Louisiana Sample Letter for Erroneous Information on Credit Report

Description

How to fill out Sample Letter For Erroneous Information On Credit Report?

If you need to total, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the site's user-friendly and convenient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other forms in the legal form template.

Step 4. Once you have located the form you need, click the Get now button. Select the payment plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to locate the Louisiana Sample Letter for Incorrect Information on Credit Report in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to access the Louisiana Sample Letter for Incorrect Information on Credit Report.

- You can also retrieve forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

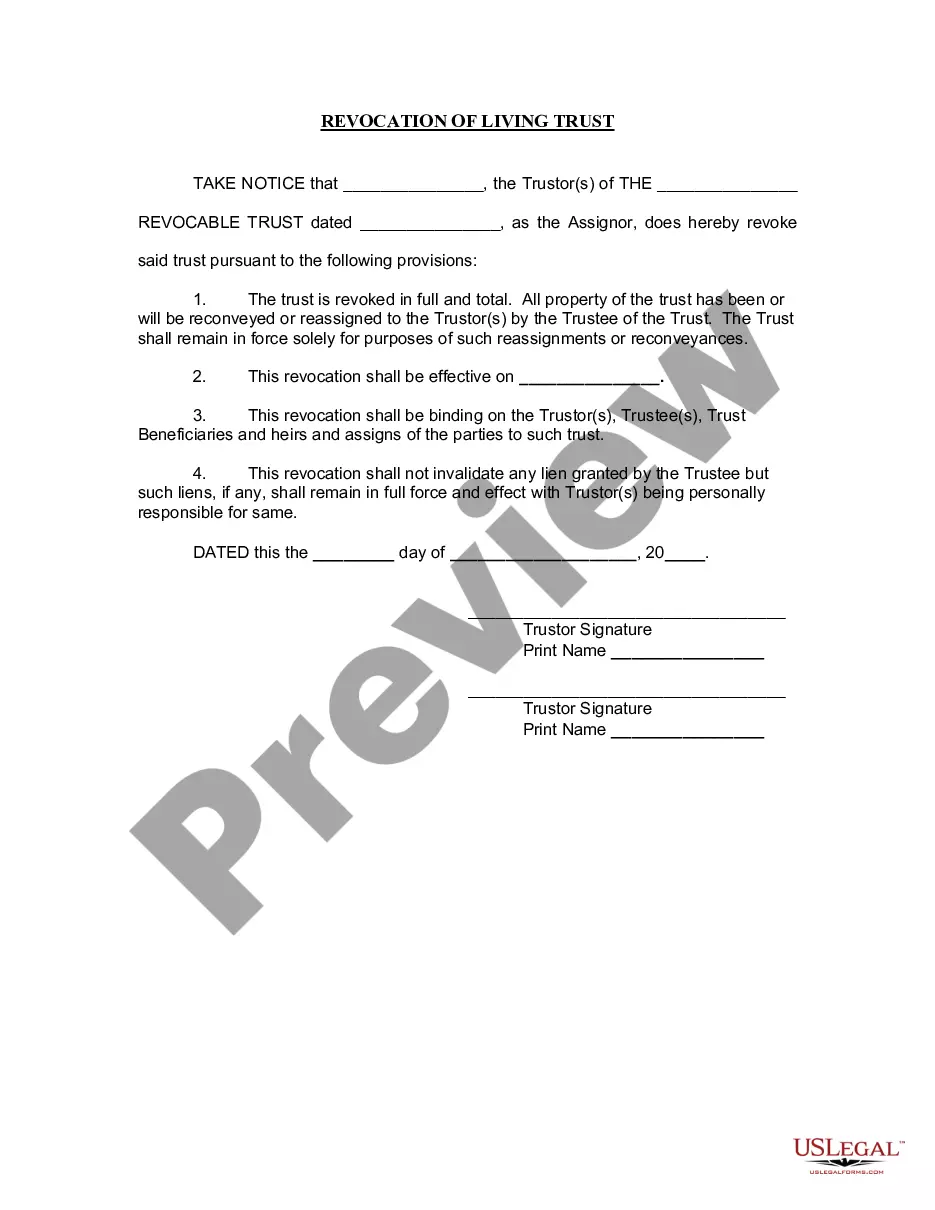

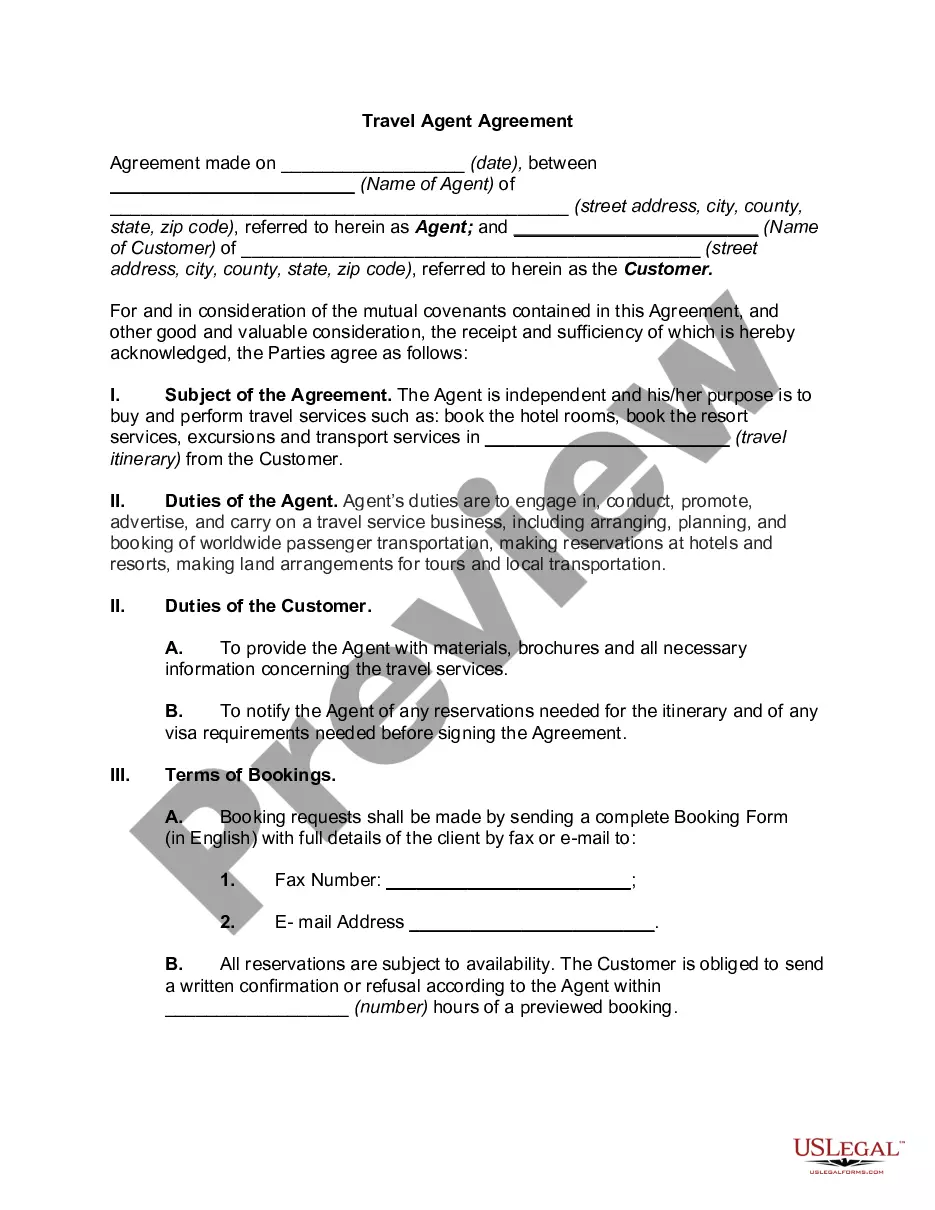

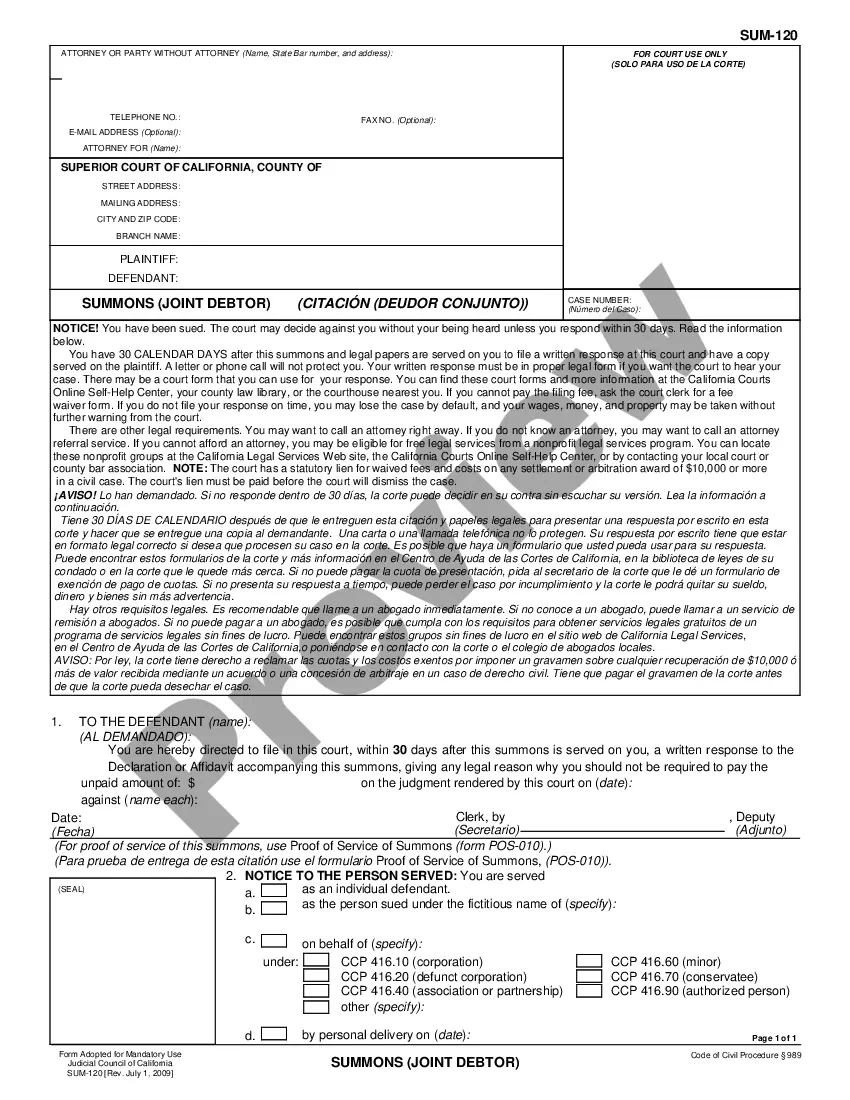

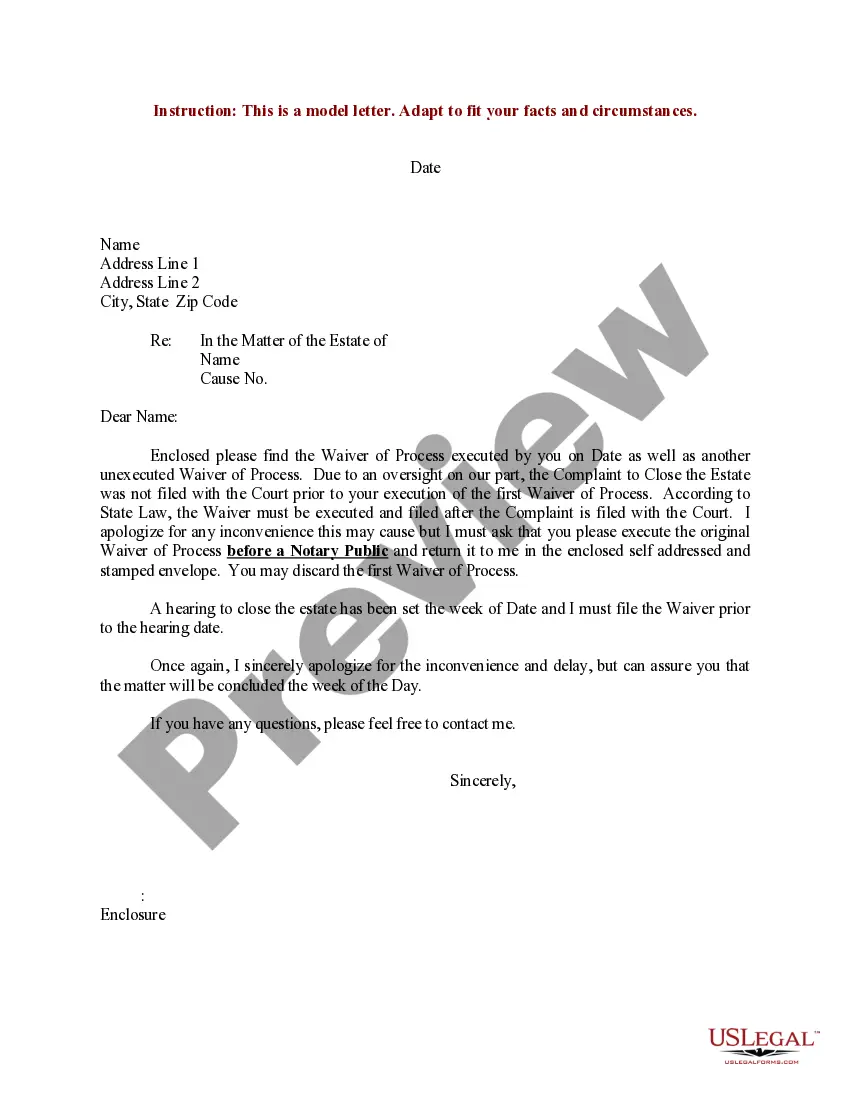

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

Form popularity

FAQ

To remove an incorrect collection from your credit report, you must dispute the entry with the credit bureau. Prepare a Louisiana Sample Letter for Erroneous Information on Credit Report, detailing why the collection is inaccurate while including supporting documentation. Once you send your letter, the credit bureau investigates your claim and should resolve it within 30 days. That way, you take a strong step toward maintaining your financial reputation.

