Louisiana Sample Letter for Tax Deeds: A Comprehensive Guide to Claiming Property through Tax Deed Sales Introduction: If you're interested in acquiring properties through tax deed sales in Louisiana, understanding the process and preparing the necessary documentation is crucial. One essential component is a well-crafted Louisiana Sample Letter for Tax Deeds. This detailed description will outline the key elements to include in such a letter and provide insight into different types of sample letters available for various situations. Here's everything you need to know to successfully navigate the tax deed investment landscape in Louisiana. 1. What are Louisiana Tax Deeds? Louisiana tax deeds are legal documents issued to individuals or entities who acquire properties through tax deed sales. These sales occur when property owners fail to pay their property taxes, leading to a tax lien being placed on the property. The government then auctions off these liens to interested investors, who have the opportunity to become owners of the property once the redemption period expires. 2. What is a Louisiana Sample Letter for Tax Deeds, and why is it important? A Louisiana Sample Letter for Tax Deeds is a crucial document that potential buyers use to communicate their intent to acquire a property through a tax deed sale. It serves as a formal request to the tax collector and outlines essential details such as the specific property and how the buyer intends to handle the purchase. A well-structured and persuasive letter can significantly increase your chances of securing the desired property. 3. Key elements to include in a Louisiana Sample Letter for Tax Deeds: — Identification: Clearly state your name, contact information, and the purpose of the letter. — Property details: Provide the complete address of the property you're interested in, including the parish and any relevant identification numbers. — Intention to purchase: Clearly express your intent to purchase the property through tax deed sales, and you're understanding of the process. — Redemption period confirmation: Acknowledge the expiration of the redemption period for the property and confirm your eligibility as a potential buyer. — Purchase strategy: Outline your proposed purchase strategy, whether you plan to bid at an upcoming auction or directly negotiate with the tax collector for a deed sale. — Offer and payment terms: Specify the amount you are willing to pay for the property or your preferred negotiation approach, ensuring to include your preferred payment method. — Contact details: Provide your full contact information, including phone number and email address, so that the tax collector can reach you to discuss the details further. 4. Types of Louisiana Sample Letter for Tax Deeds: — Bid submission letter: This type of letter is tailored for potential buyers planning to participate in an auction. It highlights the buyer's interest and commitment to bidding on the property, including the maximum bid amount. — Negotiation letter: If you prefer to negotiate directly with the tax collector, a negotiation letter should be used. It emphasizes the buyer's willingness to engage in a discussion regarding a fair price and other potential terms. — Redemption period expiration acknowledgment letter: Once the redemption period expires, this letter is used by buyers to formally express their intent to acquire the property and proceed with the necessary steps to obtain the tax deed. Conclusion: A well-crafted Louisiana Sample Letter for Tax Deeds is a powerful tool that can greatly enhance your chances of successfully acquiring properties through tax deed sales. Understanding the key components to include in such a letter and tailoring it to the specific situation at hand is essential. Whether you're submitting a bid or negotiating directly, ensure your letter communicates your intent, understanding of the process, and readiness to complete the purchase. By employing an effective sample letter, you can confidently navigate the world of tax deed investments in Louisiana.

