Louisiana Triple Net Lease for Residential Property

Description

How to fill out Triple Net Lease For Residential Property?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an array of legal template documents that you can download or print.

By utilizing the site, you can access thousands of forms for personal and business needs, organized by categories, states, or keywords.

You can acquire the latest versions of documents such as the Louisiana Triple Net Lease for Residential Property in just a few minutes.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and provide your details to create an account.

- If you are already a member, Log In and download the Louisiana Triple Net Lease for Residential Property from the US Legal Forms collection.

- The Download button will be available on each form you view.

- You can retrieve all previously purchased forms in the My documents section of your profile.

- To start using US Legal Forms for the first time, follow these simple steps.

- Ensure that you have selected the appropriate form for your city/county.

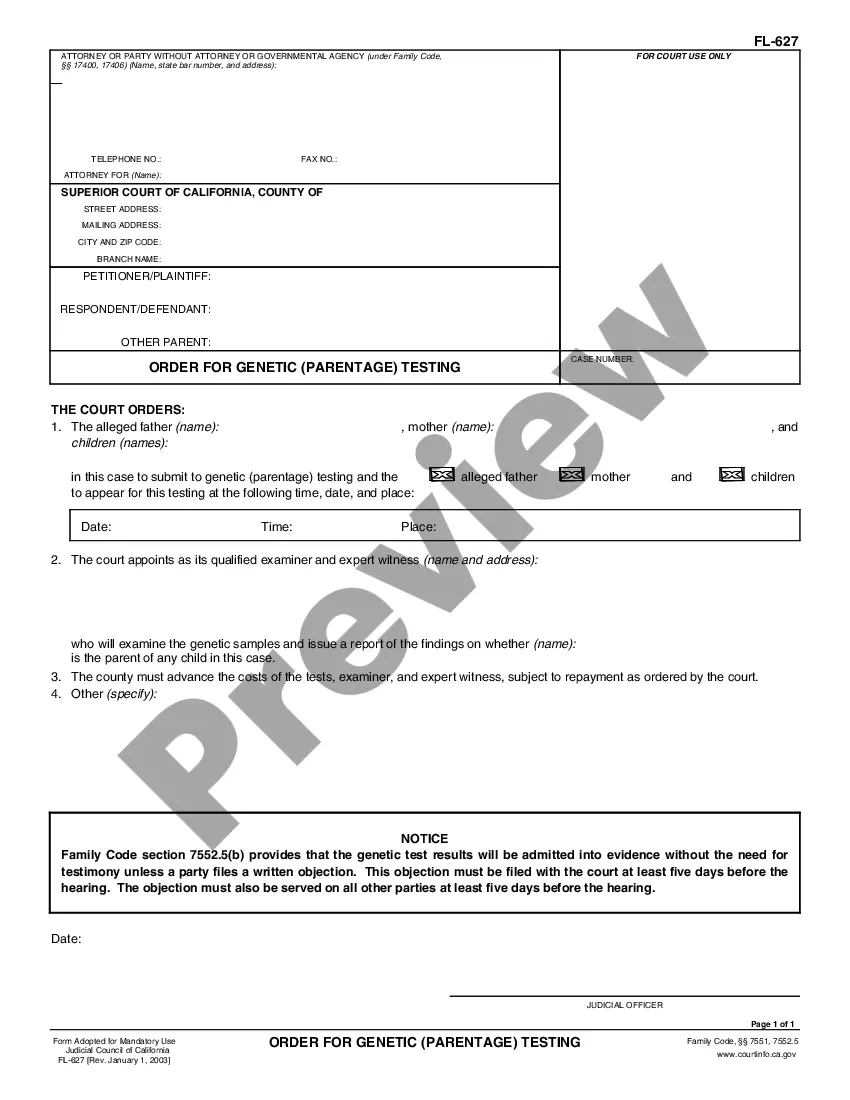

- Click the Preview button to review the contents of the form.

Form popularity

FAQ

A Louisiana Triple Net Lease for Residential Property typically includes the base rent along with the tenant’s responsibility for property taxes, insurance, and maintenance costs. In many cases, utilities may also fall under the tenant’s purview. It's wise to review the lease carefully to understand all included stipulations and to ensure a clear agreement on what is expected from both parties.

Structuring a Louisiana Triple Net Lease for Residential Property requires clear agreements on responsibilities between tenants and landlords. Outline specific duties related to taxes, insurance, and maintenance in the lease document, ensuring both parties understand their obligations. Additionally, consider including clauses that address unforeseen expenses and regular property inspections to promote transparency.

Qualifying for a Louisiana Triple Net Lease for Residential Property often involves reviewing your financial stability and rental history. Landlords typically require proof of income, credit checks, and references to ensure reliability. Being prepared with documentation can streamline the process and increase your chances of securing a favorable lease.

To calculate a Louisiana Triple Net Lease for Residential Property, begin by determining the base rent and adding estimated costs for property taxes, insurance, and maintenance. These expenses should be calculated annually and divided by twelve to find a monthly amount. It's essential to ensure accuracy by reviewing these calculations regularly, as changes in expenses can impact the overall lease agreement.

To get approved for a Louisiana Triple Net Lease for Residential Property, you should first assess your financial situation. Lenders typically look for stable income and good credit history. Moreover, providing references and a clear business plan can enhance your application. Utilizing a platform like USLegalForms can streamline the process by offering the necessary templates and guidance.

Operating expenses in a Louisiana Triple Net Lease for Residential Property typically include property taxes, insurance, and maintenance costs. These expenses fall on the tenant, meaning they are crucial to consider when calculating total living costs. Understanding these financial responsibilities will help you better prepare for the lease agreement. For a straightforward breakdown of these expenses, consider consulting resources from uslegalforms.

NNN fees in a Louisiana Triple Net Lease for Residential Property can vary widely based on the property's location and specific expenses involved. Generally, these fees cover property taxes, insurance, and maintenance costs, which can range from a few hundred to several thousand dollars monthly. It's essential to review these fees thoroughly to avoid surprises and ensure they fit within your budget.

When considering a Louisiana Triple Net Lease for Residential Property, it's important to recognize the potential disadvantages. For one, tenants typically take on all property costs, which can lead to unexpected expenses. Additionally, if property values decline, the tenant remains responsible for rent, impacting their financial commitment. Therefore, it's crucial to carefully calculate all potential costs before entering such a lease.

A triple net lease example in a Louisiana context could involve a tenant renting a duplex. The tenant pays a monthly rent, but also covers the costs for property taxes, home insurance, and necessary maintenance. This arrangement shifts financial responsibilities to the tenant, making it essential for them to budget for these additional expenses. To navigate these complexities, resources like USLegalForms can provide guidance and templates.

Not all residential leases are triple net, but some can be structured that way. If you enter into a Louisiana Triple Net Lease for Residential Property, you will take on financial responsibilities that typically belong to landlords. It is essential to review your specific lease terms to understand your obligations fully. Knowing the difference can help you make informed housing decisions.