The Louisiana Investment Letter regarding Intrastate Offering is a crucial tool that provides important information to individuals interested in intrastate investments within Louisiana. This letter serves as a detailed resource that educates potential investors about the various aspects and regulations related to intrastate offerings in the state. The Louisiana Investment Letter provides a comprehensive overview of the guidelines and requirements that must be followed when conducting intrastate offerings. It outlines the legal framework established by the Louisiana Securities Commission and other regulatory bodies to ensure the protection of investors and the integrity of the market. Within the Louisiana Investment Letter, there are different types of letters that cater to specific aspects of intrastate offerings. Some of these variations include: 1. Louisiana Investment Letter for Small Business Offerings: This type focuses specifically on small businesses seeking to raise funds through intrastate offerings. It provides detailed information about the eligibility criteria, required documentation, filing procedures, and investor protection measures applicable to small business offerings. 2. Louisiana Investment Letter for Local Real Estate Offerings: This letter is specifically tailored to intrastate offerings in the real estate sector. It elucidates the specific regulations, disclosure requirements, and investor safeguards related to real estate investment opportunities within Louisiana. 3. Louisiana Investment Letter for Technology Start-up Offerings: This variant is designed for technology start-ups looking to secure local investments. It highlights the specific rules, regulations, and reporting obligations that apply to technology-driven enterprises, emphasizing the unique aspects associated with this sector. 4. Louisiana Investment Letter for Renewable Energy Offerings: This type of letter caters to intrastate offerings related to renewable energy projects. It provides in-depth knowledge about the specific regulations, tax incentives, and environmental obligations associated with raising capital within Louisiana's renewable energy industry. In summary, the Louisiana Investment Letter regarding Intrastate Offering is a comprehensive document that educates interested parties about the guidelines, regulations, and requirements related to intrastate investments in Louisiana. It helps potential investors make informed decisions by providing them with detailed information specific to their desired investment type, such as small business, real estate, technology start-up, or renewable energy opportunities.