Louisiana Sample Letter for Tax Deeds

Description

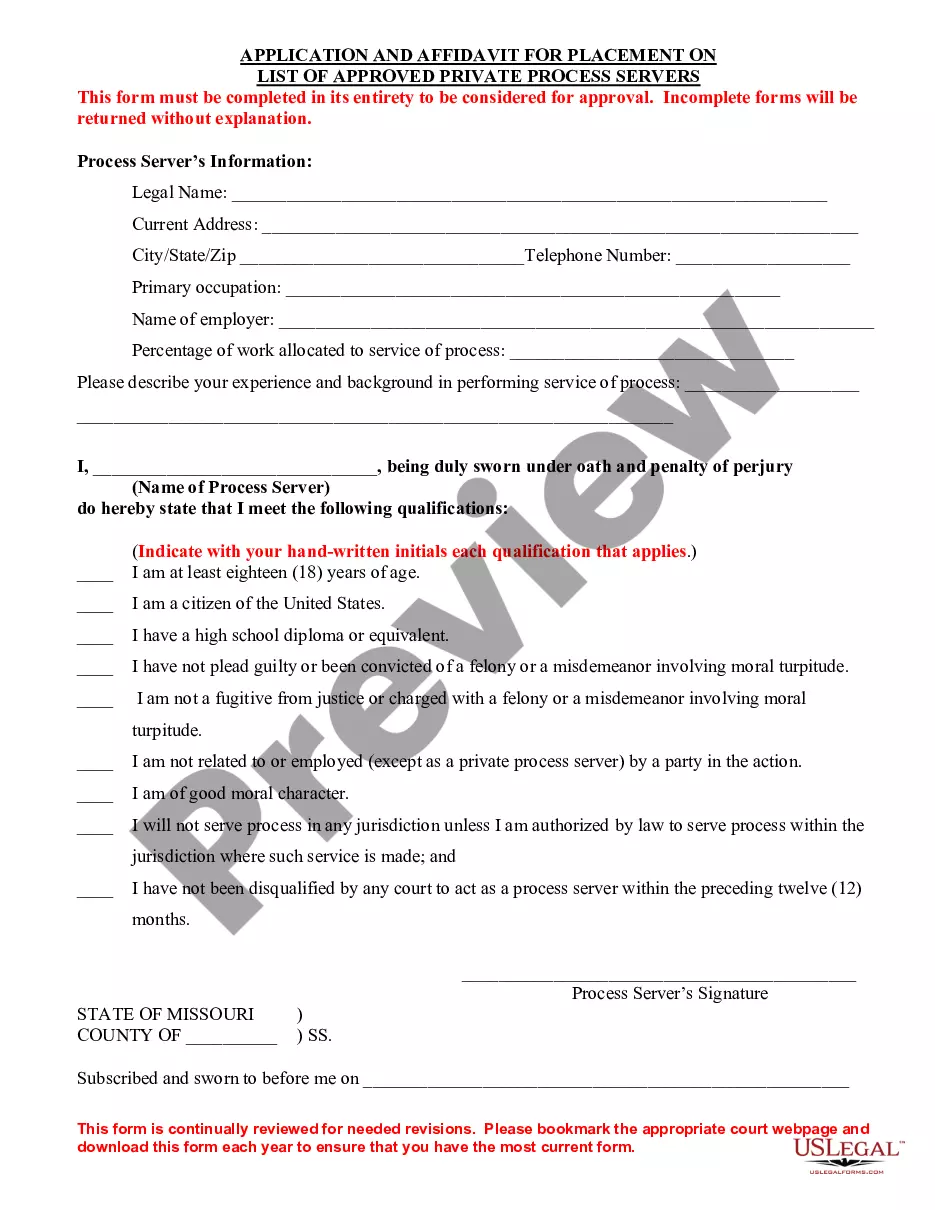

How to fill out Louisiana Sample Letter For Tax Deeds?

It is possible to commit time online trying to find the authorized file template that meets the state and federal demands you need. US Legal Forms gives a huge number of authorized types which are reviewed by specialists. It is possible to acquire or printing the Louisiana Sample Letter for Tax Deeds from the support.

If you have a US Legal Forms account, it is possible to log in and then click the Down load key. After that, it is possible to comprehensive, edit, printing, or sign the Louisiana Sample Letter for Tax Deeds. Each and every authorized file template you buy is your own forever. To get one more backup of any acquired form, visit the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms internet site initially, adhere to the easy guidelines below:

- Very first, make certain you have chosen the best file template for your county/city of your choice. See the form outline to ensure you have chosen the proper form. If readily available, utilize the Review key to search from the file template too.

- If you wish to get one more model of your form, utilize the Search area to get the template that meets your needs and demands.

- Upon having found the template you would like, just click Acquire now to continue.

- Choose the pricing plan you would like, key in your credentials, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal account to purchase the authorized form.

- Choose the format of your file and acquire it for your system.

- Make modifications for your file if possible. It is possible to comprehensive, edit and sign and printing Louisiana Sample Letter for Tax Deeds.

Down load and printing a huge number of file layouts utilizing the US Legal Forms web site, which offers the largest assortment of authorized types. Use expert and express-distinct layouts to tackle your company or personal requirements.