This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

Are you presently in a circumstance where you frequently require documentation for either business or personal purposes almost every workday.

There are numerous valid document templates available online, but finding reliable ones is not easy.

US Legal Forms offers a vast array of form templates, such as the Louisiana Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually, designed to comply with federal and state regulations.

Select the pricing plan you prefer, complete the necessary information to create your account, and process your payment using PayPal or credit card.

Choose a convenient file format and download your copy. Access all the templates you've purchased in the My documents section. You can obtain an additional copy of the Louisiana Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually at any time, simply click the necessary form to download or print the template. Utilize US Legal Forms, which is the most extensive collection of legal documents, to save time and avoid mistakes. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you’re already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then you can download the Louisiana Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Locate the form you need and confirm it's for your specific city/state.

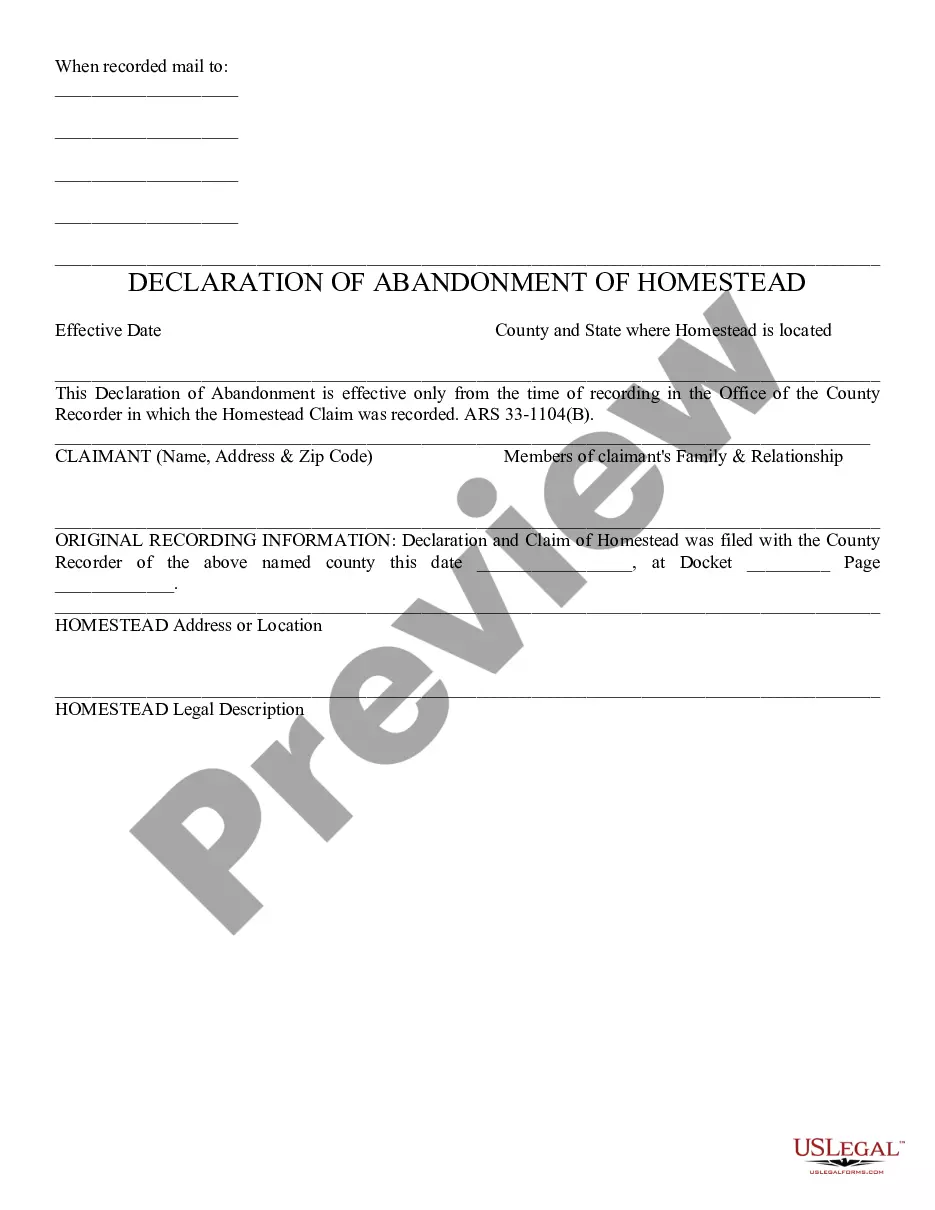

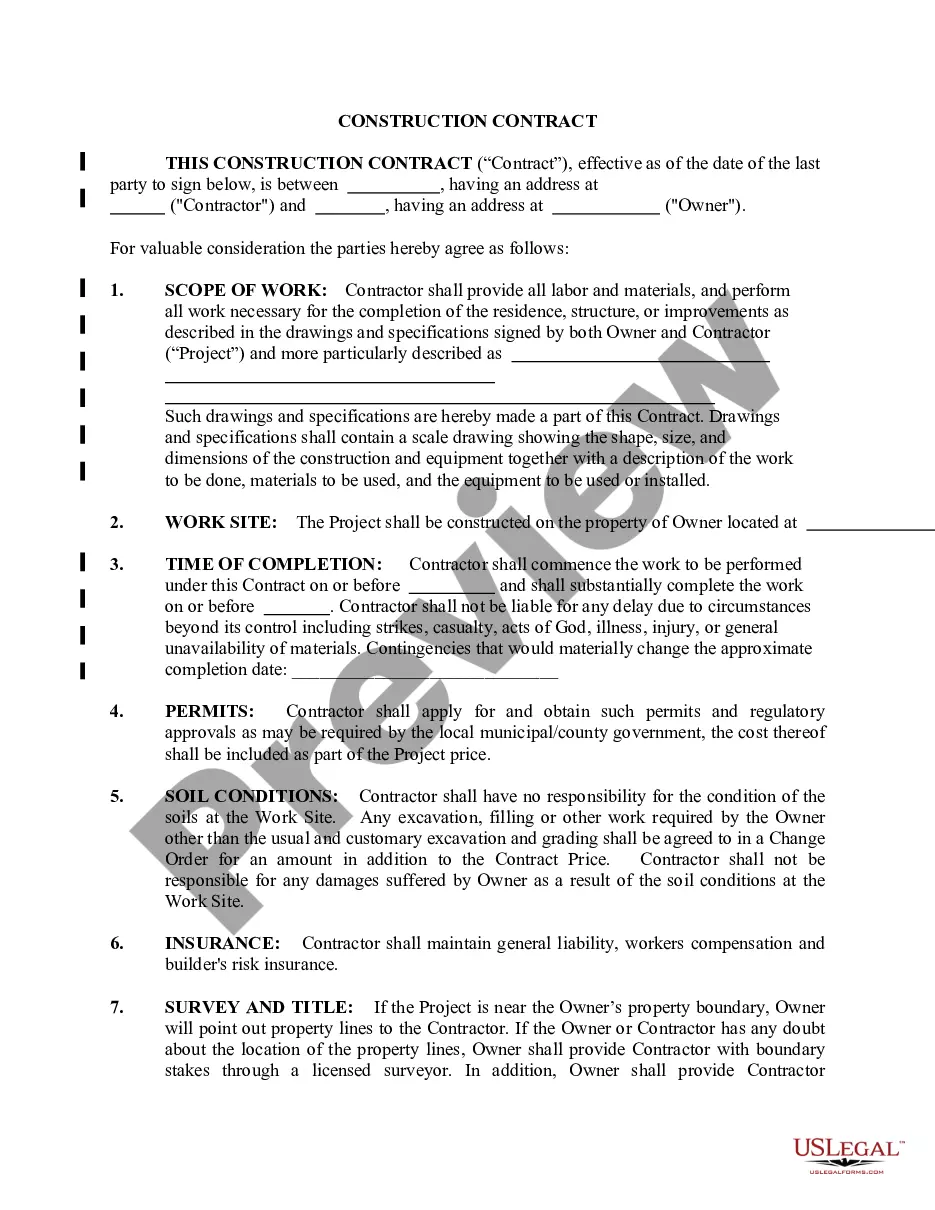

- Utilize the Review button to view the form.

- Examine the description to ensure you have selected the correct document.

- If the form is not what you are looking for, use the Search section to find the template that meets your requirements.

- Once you obtain the correct document, click Buy now.

Form popularity

FAQ

To report promissory note interest, you generally need to include it in your income on your tax return, usually under ordinary income. For notes like the Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, ensure that you account for interest accrued over the term properly. Keeping organized records can simplify the reporting process, and using uslegalforms can help you find the templates necessary to keep everything in order.

Generally, you are not required to report interest under $10; however, it is always advisable to include it in your records. If you receive interest from a Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, it's wise to track every amount to maintain accurate financial documentation. In complex situations, uslegalforms can assist you with relevant information about tax reporting.

Yes, interest does compound on a promissory note if it is structured that way. In the case of a Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the interest accumulates over time without any payments until maturity. This can enhance your potential return, making it essential to understand the terms before entering into such an agreement. For more insights, check resources on uslegalforms.

