A Louisiana subcontractor agreement for insurance is a legally binding document intended to protect the interests of both parties involved in a subcontracting arrangement, specifically in the insurance industry. It outlines the terms and conditions agreed upon between the subcontractor and the primary insurance contractor in Louisiana. This agreement serves to establish the roles, responsibilities, and obligations of each party, ensuring a smooth working relationship. Keywords: Louisiana subcontractor, agreement, insurance, subcontracting arrangement, primary insurance contractor, terms and conditions, roles, responsibilities, obligations, working relationship. There are several types of Louisiana subcontractor agreements for insurance, each tailored to address specific requirements or situations. These may include: 1. General Subcontractor Agreement for Insurance: This agreement covers the overall subcontracting relationship between the subcontractor and the primary insurance contractor. It typically incorporates clauses relating to liability, indemnification, termination, and dispute resolution. 2. Professional Services Subcontractor Agreement for Insurance: If the subcontractor provides specialized professional services, such as risk assessment, claims handling, or underwriting support, this agreement may be used. It may contain provisions related to confidentiality, intellectual property rights, and compliance with industry standards. 3. Construction Subcontractor Agreement for Insurance: When subcontracting in the construction sector, an agreement specifically addressing the unique risks and challenges of this industry is necessary. It typically outlines safety requirements, project specifications, insurance coverage, and payment terms. 4. Independent Contractor/Consultant Agreement: In some cases, an individual or consulting firm may subcontract insurance-related services on their own terms. This agreement enables them to outline their scope of work, define deliverables, and establish payment and dispute resolution mechanisms. 5. Subcontractor Agreement for Agents/Brokers: This specific agreement is used when an insurance agency or broker hires a subcontractor to assist with sales, marketing, client servicing, or administrative tasks. It may include provisions related to commission structure, client ownership, non-compete clauses, and confidentiality. Keywords: General subcontractor agreement, professional services, construction subcontractor, independent contractor, consultant agreement, insurance agent, insurance broker, sales, marketing, client servicing, administrative tasks, commission structure, non-compete clause, confidentiality. These different types of Louisiana subcontractor agreements for insurance help ensure that all parties involved understand their respective roles and obligations, and provide a clear framework for addressing any issues that may arise during the subcontracting relationship. It is important to carefully review and tailor the agreement to suit the specific needs and circumstances of the subcontracting arrangement.

Louisiana Subcontractor Agreement for Insurance

Description

How to fill out Subcontractor Agreement For Insurance?

Are you presently in a circumstance where you require documents for potential business or personal purposes almost all the time.

Numerous official document formats are accessible online, but locating ones you can trust is not easy.

US Legal Forms offers a wide variety of document templates, including the Louisiana Subcontractor Agreement for Insurance, which are designed to comply with federal and state regulations.

Select the pricing plan you prefer, complete the necessary details to create your account, and purchase your order using your PayPal or Visa or Mastercard.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Louisiana Subcontractor Agreement for Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these procedures.

- Locate the form you need and ensure it is for your specific city/county.