Removing incorrect information from your credit report requires a systematic approach. Begin by identifying the erroneous entries on your report, then write a Louisiana Sample Letter for Erroneous Information on Credit Report to the respective credit bureau. In your letter, explain why the information is incorrect and provide any supporting documentation. The bureau will investigate your claim and respond within 30 days, titled towards protecting your rights.

To obtain a 609 letter, you first need to understand that it is a formal request for your credit report, specifically for verification of the information listed. You can create a Louisiana Sample Letter for Erroneous Information on Credit Report by clearly stating your request for the credit bureau to validate the entries. Make sure to include your personal information and the specific details of the erroneous entries. After sending your letter, the credit bureau has 30 days to respond.

A 623 letter is a formal communication sent to a creditor when you dispute inaccuracies on your credit report under the Fair Credit Reporting Act. It requests them to investigate and correct any erroneous information associated with your account. Using a Louisiana Sample Letter for Erroneous Information on Credit Report can simplify crafting this letter, making sure you include all relevant details to support your request.

An example of a dispute letter for a debt includes a formal request outlining the precise debt you are disputing. Reference any inaccuracies you found in your credit report and state your case clearly, asking for verification of the debt's legitimacy. The Louisiana Sample Letter for Erroneous Information on Credit Report can serve as a helpful template to ensure you include all necessary details and formalities.

To write an effective credit dispute letter, start by clearly stating your intent to dispute specific information on your credit report. Include your personal details, such as your name, address, and Social Security number, along with a reference to the erroneous information. Use the Louisiana Sample Letter for Erroneous Information on Credit Report as a guide for structure, ensuring you provide supporting evidence to strengthen your claim.

The proper way to dispute a credit report involves reviewing your credit report for inaccuracies, gathering supporting documentation, and writing a dispute letter to the credit bureau. It’s essential to clearly outline the errors and provide evidence to back up your claims. Using a Louisiana Sample Letter for Erroneous Information on Credit Report can simplify this process, ensuring you communicate your concerns effectively and increase the likelihood of a resolution.

When writing a letter of explanation for bad credit, you should begin by explaining the reasons behind your poor credit history. Include any relevant context, such as job loss or medical emergencies, that led to your situation. Utilize a Louisiana Sample Letter for Erroneous Information on Credit Report as a template to create a clear and concise letter that addresses your credit issues while showcasing your commitment to improving your financial health.

To write a letter for a credit dispute, start by clearly stating your intention to dispute the erroneous information. Include your personal details, the specific account in question, and detailed information about the inaccuracies. You can use a Louisiana Sample Letter for Erroneous Information on Credit Report to guide you through the process, ensuring you cover all necessary points and present your case effectively.

A 623 letter is a formal request that you send to a creditor or lender when you believe they have reported incorrect information to credit bureaus. In this letter, you can use a Louisiana Sample Letter for Erroneous Information on Credit Report template that outlines specific inaccuracies and requests verification or correction. Ensure your language is clear and assertive to prompt a timely response from the creditor.