A Louisiana Security Agreement involving the Sale of Collateral by a Debtor is a legally binding document that establishes a security interest in certain assets or property (collateral) to secure a debt. This agreement provides protections for the creditor, in the event of default by the debtor, by allowing them to seize and sell the collateral to recover the owed amount. In Louisiana, there are primarily two types of Security Agreements involving the Sale of Collateral by a Debtor: 1. Traditional Security Agreement: A traditional Louisiana Security Agreement involving the Sale of Collateral by a Debtor outlines the specific details of the collateral being used to secure the debt. It generally includes a thorough description of the collateral, such as real estate, vehicles, equipment, inventory, intellectual property, or any other valuable assets. The agreement provides clarity on the terms of the sale, including the method, time, and manner in which the collateral may be sold. 2. Commercial Security Agreement: In commercial transactions, lenders may require additional security to protect their interests. A Commercial Security Agreement involving the Sale of Collateral by a Debtor is commonly used in Louisiana to secure accounts receivable, proceeds from commercial transactions, and other business-related assets. This agreement typically covers various types of collateral, including inventories, equipment, accounts, and general intangibles. Keywords for this description could include: Louisiana, Security Agreement, Sale of Collateral, Debtor, Collateral Description, Traditional Security Agreement, Commercial Security Agreement, Creditor, Default, Seize, Recover, Debt, Real Estate, Vehicles, Equipment, Inventory, Intellectual Property, Valuable Assets, Commercial Transactions, Accounts Receivable, Proceeds, Business Assets, Inventories, Accounts, General Intangibles.

Louisiana Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Louisiana Security Agreement Involving Sale Of Collateral By Debtor?

You can commit hours online looking for the lawful record web template that meets the state and federal specifications you will need. US Legal Forms supplies a huge number of lawful forms that are examined by pros. You can easily obtain or printing the Louisiana Security Agreement involving Sale of Collateral by Debtor from your assistance.

If you currently have a US Legal Forms accounts, you can log in and then click the Acquire key. Afterward, you can comprehensive, edit, printing, or indication the Louisiana Security Agreement involving Sale of Collateral by Debtor. Each and every lawful record web template you purchase is yours permanently. To obtain one more duplicate associated with a bought form, check out the My Forms tab and then click the related key.

If you work with the US Legal Forms website initially, adhere to the simple guidelines beneath:

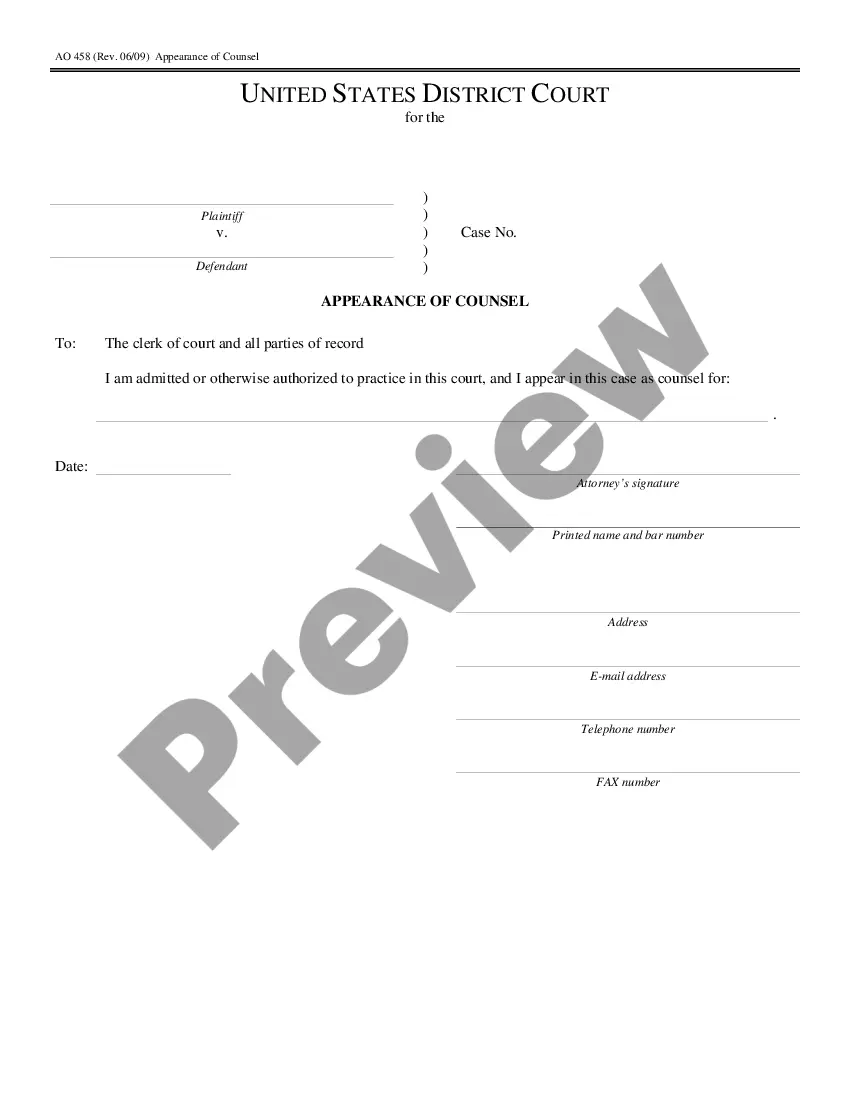

- First, make certain you have selected the proper record web template to the county/metropolis of your choice. Browse the form outline to ensure you have chosen the correct form. If accessible, make use of the Preview key to look through the record web template also.

- If you wish to find one more variation in the form, make use of the Look for discipline to discover the web template that meets your requirements and specifications.

- After you have identified the web template you want, simply click Buy now to move forward.

- Pick the pricing plan you want, type in your credentials, and register for a merchant account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal accounts to pay for the lawful form.

- Pick the formatting in the record and obtain it to the gadget.

- Make alterations to the record if possible. You can comprehensive, edit and indication and printing Louisiana Security Agreement involving Sale of Collateral by Debtor.

Acquire and printing a huge number of record layouts making use of the US Legal Forms Internet site, that offers the biggest variety of lawful forms. Use expert and state-distinct layouts to deal with your small business or person demands.