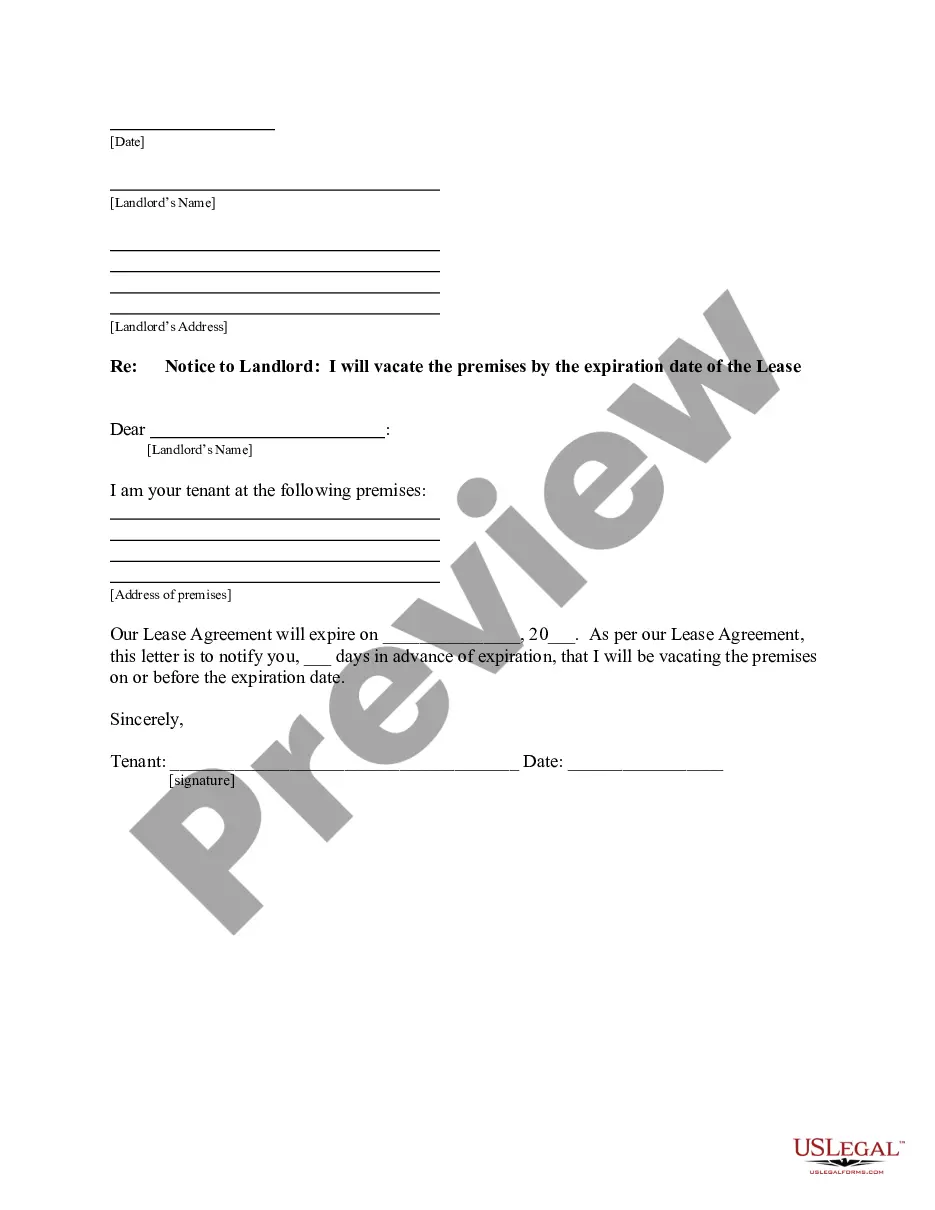

- Use the Preview feature to examine the form.

- Check the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs and requirements.

- When you locate the right form, just click Get now.

Form popularity

FAQ

To obtain a subcontract for work, you need to connect with a general contractor who requires assistance on a project. Start by presenting your qualifications, experience, and the services you offer. Once selected, you will draft a Louisiana Subcontractor Agreement for Insurance to outline the terms of your work, payment, and responsibilities. This ensures both parties have a clear understanding of their obligations and protects you legally.

The primary form that subcontractors need to fill out is the Louisiana Subcontractor Agreement for Insurance. This agreement provides essential details about the job and protects the interests of both parties. Additionally, a W-9 form may be needed for tax reporting purposes. Ensure all paperwork aligns with state regulations to avoid complications.

Subcontractors need to fill out various forms, including the Louisiana Subcontractor Agreement for Insurance and a W-9 form. These documents help define the terms of their work and tax responsibilities. It is essential for subcontractors to provide accurate information to avoid potential legal issues. Always check state-specific requirements to ensure compliance.

To fill out a contract agreement, start by clearly stating the names and contact information of both parties involved. Include the specific terms of the agreement, such as the scope of work, payment timeline, and any necessary legal provisions. Review everything for accuracy to ensure clarity and fairness. This process can be simplified using a Louisiana Subcontractor Agreement for Insurance.

Contractors typically fill out a W-9 form when providing their taxpayer information to clients. The W-9 enables clients to issue a 1099 form for reporting payments made to contractors. It helps both parties maintain accurate tax records. This process may be detailed in the Louisiana Subcontractor Agreement for Insurance to enhance clarity.

Subcontractors usually receive a 1099-NEC if they earned $600 or more during the tax year. This form reports non-employee compensation, which applies to most subcontractors. It's essential to ensure proper classification of payments, as this impacts tax filing. The Louisiana Subcontractor Agreement for Insurance may facilitate understanding these payment structures.

A subcontractor should typically fill out a Louisiana Subcontractor Agreement for Insurance. This document outlines the terms of the arrangement and protects both parties. Additionally, depending on the nature of the work, subcontractors may need to complete a W-9 form for tax purposes. Make sure to follow the specific requirements of your state.

Filling out a Louisiana Subcontractor Agreement for Insurance involves several key steps. First, gather all necessary information about the parties involved, including names and addresses. Next, clearly outline the scope of work, payment terms, and deadlines. Finally, both parties should review and sign the agreement to make it legally binding.

In Louisiana, a contractor typically has up to 30 days to bill for services rendered under the terms outlined in the Louisiana Subcontractor Agreement for Insurance. The specific timing may depend on the contract terms agreed upon by both parties. Clearly defining billing timelines in your agreement helps mitigate misunderstandings and facilitates prompt payment, ensuring smooth project execution.

Yes, many subcontractors in Louisiana are required to obtain a Certificate of Insurance (COI) to demonstrate that they carry sufficient insurance coverage. This requirement protects both the subcontractor and the contractor from potential liabilities. Including this stipulation in your Louisiana Subcontractor Agreement for Insurance can safeguard all parties involved and ensure compliance with legal standards.