Louisiana Triple Net Lease for Industrial Property

Description

How to fill out Triple Net Lease For Industrial Property?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal template documents that you can download or print.

By using the site, you will have access to thousands of forms for business and personal purposes, categorized by groups, states, or keywords. You can find the most recent versions of forms like the Louisiana Triple Net Lease for Industrial Property in just a few minutes.

If you have an account, Log In and download the Louisiana Triple Net Lease for Industrial Property from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously downloaded forms under the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form onto your device. Make amendments. Complete, modify, and print and sign the downloaded Louisiana Triple Net Lease for Industrial Property. Every template you have added to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Louisiana Triple Net Lease for Industrial Property with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

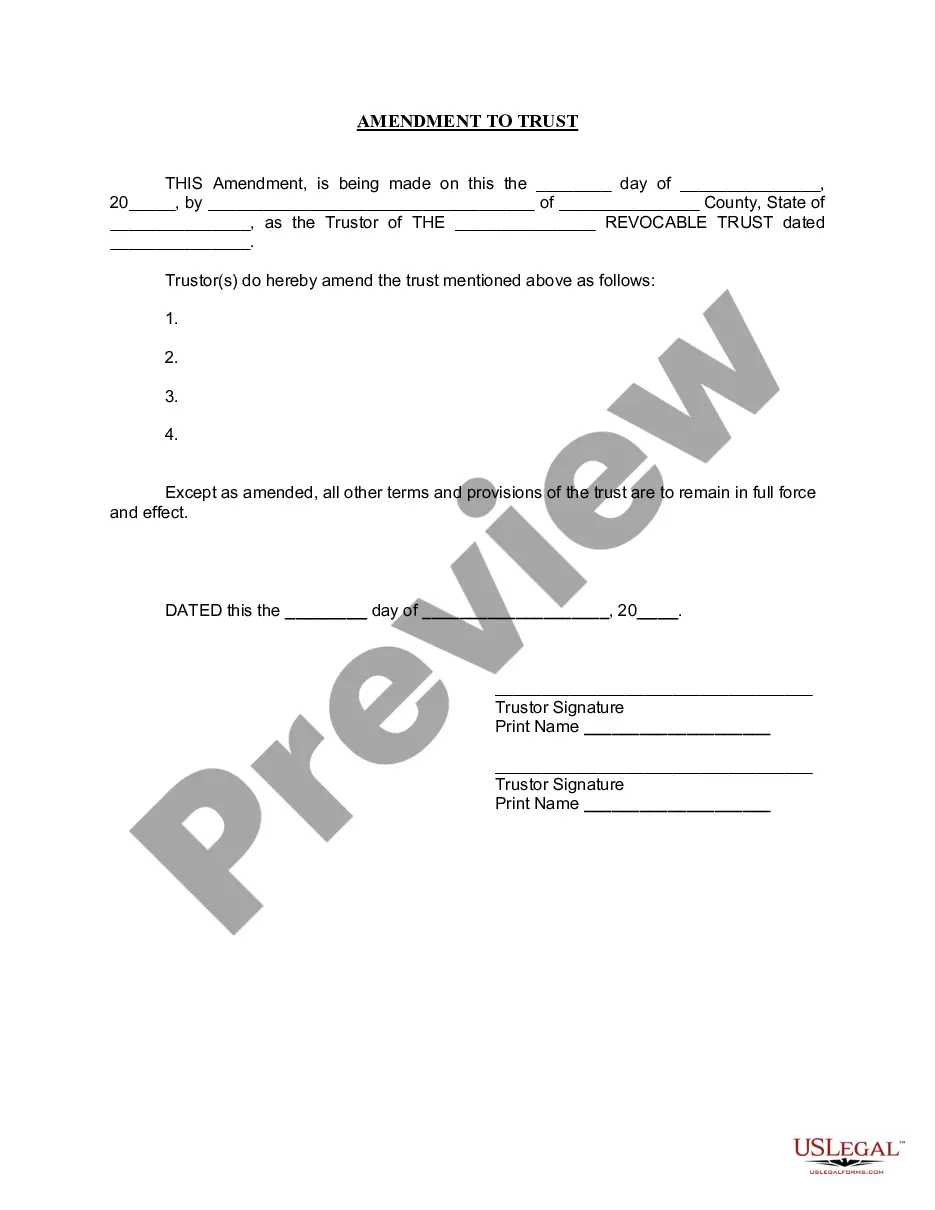

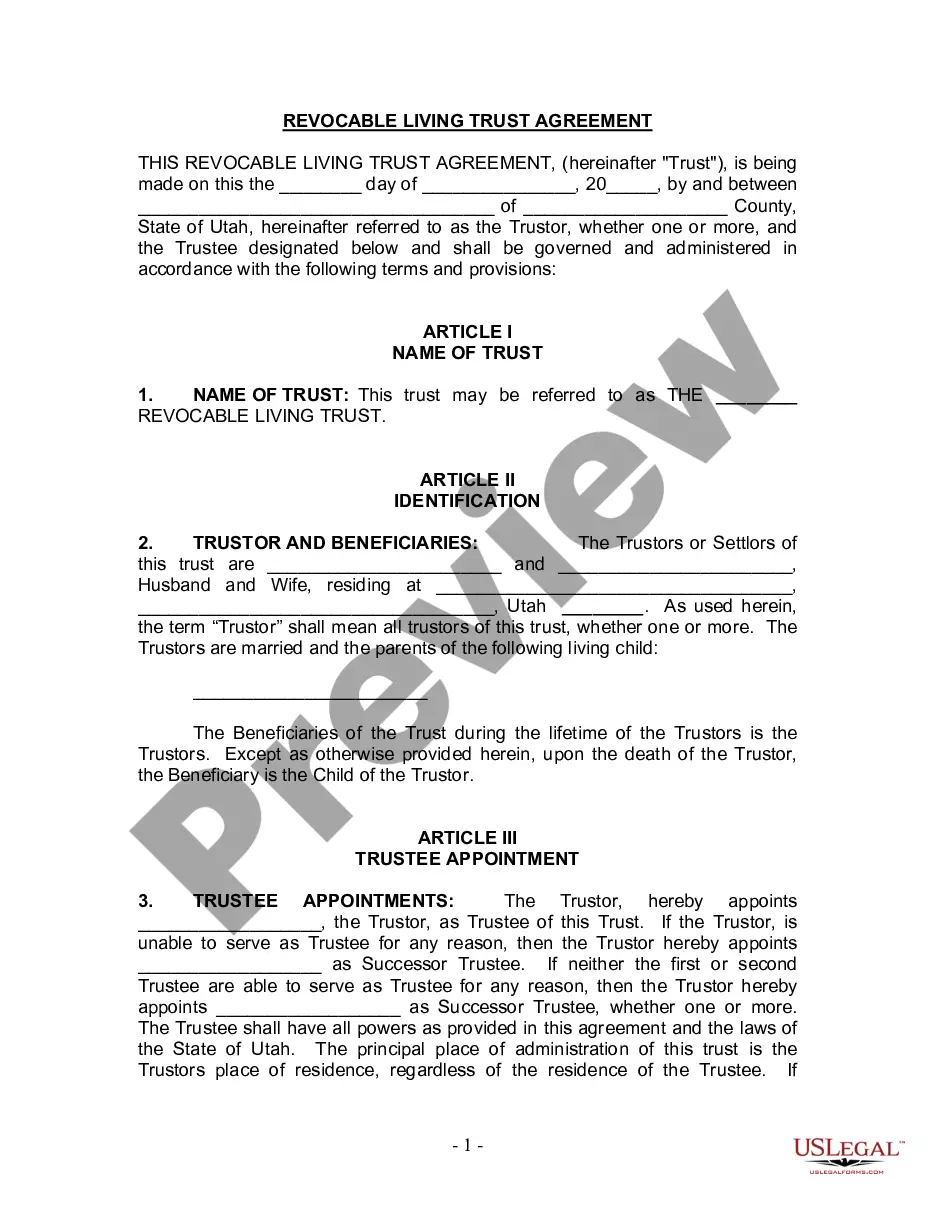

- Ensure you have selected the correct form for your area/state. Click the Preview button to check the form's content.

- Review the form description to ensure that you have chosen the right document.

- If the form does not meet your requirements, use the Lookup section at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Getting approved for a Louisiana Triple Net Lease for Industrial Property involves demonstrating your ability to cover ongoing costs. Present your financial statements, along with any business plans that show revenue potential. Moreover, landlords appreciate a strong rental history. Consider using tools from US Legal Forms to streamline your application process and ensure you meet all requirements.

In Louisiana, the two primary types of leases are the Louisiana Triple Net Lease for Industrial Property and the gross lease. The Louisiana Triple Net Lease is where tenants cover property expenses like taxes, insurance, and maintenance, while a gross lease usually includes these costs within the rent. Understanding these lease types helps property owners and tenants align their financial responsibilities effectively.

Calculating commercial rent in a Louisiana Triple Net Lease for Industrial Property involves summing the base rent with projected costs for property taxes, insurance premiums, and maintenance fees. Begin by estimating the total annual expenses, then divide by 12 to find the monthly obligation. By adding this to the base rent, both tenants and landlords gain clarity on all financial responsibilities. Using tools or platforms like US Legal Forms can further aid in accurate calculations and lease management.

