Louisiana Annual Expense Report is a comprehensive document that provides a detailed breakdown of the expenses incurred by the state government of Louisiana over a specific fiscal year. This report aims to provide transparency and accountability to taxpayers about how their tax dollars are being utilized and allocated to various sectors. The Louisiana Annual Expense Report includes a wide range of expenses, including but not limited to: 1. Personnel Expenses: This category includes salaries, wages, bonuses, and benefits paid to state employees across various departments and agencies. It also covers expenses related to pension plans and employee insurance. 2. Operating Expenses: This section comprises expenditures necessary for the day-to-day functioning of the state government. It includes office supplies, utilities, rent, communication expenses, maintenance costs, and other expenses incurred by state agencies. 3. Education Expenses: Louisiana places significant emphasis on education, so a substantial portion of the annual expense report is dedicated to detailing expenses related to K-12 schools, higher education institutions, educational programs, scholarships, and student financial aid. 4. Healthcare and Social Services: This category outlines expenses associated with healthcare programs, such as Medicaid and Medicare, public health initiatives, funding for hospitals and clinics, as well as social services provided to disadvantaged populations, including welfare programs, child and family services, and mental health services. 5. Infrastructure and Transportation: Louisiana's annual expense report includes expenses related to the maintenance, improvement, and construction of roads, bridges, airports, ports, and other transportation infrastructure projects. It also covers expenses associated with managing the state's transportation system. 6. Public Safety and Law Enforcement: This section outlines expenses dedicated to police departments, fire departments, emergency services, state prisons, and other law enforcement agencies. It includes expenditures for personnel, equipment, training, and other related expenses. 7. Economic Development: Louisiana recognizes the importance of economic growth and invests in initiatives to attract businesses, create jobs, and stimulate economic development. This category includes expenses related to grants, tax incentives, job training programs, business support services, and infrastructure improvements to support economic growth. The Louisiana Annual Expense Report provides a comprehensive overview of the state's financial activities, enabling citizens, government officials, and businesses to gain a better understanding of how taxpayer funds are being allocated. By transparently reporting these expenses, the state demonstrates its commitment to accountability and responsible financial management. Different types of Louisiana Annual Expense Reports may exist based on the specific departments or agencies covered in the report. For example, there might be a report dedicated solely to education expenses or one specifically focused on transportation-related expenditures. These specialized reports allow for a more in-depth analysis of spending within specific sectors, ensuring even greater transparency and accountability.

Louisiana Annual Expense Report

Description

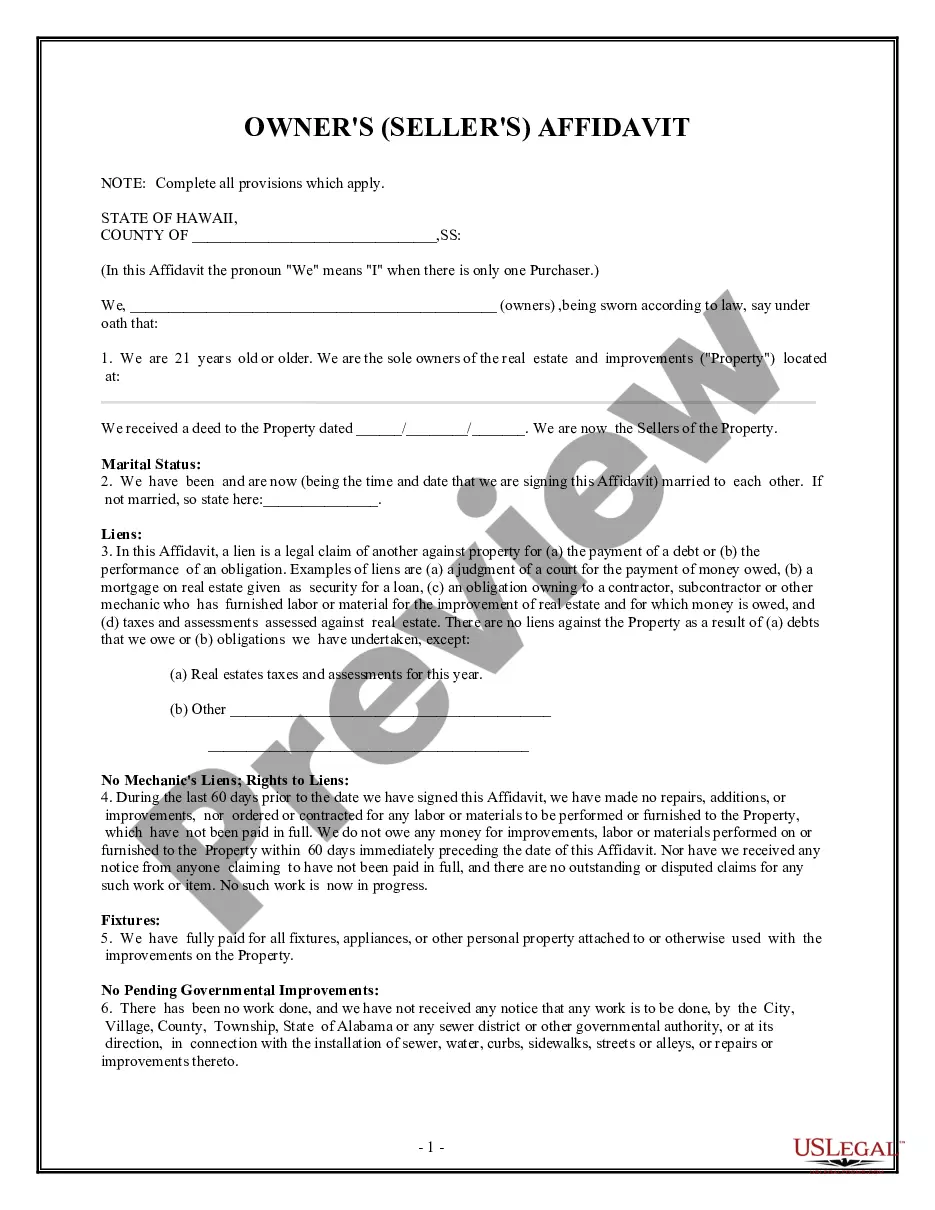

How to fill out Louisiana Annual Expense Report?

