Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Louisiana Declaration of Gift Over Several Year Period

Description

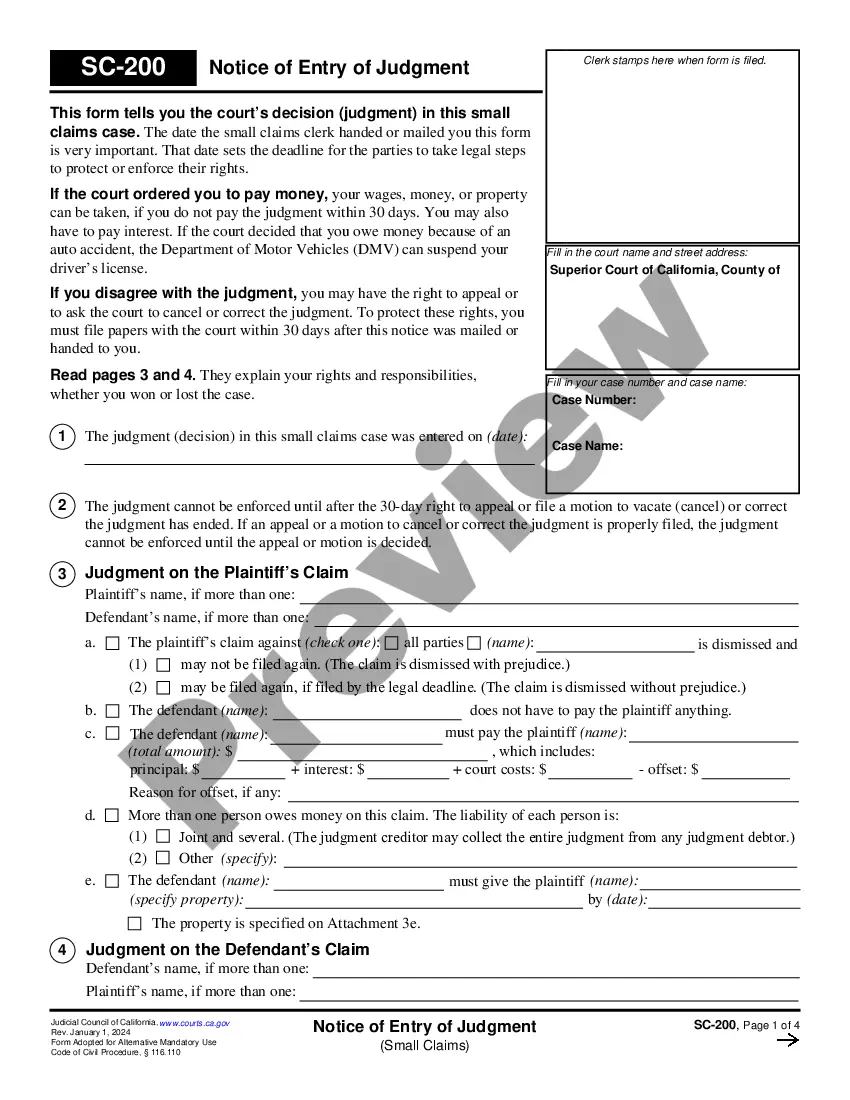

How to fill out Declaration Of Gift Over Several Year Period?

Have you ever been in a situation where you require documentation for various organizational or personal reasons almost every day.

There are numerous credible document templates available online, but obtaining forms you can trust isn't straightforward.

US Legal Forms offers a wide array of form templates, such as the Louisiana Declaration of Gift Over Multiple Years, that are crafted to comply with both state and federal requirements.

Choose a convenient file format and download your version.

You can view all the document templates you have purchased in the My documents section. You can download another version of the Louisiana Declaration of Gift Over Multiple Years anytime if needed. Simply click on the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Louisiana Declaration of Gift Over Multiple Years template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to your specific city or county.

- Utilize the Preview button to review the form.

- Read the description to verify that you have selected the correct form.

- If the form isn't what you are looking for, use the Search field to find the one that meets your needs and specifications.

- Once you find the right form, click Acquire now.

- Select the pricing plan you wish, fill in the required information to create your account, and process the payment using PayPal or a credit card.

Form popularity

FAQ

Yes, Form 709, which relates to the Louisiana Declaration of Gift Over Several Year Period, can be filed electronically. The IRS accepts electronic submissions, which can simplify the filing process. Electronic filing helps ensure that your return is processed quickly and efficiently. Explore uslegalforms for additional tools to facilitate your electronic filing.

Yes, you can obtain an extension on your gift tax return for the Louisiana Declaration of Gift Over Several Year Period. This extension gives you more time to file, but remember that any tax payments are still due on the original schedule. Taking steps early helps you avoid complications down the line. Use uslegalforms to navigate the extension process easily.

You can file a gift tax return late regarding the Louisiana Declaration of Gift Over Several Year Period. While it is possible, you may incur penalties and interest on the amount owed. Prompt filing is critical to minimize any negative financial impact. Uslegalforms provides helpful resources to assist you with filing late returns.

There is a statute of limitations for gift tax related to your Louisiana Declaration of Gift Over Several Year Period. Generally, the IRS can audit returns for up to three years from the filing date, but this period may increase in certain situations. Being informed allows you to better plan your financial future. Consult uslegalforms for more detailed information.

If you exceed the gift tax limit, you may incur additional taxes on the excess amount for your Louisiana Declaration of Gift Over Several Year Period. The IRS may assess penalties if taxes remain unpaid. It's crucial to seek guidance to understand your tax obligations fully. Uslegalforms can assist you with the necessary forms and advice.

Yes, you can file a late gift tax return for your Louisiana Declaration of Gift Over Several Year Period. However, you may face penalties and interest on any unpaid taxes. It is advisable to file as soon as possible to minimize these costs. Consider using uslegalforms to streamline your filing process.

To transfer property to a family member in Louisiana, you typically need to create and execute a deed of gift. This involves drafting the document, signing it in front of a notary, and recording it in the relevant parish courthouse. For additional guidance and resources, consider utilizing the US Legal Forms platform, which offers templates and detailed instructions to assist you in completing a Louisiana Declaration of Gift Over Several Year Period.

A gift deed in Louisiana is a legal instrument that formally transfers ownership of property from one individual to another without payment. This document is essential for ensuring that the transaction is recognized by law. Utilizing a Louisiana Declaration of Gift Over Several Year Period allows for clear documentation of your intent and obligations during the gift process.

In Louisiana, the gift tax rates can vary based on the amount and nature of the gift. Generally, gifts above a certain threshold may be subject to federal gift tax laws, with rates ranging from 18% to 40%. Understanding the implications of a Louisiana Declaration of Gift Over Several Year Period can help you navigate these potential costs more effectively.

While a gift deed can simplify asset transfer, it comes with certain disadvantages. For instance, once a gift is made, you relinquish control over the property permanently. Additionally, if the property appreciates in value, you may face unexpected gift tax implications in the future, particularly when utilizing a Louisiana Declaration of Gift Over Several Year Period.