Louisiana General Form of Agreement to Incorporate

Description

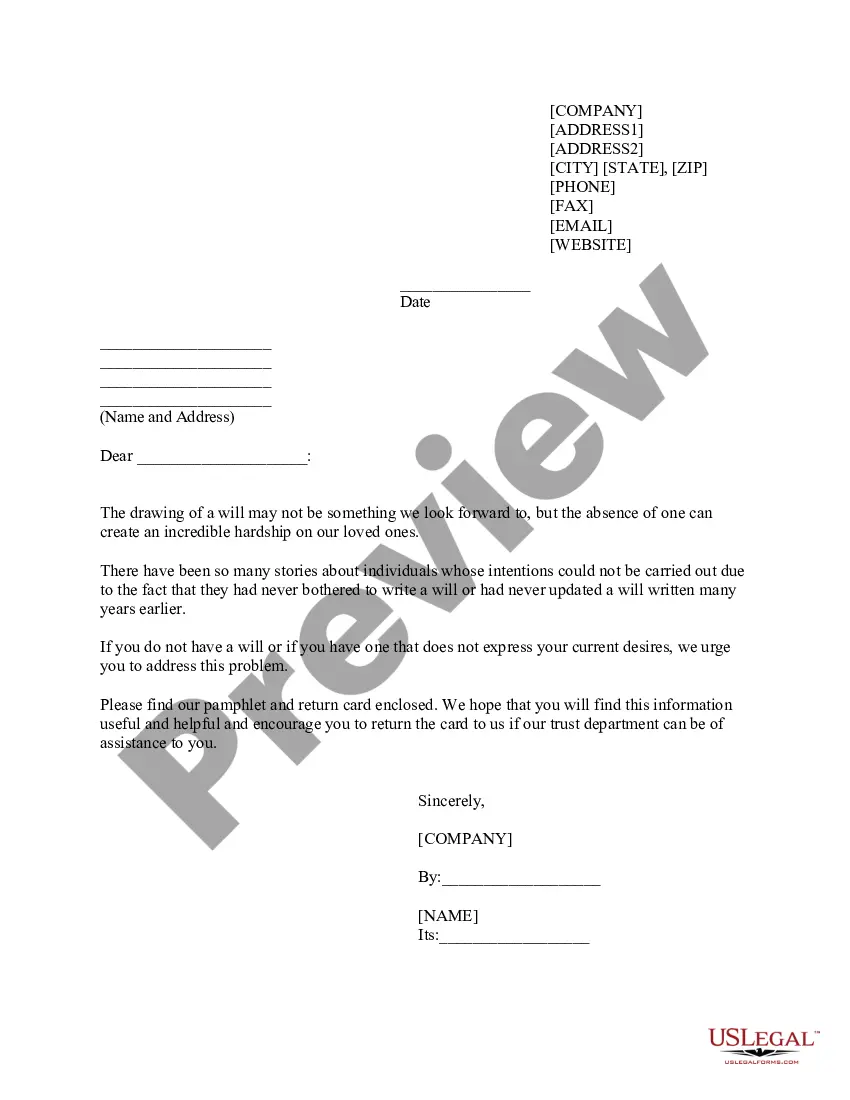

How to fill out General Form Of Agreement To Incorporate?

Locating the appropriate legal document template can be challenging.

That said, there are numerous templates accessible online, but how do you acquire the legal document you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, such as the Louisiana General Form of Agreement to Incorporate, suitable for both business and personal purposes.

You can examine the document using the Preview option and read the document description to confirm it is the right one for you.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and select the Download option to retrieve the Louisiana General Form of Agreement to Incorporate.

- You can use your account to browse through the legal forms you have purchased in the past.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

Obtaining Articles of Organization in Louisiana usually takes between 3 and 10 business days, depending on your filing method. If you file online, you can often receive your documents much faster. Utilizing the Louisiana General Form of Agreement to Incorporate helps you to understand the requirements and complete the process with ease.

Yes, Louisiana requires articles of organization for forming an LLC. This document is essential as it outlines your LLC's structure and purpose. By utilizing the Louisiana General Form of Agreement to Incorporate, you ensure that you meet all necessary legal requirements and facilitate a smoother business formation process.

The approval period for an LLC in Louisiana typically ranges from 3 to 14 business days. As mentioned, online submissions through the Louisiana General Form of Agreement to Incorporate can significantly reduce this time. Thus, if you are in a hurry, opting for an online filing may be the best choice.

To add a DBA (Doing Business As) to your LLC in Louisiana, you must file a certificate of trade name with the Secretary of State. This process requires providing details about your LLC and the intended trade name. By utilizing the Louisiana General Form of Agreement to Incorporate, you can streamline the process and ensure compliance with state regulations.

After submitting your application for an LLC in Louisiana, the processing time can range from several days to a few weeks. This timeframe often depends on the method of submission. If you use the Louisiana General Form of Agreement to Incorporate, online applications tend to be more efficient and can offer quicker turnaround times.

The approval time for Articles of Incorporation in Louisiana varies based on the filing method. Typically, online filings process faster than paper submissions. Generally, you can expect approval within 3 to 5 business days when using the Louisiana General Form of Agreement to Incorporate. However, it's wise to account for potential delays due to high volume or other factors.

To establish an S Corp in Louisiana, start by forming a standard corporation through the Louisiana General Form of Agreement to Incorporate. After approval, you'll need to file Form 2553 with the IRS to elect S Corporation status. This choice allows your business to pass income directly to shareholders, avoiding double taxation. Uslegalforms can assist you in preparing the required documents and ensuring compliance with both state and federal requirements.

To form a corporation in Louisiana, you need to file the Louisiana General Form of Agreement to Incorporate with the Secretary of State. Select a suitable name, appoint a registered agent, and prepare the corporation's bylaws. While the process can seem daunting, using uslegalforms offers an efficient solution to guide you through each necessary step, ensuring you meet all statutory requirements.

Yes, an LLC in Louisiana can technically operate without an operating agreement, but it is highly advisable to have one. The operating agreement outlines the management structure and operational procedures, helping to avoid disputes among members. Additionally, including this document strengthens the credibility of your business. You can easily create a comprehensive operating agreement using uslegalforms, tailored to your needs.

Generally, the approval time for an LLC in Louisiana can vary from a few days to several weeks. The Secretary of State typically processes the Louisiana General Form of Agreement to Incorporate within 5 to 10 business days. However, processing times may extend during peak periods. To expedite your application, consider using uslegalforms to ensure that all your documents are correctly completed and submitted.