Finding the right legitimate file template could be a struggle. Of course, there are tons of themes available on the Internet, but how do you obtain the legitimate form you want? Make use of the US Legal Forms site. The services provides thousands of themes, for example the Louisiana Annual Expense Report, that you can use for organization and private requires. Every one of the kinds are checked out by specialists and meet up with state and federal requirements.

If you are presently authorized, log in for your accounts and click on the Obtain button to find the Louisiana Annual Expense Report. Make use of your accounts to check from the legitimate kinds you possess purchased earlier. Visit the My Forms tab of your accounts and have an additional backup in the file you want.

If you are a brand new user of US Legal Forms, here are straightforward recommendations that you can adhere to:

- Very first, ensure you have selected the appropriate form for the town/area. You can examine the form utilizing the Review button and look at the form description to ensure this is the right one for you.

- In the event the form is not going to meet up with your requirements, make use of the Seach field to find the appropriate form.

- Once you are positive that the form is acceptable, click the Buy now button to find the form.

- Choose the rates strategy you would like and enter the essential information. Make your accounts and buy an order making use of your PayPal accounts or bank card.

- Pick the submit structure and download the legitimate file template for your system.

- Complete, modify and produce and indicator the attained Louisiana Annual Expense Report.

US Legal Forms is the greatest collection of legitimate kinds in which you can see numerous file themes. Make use of the service to download expertly-created files that adhere to condition requirements.

Form popularity

FAQ

Not filing an annual report, like the Louisiana Annual Expense Report, can have serious repercussions. The state may impose fines on your entity, and repeated failures could lead to the dissolution of your business. Additionally, this oversight can negatively affect your business's credibility and operational status. Utilizing resources like USLegalForms can help you navigate this process seamlessly.

Yes, filing an annual report is a requirement for businesses in Louisiana. Every entity, including corporations and limited liability companies, must file their Louisiana Annual Expense Report to provide updated information to the state. This ensures transparency and compliance with state regulations. Failing to do so can lead to penalties and complications.

If you fail to file your Louisiana Annual Expense Report, your business may face several consequences. The state could impose fines, and your business could be marked as non-compliant. This may ultimately jeopardize your ability to operate legally in Louisiana. Understanding the importance of timely filing can save you these headaches.

To file your Louisiana Annual Expense Report, you need basic information about your LLC, such as your business name, address, and the names of members or managers. You also need to include financial details, like gross revenue from the previous year. Collecting this information in advance makes the filing process easier and ensures accuracy. You can find templates and guidance through US Legal Forms to assist you in preparing your report.

Yes, you must renew your LLC every year in Louisiana by filing an Annual Expense Report. This report provides important financial information about your business and ensures your LLC remains in good standing with the state. Failure to submit the report on time may result in penalties or the dissolution of your LLC. It's essential to stay updated and compliant to continue operating smoothly.

Yes, Louisiana requires businesses to file an annual report, often referred to as the Louisiana Annual Expense Report. This report helps the state maintain updated information about your business, ensuring compliance with state regulations. Filing the annual report is essential for maintaining good standing and can enhance your business's credibility. For those unfamiliar with the process, USLegalForms offers valuable resources to assist with preparing your annual report.

Failing to file your annual report can have serious consequences for your LLC in Louisiana. This oversight may result in penalties, loss of good standing, or even automatic dissolution of your business. It is crucial to file your Louisiana Annual Expense Report on time to avoid such risks. To ensure you meet all requirements, consider using uslegalforms as your trusted resource.

In Louisiana, your annual report must be filed by the annual due date set by the state, usually around the anniversary of your business's formation. Timely submission of your Louisiana Annual Expense Report ensures compliance with state regulations. It is advisable to prepare your report well in advance to avoid any last-minute issues. By planning ahead, you can maintain your business's good standing.

Setting up an annual report involves gathering necessary information about your business, such as financial data and member details. In Louisiana, you'll need to file your Louisiana Annual Expense Report with the Secretary of State. You can easily do this online, making the process streamlined and efficient. Consider using uslegalforms to navigate the requirements more smoothly.

Yes, renewing your LLC is a critical part of staying compliant in Louisiana. Each year, you must submit the Louisiana Annual Expense Report to keep your LLC active. This process ensures that your information remains current and helps to establish your business's credibility. Utilizing platforms like uslegalforms can simplify this renewal process.

More info

Smart sheets can do nearly everything you need them to do. Learn more with videos and other resources. Learn even more through the online tutorial. This example has several columns with data, each showing a separate line item from business expense reports. Scoresheets can do virtually all the same calculations and analysis that you need for a real business. You may even find you can customize your own business expense report templates to better fit your needs. The examples also show how to do the same things with real customer reports. Learn even more with videos and other resources. Learn even more through the online tutorial. This example contains several columns with data and is structured as a standard, real customer. You can modify the structure for your own data. Learn even more through the online tutorial. Scoresheets can do virtually all the same calculations and analysis that you need for a real business.