[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Position] [Louisiana Department of Revenue] [Address] [City, State, Zip Code] Subject: Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees — [Your Company Name] Dear [Recipient's Name], I hope this letter finds you well. I am writing to address the necessary payment for our company's Corporate Income and Franchise Taxes as well as the Annual Report Filing Fees for the state of Louisiana. As a responsible corporate entity, we understand the importance of meeting our tax obligations and submitting the required documentation promptly. Hence, we would like to submit the payment for the mentioned taxes and fees for the tax year [Year]. [If there are multiple types of sample letters available, mention them here. For example, if there is a need to request an extension, provide a copy of the extension request letter alongside the payment letter.] Enclosed with this letter, you will find a check in the amount of [Payment Amount] made payable to the "Louisiana Department of Revenue" to cover our Corporate Income and Franchise Taxes for the tax year [Year]. Additionally, we have included another check in the amount of [Filing Fees Amount] as payment for the Annual Report Filing Fees for the same period. We kindly request your assistance in acknowledging receipt of the enclosed payment, preferably through an official receipt or confirmation letter. Please send the receipt or acknowledgment to the address provided above or via email at [Your Email Address]. Should you require any additional information or documentation, please do not hesitate to contact me. As required in the instructions provided by the Louisiana Department of Revenue, we have ensured that all necessary forms, schedules, and supporting documents pertaining to our Corporate Income and Franchise Taxes, as well as the Annual Report, are accurately completed and included in the submission. These documents include: 1. Louisiana Department of Revenue Corporate Income and Franchise Tax Return Form. 2. Annual Financial Statement, including the Profit and Loss Statement and Balance Sheet. 3. Any applicable Federal tax return forms (Form 1120, Schedule K-1, etc.). 4. Documents verifying any deductions, exemptions, or credits claimed. We have taken utmost care to be thorough and accurate in our submissions to comply with the state's requirements and avoid any potential penalties or delays. However, if there are any discrepancies or errors found in our submission, please notify us immediately so that we can rectify any issues promptly. We greatly appreciate your attention to this matter and your Department's continued support in keeping our company compliant with the regulations set forth by the state of Louisiana. Thank you for your prompt action and assistance. Sincerely, [Your Name] [Your Position] [Company Name] [Company Address] [City, State, Zip Code]

Louisiana Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees

Description

How to fill out Louisiana Sample Letter For Payment Of Corporate Income And Franchise Taxes And Annual Report Filing Fees?

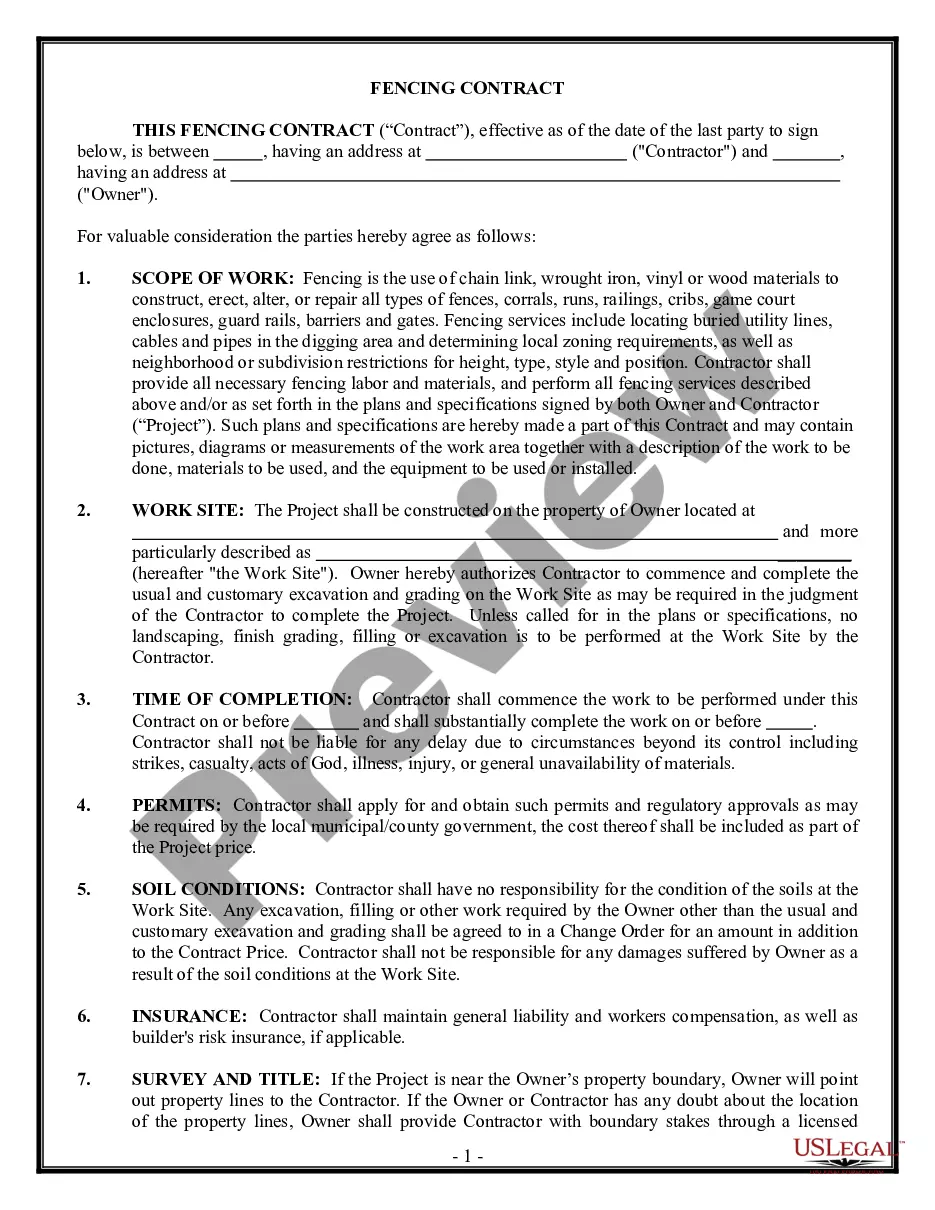

Have you been in a place that you need to have paperwork for possibly company or specific purposes virtually every day? There are plenty of lawful document themes available online, but finding versions you can trust is not easy. US Legal Forms delivers 1000s of type themes, such as the Louisiana Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees, which are created to fulfill state and federal requirements.

In case you are currently informed about US Legal Forms internet site and get your account, basically log in. Afterward, you are able to acquire the Louisiana Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees web template.

Should you not have an account and want to begin using US Legal Forms, follow these steps:

- Obtain the type you need and make sure it is for that appropriate city/state.

- Utilize the Review button to review the form.

- See the description to ensure that you have chosen the correct type.

- When the type is not what you are looking for, take advantage of the Lookup area to get the type that suits you and requirements.

- When you discover the appropriate type, click on Buy now.

- Select the prices prepare you want, submit the required info to make your bank account, and pay for the transaction with your PayPal or bank card.

- Decide on a convenient document formatting and acquire your duplicate.

Find each of the document themes you may have purchased in the My Forms food selection. You can obtain a more duplicate of Louisiana Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees anytime, if necessary. Just click the necessary type to acquire or produce the document web template.

Use US Legal Forms, the most considerable assortment of lawful kinds, to save some time and steer clear of blunders. The assistance delivers skillfully produced lawful document themes that can be used for a selection of purposes. Produce your account on US Legal Forms and initiate generating your life easier.