Louisiana Irrevocable Letter of Credit

Description

How to fill out Irrevocable Letter Of Credit?

Discovering the right authorized document web template can be a struggle. Naturally, there are a lot of themes available on the net, but how can you find the authorized type you want? Utilize the US Legal Forms site. The service provides a huge number of themes, for example the Louisiana Irrevocable Letter of Credit, that can be used for company and personal requirements. All of the forms are examined by experts and satisfy state and federal requirements.

When you are previously authorized, log in to your profile and click the Acquire switch to obtain the Louisiana Irrevocable Letter of Credit. Utilize your profile to look with the authorized forms you have acquired previously. Check out the My Forms tab of your profile and have an additional backup of your document you want.

When you are a new user of US Legal Forms, listed below are basic guidelines that you should follow:

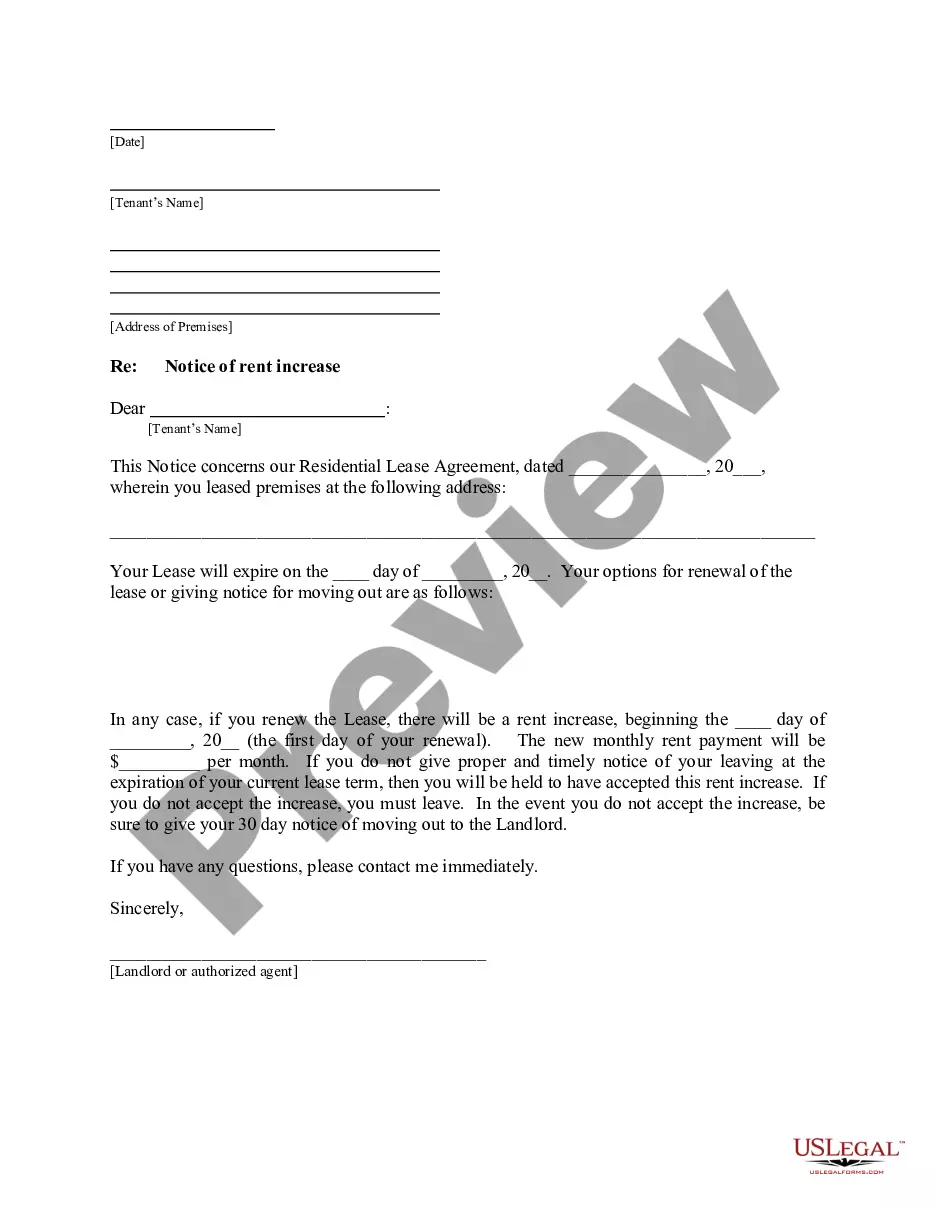

- Very first, make sure you have chosen the proper type to your area/county. You can check out the shape while using Review switch and look at the shape description to guarantee this is the best for you.

- When the type will not satisfy your needs, make use of the Seach area to get the proper type.

- When you are sure that the shape would work, select the Acquire now switch to obtain the type.

- Select the pricing strategy you desire and enter the needed information and facts. Make your profile and pay for the order using your PayPal profile or Visa or Mastercard.

- Pick the file file format and down load the authorized document web template to your system.

- Comprehensive, change and produce and signal the obtained Louisiana Irrevocable Letter of Credit.

US Legal Forms is definitely the most significant collection of authorized forms where you can find different document themes. Utilize the service to down load skillfully-made files that follow status requirements.

Form popularity

FAQ

This Letter of Credit provides much security to the beneficiary. The bills drawn under an Irrevocable Letter of Credit will be honoured by the issuing bank, once all the conditions of the LC agreement have been met.

Inland letter of credit is an obligation of the bank that opens the letter of credit (the issuing bank) to pay the agreed amount to the seller on behalf of the buyer, upon receipt of the documents specified in the letter of credit under domestic business transaction.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

An irrevocable letter of credit cannot be canceled, nor in any way modified, except with the explicit agreement of all parties involved: the buyer, the seller, and the issuing bank. For example, the issuing bank does not have the authority by itself to change any of the terms of an ILOC once it is issued.

Inland letter of credit is an obligation of the bank that opens the letter of credit (the issuing bank) to pay the agreed amount to the seller on behalf of the buyer, upon receipt of the documents specified in the letter of credit under domestic business transaction.

An Irrevocable Letter of Credit is one which cannot be cancelled or amended without the consent of all parties concerned. A Revolving Letter of Credit is one where, under terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the credit being needed.