Louisiana Sample Letter for Denial of Request for Time Extension - Purchase of Home

Description

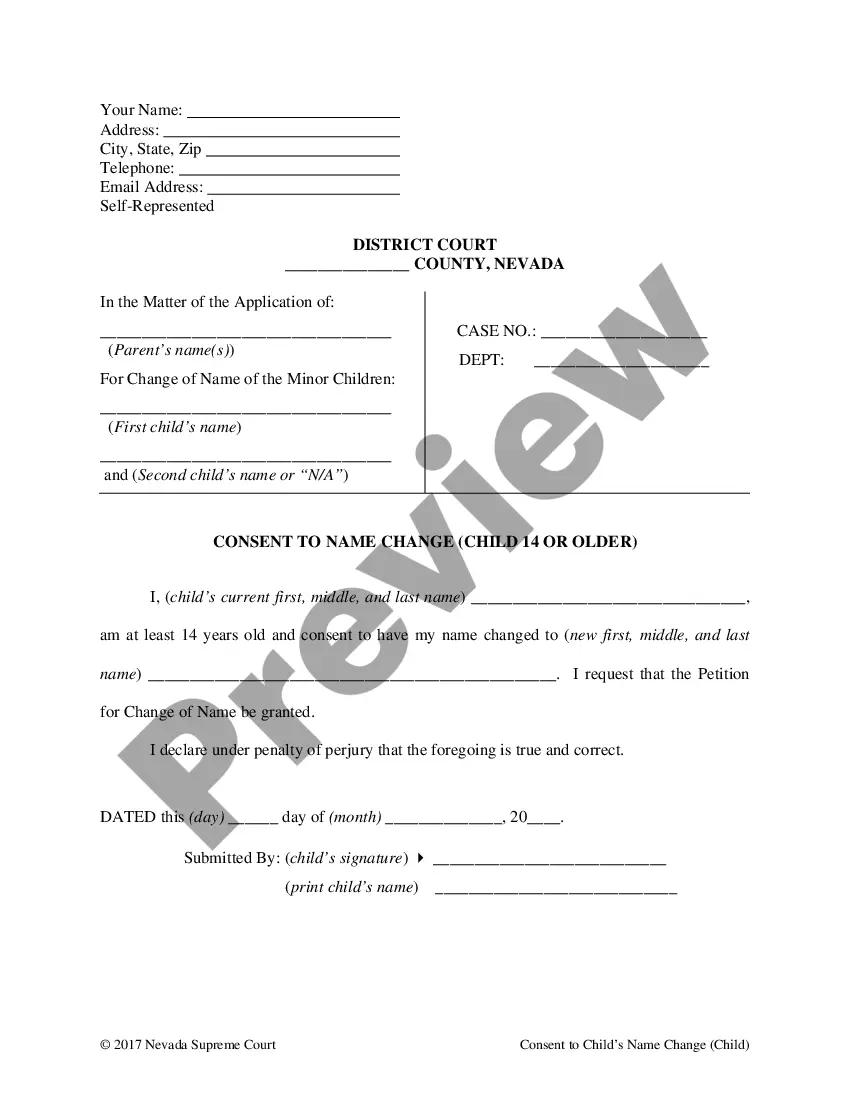

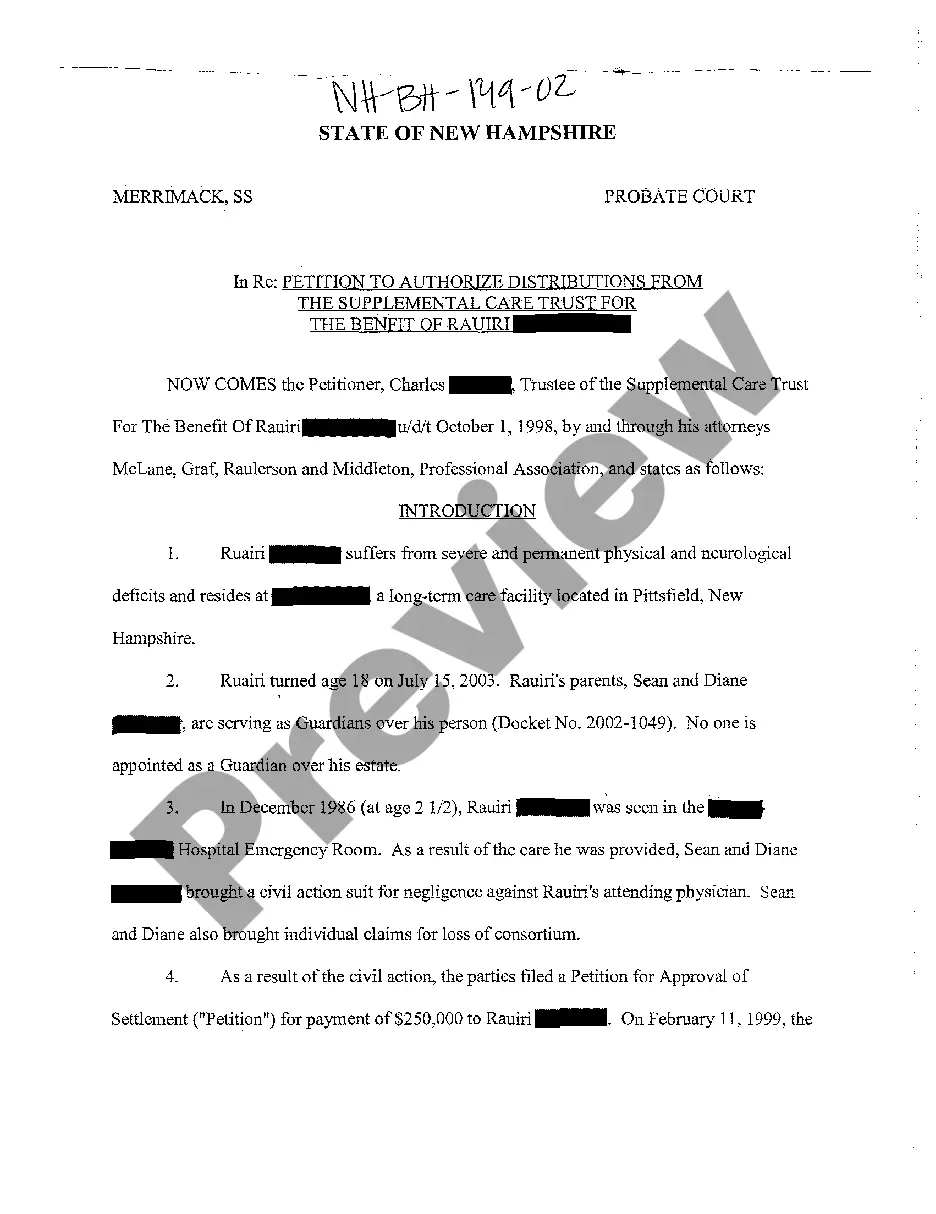

How to fill out Sample Letter For Denial Of Request For Time Extension - Purchase Of Home?

If you need to total, obtain, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, choose the Purchase now button. Select the payment plan you prefer and provide your information to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the payment.

- Utilize US Legal Forms to find the Louisiana Sample Letter for Rejection of Request for Time Extension - Home Purchase within a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to get the Louisiana Sample Letter for Rejection of Request for Time Extension - Home Purchase.

- You can also access forms you have previously obtained in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you select the form for the correct state.

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other variations of the legal form design.

Form popularity

FAQ

Politely asking for a time extension involves a brief introduction followed by a respectful request. Make sure to express your reasoning thoughtfully and detail why the extension is necessary. Ending your request with an appreciation for their understanding can further enhance the likelihood of receiving a favorable response.

When crafting a request letter for an extension of payment, begin by acknowledging your obligation and the original due date. Next, clearly explain the reasons for your request and the new payment date you propose. This transparent approach helps to foster understanding and increases the likelihood of a positive response.