Louisiana Investment Letter regarding Intrastate Offering

Description

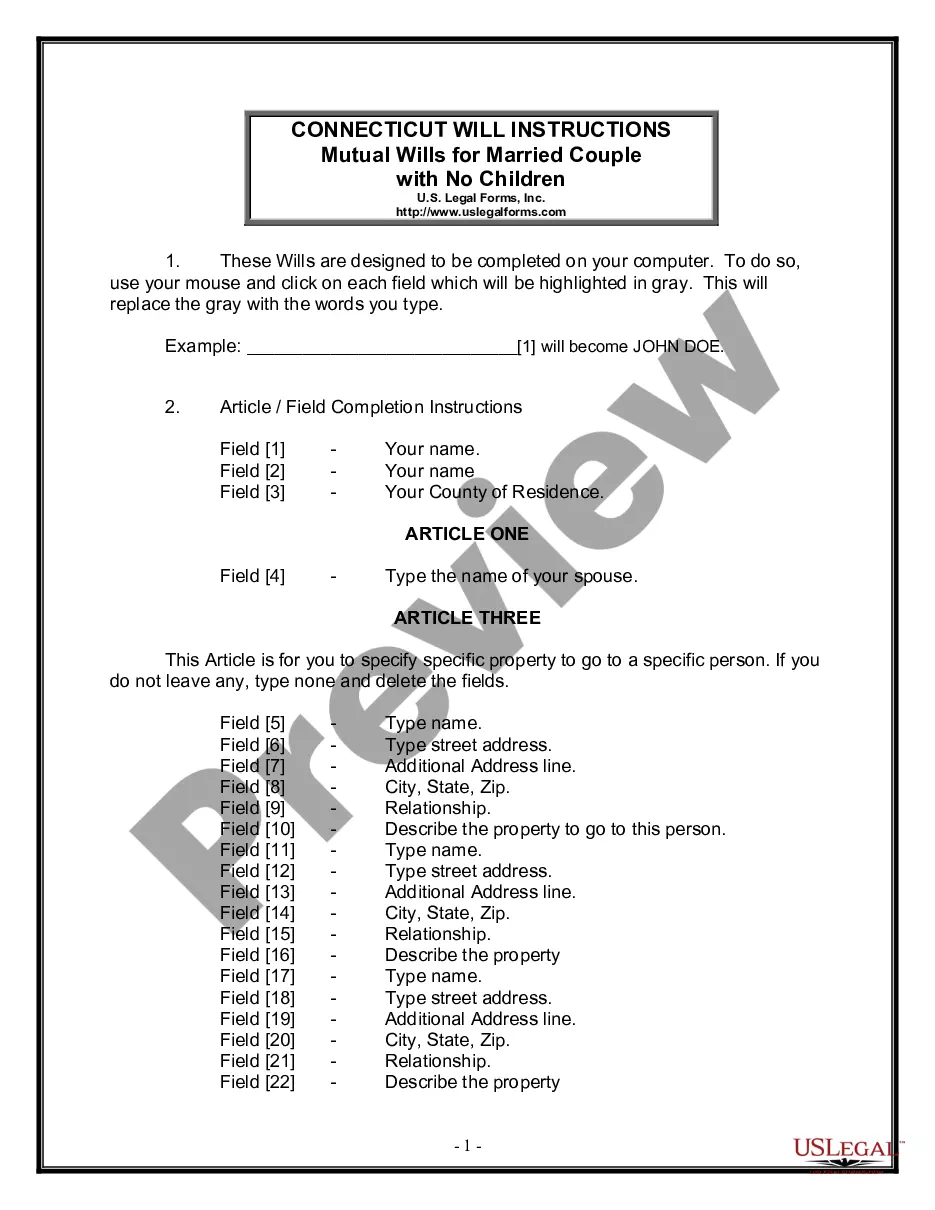

How to fill out Louisiana Investment Letter Regarding Intrastate Offering?

Are you presently in the placement where you require paperwork for possibly business or individual reasons just about every day time? There are plenty of authorized papers templates available on the Internet, but finding ones you can rely on isn`t effortless. US Legal Forms offers thousands of type templates, much like the Louisiana Investment Letter regarding Intrastate Offering, that happen to be written to satisfy federal and state specifications.

Should you be already knowledgeable about US Legal Forms site and have a free account, just log in. Afterward, it is possible to down load the Louisiana Investment Letter regarding Intrastate Offering design.

If you do not have an account and would like to begin using US Legal Forms, follow these steps:

- Discover the type you want and ensure it is for your right area/county.

- Utilize the Preview button to examine the form.

- See the outline to actually have chosen the right type.

- If the type isn`t what you are seeking, utilize the Lookup area to find the type that meets your needs and specifications.

- If you get the right type, click Acquire now.

- Choose the rates program you want, submit the desired information and facts to make your bank account, and pay for your order utilizing your PayPal or credit card.

- Pick a convenient document formatting and down load your copy.

Find every one of the papers templates you might have purchased in the My Forms food selection. You can obtain a further copy of Louisiana Investment Letter regarding Intrastate Offering any time, if required. Just click on the necessary type to down load or print the papers design.

Use US Legal Forms, by far the most substantial collection of authorized varieties, to conserve time and steer clear of faults. The support offers skillfully created authorized papers templates which can be used for a selection of reasons. Make a free account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

Yes, state laws do regulate intrastate sales of securities, establishing various requirements and exemptions. These laws ensure that local investors receive protection and clear information during offerings. The Louisiana Investment Letter regarding Intrastate Offering must align with these regulations to be valid. Using services like uslegalforms can help you navigate these complex legal waters effectively.

At the state level, several securities may qualify for exemption, such as securities issued by municipal corporations or those meeting specific criteria under state law. Knowing these exemptions is important, especially when preparing a Louisiana Investment Letter regarding Intrastate Offering. Legal platforms like uslegalforms can provide you with the necessary tools to identify and document these exemptions accurately.

Intrastate offerings can be exempt from state registration under specific conditions laid out in the law. For example, offerings that comply with local regulations may not require full registration. When dealing with the Louisiana Investment Letter regarding Intrastate Offering, navigating these requirements is crucial to ensure proper adherence to state laws. Legal consultation can provide guidance on your specific situation.

Certain securities can be exempt from registration under both federal and state laws. These include some government securities, bank securities, and specific offerings under Regulation D. Understanding these exemptions can simplify the process of filing a Louisiana Investment Letter regarding Intrastate Offering. Consulting legal resources will provide clarity on what qualifies.

Yes, intrastate offerings typically require state registration. However, there are specific exemptions depending on the state laws. When considering the Louisiana Investment Letter regarding Intrastate Offering, it's vital to understand the nuances that may apply. Always consult with legal experts to ensure compliance with state regulations.

Rule 147 focuses on intrastate offerings, enabling local businesses to secure funding without extensive federal registrations. In contrast, Rule 144 pertains to the resale of publicly traded securities, regulating how restricted or control securities can be sold. Understanding the distinction between these rules, especially regarding a Louisiana Investment Letter regarding Intrastate Offering, can aid businesses in navigating their fundraising efforts effectively.

Rule 147 addresses intrastate offerings by allowing businesses to sell stocks or bonds exclusively to residents of their state. This regulation simplifies the fundraising process for companies looking to generate local investment using a Louisiana Investment Letter regarding Intrastate Offering. Understanding this rule is crucial for entities focused on community-based investment strategies.

To comply with Rule 147, an issuer must meet specific criteria, including being incorporated or having a principal place of business in the state. Additionally, the issuer must ensure that the majority of the offering is conducted within the state. Adhering to these guidelines supports the effective use of a Louisiana Investment Letter regarding Intrastate Offering and helps streamline the fundraising process.

Rule 147 allows issuers to offer and sell securities within their home state without registering with the SEC. This provision is essential for businesses aiming to raise capital locally, emphasizing the importance of the Louisiana Investment Letter regarding Intrastate Offering. This facilitates easier access to funds while ensuring compliance with state regulations.