Louisiana Owner Financing Contract for Land is a legal agreement that outlines the terms and conditions between a property owner, known as the seller, and a buyer who wishes to purchase land using owner financing. This type of contract allows the buyer to make payments directly to the seller over time, eliminating the need for traditional bank financing. In a Louisiana Owner Financing Contract for Land, the seller retains legal ownership of the property until the buyer fulfills all payment obligations. This agreement is highly beneficial for buyers who might face difficulty obtaining a conventional mortgage or desire a more flexible payment schedule. Types of Louisiana Owner Financing Contracts for Land may include: 1. Down Payment: This contract type requires the buyer to make an initial down payment, which is deducted from the total purchase price. The remaining balance is then divided into equal installments, often over several years, along with interest. 2. Land Contract: This type of contract outlines the specific terms of the purchase, such as the purchase price, payment schedule, interest rates, and any additional conditions both parties agree upon. 3. Lease Purchase Agreement: In this variation, the buyer leases the land for a set period before the ownership is transferred. During the lease period, a portion of the monthly payment is applied towards building equity, and the buyer has the option to purchase the land at a later date. 4. Balloon Payment: This contract specifies regular monthly payments for a pre-determined period of time, typically ranging from 3 to 10 years. However, at the end of the term, a lump-sum, often in the form of a balloon payment, becomes due. Additionally, Louisiana Owner Financing Contracts for Land can include other essential clauses like property description, payment due dates, late payment penalties, default terms, and any specific provisions unique to the agreement. It is crucial for both buyers and sellers to consult a legal professional experienced in real estate transactions to draft or review any Louisiana Owner Financing Contract for Land. This ensures that the agreement accurately reflects the intentions of both parties and complies with relevant state laws and regulations. In conclusion, a Louisiana Owner Financing Contract for Land enables buyers to overcome conventional financing challenges and offers sellers the opportunity to sell their property while generating a stable income stream.

Louisiana Owner Financing Contract for Land

Description

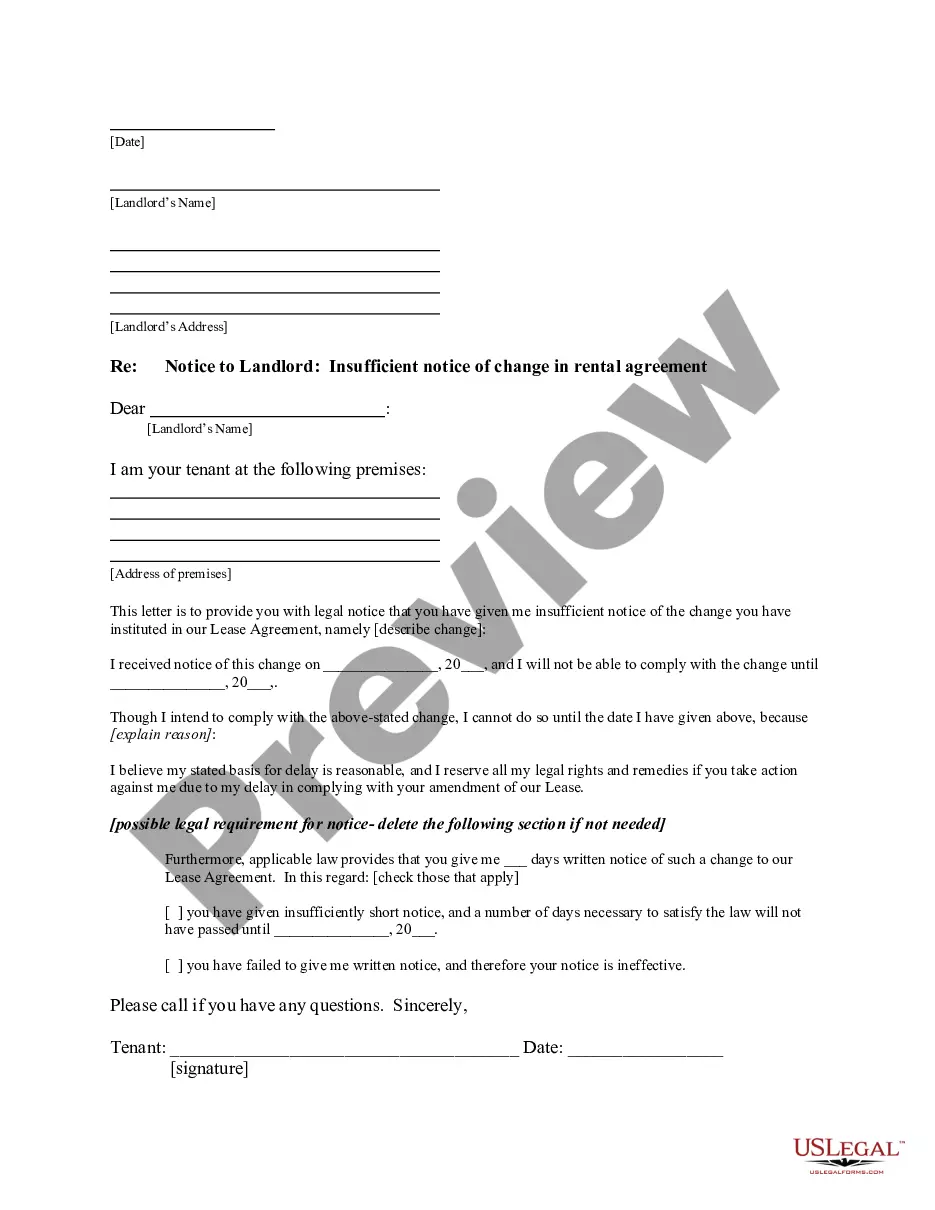

How to fill out Louisiana Owner Financing Contract For Land?

US Legal Forms - one of the greatest libraries of authorized kinds in the States - gives an array of authorized file templates you may down load or produce. Using the website, you can get thousands of kinds for organization and individual reasons, sorted by classes, suggests, or keywords and phrases.You will discover the newest variations of kinds such as the Louisiana Owner Financing Contract for Land in seconds.

If you currently have a membership, log in and down load Louisiana Owner Financing Contract for Land through the US Legal Forms collection. The Down load button will show up on every type you look at. You have access to all previously downloaded kinds inside the My Forms tab of your account.

If you want to use US Legal Forms the first time, allow me to share easy instructions to help you started off:

- Make sure you have picked out the right type for the area/region. Click the Review button to examine the form`s articles. Browse the type description to actually have chosen the right type.

- When the type doesn`t satisfy your requirements, make use of the Look for industry on top of the display to obtain the the one that does.

- If you are pleased with the shape, verify your decision by clicking the Get now button. Then, pick the pricing plan you prefer and give your credentials to sign up to have an account.

- Approach the transaction. Make use of your Visa or Mastercard or PayPal account to perform the transaction.

- Choose the format and down load the shape on the gadget.

- Make changes. Load, edit and produce and signal the downloaded Louisiana Owner Financing Contract for Land.

Every single web template you put into your account does not have an expiry day and is yours eternally. So, in order to down load or produce one more version, just go to the My Forms portion and click on around the type you want.

Get access to the Louisiana Owner Financing Contract for Land with US Legal Forms, the most considerable collection of authorized file templates. Use thousands of expert and state-specific templates that meet your company or individual demands and requirements.