The term homestead embraces a variety of concepts with different meanings when applied to different factual situations. Generally, a homestead is deemed to be the dwelling house in which a family resides, with the usual and customary appurtenances, including outbuildings that are necessary and convenient for the family use, and lands that are devoted to the same use.

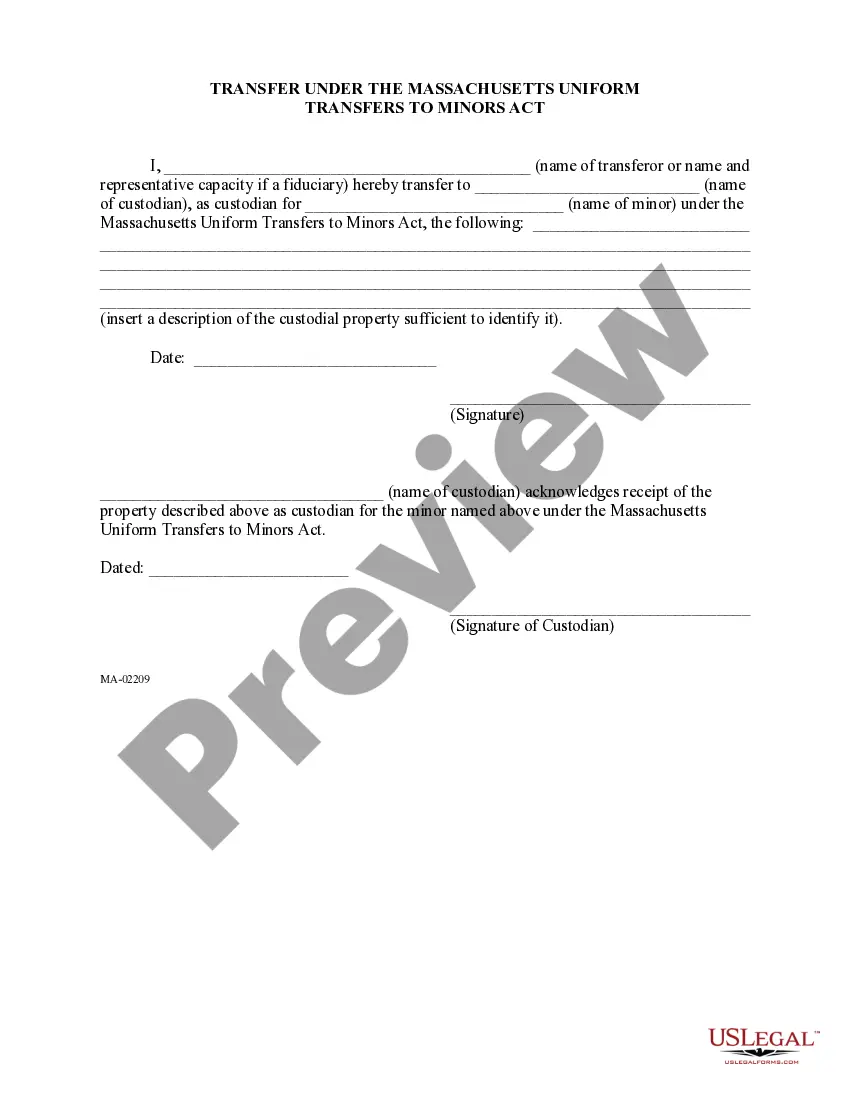

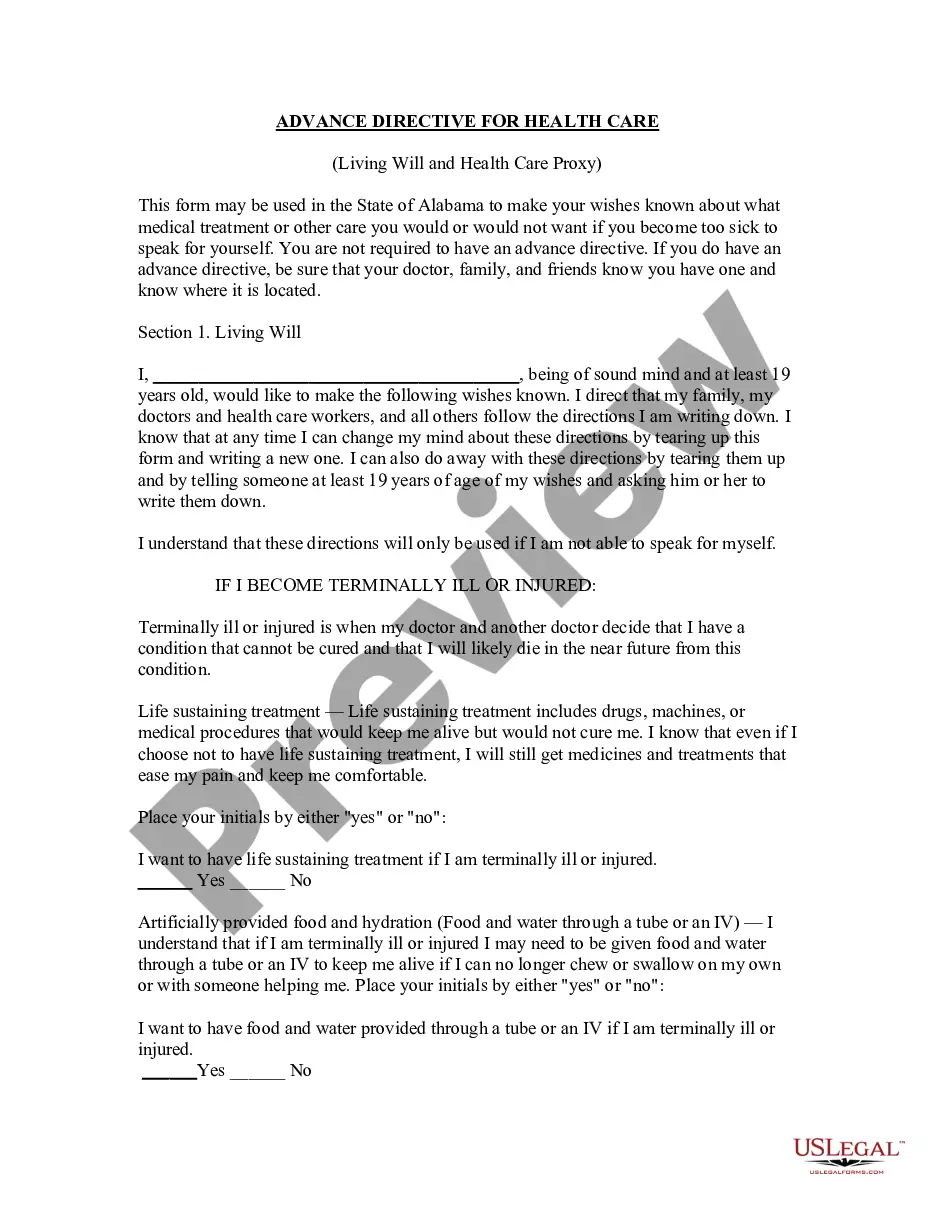

Local law must, of course, be checked to determine if a formal declaration of homestead is required by statute to be executed and recorded. In order that a claim of a declaration of homestead must be executed and filed exactly as provided in the law of the state where the property is located. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Louisiana Claim of Homestead Rights in Form of Affidavit is a legal document that allows homeowners in Louisiana to declare their homestead rights and protect their property from certain types of creditors. A homestead exemption offers individuals and families certain protections and benefits, such as preventing forced sale of a primary residence to satisfy debts. Here's an overview of the Louisiana Claim of Homestead Rights in Form of Affidavit, highlighting its purpose, requirements, and variations: Purpose of Louisiana Claim of Homestead Rights in Form of Affidavit: The purpose of this affidavit is to officially establish and declare a homeowner's homestead rights to benefit from the exemptions and protections provided by Louisiana state law. By filing this document with the appropriate authority, homeowners ensure that their property is treated as a homestead, making it exempt from forced sale to satisfy most debts or claims against them. Requirements for Filing: To qualify for the Louisiana Claim of Homestead Rights in Form of Affidavit, certain requirements must be met. The property in question