This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

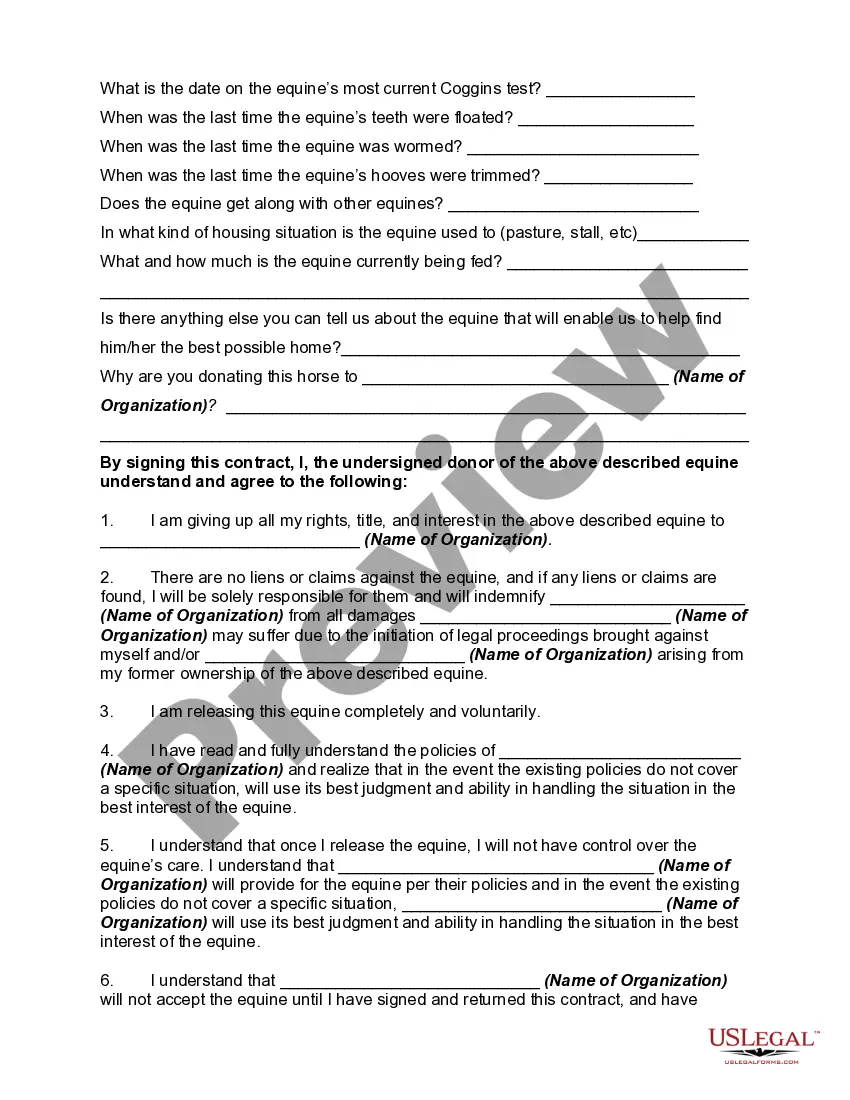

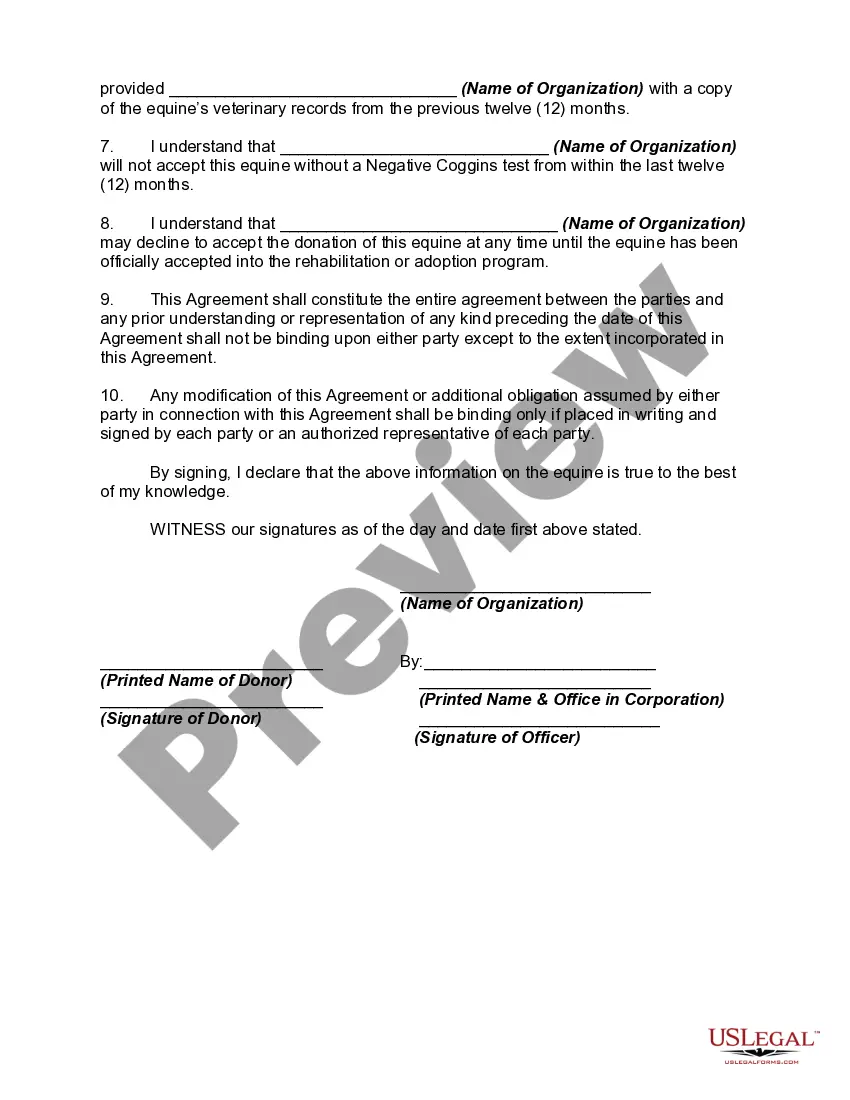

Louisiana Equine or Horse Donation Contract is a legal agreement that outlines the terms and conditions of donating a horse or equine in the state of Louisiana. This contract ensures that both the donor and the recipient understand their responsibilities and obligations regarding the donation. The Louisiana Equine or Horse Donation Contract typically includes essential details such as the identification information of the donor and the recipient, the description of the horse or equine being donated, and the purpose of the donation. It also outlines the rights and obligations of both parties, including the care, maintenance, and use of the donated horse. Different types of Louisiana Equine or Horse Donation Contracts may include: 1. Full Donation Contract: This type of contract involves the complete donation of the horse or equine to the recipient. The donor relinquishes all ownership rights and responsibilities over the horse, transferring them to the recipient. 2. Partial Donation Contract: In this contract, the donor retains partial ownership rights and responsibilities over the horse or equine. The recipient may be required to share the costs or take care of certain aspects of the horse's care while it remains in the donor's ownership. 3. Lease with Option to Purchase: This type of contract allows the recipient to lease the horse or equine for a specified period, with the option to purchase it at a later date. During the lease period, the recipient is responsible for the care and maintenance of the horse, but ownership remains with the donor until the purchase option is exercised. 4. Loan Agreement: A loan agreement allows the donor to lend the horse or equine to the recipient for a specific period. The recipient is responsible for the horse's care and maintenance during the loan period, but ownership remains with the donor. This type of contract specifies the conditions and duration of the loan, as well as any restrictions or limitations imposed by the donor. It is essential for both the donor and the recipient to thoroughly read and understand the terms and conditions specified in the Louisiana Equine or Horse Donation Contract before entering into an agreement. Seeking legal advice may also be beneficial to ensure compliance with state laws and regulations regarding equine or horse donations.