A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

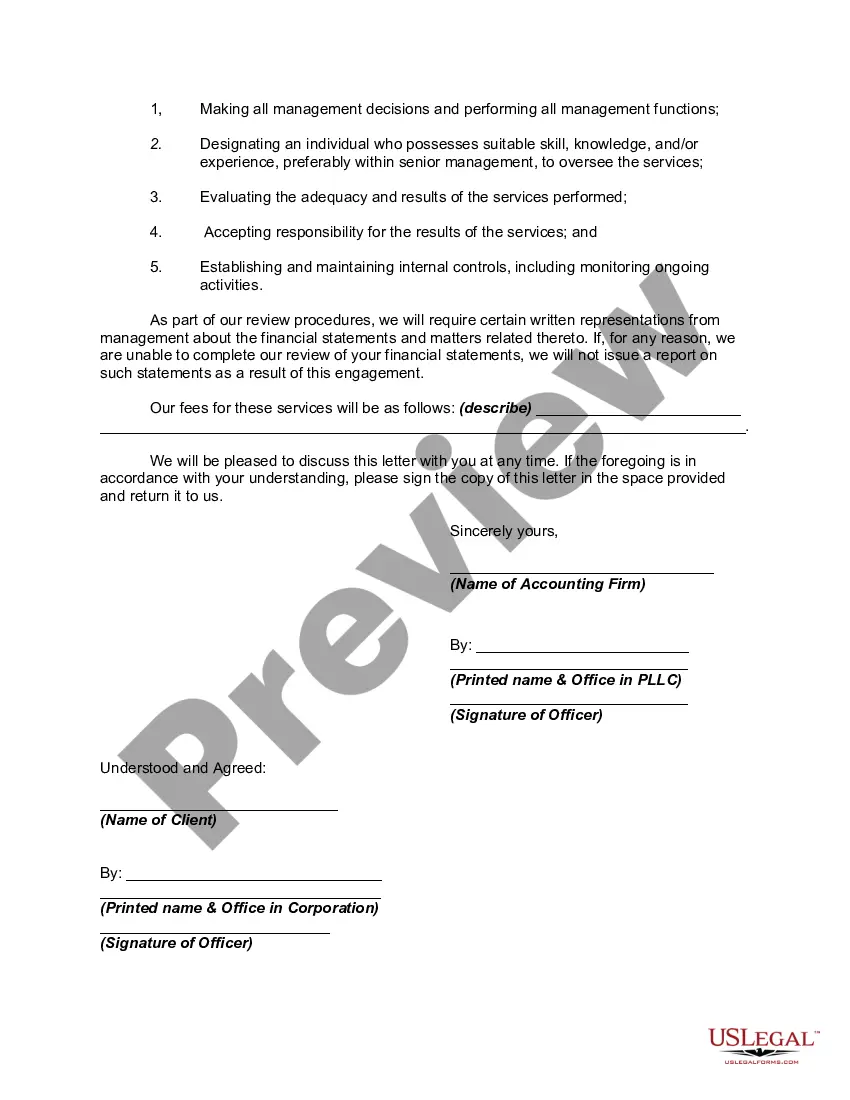

Louisiana Engagement Letter for Review of Financial Statements by Accounting Firm is a legally binding document that outlines the terms and conditions between an accounting firm and their client in regard to conducting a review of the client's financial statements. This engagement letter serves as a crucial communication tool that clarifies the scope of the review engagement and helps establish a clear understanding of the responsibilities and expectations for both the accounting firm and the client. The purpose of the Louisiana Engagement Letter for Review of Financial Statements by Accounting Firm is to provide assurance to the client's stakeholders, such as investors, lenders, and regulatory bodies, that the financial statements have been assessed by a qualified independent professional. This review engagement is conducted in accordance with the standards set by the American Institute of Certified Public Accountants (AICPA), including the Statements on Standards for Accounting and Review Services (STARS). The Louisiana Engagement Letter for Review of Financial Statements by Accounting Firm typically includes the following key components: 1. Identification of the Parties: The engagement letter begins by clearly identifying the accounting firm and the client. It includes their names, addresses, and contact information to establish a formal business relationship. 2. Objective and Scope of the Review Engagement: This section outlines the purpose of the review engagement, which is to express limited assurance on the financial statements in accordance with applicable professional standards. It also defines the scope of the review, specifying the period covered, the specific financial statements to be reviewed, and any restrictions imposed on the review. 3. Responsibilities of the Accounting Firm: The engagement letter specifies the accounting firm's responsibilities, including conducting the review in accordance with professional standards, evaluating the presentation and disclosure of the financial statements, and preparing the required review report. 4. Responsibilities of the Client: The client's responsibilities are also stipulated in the engagement letter. This includes providing the accounting firm with complete and accurate financial statements, disclosing all relevant information, and granting the firm access to appropriate records and personnel. 5. Timeline and Reporting: The engagement letter establishes the expected timeline for completing the review and sets deadlines for the submission of relevant documents. It also details the format and distribution of the review report, stating who will receive the report and how it will be presented. 6. Fees and Payment Terms: This section outlines the fees associated with the review engagement, including hourly rates or fixed fees, and any additional charges for travel or other expenses. Payment terms, such as due dates and acceptable methods of payment, are also specified. Depending on the specific circumstances and requirements of the engagement, there may be variations of the Louisiana Engagement Letter for Review of Financial Statements by Accounting Firm. For instance, there might be separate engagement letters for reviews conducted under different reporting frameworks, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Additionally, engagement letters may differ based on the size and complexity of the client's business, industry-specific regulations, or any additional services requested by the client, such as the