must be a primary residence, meaning that the homeowner resides there for a significant portion of the year. Additionally, the homeowner must hold the legal title to the property. The affidavit needs to be notarized and filed with the appropriate parish clerk's office or recorder of mortgages. Types of Louisiana Claim of Homestead Rights in Form of Affidavit: While there may not be different types of the Louisiana Claim of Homestead Rights in Form of Affidavit, variations of the document may exist depending on the specific circumstances or purpose. For example, some homeowners may file a joint affidavit if the property ownership is shared between married individuals. Others may need to update or amend their affidavit when changes occur, such as refinancing the property or transferring ownership to another person. Benefits and Protections: By properly filing the Louisiana Claim of Homestead Rights in Form of Affidavit, homeowners can avail themselves of various benefits and protections. Firstly, the homestead exemption can shield a portion of the property's value from being included in bankruptcies or other legal proceedings. This protection can be particularly valuable in safeguarding a family's primary residence from creditors. Additionally, the homestead exemption can provide property tax reductions, making homeownership more affordable for eligible individuals. In conclusion, the Louisiana Claim of Homestead Rights in Form of Affidavit is a crucial legal document that allows homeowners in Louisiana to assert their homestead rights and protect their property from certain creditor claims. By filing this affidavit with the appropriate authorities, homeowners can enjoy the benefits and protections offered under Louisiana state law. It's important for individuals to ensure they meet all requirements and consult legal professionals for specific guidance based on their unique circumstances.