louisiana Receipt Template for Cash Payment with Logo, which enables the insertion of a company logo for a more personalized touch. This type of template helps enhance brand recognition and professionalism in financial transactions. The Louisiana Receipt Template for Cash Payment is crucial as it serves as evidence of payment and acts as proof for both the payer and the recipient. It ensures transparency in financial dealings, helps with accurate record-keeping, and simplifies bookkeeping procedures. By utilizing different templates tailored to their needs, businesses and individuals can streamline their financial processes, facilitate cash management, and comply with legal requirements in the state of Louisiana.

Louisiana Receipt Template for Cash Payment

Description

How to fill out Louisiana Receipt Template For Cash Payment?

Have you been within a situation in which you will need files for either business or person reasons virtually every day time? There are tons of lawful record layouts available on the Internet, but getting kinds you can depend on isn`t straightforward. US Legal Forms gives 1000s of form layouts, like the Louisiana Receipt Template for Cash Payment, that happen to be composed to fulfill federal and state requirements.

When you are already informed about US Legal Forms web site and get a merchant account, simply log in. Next, you may obtain the Louisiana Receipt Template for Cash Payment format.

Should you not come with an accounts and would like to begin using US Legal Forms, adopt these measures:

- Get the form you want and ensure it is for your correct metropolis/area.

- Utilize the Preview switch to review the form.

- Look at the information to ensure that you have selected the appropriate form.

- In case the form isn`t what you`re searching for, make use of the Search field to obtain the form that fits your needs and requirements.

- When you discover the correct form, simply click Purchase now.

- Select the rates plan you desire, complete the required information and facts to generate your bank account, and pay money for an order with your PayPal or charge card.

- Pick a handy paper file format and obtain your version.

Locate every one of the record layouts you may have bought in the My Forms menus. You can aquire a additional version of Louisiana Receipt Template for Cash Payment at any time, if necessary. Just click the necessary form to obtain or print the record format.

Use US Legal Forms, one of the most extensive assortment of lawful types, in order to save some time and stay away from blunders. The assistance gives skillfully created lawful record layouts that you can use for a variety of reasons. Create a merchant account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

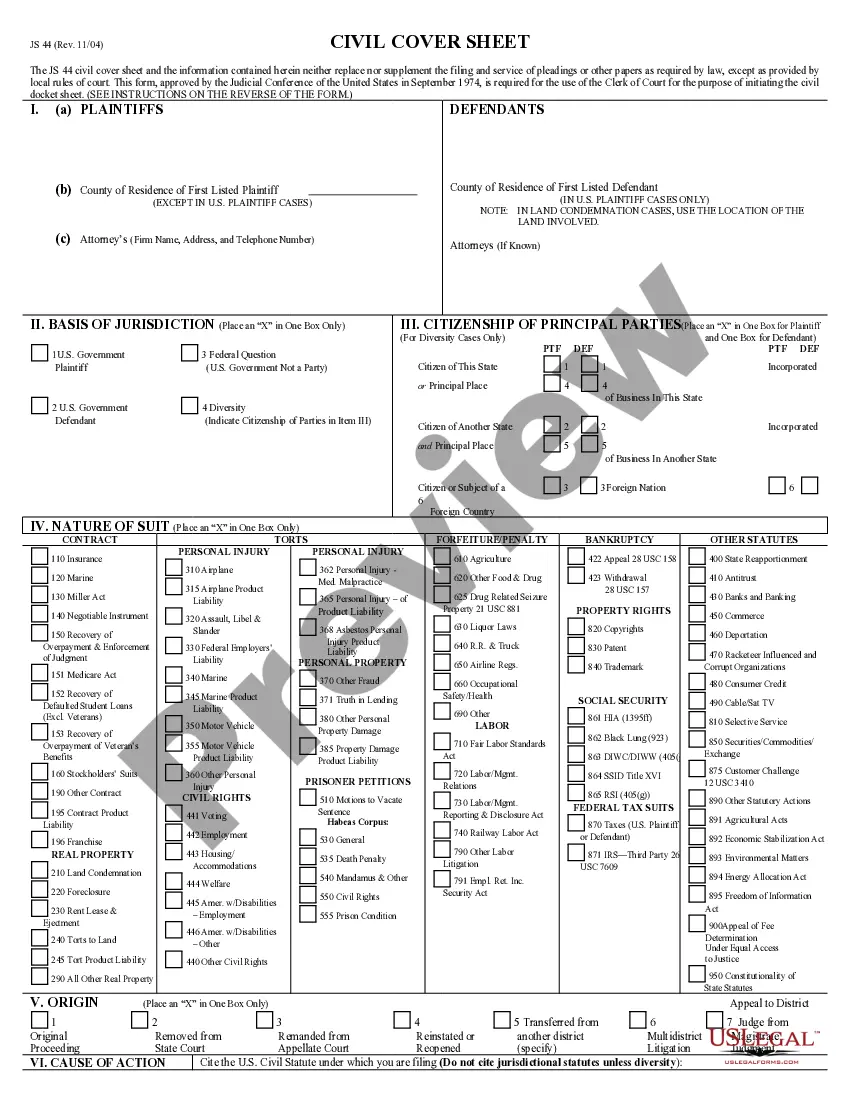

Format of Cash ReceiptThe date on which the transaction happened.The unique number assigned to the document for identification.The name of the customer.The amount of cash received.The method of payment, i.e., by cash, cheque, etc.;The signature of the vendor.

Regardless of what you're paying for, if it's a legitimate transaction, you should be entitled to a receipt of some kind. This is especially true in the case of rent payments. If your landlord accepts rent payments in cash, you must get a receipt for each payment you make.

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

This is the information that should be included on a receipt: Your company's details including name, address, telephone number, and/or e-mail address. The date the transaction took place. List of products/services with a brief description of each along with the quantity delivered.

How to Write a ReceiptDate;Receipt Number;Amount Received ($);Transaction Details (what was purchased?);Received by (seller);Received from (buyer);Payment Method (cash, check, credit card, etc.);Check Number (if applicable); and.More items...?

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)

Write down the payment method and the customer's name. On the last line of the receipt write the customer's full name. If they paid by credit card, have them sign the bottom of the receipt. Then, make a copy of the receipt and keep it for your records and hand the customer the original receipt.

Interesting Questions

More info

925 MISSION DRIVE SUITE 200 PODCAST CORPORATION Address2 :BASIN, INC.