inclusion of supplementary schedules or explanations.Louisiana Engagement Letter for Review of Financial Statements by Accounting Firm is a legally binding document that outlines the terms and conditions between an accounting firm and their client in regard to conducting a review of the client's financial statements. This engagement letter serves as a crucial communication tool that clarifies the scope of the review engagement and helps establish a clear understanding of the responsibilities and expectations for both the accounting firm and the client. The purpose of the Louisiana Engagement Letter for Review of Financial Statements by Accounting Firm is to provide assurance to the client's stakeholders, such as investors, lenders, and regulatory bodies, that the financial statements have been assessed by a qualified independent professional. This review engagement is conducted in accordance with the standards set by the American Institute of Certified Public Accountants (AICPA), including the Statements on Standards for Accounting and Review Services (STARS). The Louisiana Engagement Letter for Review of Financial Statements by Accounting Firm typically includes the following key components: 1. Identification of the Parties: The engagement letter begins by clearly identifying the accounting firm and the client. It includes their names, addresses, and contact information to establish a formal business relationship. 2. Objective and Scope of the Review Engagement: This section outlines the purpose of the review engagement, which is to express limited assurance on the financial statements in accordance with applicable professional standards. It also defines the scope of the review, specifying the period covered, the specific financial statements to be reviewed, and any restrictions imposed on the review. 3. Responsibilities of the Accounting Firm: The engagement letter specifies the accounting firm's responsibilities, including conducting the review in accordance with professional standards, evaluating the presentation and disclosure of the financial statements, and preparing the required review report. 4. Responsibilities of the Client: The client's responsibilities are also stipulated in the engagement letter. This includes providing the accounting firm with complete and accurate financial statements, disclosing all relevant information, and granting the firm access to appropriate records and personnel. 5. Timeline and Reporting: The engagement letter establishes the expected timeline for completing the review and sets deadlines for the submission of relevant documents. It also details the format and distribution of the review report, stating who will receive the report and how it will be presented. 6. Fees and Payment Terms: This section outlines the fees associated with the review engagement, including hourly rates or fixed fees, and any additional charges for travel or other expenses. Payment terms, such as due dates and acceptable methods of payment, are also specified. Depending on the specific circumstances and requirements of the engagement, there may be variations of the Louisiana Engagement Letter for Review of Financial Statements by Accounting Firm. For instance, there might be separate engagement letters for reviews conducted under different reporting frameworks, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Additionally, engagement letters may differ based on the size and complexity of the client's business, industry-specific regulations, or any additional services requested by the client, such as the inclusion of supplementary schedules or explanations.