To report interest income from Treasury bills, you must first gather your tax documents, including any 1099-INT forms. This income should be reported on your tax return as ordinary income. If you have received Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, remember to include that interest as well, as both are subject to taxation. Using uslegalforms can simplify the process of determining the exact reporting requirements.

Yes, promissory notes can accrue interest as specified in their terms. A Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually specifically allows for interest to build over time, providing potential growth on your investment. Accrued interest may be calculated differently depending on the type of interest applied, making it vital to understand your specific agreement. USLegalForms can assist in crafting an agreement that meets your needs.

Interest on a promissory note is typically computed based on the stated interest rate and the outstanding principal amount. For a Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, interest accumulates at specified intervals, which can significantly impact the total amount owed at maturity. Understanding how interest is calculated is crucial for effective financial planning. If you have questions, consider utilizing USLegalForms to navigate your options.

In Louisiana, the validity of a promissory note typically lasts for ten to fifteen years, depending on whether it is a written or verbal agreement. However, the specific time frame can vary based on the terms laid out in the note. A Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is often structured to specify the maturity date clearly, ensuring clarity for both parties. Always consult with a legal professional for personalized advice.

A promissory note can feature either simple or compound interest, depending on its terms. With the Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you will generally encounter compound interest. This means your interest accumulates on the initial amount and any previously earned interest, leading to potentially higher returns over time. Understanding these terms helps you make informed financial decisions.

While many promissory notes feature a maturity date, it is not always required. In cases like a Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the lack of a specific payment deadline can reflect a flexible repayment plan. However, clarity is essential to avoid misunderstandings. To ensure all aspects are covered properly, utilizing platforms such as uslegalforms can be advantageous.

The four main types of promissory notes include unsecured notes, secured notes, demand notes, and installment notes. Each provides different levels of security and repayment structures, which may influence your choice. Specifically, a Louisiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually fits within the category of installment notes due to its unique payment terms. For detailed guidance on creating these notes, uslegalforms can provide helpful templates and information.