To structure a Louisiana Triple Net Lease for Industrial Property, define the base rent, clarify the tenant's responsibility for property taxes, insurance, and maintenance, and specify any additional expenses. This structure protects the landlord from unexpected costs while providing the tenant with a clear understanding of their financial obligations. Both parties should carefully review the lease terms to ensure transparency. Using resources like US Legal Forms can simplify this process and provide standard templates.

Triple net leases are most commonly associated with industrial, retail, and warehouse properties. These types of real estate often involve long-term agreements that provide security for both landlords and tenants. For investors looking into the Louisiana Triple Net Lease for Industrial Property, these leases offer a stable return and minimal active management. Thus, if you're exploring different property types, consider how a triple net lease can fit into your investment strategy.

Yes, many commercial leases, especially in industrial real estate, tend to be structured as triple net leases. This arrangement shifts most expenses, including property taxes, insurance, and maintenance, to the tenant. The Louisiana Triple Net Lease for Industrial Property stands out because it allows landlords to maintain predictable income while tenants benefit from having control over specific property expenses. Understanding this type of lease can empower both parties to negotiate terms that meet their needs.

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These expenses are in addition to the cost of rent and utilities.

Meaning of $/SF Year in the Commercial Rental Industry In the commercial leasing industry, $/SF/year or $/SF/yr means the rent per square foot per year. Why is this important? This is because most commercial rental rates are usually quoted in dollars per square foot on an annual basis.

For example, in a triple net lease, the tenant pays all of the expenses in addition to the rent. A net lease, in particular a triple net lease, is commonly used by commercial tenants. A large company may have a triple net lease and rent an entire office building. You just studied 18 terms!

To determine the triple net lease amount for each renter, add those monthly expenses and the monthly rental per square foot charges and multiply it by the number of square feet a renter is leasing. That is the monthly triple net lease amount.