To write a letter for a renewal request of an extension, open with a friendly greeting and state your intentions clearly. Include specifics regarding your original agreement and the reasons for requesting a renewal. Maintain a professional tone while also expressing gratitude for the opportunity to request this renewal.

In your letter of extension of time, begin with a polite salutation. Introduce the purpose of your letter in the opening lines, clearly stating you are requesting an extension. It is essential to provide the relevant context and to express your willingness to comply with any further requirements that might be necessary.

When writing a letter to request an extension of time, start with your address and the date, followed by the recipient's address. Clearly articulate your request in the first paragraph, providing a brief explanation of your circumstances. Finally, express your appreciation for their consideration and include your contact information for follow-up.

Louisiana Department of Revenue means the Department of Revenue for the State of Louisiana established as provided in Louisiana Revised Statutes Section 1 and any predecessor or successor Governmental Instrumentality.

Important notice: Louisiana recognizes and accepts the federal extension (Federal Form 4868).

When a state department of revenue sends you a letter, it usually is to start a dialogue about proposed changes to your state return. You won't owe any tax to the state until you agree with the proposed changes.

Revised Statute 3 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

If you owe back state taxes, Louisiana has three years to come after you under the statute of limitations for tax debt. The three-year period begins to run either from the date you file your state tax return or three years from the date the return was due, whichever is later.